Australia Heat Pump Market Size, Share, Trends and Forecast by Rated Capacity, Product Type, End Use Sector, and Region, 2025-2033

Australia Heat Pump Market Overview:

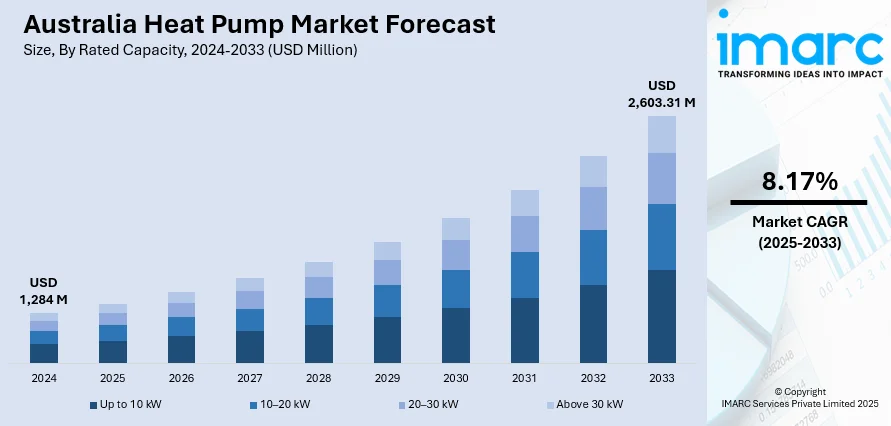

The Australia heat pump market size reached USD 1,284 Million in 2024. Looking forward, the market is expected to reach USD 2,603.31 Million by 2033, exhibiting a growth rate (CAGR) of 8.17% during 2025-2033. Rising energy prices, growing demand for eco-friendly solutions, and government incentives drive the market growth. The drivers consist of a change in energy-efficient systems, tech evolution in heat pump efficiency, and a growing trend towards renewable energy integration. Also, consumer knowledge of long-term cost savings, severe weather conditions, and the rising construction of residential and commercial building are factors supporting the Australia heat pump market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,284 Million |

| Market Forecast in 2033 | USD 2,603.31 Million |

| Market Growth Rate 2025-2033 | 8.17% |

Key Trends of Australia Heat Pump Market:

Rising Energy Costs

Energy prices in Australia have been steadily increasing, prompting both households and businesses to look for more efficient ways to heat and cool their spaces. As a result, heat pumps are becoming an attractive option. Unlike traditional systems such as gas or electric heaters, heat pumps are designed to be more energy efficient. They work by transferring heat from the air or ground, rather than generating heat through energy consumption. This makes them far more efficient, allowing for lower energy bills over time. With the ongoing rise in electricity costs, many consumers are opting for heat pumps to save money in the long run. Additionally, the shift toward energy-efficient solutions is also supported by rising awareness of the environmental benefits of using less energy, which is providing a thrust to the Australia heat pump market growth.

To get more information on this market, Request Sample

Escalating Demand for Sustainable Solutions

Sustainability is becoming a key consideration for many consumers, which is fueling the growth of the heat pump market in Australia. With growing concerns over climate change and environmental impact, many people are actively seeking out greener alternatives for their energy needs. Heat pumps are an excellent alternative because they are less harmful to the environment compared to conventional heating systems. They can utilize renewable energy derived from the ground or air, which makes them a clean alternative for people who want to minimize their carbon emissions. Unlike electric or gas systems, they are less energy-intensive and emit fewer greenhouse emissions to produce heat, thus reducing greenhouse gas emissions. As Australia is working towards achieving its net-zero emissions goal, consumers are opting for energy-efficient as well as environmentally friendly options. This shift in consumer priorities is driving the growth of the heat pump market, as more people choose products that contribute to a more sustainable future.

Government Incentives and Rebates

Government programs offering incentives and rebates have made it more affordable for Australians to install heat pumps, contributing to the market’s growth. Both state and federal governments provide financial assistance to encourage the adoption of energy-efficient technologies. These programs will help cover part of the cost of installing a heat pump, making it a more accessible option for households and businesses alike. For instance, in some states, homeowners can receive rebates for installing energy-efficient systems, which can significantly reduce the upfront cost of purchasing and installing a heat pump. Additionally, there may be tax breaks or low-interest loans available to further ease the financial burden. These government-backed incentives not only make heat pumps more affordable but also encourage consumers to make environmentally conscious choices, which is propelling the market growth.

Growth Factors of Australia Heat Pump Market:

Transition Toward Renewable Energy and Decarbonization Targets

The push toward decarbonization and the overall transition to renewable energy is one of the strongest drivers of growth within the Australia heat pump market. The Australian government has set out aggressive climate targets, and heat pumps are being increasingly identified as a key part of helping to cut residential and commercial carbon emissions. Older, gas- or electric-resistance-based heating systems are being supplanted by more efficient and environmentally friendly technologies like heat pumps. In addition to reducing greenhouse gas emissions, these systems also drop overall energy use in the long term. Australia's transition from natural gas to electric systems has put heat pumps at the forefront of national energy plans. Government incentives and federal and state rebates have been initiated to promote the use of heat pump technologies by households as well as builders. The strategic fit of heat pump uptake with the sustainability goals of Australia makes them an attractive and viable means of delivering heating and cooling requirements in the nation, which further propels the Australia heat pump market demand as well.

Increased Demand for Energy Efficiency in Residential and Commercial Properties

Another key driver of growth for the heat pump market in Australia is the mounting emphasis on increasing energy efficiency for new and existing buildings. As energy prices rise and consumer education improves, property owners are more incentivized to spend on energy-efficient solutions. Heat pumps provide a dual benefit—heating and cooling—making them an attractive option for Australia's varied climate zones. From the cooler parts of Tasmania and the Australian Alps to the hotter states of Queensland and Western Australia, heat pumps can be designed to suit different environmental requirements. In the home market, modifications and new eco-friendly housing developments have heat pumps as standard or highly recommended appliances. Apart from this, business owners and commercial property developers are also adding heat pumps to their sustainability plans in order to achieve green building standards and lower operating expenses. This sectoral demand is making heat pumps a core component of the built environment in Australia.

Technological Improvements and Regional Manufacturing Support

According to the Australia heat pump market analysis, expansion in the region is also being led by improved technology for heat pumps and growing local support for manufacturing and local innovation. Heat pumps today are more efficient, quiet, and are able to operate in a broader range of climatic conditions, such as Australia's warm summers and moderate winters. The companies are meeting the country's special requirements by offering models that are energy-efficient, space-saving, and eco-friendly with the use of low-GWP refrigerants and intelligent control systems. Also, with increased interest in combining heat pumps with other green technologies like solar PV systems and energy storage, especially in off-grid and rural zones, Australia's clean-tech and engineering industries are already leading the way with the integration of such hybrid systems, with its local startups and universities taking a leading role in research and implementation. The encouragement of local innovation, combined with increasing consumer demand for smart home integration, guarantees that heat pump technology will keep changing to suit the needs of the contemporary Australian home and business.

Opportunities of Australia Heat Pump Market:

Growing Applications in Off-Grid and Remote Communities

Australia's sheer size, along with numerous communities situated remotely or off-grid, creates a huge potential for market growth of the heat pump. These areas tend to struggle with accessing affordable and consistent energy, particularly in cold months or unstable climates. Heat pumps, in combination with solar photovoltaic systems, present a clean and energy-efficient option compared to conventional gas or diesel-heating systems. Areas like Northern Territory and Western Australia, where grid connections are restricted or unavailable, would gain from standalone heat pump systems. Government programs for promoting off-grid renewable energy solutions also enhance adoption in such areas. In addition, Indigenous communities are starting to investigate cleaner technology to replace older, less efficient heating systems. With the high solar capability of Australia and advances in battery storage, the use of heat pumps in remote dwellings and community buildings adds comfort while addressing sustainability and energy autonomy.

Development in Sustainable Building and Green Building Design

The growing traction of Australia's green building drive creates tremendous scope for integrating heat pumps in both residential and commercial properties. Green building practices are gaining popularity at a fast pace, with developers and architects wanting to gain Green Star, NABERS, and BASIX certifications. Heat pumps fit extremely well into these systems as they consume less energy, have low emissions, and can be easily integrated into renewable energy systems. New apartment developments, housing estates, and office buildings in major cities such as Melbourne, Sydney, and Canberra are integrating heat pumps into building designs to future-proof structures for the increasing cost of energy and environmental requirements. Retrofitting existing buildings to enhance energy efficiency is another burgeoning industry where heat pumps have the potential to be an essential player. With government backing for urban densification and sustainable developments, particularly in the face of climate resilience policies, there is an emerging demand for scalable cooling and heating solutions that support net-zero targets. Heat pumps are now seen as integral parts of efficient, smart infrastructure.

Emerging Demand in Industrial and Agricultural Sectors

Although residential and commercial uses are predominant today, there is increasing potential for heat pump uptake in Australia's industrial and agricultural sectors. Industrial processes often demand low to medium-temperature heating, which can be effectively delivered by sophisticated industrial heat pump technology. Food processing, dairy, and textile industries are progressively looking to heat pumps as a cleaner alternative to fossil-fuel-fired boilers. Australia's farming industry also offers strong potential, especially in states such as Victoria and South Australia, where controlled heating is needed within greenhouses, animal shelters, and product storage. As concerns regarding the carbon footprint of conventional heating machinery increase, farmers and food processors are looking to more eco-friendly options. Farm businesses that fit energy-efficient devices such as heat pumps can also receive grants and tax credits to reduce emissions in the agricultural sector. As the technology keeps improving and awareness increases, these unconventional markets will continue to be significant drivers of overall heat pump market growth in Australia.

Challenges of Australia Heat Pump Market:

High Upfront Costs and Limited Consumer Awareness

One of the most intractable challenges confronting the Australia heat pump market is the comparably high initial installation cost, which discourages mass adoption—particularly by homeowners and small businesses. While heat pumps ultimately save money through lower energy bills over the long term, the initial outlay is generally much more than for conventional electric or gas heating systems. In most instances, the payback period is too extended for customers lacking knowledge of the total economic and environmental benefits. Additionally, awareness of the workings of heat pumps and their efficiency benefits remains restricted. Although large cities such as Melbourne and Sydney experience higher exposure to clean technologies, rural and regional areas are behind in awareness and availability. A lack of defined, focused communication from manufacturers, retailers, and policymakers is part of the reasons for slower market adoption. In the absence of sustained education campaigns and incentives reducing initial costs, it is challenging for the technology to pick up among frugal Australian consumers.

Infrastructure Limitations and Shortages of Skilled Labor

Another significant challenge to the Australia heat pump market is the existing lack of infrastructure and state of readiness of the workforce to facilitate extensive installation. Heat pumps need specialized installation, periodic maintenance, and in some cases, customized design based on building size and application. There is, however, a lack of trained technicians and installers in heat pump technology, especially in non-metropolitan regions. This skills deficiency can lead to variable installation quality, delayed service, and increased costs for consumers. Moreover, much of Australia's older residential and commercial stock might lack electrical infrastructure capable of supporting heat pumps, necessitating expensive upgrades that discourage adoption. Space limitations and intricate shared infrastructure in multi-unit buildings and apartment blocks can make retrofitting in-building central systems more challenging. These challenges are going to need workforce training investment, technical support at large scale, and planning of integration across Australia's building and construction industries.

Regulatory Complexity and Fragmented Policies

Australia's federal government system results in energy policies and building codes varying from state to state, which makes the market for heat pumps a fragmented regulatory space that makes it harder for the market to expand. Some states provide rebates and incentives to promote uptake while others fall behind in policy formulation or offer confusing guidelines that discourage prospective buyers and developers. For instance, variations in energy efficiency regulations, renewable penetration obligations, and carbon emission limits can affect project viability and return on investment throughout jurisdictions. This absence of policy consistency also hinders manufacturers and installers to scale-up nationally. For the heat pump industry to realize significant growth in Australia, it needs a better coordinated and streamlined national policy response that brings incentives together, harmonizes regulation, and promotes cooperation among the federal government and states to provide consistent assistance to sustainable heating and cooling technologies throughout the country.

Australia Heat Pump Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on rated capacity, product type, and end use sector.

Rated Capacity Insights:

- Up to 10 kW

- 10–20 kW

- 20–30 kW

- Above 30 kW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes 10 kW, 10–20 kW, 20–30 kW, and above 30 kW.

Product Type Insights:

- Air Source Heat Pump

- Ground Source Heat Pump

- Water Source Heat Pump

- Exhaust Air Heat Pump

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes air source heat pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others.

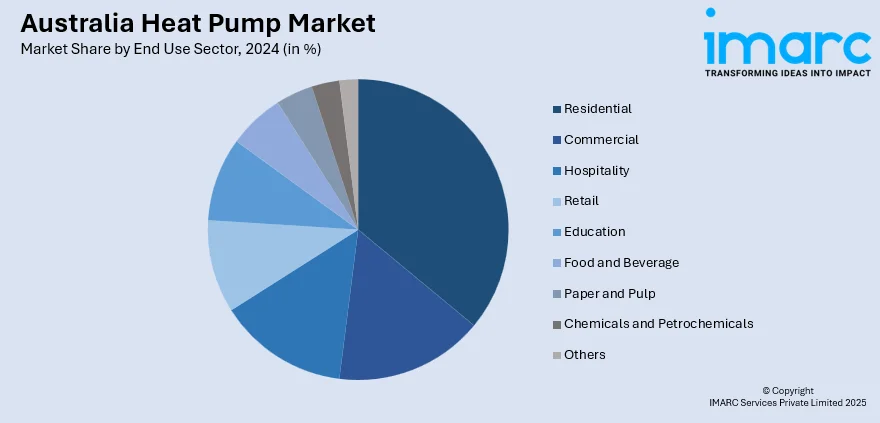

End Use Sector Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Education

- Food and Beverage

- Paper and Pulp

- Chemicals and Petrochemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes residential, commercial, hospitality, retail, education, food and beverage, paper and pulp, chemicals and petrochemicals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heat Pump Market News:

- In 2025, Rheem introduced its RD17AZ residential heat pump, offering high efficiency with up to 19 SEER2 and 8.5 HSPF2 ratings. The unit features R-410a refrigerant, inverter-driven variable-speed technology, and built-in Bluetooth connectivity via Rheem's EcoNet app, enhancing user control and energy management.

- In 2023, Panasonic Australia partnered with Reclaim Energy to launch a CO₂-based hot water heat pump system. The system boasts a Coefficient of Performance (COP) of 6.1, making it up to five times more efficient than traditional gas or electric heaters. It is suitable for both residential and commercial use.

Australia Heat Pump Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Rated Capacities Covered | Up to 10 kW, 10–20 kW, 20–30 kW, Above 30 kW |

| Product Types Covered | Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, Others |

| End Use Sectors Covered | Residential, Commercial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heat pump market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heat pump market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heat pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia heat pump market was valued at USD 1,284 Million in 2024.

The Australia heat pump market is projected to exhibit a CAGR of 8.17% during 2025-2033.

The Australia heat pump market is expected to reach a value of USD 2,603.31 Million by 2033.

The Australia heat pump market is moving toward eco-friendly, energy-efficient solutions in response to the shift from gas. Smart home integration, all-climate performance systems, and hybrid models that integrate solar power are becoming more popular. Buyers and developers are also increasingly seeking sustainable heating and cooling solutions consistent with national decarbonization and energy-efficiency objectives.

The Australia heat pump market is fueled by the shift toward carbon neutrality, increasing energy prices, and urban demand for energy-efficient technologies. Government incentives, green building trends, and the transition from gas to electric heating systems also contribute toward adoption, particularly within residential and commercial markets across diverse Australian climate regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)