Australia Home Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Form, Distribution Channel, and Region, 2025-2033

Australia Home Diagnostic Testing Market Overview:

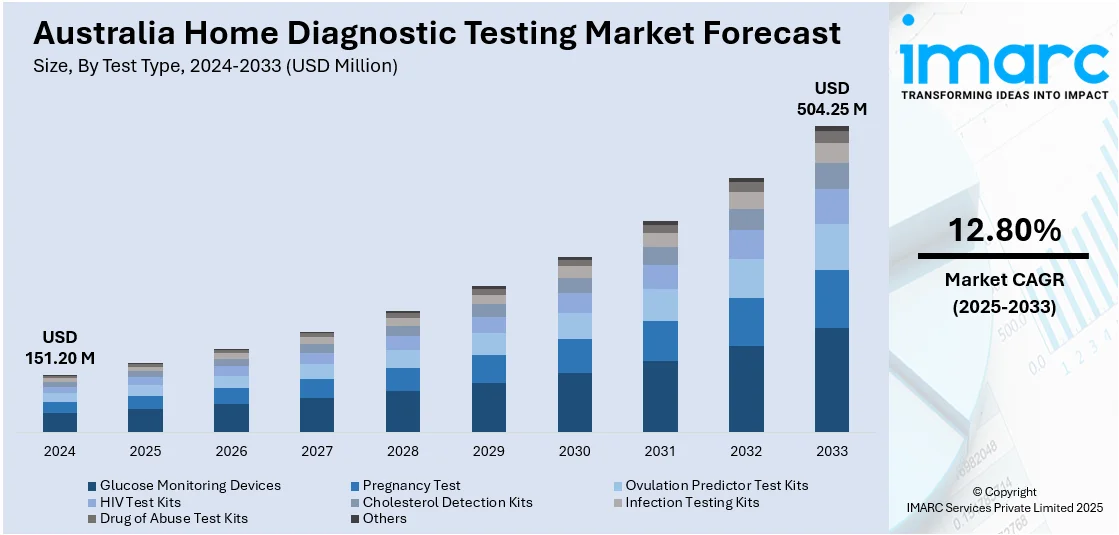

The Australia home diagnostic testing market size reached USD 151.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 504.25 Million by 2033, exhibiting a growth rate (CAGR) of 12.80% during 2025-2033. The market is driven by rising consumer demand for personalized health management and the convenience of private, in-home testing services. Telehealth integration and digital health platforms are enhancing test accessibility, data usability, and clinical interoperability across the care continuum. Government-backed programs promoting preventive care are embedding self-testing into national health strategies, further augmenting the Australia home diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 151.20 Million |

| Market Forecast in 2033 | USD 504.25 Million |

| Market Growth Rate 2025-2033 | 12.80% |

Australia Home Diagnostic Testing Market Trends:

Digital Health Ecosystem and Telehealth Integration

Australia’s rapid adoption of telehealth services has created a seamless framework for incorporating home diagnostic testing into mainstream healthcare pathways. General practitioners and specialists are increasingly recommending self-testing kits that integrate with digital platforms, enabling remote consultations based on real-time data. This model is particularly valuable in rural and remote regions, where access to pathology labs is limited and logistical delays hinder timely care. As per recent industry reports, over 30% of Australians live in rural or remote regions where healthcare accessibility is a concern. Leading telehealth providers now bundle consultations with diagnostic services, allowing patients to receive test kits at home and upload results securely via dedicated portals or mobile apps. Furthermore, the integration of AI-enabled interpretation tools supports patients in understanding results while alerting clinicians to potential anomalies. Public health campaigns, supported by both federal and state health departments, are encouraging regular self-screening for conditions such as bowel cancer and COVID-19, driving demand for reliable, TGA-approved test kits. The growing interoperability between test devices, smartphones, and healthcare databases strengthens confidence in home-based diagnostics and broadens their clinical application. This digital synergy is expected to remain a cornerstone of patient-centric care, particularly as the country’s healthcare system modernizes its infrastructure. Together, these conditions contribute substantially to Australia home diagnostic testing market growth as consumers prioritize autonomy and efficiency in health assessment.

To get more information on this market, Request Sample

Cost-Effectiveness and Public Health Initiatives

In a landscape characterized by escalating healthcare costs and an aging population, home diagnostic testing offers a cost-efficient alternative to routine screenings and laboratory-based diagnostics. National health policies increasingly emphasize preventive care, with self-testing positioned as a means to reduce hospital admissions, facilitate early detection, and streamline resource allocation. Apart from this, government-sponsored programs such as the National Bowel Cancer Screening Program (NBCSP) and initiatives for sexual health awareness among youth directly distribute or subsidize test kits to encourage wide participation. On December 4, 2024, Australia’s Therapeutic Goods Administration (TGA) approved the first at-home diagnostic test for chlamydia and gonorrhea. Developed by Sydney-based Touch Biotechnology, the test, which involves a simple vaginal swab. With over 95% accuracy, it helps differentiate between these common sexually transmitted infections and supports early treatment. For the healthcare system, this model reduces bottlenecks in pathology labs and lowers operational burdens on general practitioners. Additionally, insurance providers and health funds are beginning to explore partial reimbursements or incentives for using approved home test kits, further encouraging adoption across income groups. Educational outreach and multilingual instruction materials have also made home diagnostics more accessible to Australia’s diverse population. As the country invests in strengthening its community healthcare model, home-based testing is gaining institutional support as a scalable solution that complements traditional care without undermining medical oversight. The economic and societal efficiencies achieved through these strategies continue to reinforce the relevance of self-administered diagnostics.

Australia Home Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, form, and distribution channel.

Test Type Insights:

- Glucose Monitoring Devices

- Pregnancy Test

- Ovulation Predictor Test Kits

- HIV Test Kits

- Cholesterol Detection Kits

- Infection Testing Kits

- Drug of Abuse Test Kits

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes glucose monitoring devices, pregnancy test, ovulation predictor test kits, HIV test kits, cholesterol detection kits, infection testing kits, drug of abuse test kits, and others.

Form Insights:

- Cassettes

- Midstream

- Instruments

- Strips

- Test

- Digital Monitoring

- Dip Cards

The report has provided a detailed breakup and analysis of the market based on the form. This includes cassettes, midstream, instruments, strips, test, digital monitoring, and dip cards.

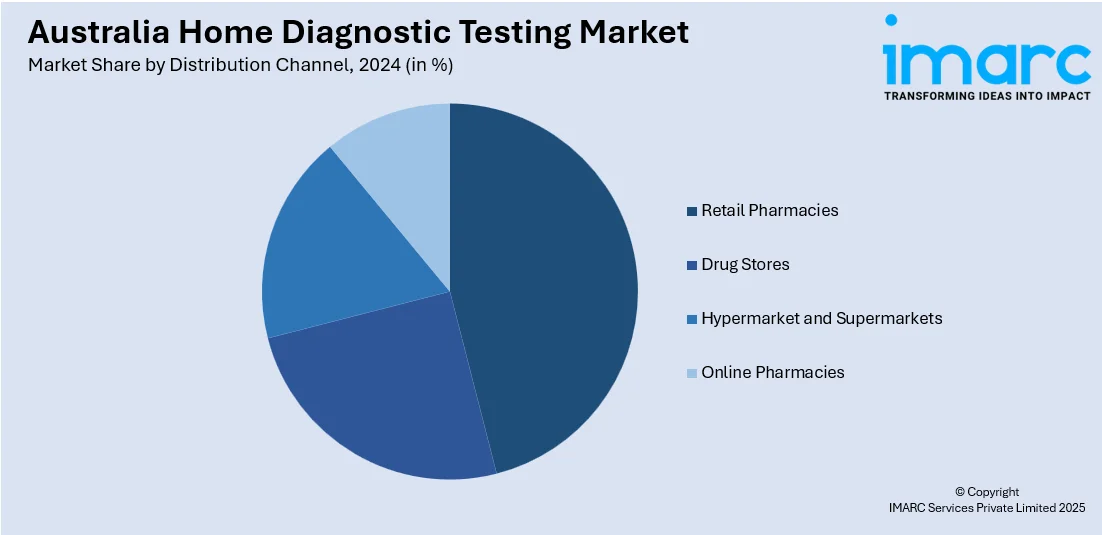

Distribution Channel Insights:

- Retail Pharmacies

- Drug Stores

- Hypermarket and Supermarkets

- Online Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, drug stores, hypermarket and supermarkets, and online pharmacies.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Diagnostic Testing Market News:

- On April 7, 2025, Atomo Diagnostics received a USD 230,000 order from Thorne Harbour Health to supply HIV self-test kits as part of the Australian government's CONNECT program. This program, designed to promote HIV self-testing, is expanding across South Australia and Victoria under the 2024 federal budget initiative. Atomo's HIV self-test kits, known for their high accuracy, are crucial to the government’s ongoing HIV prevention efforts, with a portion of the USD 43.9 Million budget allocated for their procurement.

Australia Home Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Glucose Monitoring Devices, Pregnancy Test, Ovulation Predictor Test Kits, HIV Test Kits, Cholesterol Detection Kits, Infection Testing Kits, Drug of Abuse Test Kits, Others |

| Forms Covered | Cassettes, Midstream, Instruments, Strips, Test, Digital Monitoring, Dip Cards |

| Distribution Channels Covered | Retail Pharmacies, Drug Stores, Hypermarket and Supermarkets, Online Pharmacies |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home diagnostic testing market on the basis of test type?

- What is the breakup of the Australia home diagnostic testing market on the basis of form?

- What is the breakup of the Australia home diagnostic testing market on the basis of distribution channel?

- What is the breakup of the Australia home diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Australia home diagnostic testing market?

- What are the key driving factors and challenges in the Australia home diagnostic testing market?

- What is the structure of the Australia home diagnostic testing market and who are the key players?

- What is the degree of competition in the Australia home diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home diagnostic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)