Australia Helicopter Services Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Australia Helicopter Services Market Overview:

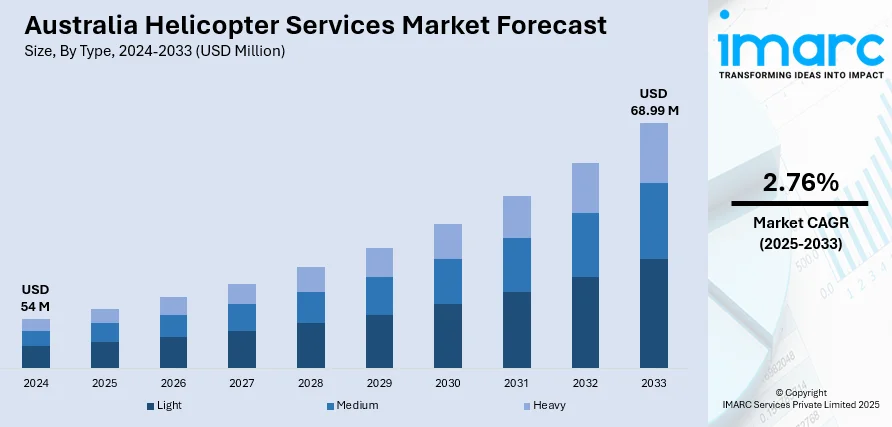

The Australia helicopter services market size reached USD 54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 68.99 Million by 2033, exhibiting a growth rate (CAGR) of 2.76% during 2025-2033. The demand for Australian aerial emergency services is rising steadily due to the mounting need for quick medical evacuation, disaster response, and firefighting missions. Additionally, helicopter technology is evolving, enhancing the performance of helicopter services throughout Australia. Apart from this, the innovations in the tourism industry are expanding the Australia helicopter services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54 Million |

| Market Forecast in 2033 | USD 68.99 Million |

| Market Growth Rate 2025-2033 | 2.76% |

Australia Helicopter Services Market Trends:

Growing Need for Air Emergency Services

The demand for Australian aerial emergency services is expanding steadily due to the mounting need for quick medical evacuation, disaster response, and firefighting missions. Helicopters are increasingly being used as indispensable tools in emergencies when road travel is restricted or not accessible. With wildfires, floods, and medical emergencies persisting at an increased scale, helicopter services are increasingly being used for urban and remote locations. Helicopter operators continually upgrade their capabilities and fleets to accommodate the increasing demand for these essential services. With Australia's extensive and rough landscapes, combined with its vulnerability to catastrophes such as bushfires, helicopter services are working progressively to ensure effective and timely response. Operators are upgrading their technology and training staff, upgrading to respond better both to emergency and non-emergency situations. This transformation is an indication of an increasing awareness of helicopters as important resources for rescuing lives during emergency circumstances. In 2024, Two Airbus H175 helicopters were officially operational with PHI Aviation in Australia, aiding their offshore energy transport, search and rescue, and medical evacuation missions. PHI, known for many pioneering achievements during its 75-year history, maintains bases in Broome, Darwin, and Exmouth, Australia. The new H175 helicopters were decided to operate from Broome, with more H175s anticipated to be added to the fleet soon. “These cutting-edge planes are an important enhancement to our expanding fleet in Australia. They enhance our operational efficiency while strengthening our dedication to sustainable innovation and providing top-notch service to our customers," stated Cory Latiolais, Chief Operating Officer of PHI Aviation for Asia Pacific.

To get more information on this market, Request Sample

Developments in Helicopter Technology

Helicopter technology keeps evolving, enhancing the performance of helicopter services throughout Australia. The infusion of cutting-edge systems, including sophisticated avionics, more efficient power plants, and more safety features, is radically enhancing the capability and dependability of helicopters. Operators are more embracing new technologies such as digital flight management, real-time weather tracking, and autonomous flight. These technologies are fueling the need for more powerful and adaptable helicopters, which enable operators to cover a broader spectrum of industries. The changing technology is not only enhancing the safety and operational effectiveness of helicopter operations but also lowering costs by making flight operations more fuel-efficient and minimizing maintenance downtime. Further, the advent of green technologies, such as hybrid-electric helicopters, is solving sustainability issues. As these advancements in technology continue, helicopter operators are adding to their fleets and modernizing existing ones to remain competitive in a more technologically advanced market. In 2025, The Australian military is preparing to utilize the Boeing AH-64E Apache attack helicopter, with initial deliveries anticipated by the close of 2025. Boeing reports that Australia's first Apache, AT001, has begun final assembly in Mesa, Arizona. Amy List, managing director of Boeing Defence Australia, mentions that five Australian firms are part of the supply chain supporting the Apache initiative. At first, the primary weapon of the rotorcraft will be the Lockheed Martin AGM-114 Hellfire air-to-ground missile.

Tourism and Scenic Flight Growth

Australia's thriving tourism industry is at the forefront of demand for helicopter services, particularly for scenic and luxury flights. Australia's symbolic landscapes, ranging from the Great Barrier Reef to the outback and coastal areas, are drawing more tourists who want to explore these natural attractions from the air. Helicopter businesses are catering to this demand with customized sightseeing packages, luxury tours, and private charters. As more prosperous travelers seek unique and memorable experiences, the demand for tourism-related helicopter services is growing. Helicopter businesses are aggressively developing their services to meet these high-end travelers, emphasizing luxury and customized experiences. Furthermore, tourism-oriented helicopter services are being combined with other adventure tourism activities, including wine tours, island hopping, and access to select resorts. This increased demand for out-of-the-ordinary travel experiences is propelling the Australian helicopter services market growth. IMARC Group predicts that the Australia travel & tourism market is projected to attain USD 21.1 Billion by 2033.

Australia Helicopter Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Light

- Medium

- Heavy

The report has provided a detailed breakup and analysis of the market based on the type. This includes light, medium, and heavy.

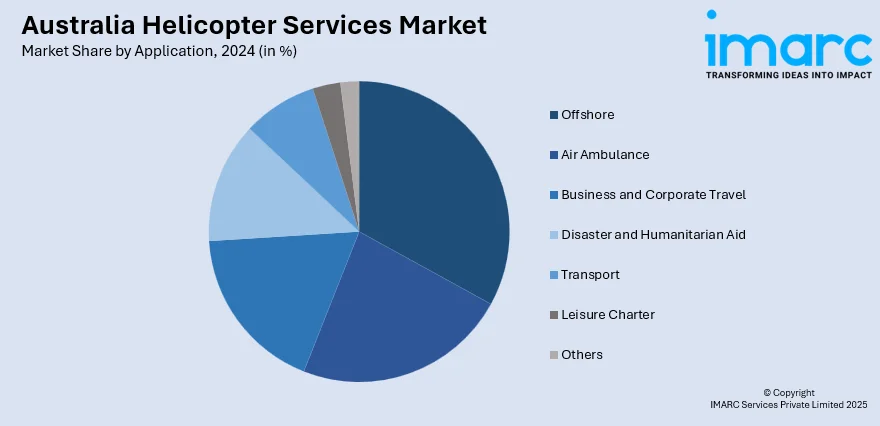

Application Insights:

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and others.

End User Insights:

- Civil

- Commercial

- Military

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes civil, commercial, and military.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Helicopter Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Heavy |

| Applications Covered | Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, Others |

| End Users Covered | Civil, Commercial, Military |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia helicopter services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia helicopter services market on the basis of type?

- What is the breakup of the Australia helicopter services market on the basis of application?

- What is the breakup of the Australia helicopter services market on the basis of end user?

- What is the breakup of the Australia helicopter services market on the basis of region?

- What are the various stages in the value chain of the Australia helicopter services market?

- What are the key driving factors and challenges in the Australia helicopter services market?

- What is the structure of the Australia helicopter services market and who are the key players?

- What is the degree of competition in the Australia helicopter services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia helicopter services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia helicopter services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia helicopter services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)