Australia Home Improvement Services Market Size, Share, Trends and Forecast by Type, Buyers Age, City Type, and Region, 2025-2033

Australia Home Improvement Services Market Overview:

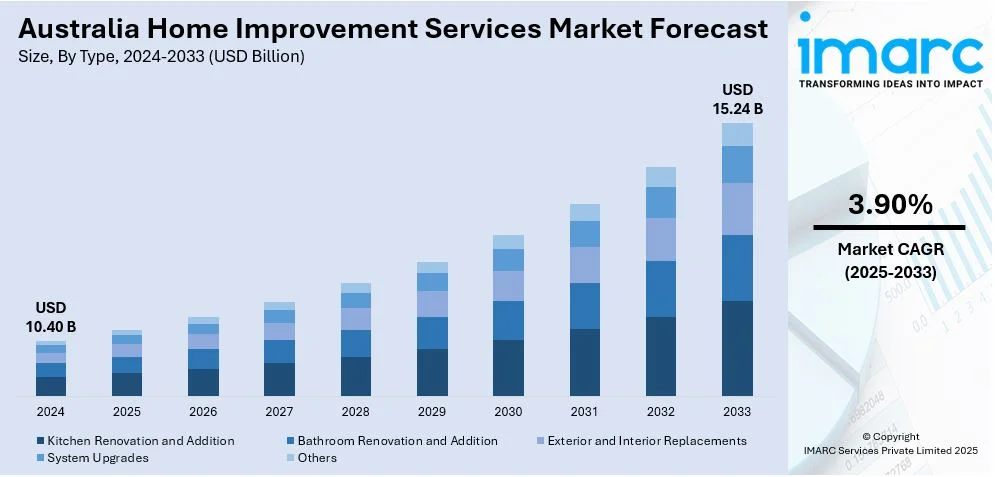

The Australia home improvement services market size reached USD 10.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.24 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is being driven by rising property values, increased homeownership, higher disposable incomes, extensive investments in renovations, a surge in do-it-yourself (DIY) projects, and government incentives promoting energy-efficient and sustainable home upgrades.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.40 Billion |

| Market Forecast in 2033 | USD 15.24 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

Australia Home Improvement Services Market Trends:

Rising Demand for Sustainable and Energy-Efficient Renovations

A major trend reshaping Australia’s home improvement services market is the rising demand for sustainable and energy-efficient upgrades. With growing concerns over climate change and energy costs, homeowners are prioritizing renovations that reduce their carbon footprint and lower utility bills. According to the Clean Energy Council, rooftop solar accounted for 11.2% of Australia's electricity supply as of April 2024. This surge has spurred demand for services supporting solar integration, energy-efficient insulation, smart thermostats, and double-glazed windows. By 2025, nearly 50% of Australian homes are expected to feature at least one energy-efficiency upgrade. Government initiatives like the Home Energy Upgrade Fund, introduced in 2023, offer low-interest loans and grants of up to AUD 15,000 for sustainable renovations, encouraging investment in eco-friendly materials and certified professionals. Builders and service providers are also offering “green packages” and sustainability certifications to attract environmentally conscious consumers. This shift is projected to drive a 6.5% annual growth rate in the eco-friendly renovation segment by 2025, creating a positive outlook for market expansion.

To get more information on this market, Request Sample

Growth in Smart Home Integration and Tech-Driven Upgrades

Australia's home improvement services market is being reshaped by the rapid rise of smart home technologies, driven by consumer demand for enhanced convenience, security, and energy efficiency. In 2024, Australia's smart homes market reached USD 3.8 billion in size and it is projected to reach USD 11.5 billion by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. Home automation and smart security systems dominate this growth, leading to an increased demand for electricians, network installers, and integration specialists. Homeowners are upgrading traditional systems with smart lighting, voice-controlled assistants, remote security surveillance, and connected HVAC systems, particularly during kitchen and bathroom remodels. The trend is being further driven by Millennials and Gen Z, who prefer properties with pre-installed smart systems or retrofit homes shortly after purchase. Builders and renovators are partnering with tech giants like Google Nest, Ring, and Schneider Electric to offer integrated solutions, blending aesthetics with functionality. This digital shift is encouraging service providers to expand their technical expertise and certifications, creating new opportunities in the market.

Australia Home Improvement Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, buyers age, and city type.

Type Insights:

- Kitchen Renovation and Addition

- Bathroom Renovation and Addition

- Exterior and Interior Replacements

- System Upgrades

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes kitchen renovation and addition, bathroom renovation and addition, exterior and interior replacements, system upgrades, and others.

Buyers Age Insights:

.webp)

- Under 35

- 35-54

- 55-64

- Above 65

A detailed breakup and analysis of the market based on the buyers age have also been provided in the report. This includes under 35, 35-54, 55-64, and above 65.

City Type Insights:

- Metro Cities

- Non-metro Cities and Towns

The report has provided a detailed breakup and analysis of the market based on the city type. This includes metro cities and non-metro cities and towns.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Improvement Services Market News:

- March 2025: Roborock launched the Saros 10 and Saros 10R robotic vacuums in Australia, marking a significant advancement in smart home cleaning. The Saros 10 features a retractable navigation puck, enabling it to clean under low-clearance furniture, and boasts a powerful 22,000Pa suction along with a VibraRise 4.0 mopping system. The Saros 10R offers enhanced obstacle avoidance through the StarSight Autonomous System.

- February 2025: Vorwerk introduced the Thermomix TM7 in Australia and New Zealand, featuring advanced technological enhancements. The TM7 boasts a 10-inch touch display, AI-assisted cooking assistant, voice control, and seamless connectivity with smartphones and PCs. It also includes a digital twin for real-time weighing and guidance, along with an "Open Cooking" feature that allows cooking without the lid.

- November 2024: ING Australia announced that it would launch the Home Energy Helper, a digital platform designed to simplify energy-efficient home upgrades. In collaboration with BOOM! Power, the platform enables homeowners to obtain quotes from accredited installers, explore available rebates, and assess potential savings on energy bills and emissions.

Australia Home Improvement Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Renovation and Addition, Bathroom Renovation and Addition, Exterior and Interior Replacements, System Upgrades, Others |

| Buyers Ages Covered | Under 35, 35-54, 55-64, Above 65 |

| City Types Covered | Metro Cities, Non-metro Cities and Towns |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home improvement services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home improvement services market on the basis of type?

- What is the breakup of the Australia home improvement services market on the basis of buyers age?

- What is the breakup of the Australia home improvement services market on the basis of city type?

- What is the breakup of the Australia home improvement services market on the basis of region?

- What are the various stages in the value chain of the Australia home improvement services market?

- What are the key driving factors and challenges in the Australia home improvement services market?

- What is the structure of the Australia home improvement services market and who are the key players?

- What is the degree of competition in the Australia home improvement services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home improvement services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home improvement services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home improvement services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)