Australia Heat Transfer Fluids Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia Heat Transfer Fluids Market Size and Share:

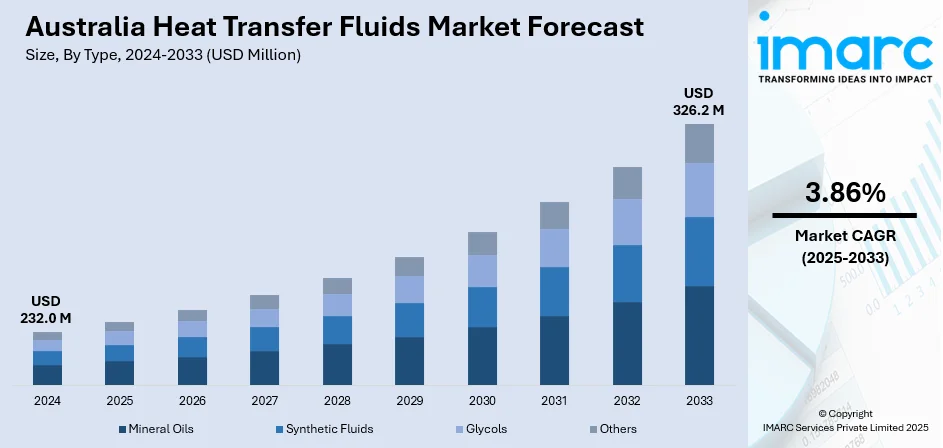

The Australia heat transfer fluids market size reached USD 232.0 Million in 2024. Looking forward, the market is expected to reach USD 326.2 Million by 2033, exhibiting a growth rate (CAGR) of 3.86% during 2025-2033. Investments in solar thermal energy, geothermal systems, and mining operations are increasing the demand for advanced thermal fluids. Regulatory pressure on energy efficiency is driving upgrades in industrial heat management systems. Use of synthetic and biodegradable fluids, nano-enhanced formulations, and expanded aftermarket services are some of the factors positively impacting the Australia heat transfer fluids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 232.0 Million |

| Market Forecast in 2033 | USD 326.2 Million |

| Market Growth Rate 2025-2033 | 3.86% |

Key Trends of Australia Heat Transfer Fluids Market:

Industrial Expansion in Renewable Energy and Mining Operations

Australia's energy landscape has undergone a significant transformation with growing investments in solar thermal power plants and geothermal systems, particularly in regions such as South Australia and Queensland. These sectors rely extensively on heat transfer fluids to regulate system temperatures and enhance energy efficiency across fluctuating operational loads. On April 12, 2023, Brisbane-based Graphene Manufacturing Group (GMG) announced the commercialization progress of THERMAL-XR®, a graphene-enhanced heat transfer coating approved for large-scale production and sale in Australia. The company secured its largest domestic order worth AUD 130,000 (approx. USD 87,000) to coat nearly 200 air conditioning units at an eco-resort, marking strong adoption in the HVAC-R market and signaling increased demand for advanced heat transfer solutions. GMG estimates the total addressable market for THERMAL-XR® at over USD 28.4 Billion globally, with potential applications extending into data centres and LNG facilities.

To get more information on this market, Request Sample

Concentrated solar power (CSP) plants, for instance, use synthetic oils or molten salts to store and transfer heat, making fluid performance critical to plant stability and cost control. The expansion of such thermal-based renewable energy infrastructure, supported by national and regional decarbonization policies, increases the technical requirements for thermal stability, oxidation resistance, and environmental safety in fluid selection. Simultaneously, Australia's dominant mining industry contributes to demand, especially in operations involving metal extraction, chemical processing, and on-site energy systems. These processes necessitate specialized thermal fluids to handle high pressures and maintain consistent performance under extreme conditions. As global commodity demands fluctuate, Australian mining companies are upgrading thermal systems to meet efficiency targets and environmental standards. As procurement and engineering teams prioritize reliable and safe thermal operations, broader adoption of custom-formulated fluids tailored to site-specific thermal profiles is becoming central to Australia heat transfer fluids market growth.

Technological Advancements and Regulatory Emphasis on Energy Efficiency

The advancement of high-performance formulations in thermal management systems has become a central element in shaping end-user adoption. Recent innovations include synthetic aromatic-based fluids and nano-enhanced thermal compounds, designed to provide superior heat conductivity, lower maintenance cycles, and resistance to thermal degradation. These enhancements have proven particularly relevant in precision-driven sectors such as pharmaceuticals, food processing, and electronics manufacturing, where consistent thermal control is essential. In Australia, mid-sized manufacturing plants have begun integrating such technologies to meet international quality standards and minimize energy losses. Regulatory institutions, including the Australian Energy Regulator (AER) and various state agencies, have emphasized energy efficiency through compliance frameworks and financial incentives. Industrial users are increasingly obligated to evaluate thermal system losses and improve energy audits, which brings thermal fluid performance into direct focus.

On September 18, 2023, CSIRO and the Australian National University announced they would showcase a liquid sodium solar receiver at the SolarPACES Conference, highlighting Australia’s advancement in high-efficiency concentrated solar power (CSP) technologies. The receiver operates with liquid sodium as the heat transfer fluid, delivering thermal energy at up to 740 °C for coupling with supercritical CO₂ Brayton cycles capable of thermal-to-electric efficiencies exceeding 50%, compared to 40% in conventional steam cycles. The system’s 220 °C operating range and projected 87% combined optical and thermal efficiency mark a significant step forward in high-temperature thermal transfer applications, expanding potential use cases for advanced heat transfer fluids in solar and industrial energy sectors. Moreover, sustainability-oriented procurement policies among corporate buyers have prompted a shift toward biodegradable or low-toxicity fluid options. The convergence of performance expectations and policy compliance has prompted local distributors and global suppliers to expand product lines and invest in after-market services, such as system flushing and lifecycle monitoring. This complex mix of regulation and innovation forms a resilient demand base that further shapes Australia heat transfer fluids market trends.

Growth Drivers of Australia Heat Transfer Fluids Market:

Renewable Energy Growth and Solar-Thermal Market

Australia's swift transition to renewable energy is a key driver for the expansion of its heat transfer fluids market, especially in investments in solar-thermal technologies. The nation's expansive and sun-abundant territories, particularly in the Northern Territory and Western Australia are perfect for concentrated solar power (CSP) schemes, which depend heavily on heat transfer fluids in order to store and transport thermal energy. These fluids are essential to provide constant energy output even during cloudy days or after dusk. Regional innovation in hybrid energy designs integrating solar with other renewable options has raised the level of complexity in thermal systems, where high-performance, thermally stable fluids become increasingly important. The support of the Australian government for solar infrastructure through regional energy zones and plans for clean energy transition has also contributed to increasing demand. These projects look to lower carbon emissions and enhance energy resilience in off-grid communities, where effective heat management systems are critical to maintaining renewable power flows.

Industrial and Mining Application in Hostile Environments

The region’s mining and processing of natural resources are critical drivers for the Australia heat transfer fluids market demand, particularly in light of the country's rugged environment and remote operations. Operations associated with extraction in areas such as the Pilbara, Mount Isa, and the Outback necessitate thermal management systems that are capable of withstanding intense heat, dust, and extended cycles of operations. Heat transfer fluids are critical in the processing of ores, smelting, and the functioning of mobile and stationary equipment dependent upon reliable thermal output. Additionally, most of these industrial locations are remote, where mechanical breakdown through thermal stress can shut down production and incur significant costs. To counter such risks, industries are resorting more to advanced synthetic fluids and maintenance-friendly systems with extended lifetimes. Apart from mining, industries such as chemicals, pharmaceuticals, and food processing, particularly around coastal urban areas, are implementing cleaner thermal technologies, motivated both by environmental compliance requirements and cost-effective production needs.

Innovation, Sustainability, and Local Manufacturing

Australia's heat transfer fluid market is also being driven by a strong emphasis on innovation and sustainable production methods. The nation's research institutions and scientific sector are working with industry to establish new thermal fluid formulations that will perform even under high-temperature and long-duration storage conditions. As clean hydrogen, battery storage, and renewable industrial processes grow, demand for specially designed heat transfer solutions grows with it. Responding to this, local manufacturers are increasingly manufacturing non-toxic, biodegradable, and circular economy compatible fluids. Government incentives and financing to increase domestic manufacturing capacity have made it possible to cut back on imports and customize products for the local environment. This focus on sustainability is also evidenced in procurement patterns as most companies prefer suppliers who are environmental and safety certified. Together, these elements create a vibrant ecosystem that enables innovation alongside the special thermal requirements of Australia's varied climate and industries.

Opportunities of Australia Heat Transfer Fluids Market:

Expansion of Hydrogen and Green Industrial Projects

Australia's increasing position in the international green hydrogen economy offers a significant opportunity for the heat transfer fluids industry. With huge renewable energy resources and extensive areas of unused land, the nation is emerging as a center for production of green hydrogen, mainly in zones like Western Australia, South Australia, and Queensland. Such hydrogen plants need thermal management during different stages of electrolysis, compression, and storage, which are processes that rely on stable heat transfer systems. When hydrogen production increases in scale, there will be a significant demand for high-performance fluids that can handle extreme temperature fluctuations. Hybrid facilities that combine hydrogen with wind or solar power also require sophisticated thermal regulation in order to maintain operational efficiency. The growth of green ammonia and hydrogen export terminals introduces additional complexity, which needs thermal fluids with high safety and performance requirements. This conversion of Australia's industrial energy base presents a long-term market for advanced thermal fluid technologies.

Improvements in District Heating and Cooling Systems

While previously less widespread in Australia because of its lower population and milder climatic conditions in some regions, district heating and cooling networks are appearing in high-density city developments, specifically in Melbourne, Sydney, and Canberra. These systems gain huge advantages from low loss heat transfer fluids, particularly since more mixed-use precincts and smart infrastructure initiatives are being constructed. As urban planners work towards sustainable urbanization and mitigating energy wastage, centralized thermal energy networks gain feasibility, creating new opportunities for fluid system integration. Commercial areas and university campuses offer chances for district energy systems to apply novel thermal storage and heat transfer technologies, largely connected to renewable or recovered sources of energy. The shift towards carbon-neutral campuses and net-zero buildings further promotes the use of low-carbon footprint energy-efficient fluids. Since the new buildings will be designed with built-in heating and cooling right from the beginning, the demand for long-life, customizable fluids compatible with Australian building standards is bound to increase.

Agriculture and Cold Chain Infrastructure Expansion

Australia's high-volume agricultural production and its growing export-market-oriented food processing industry offer a unique opportunity for the heat transfer fluids market, especially in cold chain logistics and refrigeration. Areas such as Victoria, Tasmania, and South Australia are witnessing growing demand for efficient cold storage as a result of rising meat, dairy, and horticulture exports. Having ideal temperature conditions in these supply chains is critical to food safety and quality and this can only be achieved through proper thermal management systems employing environmentally friendly high-performance fluids. In addition, with climate change contributing increasingly harsher weather patterns, there is increasing interest in climate-resilient refrigeration and heating systems for indoor agriculture and storage warehouses. Agribusiness companies are also investing in hybrid systems and solar-assisted cooling to cut costs and emissions, calling for multi-purpose heat transfer fluids with the ability to perform well in changing conditions. These agri-environmental advancements, along with logistics modernization, are creating a strong niche market for regionally specific fluid technologies.

Challenges of Australia Heat Transfer Fluids Market:

Severe Weather Conditions and Degradation of Fluids

According to the Australia heat transfer fluids market analysis, one of the major challenges for the industry is the country's severe and fluctuating climate, which subjects fluid systems to extreme thermal stress. Ambient temperatures in much of the country, especially in the Outback and central Western and South Australia, are very high over extended periods, which hastens the degradation of traditional heat transfer fluids. Extended exposure to high-intensity UV radiation and dusty, dry conditions poses risks of oxidation, fouling, and contamination in closed-loop systems. Such conditions require specialized fluids with higher thermal stability and chemical resistance, which are products that tend to be more costly and harder to find in household supply chains. Additionally, dispersed industrial plants like mines and solar power facilities often work under conditions where frequent fluid maintenance is not feasible, resulting in performance declines and safety issues. Resolution of these environmental limitations continues to be a primary challenge for manufacturers and service providers seeking to operate efficiently throughout Australia's varied climatic regions.

Limited Domestic Manufacturing and Supply Chain Dependence

Australia's comparatively small domestic market for chemical production restricts local manufacturing of high-end heat transfer fluids, necessitating imports from Europe, North America, and Asia. Such dependence is logistically inconvenient, particularly when there is an urgent need for replacement or specialty products in far-flung locations like mining districts or solar farms. The long lead times of overseas shipments can lead to expensive project delays or extended downtime for essential thermal systems. In addition, volatile global freight prices and regional disruptions, e.g., congestion at shipping ports or geopolitical tensions, can boost procurement costs and make inventory planning more difficult for industrial consumers. Limited technical support and servicing infrastructure for high-end thermal fluid systems also constrains adoption in smaller or mid-sized operations. For Australia to minimize this vulnerability, the market would require additional local formulation capabilities, warehousing centers close to industrial hubs, and selected investment in onshore manufacture of fluid components appropriate to regional needs.

Regulatory Complexity and Environmental Compliance

Compliance with Australia's regulatory framework for industrial fluids can be tricky, particularly as the government shores up its commitment to environmental sustainability and carbon abatement targets. Though these measures are valuable to long-term economic and environmental well-being, they pose compliance issues for businesses handling heat transfer fluids that are toxic in some way or have limited recyclability. Importers and users need to guarantee compliance with changing chemical safety, emission, and waste management requirements, which tend to vary across states and territories. Some thermal fluids used in the past in mining or energy industries, for instance, are now regulated under stricter classification and disposal regulations, necessitating modifications in system design and handling procedures. Moreover, more Australian industries are being compelled to record the entire lifecycle effect of operational chemicals, leading to pressure on fluid suppliers to provide traceability, environmental declarations, and certified green products. Changing to accommodate regulatory conditions takes time and money, thus becoming a big barrier for some companies in the industry.

Australia Heat Transfer Fluids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Mineral Oils

- Synthetic Fluids

- Glycols

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mineral oils, synthetic fluids, glycols, and others.

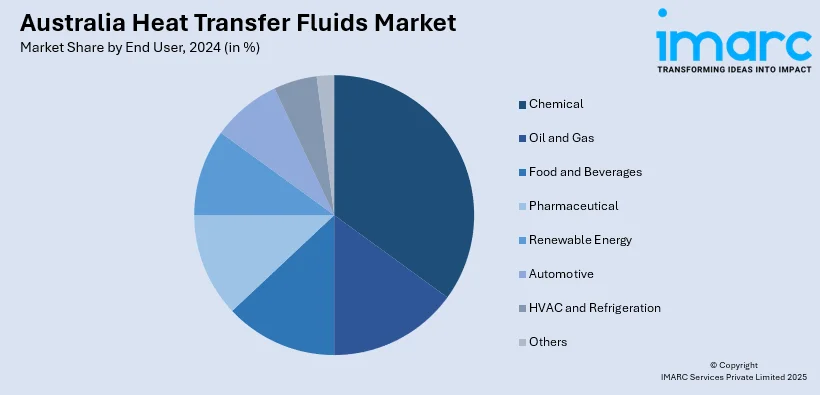

End User Insights:

- Chemical

- Oil and Gas

- Food and Beverages

- Pharmaceutical

- Renewable Energy

- Automotive

- HVAC and Refrigeration

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes chemical, oil and gas, food and beverages, pharmaceutical, renewable energy, automotive, HVAC and refrigeration, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including demand trends by component, deployment mode, enterprise size, application, and end user. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heat Transfer Fluids Market News:

- On August 2023, UK-based Global Heat Transfer expanded its thermal fluid safety technology into Australia and New Zealand by launching its Thermal Fluid Analysis Kit and Light Ends Removal Kit (LERK) to support safer and more efficient heat transfer fluid operations. These tools enable on-site sampling and degradation analysis, particularly for remote or offshore facilities, and the LERK reduces fire risk by removing volatile light ends from degraded thermal fluids, which can lower the fluid’s flash point. The rollout addresses a critical demand in Australia’s food, chemical, and industrial processing sectors for improved thermal fluid lifecycle management and safety compliance.

Australia Heat Transfer Fluids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Oils, Synthetic Fluids, Glycols, Others |

| End Users Covered | Chemical, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heat transfer fluids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heat transfer fluids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heat transfer fluids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia heat transfer fluids market was valued at USD 232.0 Million in 2024.

The Australia heat transfer fluids market is projected to exhibit a CAGR of 3.86% during 2025-2033.

The Australia heat transfer fluids market is expected to reach a value of USD 326.2 Million by 2033.

The Australia heat transfer fluids market is shifting toward environment-friendly, high-performance formulations. Growing investments in renewable energy, green hydrogen, and cold chain logistics drive demand. There is also a trend toward localized production and customization to suit harsh climates, alongside stricter regulations encouraging sustainable, non-toxic, and biodegradable thermal fluid solutions.

Key drivers of the Australia heat transfer fluids market include expanding renewable energy projects, especially solar-thermal and hydrogen, growth in mining and industrial processing, and increasing demand for energy-efficient systems. Government support for decarbonization and infrastructure development also boosts adoption of advanced thermal fluids across diverse regional and climatic conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)