Australia Home Healthcare Monitoring Devices Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Home Healthcare Monitoring Devices Market Overview:

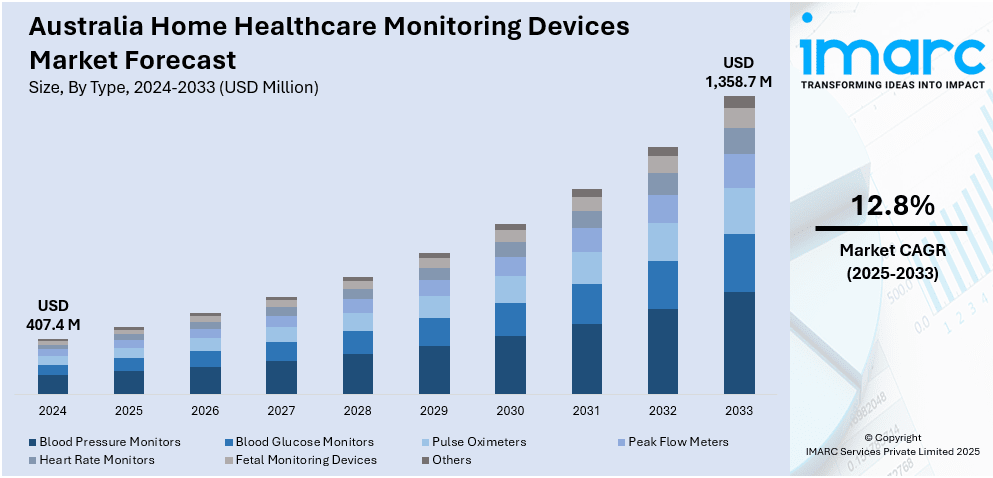

The Australia home healthcare monitoring devices market size reached USD 407.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,358.7 Million by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. The market is experiencing significant growth mainly driven by rising healthcare costs and an aging population. The demand for remote patient monitoring devices, such as blood pressure monitors, glucose meters, and ECG monitors, is also rising. Technological advancements, growing awareness about preventive healthcare and favorable government policies are further contributing to the Australia home healthcare monitoring devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 407.4 Million |

| Market Forecast in 2033 | USD 1,358.7 Million |

| Market Growth Rate (2025-2033) | 12.8% |

Australia Home Healthcare Monitoring Devices Market Trends:

Increasing Government Support

The Australian government plays an important role in encouraging the uptake of home healthcare monitoring devices through positive policies and reimbursement strategies. Programs including the National Disability Insurance Scheme (NDIS) and the Chronic Disease Management (CDM) plan subsidize the cost of medical devices for individuals who are eligible. These programs lower financial hurdles to healthcare for patients, making it simpler for them to use necessary healthcare technologies. Moreover, the Australian government has also invested in telehealth services that depend greatly on home monitoring devices for managing patients remotely. For instance, in March 2025, Tasmania expanded its Care@home virtual service to include more short-term conditions, supporting patients who have been discharged. Additionally, a new clinical alert system for real-time patient updates has been implemented. In Queensland, a telehealth service for rural women provides mental health and midwifery support, with a funding allocation of A$11.35 million over four years. The introduction of programs like Medicare Benefits Schedule (MBS) items for telehealth consultations further supports the use of these devices by ensuring that healthcare providers are reimbursed for virtual consultations. Such policy frameworks are instrumental in increasing the availability and adoption of home healthcare devices across the country, improving accessibility to quality care.

To get more information on this market, Request Sample

Rising Geriatric Population

Australia's aging population is a key factor contributing to the growing demand for home healthcare monitoring devices, particularly in chronic disease management. According to the article published by the Property Council of Australia, Australia's population aged 75 and over is projected to increase by 49% in the next decade, reaching over 3.2 million. With rising life expectancy, there are growing concerns regarding healthcare. As the percentage of elderly citizens increases, there is an increased need for healthcare solutions that provide seniors an opportunity to monitor long-term conditions like diabetes, hypertension, and heart disease from the comfort of their own homes. Home monitoring equipment, such as blood pressure monitors, glucose meters, and wearable health trackers, provides elderly individuals with the ability to monitor their state of health regularly, decreasing hospital visits and overall healthcare outcomes. The Australian government’s initiatives, along with increased awareness of preventive care, are helping older Australians access these devices. This demographic shift, combined with technological advancements, is a driving force behind the Australia home healthcare monitoring devices market growth, ensuring that more seniors have the tools to maintain their health independently and effectively.

Australia Home Healthcare Monitoring Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Blood Pressure Monitors

- Blood Glucose Monitors

- Pulse Oximeters

- Peak Flow Meters

- Heart Rate Monitors

- Fetal Monitoring Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blood pressure monitors, blood glucose monitors, pulse oximeters, peak flow meters, heart rate monitors, fetal monitoring devices, and others.

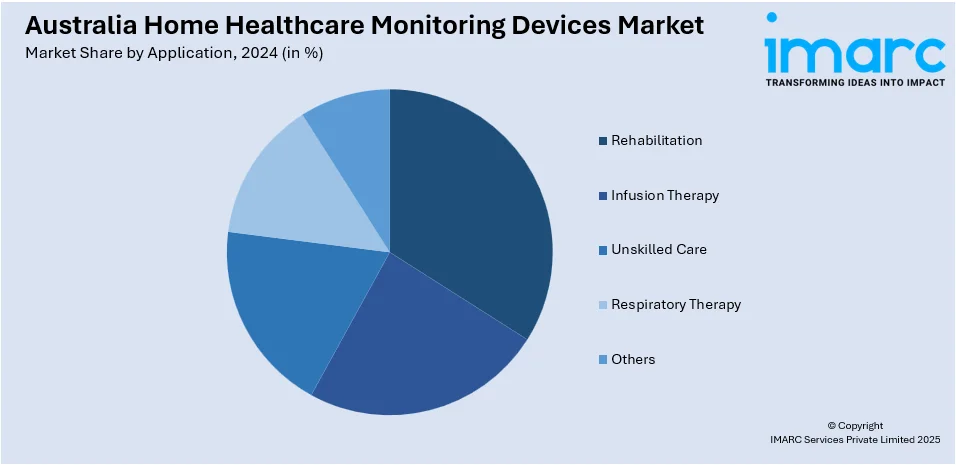

Application Insights:

- Rehabilitation

- Infusion Therapy

- Unskilled Care

- Respiratory Therapy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes rehabilitation, infusion therapy, unskilled care, respiratory therapy, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Healthcare Monitoring Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blood Pressure Monitors, Blood Glucose Monitors, Pulse Oximeters, Peak Flow Meters, Heart Rate Monitors, Fetal Monitoring Devices, Others |

| Applications Covered | Rehabilitation, Infusion Therapy, Unskilled Care, Respiratory Therapy, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home healthcare monitoring devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home healthcare monitoring devices market on the basis of type?

- What is the breakup of the Australia home healthcare monitoring devices market on the basis of application?

- What is the breakup of the Australia home healthcare monitoring devices market on the basis of region?

- What are the various stages in the value chain of the Australia home healthcare monitoring devices market?

- What are the key driving factors and challenges in the Australia home healthcare monitoring devices market?

- What is the structure of the Australia home healthcare monitoring devices market and who are the key players?

- What is the degree of competition in the Australia home healthcare monitoring devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home healthcare monitoring devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home healthcare monitoring devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home healthcare monitoring devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)