Australia Home Healthcare Market Size, Share, Trends and Forecast by Product, Service, Indication, and Region, 2025-2033

Australia Home Healthcare Market Size and Share:

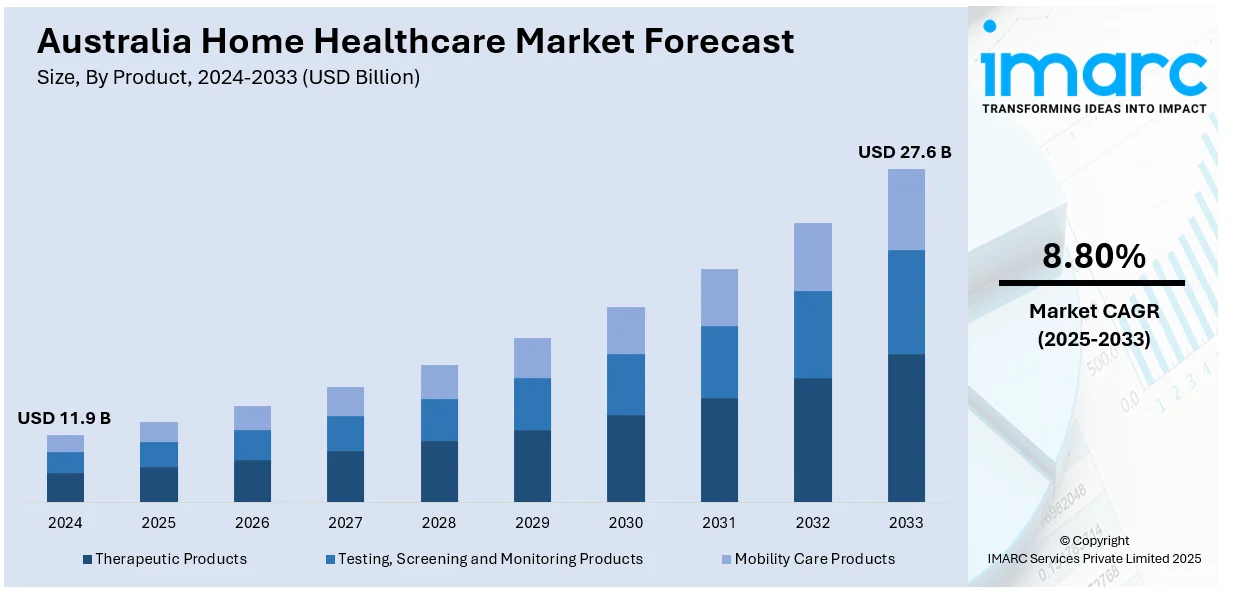

The Australia home healthcare market size reached USD 11.9 Billion in 2024. Looking forward, the market is expected to reach USD 27.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. The market share is growing driven by an aging population with chronic conditions, supportive government policies, and rapid technological advancements that enable personalized, cost-effective, and data-driven care in home settings, reducing hospital strain and improving access across both urban and remote communities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.9 Billion |

| Market Forecast in 2033 | USD 27.6 Billion |

| Market Growth Rate 2025-2033 | 8.80% |

Key Trends of Australia Home Healthcare Market:

Aging Population and Chronic Disease Prevalence

The home healthcare market in Australia is largely influenced by its aging demographic and the rising occurrence of chronic illnesses. As the average age of Australians keeps increasing, there is a related rise in age-associated health problems like cardiovascular diseases, arthritis, and dementia. This change in demographics exerts greater strain on the conventional healthcare system, which frequently faces challenges related to capacity and expenses. As a solution, home healthcare offers a feasible and expandable option, allowing elderly people to receive ongoing support in the comfort of their residences. Additionally, handling chronic conditions frequently necessitates ongoing treatment, lifestyle management, and regular check-ups, factors that are ideally suited for home-based care. The personalized approach and cost-effectiveness of home healthcare render it an attractive option for patients and healthcare providers alike. This demographic and healthcare shift is a key structural factor propelling the Australia home healthcare market growth. In 2024, the Australian Department of Health and Aged Care announced the launch of a telehealth service for aged care residents, seeking providers to deliver virtual nursing consultations across 30 aged care homes. The initiative aimed to enhance person-centered care and improve technology integration. The project was a part of efforts to support the Aged Care Data and Digital Strategy, including AI and virtual reality trials.

To get more information of this market, Request Sample

Technological Advancements and Digital Health Integration

Innovations in medical devices, remote monitoring systems, and digital health platforms are transforming how care is delivered, making in-home treatments safer, more efficient, and data driven. Wearable sensors, telehealth services, and cloud-based health records allow practitioners to monitor patients remotely and intervene promptly when needed. This digital integration not only enhances clinical decision-making but also empowers patients to engage more actively in their care journeys. Moreover, automation and AI are streamlining administrative functions, improving scheduling, medication adherence, and communication between multidisciplinary teams. These technologies are particularly vital in ensuring continuity of care across vast geographic areas, especially in remote communities where access to health facilities is limited. In 2025, AlayaCare launched its Client Intelligence Suite in Australia to help home care providers reduce hospitalizations by predicting risks for clients. The AI-driven tool, tested by organizations like Absolute Care & Health, integrates clinical data and provides proactive alerts to staff, improving care efficiency. This suite is a premium feature of AlayaCare's Cloud software, designed to enhance client outcomes and reduce administrative workloads. The Australia home healthcare market forecast remains positive, with continued technology adoption and robust sector growth in the coming years.

Evolving Healthcare Policies and Government Support

In Australia, governmental strategies are promoting the growth of the industry by emphasizing in-home assistance for elderly individuals and those with chronic illnesses within public healthcare. Recent policy changes are focusing on affordable, patient-centered care beyond conventional hospital environments, providing more funding, equipment assistance, and regulatory leniency to enhance home-based services. This strategic shift seeks to improve life quality, ease hospital strain, and allow older individuals to receive care in familiar surroundings. A significant advancement is the Australian Government’s announcement that the Support at Home initiative will commence on July 1, 2025, succeeding current programs such as the Home Care Packages and the Short-Term Restorative Care Programme. This new program aims to make it easier to access in-home aged care and necessary equipment, enhancing service delivery. The Commonwealth Home Support Programme is anticipated to integrate into this system no sooner than July 1, 2027, further strengthening ongoing home healthcare assistance. These reforms are shaping a positive Australia home healthcare market outlook, driven by policy support and growing demand for personalized care solutions.

Growth Drivers of Australia Home Healthcare Market:

Rise in Preference for In-Home Recovery

Across Australia, a growing number of patients are choosing to recover at home following surgeries, medical treatments, or major illnesses. This trend is largely influenced by the desire for greater comfort, reduced disruption to daily life, and more personalized care. Hospitals can be intimidating and expensive, with added risks such as hospital-acquired infections and emotional stress. Home healthcare allows patients to heal in familiar surroundings with the ongoing support of medical professionals. Furthermore, with rising hospital occupancy rates, healthcare systems are increasingly advocating home recovery as a practical solution to manage patient loads. This preference for at-home recovery not only aligns with individual patient needs but also supports long-term cost management and resource optimization within Australia’s broader healthcare infrastructure.

Expansion of Skilled Home Healthcare Workforce

Australia's home healthcare landscape is being significantly shaped by the growth of a skilled and diverse in-home medical workforce. The sector now includes a wide range of professionals, registered nurses, physiotherapists, occupational therapists, and palliative care specialists, trained specifically for in-home settings. This expansion is enhancing the quality and scope of care available outside traditional hospitals, making it possible to treat more complex conditions at home. Government accreditation programs and private sector initiatives have also contributed to the formalization of training and service standards, boosting patient trust in home-based medical care. As more professionals enter this field and geographic coverage widens, accessibility to home healthcare improves, encouraging more Australians to adopt these services for chronic conditions, recovery support, or elderly care.

Cost-Effectiveness Compared to Institutional Care

Home healthcare is increasingly recognized as a cost-effective alternative to long-term hospitalization or residential aged care facilities in Australia. For many families, the ability to access quality medical services at home, without incurring high hospital fees or full-time residential charges, offers significant financial relief. This is particularly appealing to middle-income households and private health insurers looking to optimize care expenditures, which is further driving the Australia home healthcare market demand. Additionally, in-home services reduce indirect costs such as patient transportation, caregiver travel, and extended time off work. As healthcare expenses continue to rise nationally, home-based care stands out as a practical solution that balances affordability with quality. This economic advantage is contributing to steady demand growth across both metropolitan and regional areas, reinforcing home healthcare’s role in future healthcare planning.

Opportunities of Australia Home Healthcare Market:

Integration with Mental Health and Wellness Services

As mental health gains increasing attention in Australia, integrating psychological and emotional wellness services into home healthcare presents a timely and strategic opportunity. Traditional home healthcare has focused on physical ailments, but providers are now expanding their offerings to include mental health support such as remote therapy, stress management, and emotional counseling. With rising cases of anxiety, depression, and loneliness, especially among the elderly and chronically ill, home-based mental health interventions can deliver impactful, personalized support. Behavioral monitoring and wellness coaching delivered via virtual platforms, or in-person visits allow for early intervention and continuity of care. This holistic approach not only enhances patient outcomes but also fills a critical gap in community-based mental healthcare, promoting a more comprehensive model of in-home wellness services across Australia.

Growth in Home-Based Rehabilitation and Post-Acute Care

Australia is witnessing a growing demand for rehabilitation services that can be delivered at home, especially for patients recovering from strokes, orthopedic surgeries, and cardiac events. According to the Australia home healthcare market analysis, this trend offers substantial opportunities for home healthcare providers to expand into physical, occupational, and speech therapy services tailored to individual recovery needs. Home-based rehabilitation improves accessibility for patients with limited mobility and creates a more comfortable, familiar environment that supports faster healing. It also helps reduce the burden on hospitals and minimizes the risk of readmissions, which is appealing to both public health agencies and private insurers. As the population ages and elective surgeries become more common, offering post-acute care at home positions providers to meet a broader range of needs while improving long-term patient outcomes.

Customized Care Plans for Rural and Remote Areas

Australia’s geographically dispersed population creates a strong need for adaptable home healthcare solutions in rural and remote regions. Limited access to hospitals and specialist clinics in these areas presents an opportunity for providers to design mobile, community-based care models. By deploying trained local nurses, mobile medical units, and telehealth technology, home healthcare can be tailored to meet region-specific health needs, such as chronic disease management or elderly care. These customized plans ensure consistent and culturally relevant support, especially for Indigenous and underserved populations. Additionally, collaboration with local governments and rural health networks can enhance outreach and sustainability. This strategic expansion not only bridges critical care gaps but also promotes healthcare equity by extending high-quality in-home services to all corners of the country.

Australia Home Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, service, and indication.

Product Insights:

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutic products, testing, screening, and monitoring products, and mobility care products.

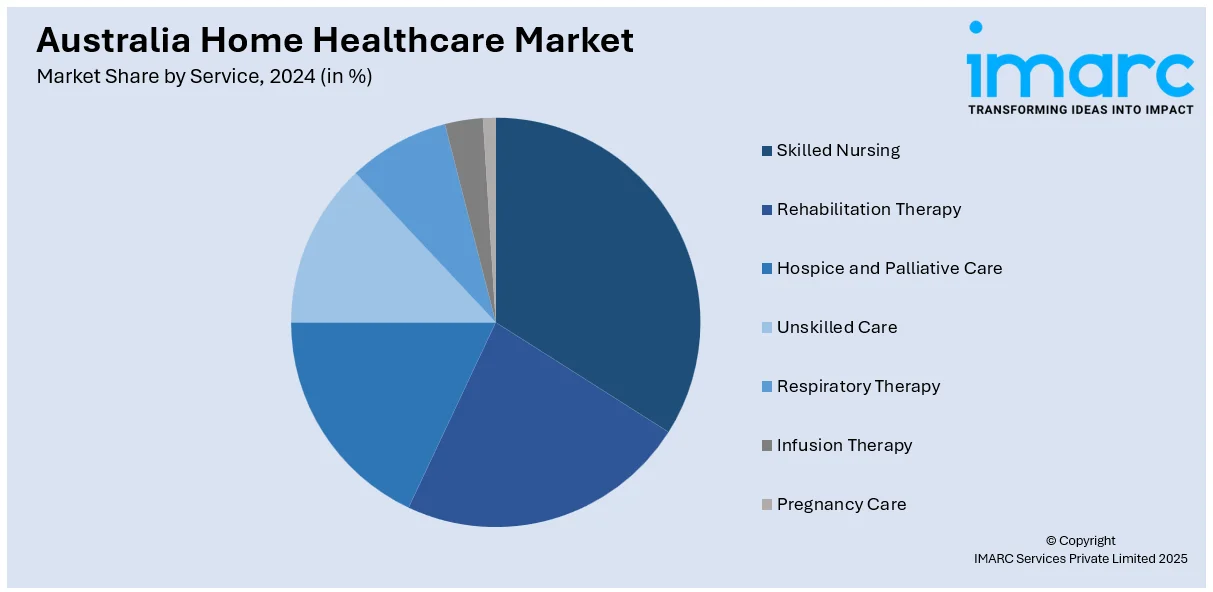

Service Insights:

- Skilled Nursing

- Rehabilitation Therapy

- Hospice and Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes skilled nursing, rehabilitation therapy, hospice and palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care.

Indication Insights:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases and Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes cancer, respiratory diseases, movement disorders, cardiovascular diseases and hypertension, pregnancy, wound care, diabetes, hearing disorders, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Healthcare Market News:

- In February 2024, Australian Unity announced its agreement to acquire myHomecare Group for $285 million to expand its Home Health portfolio. The acquisition enabled Australian Unity to serve over 50,000 customers and enhance its home care services, including self-managed options. This move aimed to address growing healthcare demands and strengthen Australian Unity’s workforce and regional presence.

- In January 2024, CareLineLive, a homecare management software company, expanded into Australia to enhance homecare services. The platform integrated scheduling, medication management, and compliance, supporting over 600 providers globally. It aimed to improve efficiency, productivity, and communication for Australian homecare agencies.

Australia Home Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Therapeutic Products, Testing, Screening, and Monitoring Products, Mobility Care Products |

| Services Covered | Skilled Nursing, Rehabilitation Therapy, Hospice and Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care |

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases and Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home healthcare market in Australia was valued at USD 11.9 Billion in 2024.

The Australia home healthcare market is projected to exhibit a CAGR of 8.80% during 2025-2033.

The Australia home healthcare market is projected to reach a value of USD 27.6 Billion by 2033.

The Australia home healthcare market is experiencing significant trends. A rapidly aging population and increasing prevalence of chronic diseases are driving demand for in-home care. Technological advancements, such as telehealth, remote monitoring, AI, and smart home sensors are transforming service delivery, enhancing efficiency and patient engagement. There is also a growing preference for "aging in place" and government initiatives supporting home-based care.

The Australian home healthcare market is driven by an aging population with chronic conditions, a strong preference for "aging in place," and supportive government initiatives. Technological advancements like telehealth, sremote monitoring, and AI-powered tools are revolutionizing care delivery, making it more efficient and accessible.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)