Australia Home Healthcare Equipment Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Australia Home Healthcare Equipment Market Overview:

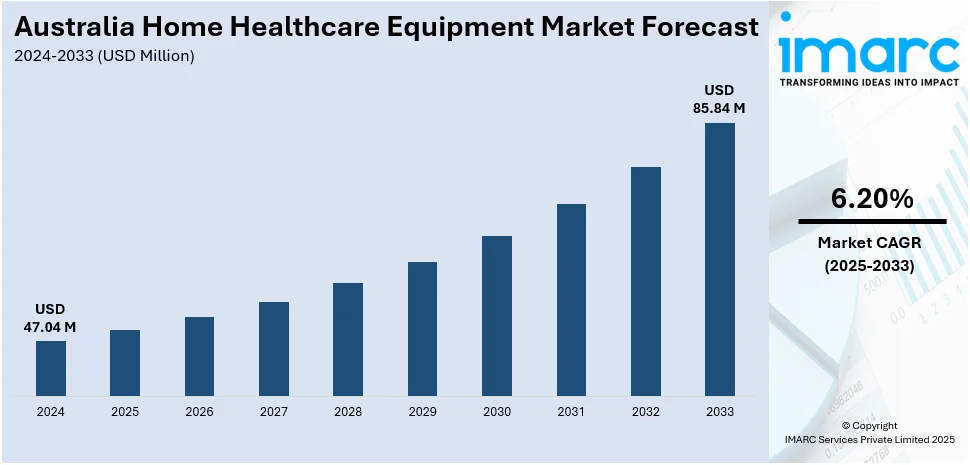

The Australia home healthcare equipment market size reached USD 47.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 85.84 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is expanding due to increased investment in digital health platforms and clinic infrastructure. Additionally, growing demand for remote care technologies and regulatory support continues to strengthen Australia home healthcare equipment market share across urban and regional healthcare delivery systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 47.04 Million |

| Market Forecast in 2033 | USD 85.84 Million |

| Market Growth Rate 2025-2033 | 6.20% |

Australia Home Healthcare Equipment Market Trends:

Cross-Border Collaboration Enhancing Innovation in Home Healthcare

The Australian home healthcare equipment market is experiencing a notable trend driven by international collaboration and innovation exchange. As the demand for advanced, patient-centric technologies grows, partnerships between domestic and global medical technology (MedTech) ecosystems are becoming increasingly essential. These collaborations not only facilitate access to new markets but also accelerate the development and deployment of cutting-edge home healthcare solutions. A key example of this trend occurred in October 2024, when MTPConnect renewed its Memorandum of Understanding with Medical Alley, a prominent U.S.-based hub for health innovation. This agreement aimed to support Australian medtech companies by opening pathways into the U.S. market, fostering innovation exchange, and enabling joint initiatives. The renewed partnership also emphasized support for inbound and outbound missions, knowledge sharing, and strategic networking. By connecting Australian innovators with one of the world’s most advanced medtech ecosystems, the collaboration has helped accelerate the commercialization of home-use medical technologies. This trend reflects a broader shift toward global integration in healthcare innovation, where shared expertise and market access play a critical role in shaping product development. As a result, the Australian home healthcare equipment market is becoming more competitive, with increased availability of high-quality, globally aligned solutions tailored for home-based care.

To get more information on this market, Request Sample

Private Capital Accelerating Infrastructure and Equipment Modernization

The Australian home healthcare equipment market is also being shaped by a strong trend of private capital investment aimed at expanding healthcare infrastructure and modernizing clinical services. This trend is particularly evident in the growing involvement of global investment firms that provide tailored financial solutions to support healthcare providers. In March 2025, KKR, a leading global investment firm, extended a bespoke financing solution to Family Doctor Pty Ltd, one of Australia’s largest networks of GP clinics. This funding was designed to support the expansion of over 110 clinics across key metropolitan and regional areas. The investment enabled Family Doctor to enhance its service delivery by integrating modern medical technologies, including home-use diagnostic and monitoring equipment. This development not only improved access to primary care but also strengthened the role of home healthcare tools in everyday clinical practice. As more clinics adopt advanced equipment to support remote care and chronic disease management, the demand for reliable, high-quality home healthcare devices is expected to continue rising. This trend highlights the growing importance of financial backing in scaling healthcare services and ensuring that modern, technology-enabled solutions are accessible to patients nationwide. It also reinforces the market’s shift toward decentralized, patient-focused care models, further driving Australia home healthcare equipment market growth.

Australia Home Healthcare Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product.

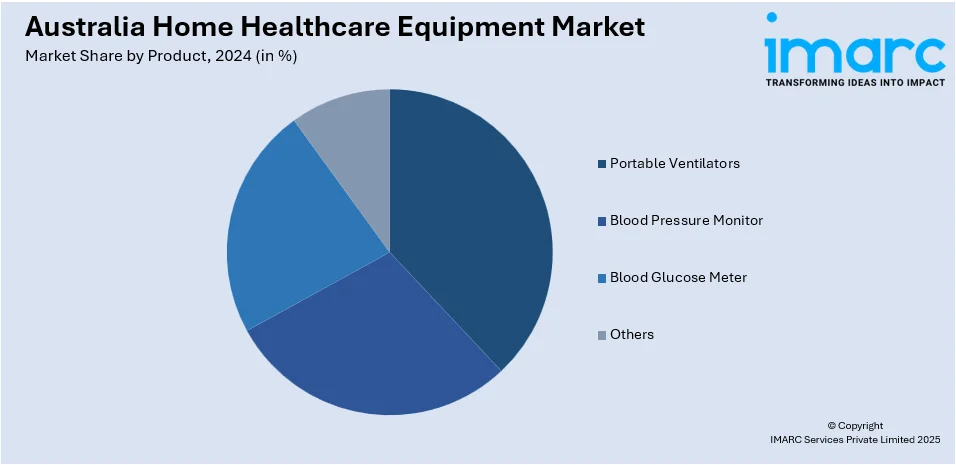

Product Insights:

- Portable Ventilators

- Blood Pressure Monitor

- Blood Glucose Meter

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes portable ventilators, blood pressure monitor, blood glucose meter, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Healthcare Equipment Market News:

- April 2025: NextClinic received nationwide approval to issue electronic prescriptions across Australia. This advancement improved access to digital healthcare tools, supporting the Australia home healthcare equipment market by enhancing remote care delivery, reducing clinic visits, and strengthening continuity of care for patients in all regions.

- November 2024: AVITA Medical signed an exclusive distribution agreement with Revolution Surgical to reintroduce its RECELL wound care platform in Australia and New Zealand. This expanded access to advanced regenerative devices, strengthening the Australia home healthcare equipment market through localized innovation and improved patient outcomes.

Australia Home Healthcare Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Portable Ventilators, Blood Pressure Monitor, Blood Glucose Meter, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home healthcare equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home healthcare equipment market on the basis of product?

- What is the breakup of the Australia home healthcare equipment market on the basis of region?

- What are the various stages in the value chain of the Australia home healthcare equipment market?

- What are the key driving factors and challenges in the Australia home healthcare equipment market?

- What is the structure of the Australia home healthcare equipment market and who are the key players?

- What is the degree of competition in the Australia home healthcare equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home healthcare equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home healthcare equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home healthcare equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)