Australia Home Furnishings Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2025-2033

Australia Home Furnishings Market Overview:

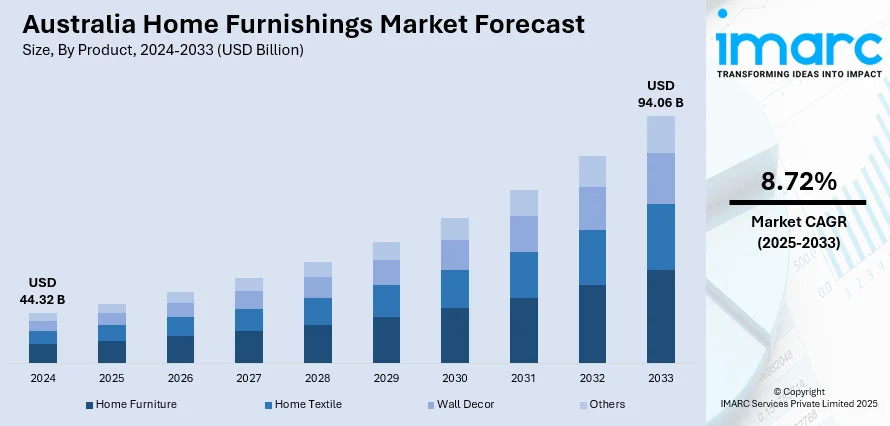

The Australia home furnishings market size reached USD 44.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 94.06 Billion by 2033, exhibiting a growth rate (CAGR) of 8.72% during 2025-2033. The market is being driven by rising urbanization, evolving consumer lifestyles, elevating demand for multifunctional and space-saving furniture, growing interest in sustainable and ethically sourced products, substantial housing development, and the expanding retail footprints by global brands aiming to meet the preferences of design-conscious and eco-aware consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 44.32 Billion |

| Market Forecast in 2033 | USD 94.06 Billion |

| Market Growth Rate 2025-2033 | 8.72% |

Australia Home Furnishings Market Trends:

Rising Urbanization and Changing Housing Trends

One of the strongest drivers of the home furnishings industry in Australia is the fast rate of urbanization and the changing character of residential living. With more people moving to cities, there's a greater need for space-saving, space-efficient, and multi-functional furniture that is appropriate for apartments and small living spaces. Australia is one of the most urbanized countries in the world, with nearly 90% of the population living in urban conglomerations, particularly Sydney, Melbourne, and Brisbane. In these areas, the high property prices have facilitated the development of high-rise apartments and townhouses rather than detached houses. This transformation in housing types is redefining consumer tastes when it comes to furnishings. Compact living pushes consumers to spend on modular furniture, fold-down tables, expandable sofas, and storage-packed pieces that fill minimal square space. Additionally, the visual tastes of city residents are inclined toward minimalist, Scandinavian-style pieces that keep pace with contemporary interior styles and minimal space. Developers and retailers are pushing back with edited furniture collections that directly address apartment dwelling.

To get more information on this market, Request Sample

Emergence of Sustainable and Ethical Consumerism

Consumers in Australia are growing more conscious about the environmental footprint, so they are demanding furniture that is sustainably sourced, ethically produced, and long-lasting. Purchasers are increasingly examining the provenance of raw materials, opting for FSC-certified timber, recycled metal, and natural rather than synthetic or non-renewable materials. Likewise, demand for brands that use fair labor practices, minimize manufacturing waste, and employ environmentally friendly packaging is on the rise. Local manufacturers that specialize in hand-made, long-lasting, and low-impact furniture are increasingly desirable against mass-produced and throwaway furniture. This increased eco-awareness is also leading to material science innovation in the form of using bamboo composites, recycled wood, and compostable upholstery. Rental-based furniture models, refurbished marketplaces, and renewing services are also becoming in-vogue replacements for the original purchase, targeting consumers with an affinity towards circular economy strategies.

Australia Home Furnishings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, price, and distribution channel.

Product Insights:

- Home Furniture

- Home Textile

- Wall Decor

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes home furniture, home textile, wall decor, and others.

Price Insights:

- Mass

- Premium

A detailed breakup and analysis of the market based on the price have also been provided in the report. This includes mass and premium.

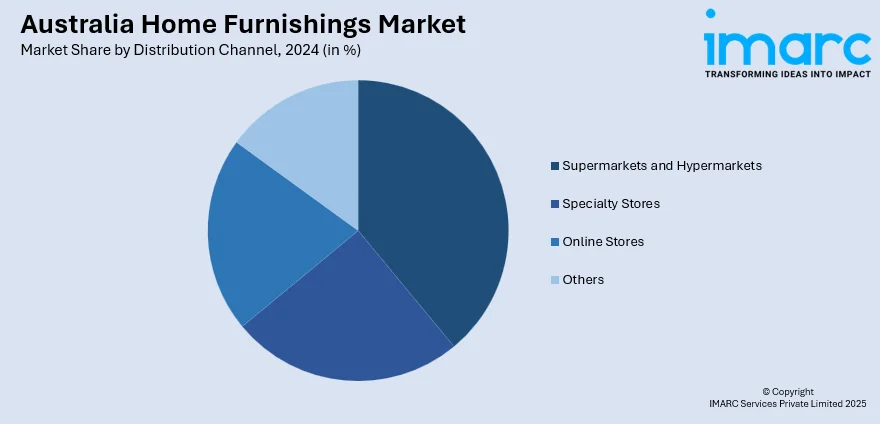

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Furnishings Market News:

- December 2024: Country Road and Tait unveiled the Saltbush collection, a limited-edition outdoor furniture range celebrating Australian design and outdoor living. The collection includes a lounger, side table, and occasional table, all crafted in Melbourne using sustainable materials like 100% recycled boucle and porcelain.

- July 2024: UK-based David Phillips Group expanded into Australia’s growing living sector. With over 2,500 Build-to-Rent units and 30+ display apartments furnished nationwide, the company offers tailored, sustainable solutions for both rental and sale properties.

- May 2023: Laura Ashley partnered with Basford Brands to reintroduce its British home furnishings to Australia and New Zealand. The collaboration offers exclusive collections featuring the brand’s signature prints on cushions, throws, curtains, and made-to-measure fabrics.

Australia Home Furnishings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Home Furniture, Home Textile, Wall Decor, Others |

| Prices Covered | Mass, Premium |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home furnishings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home furnishings market on the basis of product?

- What is the breakup of the Australia home furnishings market on the basis of price?

- What is the breakup of the Australia home furnishings market on the basis of distribution channel?

- What is the breakup of the Australia home furnishings market on the basis of region?

- What are the various stages in the value chain of the Australia home furnishings market?

- What are the key driving factors and challenges in the Australia home furnishings market?

- What is the structure of the Australia home furnishings market and who are the key players?

- What is the degree of competition in the Australia home furnishings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home furnishings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home furnishings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home furnishings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)