Australia Home Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Australia Home Furniture Market Overview:

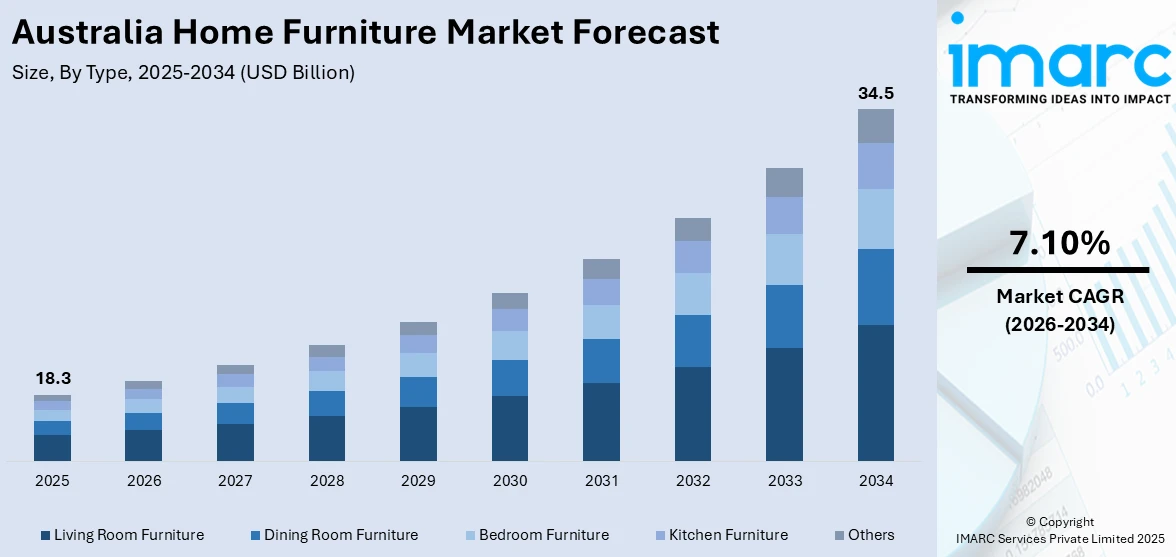

The Australia home furniture market size reached USD 18.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 34.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.10% during 2026-2034. The market is driven by rising preferences for open plan living and multifunctional layouts in modern homes, along with the growing reliance on online platforms to discover new brands and compare styles, are some of the major factors contributing to the Australia home furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.3 Billion |

| Market Forecast in 2034 | USD 34.5 Billion |

| Market Growth Rate 2026-2034 | 7.10% |

Key Trends Australia Home Furniture Market:

Increasing Construction Activities

Rising construction activities are offering a favorable Australia home furniture market outlook. As per the IMARC Group, the Australia construction market size was valued at USD 403.2 Billion in 2024. As more residential projects are being developed to accommodate the growing population and urban expansion, the demand for furnishing new homes is increasing. Newly built houses, apartments, and townhouses require a wide assortment of furniture, inculcating bedroom furniture, dining pieces, living room sets, and storage units. This rising need is promoting the local furniture manufacturing. As homeowners are seeking to furnish their spaces with modern, functional, and stylish pieces, furniture brands are responding with diverse item offerings. High construction activity also aligns with user spending patterns, wherein individuals are more inclined to invest in interior aesthetics once they move into new spaces. Moreover, the growing preferences for open-plan living and multifunctional layouts in modern homes are encouraging purchases of modular and space-saving furniture. Rising homeownership among younger generations is also supporting this trend, as they are more likely to personalize their homes with curated furniture.

To get more information on this market Request Sample

Rising Influence of Social Media

The increasing influence of social media is fueling the Australia home furniture market growth. With an increasing number of social media users across different age groups, people are increasingly exposed to a wide variety of interior design ideas and furniture styles. According to industry reports, by January 2024, there were roughly 20.8 Million individuals using social media in Australia, which represented about 76% of the population. Social media platforms are exposing users to the latest interior design trends, encouraging them to update their living spaces with modern and aesthetically pleasing furniture. Social media influencers, home décor bloggers, and content creators frequently showcase furniture setups, do it yourself (DIY) hacks, and styling tips, which motivates followers to recreate similar looks in their own homes. This visual exposure is increasing awareness and demand for stylish, functional, and trendy pieces. Younger consumers, in particular, often rely on online platforms to discover new brands and compare styles, leading to more informed and design-based purchases. Many furniture retailers and manufacturers are also leveraging social media to market their products directly to people, using targeted ads and user-generated content. The ease of shopping through integrated e-commerce links on social platforms is further boosting sales.

Growth in Sustainable and Eco-Friendly Furniture

Australia’s home furniture market is witnessing a growing trend toward sustainability and eco-conscious products. Consumers are increasingly choosing furniture made from reclaimed wood, responsibly sourced timber, recycled metals, and organic fabrics. This shift is driven by rising environmental awareness and demand for non-toxic, durable materials that support circular economy principles. Brands are responding with lines that highlight certified materials, low-emission finishes, and upcycling initiatives. Additionally, transparency in supply chains and ethical production practices—often showcased through certifications like FSC or OEKO-TEX—are becoming key purchase influencers. With households committed to reducing their carbon footprints, sustainable furniture is not only a style preference but a lifestyle statement, paving the way for long-term growth in eco-centric product categories.

Growth Drivers of Australia Home Furniture Market:

Rapid Urbanization and Residential Development

Australia’s accelerating urban growth—particularly in cities like Sydney, Melbourne, and Brisbane—is significantly boosting demand for home furniture. As new housing and apartment projects proliferate to accommodate population increases, more households seek functional, modern furnishings to outfit living spaces. Developers and homeowners are opting for open‑plan layouts featuring modular and multifunctional furniture that adapts to compact urban settings. This urban expansion, coupled with rising homeownership rates, is encouraging sustained demand for bedroom, lounge, dining, and storage products. The construction of new homes and rentals provides a steady pipeline for furniture sales, making residential development a critical pillar of growth in the home furniture sector.

Increasing Disposable Incomes and Lifestyle Spending

Rising disposable incomes and elevated living standards are empowering Australian consumers to invest more in home décor and comfort. Amidst a cultural shift that values interior aesthetics, branded and premium furniture purchases have surged. Households are prioritizing durable, stylish, and sustainable furnishings, opting for pieces that reflect lifestyle and personal taste. Additionally, remote working trends have spurred investment in home office furniture, while growing interest in outdoor living drives demand for patio and alfresco products. According to the Australia home furniture market analysis, these shifts create ongoing demand across diverse furniture segments, supporting both entry‑level and high-end brands and stimulating market growth across channels.

E‑commerce Expansion and Digital Consumer Engagement

The Australian market for home furniture is being reshaped by the rapid expansion of online retail channels. E‑commerce platforms like Temple & Webster are gaining traction through augmented reality (AR) tools, 3D visualizations, and immersive virtual showrooms, helping consumers visualize furniture in their homes before purchasing. This digital evolution enables easy browsing, comparison, and delivery, enhancing convenience and expanding reach, especially in regional or underserved areas. As online and omnichannel models mature, furniture brands that invest in digital innovation are better positioned to capture tech‑savvy consumers and drive sustained market expansion.

Market Outlook of Australia Home Furniture:

Rising Preference for Modular and Custom-Built Furniture

Australia’s home furniture market is witnessing a shift toward modular and customizable furniture solutions as consumers seek greater control over style, functionality, and fit. Modular designs are gaining traction due to their versatility, ease of transport, and adaptability to diverse spaces. This trend is particularly prominent among millennials and Gen Z, who favor designs that suit their evolving lifestyle needs and room configurations. Furniture brands are introducing mix-and-match components and offering digital configuration tools for personalized selections. These innovations are also appealing to renters and first-time homebuyers who desire flexible yet affordable options. As demand for bespoke aesthetics and space efficiency continues to rise, brands focusing on modular innovations are expected to achieve stronger market relevance and growth in the years ahead.

Growing Influence of Interior Design Trends and Media Exposure

Contemporary interior design trends, amplified by television programs, home makeover shows, and social media influencers, are playing a key role in shaping consumer purchasing behavior in Australia’s home furniture market. Platforms such as Instagram, Pinterest, and TikTok expose consumers to a wide variety of furniture styles, ranging from Scandinavian minimalism to industrial and bohemian aesthetics. This visual inspiration increases brand discovery, drives aspirational purchases, and shortens buying cycles. Influencer partnerships and curated online room sets also stimulate demand for full-theme décor, encouraging consumers to replace or upgrade existing furnishings. As media continues to impact consumer taste and awareness, companies that align with emerging design narratives and collaborate with digital creators are poised to gain stronger market traction.

Integration of Smart Technology in Furniture Offerings

The growing adoption of smart homes in Australia is opening new avenues for technology-integrated home furniture. Consumers are increasingly drawn to furniture items equipped with tech features such as wireless charging, LED lighting, and voice control compatibility. Smart desks with USB ports, adjustable height beds, and sofas with built-in Bluetooth speakers are gaining popularity among tech-savvy households and remote workers. This shift is also supported by Australia’s expanding digital infrastructure and lifestyle changes post-pandemic, where convenience and connected living have become key priorities. Furniture manufacturers collaborating with tech companies or developing in-house smart innovations are expected to capitalize on this demand, transforming traditional furnishings into lifestyle-enhancing assets.

Australia Home Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Living Room Furniture

- Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes living room furniture, dining room furniture, bedroom furniture, kitchen furniture, and others.

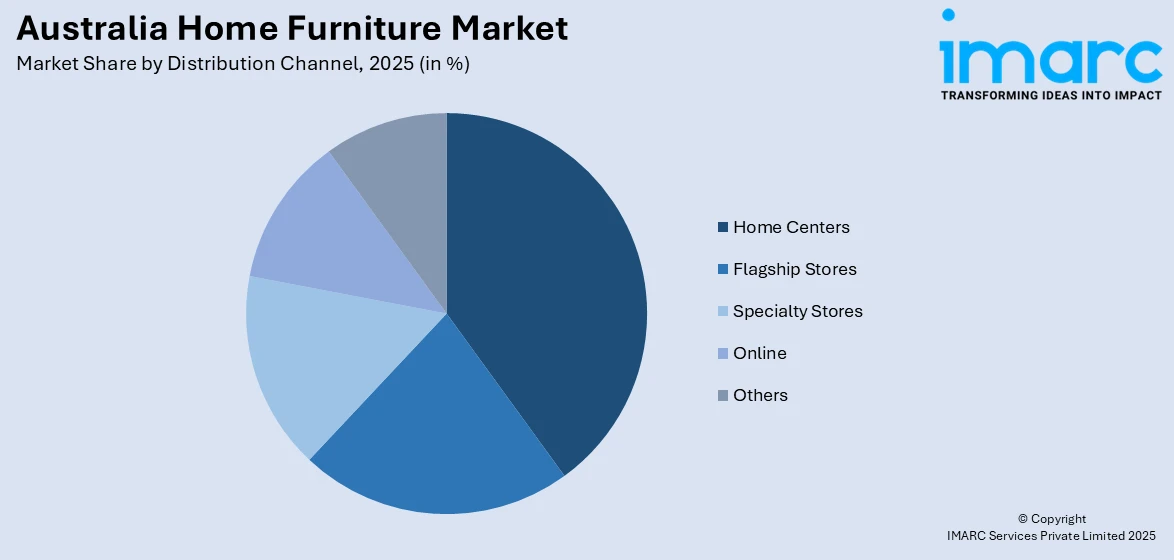

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Home Centers

- Flagship Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home centers, flagship stores, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Furniture Market News:

- In April 2025, IKEA introduced the eighth iteration of the STOCKHOLM collection in Australia. The new version featured the largest collection to date with 96 elegantly crafted items. It inculcated an array of furniture, textiles, lighting, and accessories for every part of home, including eye-catching sofas, handwoven wool rugs, mouthblown glass vases, and ceramic dishware.

- In December 2024, Enza Home, the prominent furniture retailer, opened its first Australian showroom in Melbourne. The flagship store, covering 1500sqm, was inaugurated at Ringwood and showcased a variety of sofas, dining sets, bedroom furnishings, lighting, and home textiles.

Australia Home Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Others |

| Distribution Channels Covered | Home Centers, Flagship Stores, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home furniture market in Australia was valued at USD 18.3 Billion in 2025.

The Australia home furniture market is projected to exhibit a CAGR of 7.10% during 2026-2034.

The Australia home furniture market is projected to reach a value of USD 34.5 Billion by 2034.

Some of the growth drivers propelling the market include rapid urbanization and increased homeownership and expansion of e-commerce and omnichannel retail enhancing accessibility. Rising disposable incomes also boost spending on quality and designer furniture. Sustainability awareness encouraging eco-friendly product adoption; and growth in home renovation and lifestyle upgrades further support market expansion.

Key trends in the Australia home furniture market include rising demand for multifunctional and space-saving furniture, growing adoption of online and AR-based shopping platforms, and increasing consumer preference for sustainable and eco-friendly materials in both design and manufacturing processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)