Australia Heat Reflective Roof Coatings Market Size, Share, Trends and Forecast by Type, Resin Type, Application, and Region, 2025-2033

Australia Heat Reflective Roof Coatings Market Overview:

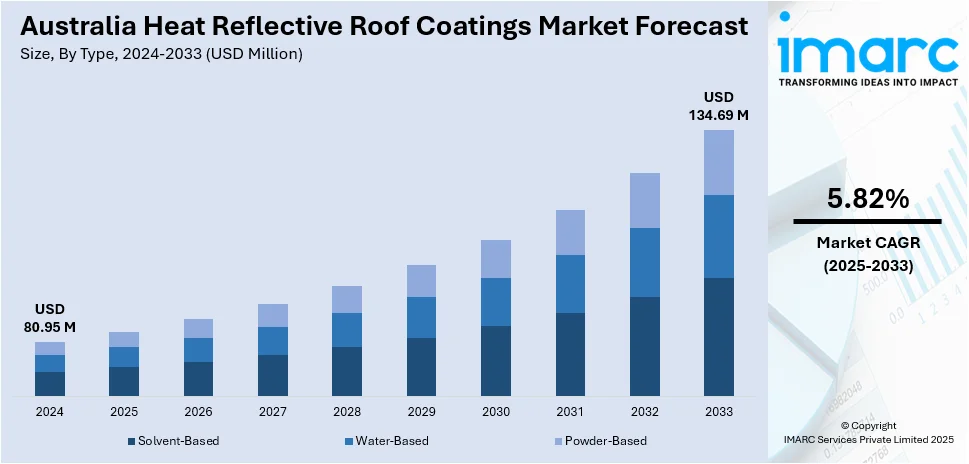

The Australia heat reflective roof coatings market size reached USD 80.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 134.69 Million by 2033, exhibiting a growth rate (CAGR) of 5.82% during 2025-2033. The market is driven by growing emphasis on sustainable construction, energy efficiency, and thermal comfort across residential, commercial, and industrial sectors. Heat reflective roof coatings are being increasingly integrated into green building codes and infrastructure strategies due to their capacity to mitigate heat load, reduce energy use, and prolong roof durability. Their expanding role in climate-adaptive construction practices is contributing significantly to the rising Australia heat reflective roof coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.95 Million |

| Market Forecast in 2033 | USD 134.69 Million |

| Market Growth Rate 2025-2033 | 5.82% |

Australia Heat Reflective Roof Coatings Market Trends:

Increasing Adoption in Urban Residential Construction

The heightening focus on sustainable urban growth has greatly impacted the uptake of heat reflective roof coatings in Australian urban centers. Residential building, especially in urban centers with hot summer conditions, is more and more adopting reflective coatings as a passive method of cooling. These coatings help achieve thermal comfort through solar radiation reflection, which in turn keeps indoor temperatures lower and decreases energy usage related to air conditioning. Housing developers and homeowners are beginning to see the long-term financial advantages of these coatings, particularly as energy prices increase and environmental regulations tighten. For instance, in May 2025, Solacoat introduced its two-stage heat reflective coating system for metal, concrete, timber, and so on that reflects up to 84.9% of solar rays, minimizing heat accumulation and saving on cooling expenses. Moreover, residential building practices are projected to be a key driver of product usage for a long time to come. Australia heat reflective roof coatings growth is thus closely associated with accelerating consumer awareness and the integration of energy-efficient solutions within home designs, driving sustained market momentum in the residential market across urbanized areas.

To get more information on this market, Request Sample

Incorporation within Green Building Certification Standards

As Australia moves more towards achieving international sustainability objectives, green building certification systems like Green Star and NABERS are impacting the selection of building materials, such as the application of heat reflective roof coats. These certifications encourage the adoption of materials that enhance thermal efficiency and minimize carbon emissions. Heat reflective coatings, by helping to create cooler roof surfaces and greater energy efficiency, are becoming a standard feature in high environmental rating projects. Their capacity to assist with compliance with national and local energy standards places them in an attractive position as a pragmatic option for architects and builders committed to sustainability targets. Incorporation of reflective technology in green certification requirements further encourages formulation and application innovation. Here, Australia heat reflective roof coatings market growth is being spurred by institutional encouragement and industry-wide intentions toward sustainable building practices.

Growing Application in Industrial and Infrastructure Projects

Outside residential and commercial areas, industrial buildings and infrastructure developments in Australia are now prime adopters of heat reflective roof coatings. Warehouses, distribution facilities, and public structures with extensive roof areas are giving high priority to reflective technologies to combat heat load and shield roofing materials from deterioration. These coatings not only help improve energy performance but also increase roofing system durability by lessening thermal cycling. Urban heat island management and building durability in Australia's diverse climate zones are being recognized by infrastructure planners with the involvement of reflective coatings. These coatings are attractive with their double advantage, thermal control and asset protection—that aligns with long-term operational strategies for large facilities. Australia heat reflective roof coatings growth in this segment indicates strategic investments directed towards climate resilience and operational efficiency in the built environment.

Australia Heat Reflective Roof Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, resin type, and application.

Type Insights:

- Solvent-Based

- Water-Based

- Powder-Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes solvent-based, water-based, and powder-based.

Resin Type Insights:

- Epoxy

- Polyester

- Silicon

- Acrylic

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes epoxy, polyester, silicon, and acrylic.

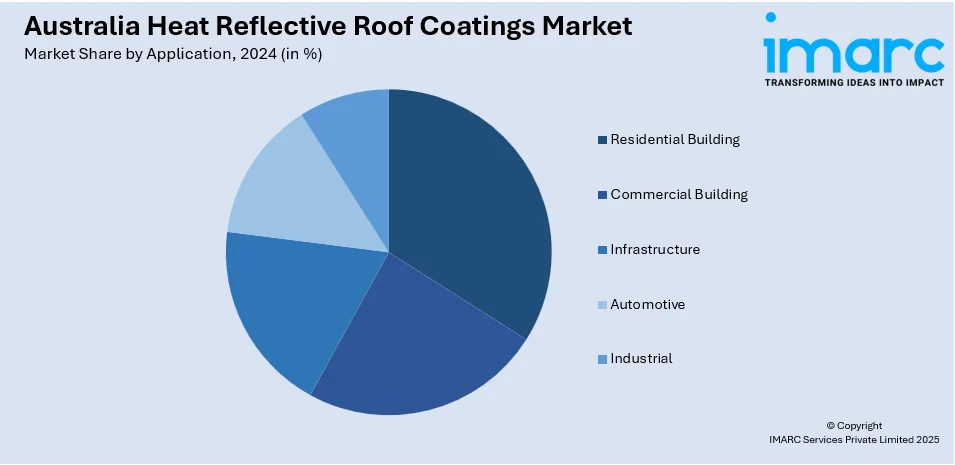

Application Insights:

- Residential Building

- Commercial Building

- Infrastructure

- Automotive

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential building, commercial building, infrastructure, automotive, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heat Reflective Roof Coatings Market News:

- In February 2025, Australia's Nutech Paint introduced its next-generation NXT® Cool Zone® Heat Reflective Roof Coating. Combining thermal protection and self-cleaning nanotechnology, the innovation lowers roof temperatures, saves cooling energy costs, and preserves aesthetic appeal—a sustainable, energy-efficient solution in accordance with contemporary design and environmental standards.

Australia Heat Reflective Roof Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent-Based, Water-Based, Powder-Based |

| Resin Types Covered | Epoxy, Polyester, Silicon, Acrylic |

| Applications Covered | Residential Building, Commercial Building, Infrastructure, Automotive, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia heat reflective roof coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia heat reflective roof coatings market on the basis of type?

- What is the breakup of the Australia heat reflective roof coatings market on the basis of resin type?

- What is the breakup of the Australia heat reflective roof coatings market on the basis of application?

- What is the breakup of the Australia heat reflective roof coatings market on the basis of region?

- What are the various stages in the value chain of the Australia heat reflective roof coatings market?

- What are the key driving factors and challenges in the Australia heat reflective roof coatings?

- What is the structure of the Australia heat reflective roof coatings market and who are the key players?

- What is the degree of competition in the Australia heat reflective roof coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heat reflective roof coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heat reflective roof coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heat reflective roof coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)