Australia Heat Exchanger Tubes Market Size, Share, Trends and Forecast by Material Type, Product Type, Tube Configuration, Distribution Channel, End Use Industry, and Region, 2025-2033

Australia Heat Exchanger Tubes Market Overview:

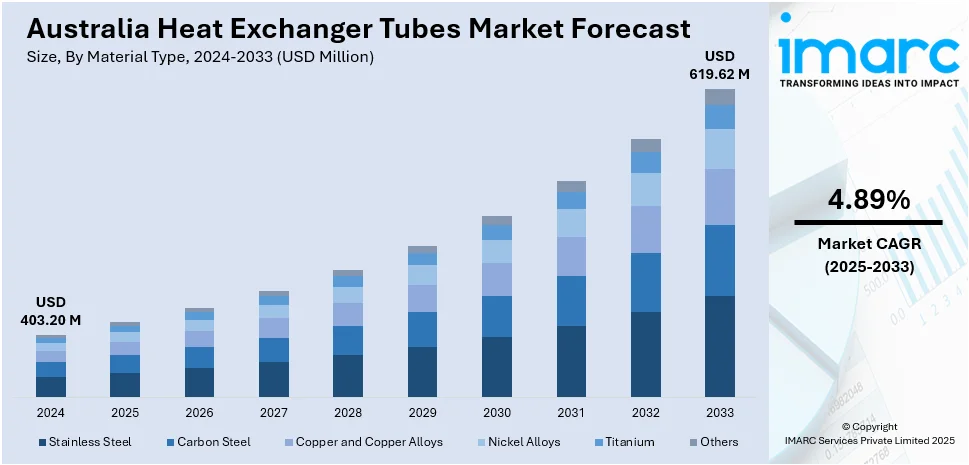

The Australia heat exchanger tubes market size reached USD 403.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 619.62 Million by 2033, exhibiting a growth rate (CAGR) of 4.89% during 2025-2033. The increasing demand for energy-efficient systems, rapid industrialization, urbanization, and the expansion of renewable energy sources are propelling the market growth. Moreover, alongside technological advancements in materials, stricter environmental regulations, growth in power generation, infrastructure development, and rising investments in renewable energy are fostering the market growth. Apart from this, the need for industrial upgrades, cost-effective energy solutions, greater focus on sustainability, the automotive industry's demand for cooling systems, and a shift towards smart technologies in various sectors are accelerating the Australia heat exchanger tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 403.20 Million |

| Market Forecast in 2033 | USD 619.62 Million |

| Market Growth Rate 2025-2033 | 4.89% |

Australia Heat Exchanger Tubes Market Trends:

Growing demand for energy-efficient systems

The increasing demand for energy-efficient systems is one of the major drivers of growth of the heat exchanger tubes market in Australia. As businesses seek to reduce their energy consumption and costs, energy-efficient systems like heat exchangers gain immense popularity. The systems effectively transfer heat between two fluids with minimum energy loss and improving the efficiency of industrial processes. In power generation, heating, ventilation, and air conditioning (HVAC), and petroleum industries, organizations are relying more and more on heat exchangers to maintain maximum thermal regulation with less environmental impact. Governments and regulatory bodies are tightening energy-efficiency laws as well, encouraging industries further to adopt such systems. In line with this, companies are investing more funds in high-performance heat exchangers that not only yield enhanced thermal performance but also contribute toward lower energy consumption and cost reduction.

To get more information on this market, Request Sample

Rapid Industrialization and Urbanization

Industrialization and urbanization in Australia have been the key drivers of the growth of the heat exchanger tubes market. While firms and cities are growing in size, the demands for power and infrastructure solutions also grow, which leads to greater utilization of heat exchangers. Manufacturing, petrochemical, and food and beverage industries require heat exchangers for their bulk production activities. The demands for residential, commercial, and industrial building cooling and heating have also increased because of urbanization, which further stimulates the market. Besides, urbanization has brought a boost in demand for energy-efficient solutions during the process of cutting carbon footprints and optimizing the usage of resources. Heat exchangers play a crucial role in achieving such measures because they assist in temperature control and energy recovery in various industrial operations. Furthermore, new building developments, residential and commercial, in the rapidly developing urban areas in Australia are boosting demand for advanced heat exchange systems.

Expansion of Renewable Energy Sources

The rise in renewable energy sources in Australia is also contributing positively to the market of heat exchanger tubes. Australia's clean energy sector has experienced a huge boost, with the country installing a record 7.5 gigawatts (GW) of clean power in 2024. This consists of 4.3 GW from large solar farms and 3.2 GW from rooftop solar installations. With the country transitioning to cleaner, more greener power sources, renewable power systems like solar, wind, and geothermal power are making inroads. These systems typically necessitate effective thermal management to help them operate at their best, and that is where heat exchangers are utilized. While Australia promotes the use of renewable energy to reduce its fossil fuel dependency, demand for heat exchangers in these systems is increasing. The government's push towards carbon reduction and the promotion of clean energy are also pushing companies to invest in renewable energy technology, further adding to Australia heat exchanger tubes market growth.

Australia Heat Exchanger Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, product type, tube configuration, distribution channel, and end use industry.

Material Type Insights:

- Stainless Steel

- Carbon Steel

- Copper and Copper Alloys

- Nickel Alloys

- Titanium

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, carbon steel, copper and copper alloys, nickel alloys, titanium, and others.

Product Type Insights:

- Seamless Heat Exchanger Tubes

- Welded Heat Exchanger Tubes

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes seamless heat exchanger tubes and welded heat exchanger tubes.

Tube Configuration Insights:

- U-Tubes

- Straight Tubes

- Finned Tubes

The report has provided a detailed breakup and analysis of the market based on the tube configuration. This includes U-tubes, straight tubes, and finned tubes.

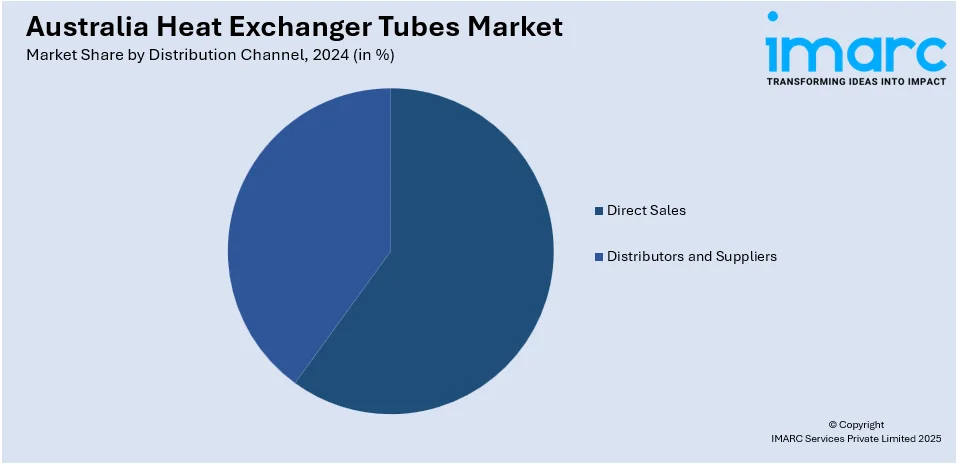

Distribution Channel Insights:

- Direct Sales

- Distributors and Suppliers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and distributors and suppliers.

End Use Industry Insights:

- Power Generation

- Oil and Gas

- Chemical and Petrochemical

- HVAC and Refrigeration

- Food and Beverage Processing

- Automotive and Aerospace

- Marine and Shipbuilding

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes power generation, oil and gas, chemical and petrochemical, HVAC and refrigeration, food and beverage processing, automotive and aerospace, marine and shipbuilding, pharmaceuticals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heat Exchanger Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Carbon Steel, Copper and Copper Alloys, Nickel Alloys, Titanium, Others |

| Product Types Covered | Seamless Heat Exchanger Tubes, Welded Heat Exchanger Tubes |

| Tube Configurations Covered | U-Tubes, Straight Tubes, Finned Tubes |

| Distribution Channels Covered | Direct Sales, Distributors and Suppliers |

| End Use Industries Covered | Power Generation, Oil and Gas, Chemical and Petrochemical, HVAC and Refrigeration, Food and Beverage Processing, Automotive and Aerospace, Marine and Shipbuilding, Pharmaceuticals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia heat exchanger tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia heat exchanger tubes market on the basis of material type?

- What is the breakup of the Australia heat exchanger tubes market on the basis of product type?

- What is the breakup of the Australia heat exchanger tubes market on the basis of tube configuration?

- What is the breakup of the Australia heat exchanger tubes market on the basis of distribution channel?

- What is the breakup of the Australia heat exchanger tubes market on the basis of end use industry?

- What is the breakup of the Australia heat exchanger tubes market on the basis of region?

- What are the various stages in the value chain of the Australia heat exchanger tubes market?

- What are the key driving factors and challenges in the Australia heat exchanger tubes market?

- What is the structure of the Australia heat exchanger tubes market and who are the key players?

- What is the degree of competition in the Australia heat exchanger tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heat exchanger tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heat exchanger tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heat exchanger tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)