Australia Homeopathic Supplements Market Size, Share, Trends and Forecast by Product Type, Source, Application, Distribution Channel, Potency, End-User, and Region, 2025-2033

Australia Homeopathic Supplements Market Overview:

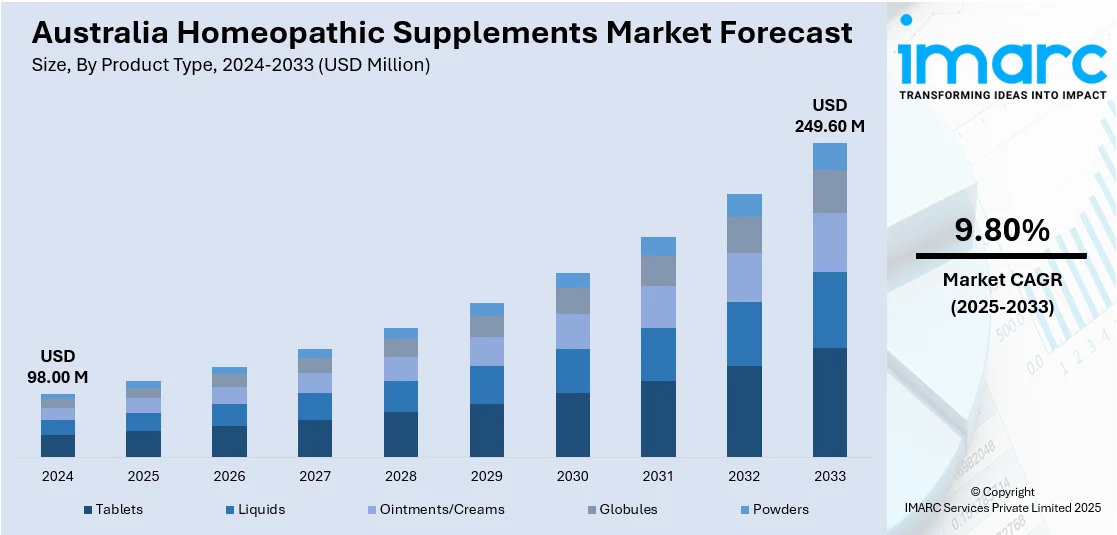

The Australia homeopathic supplements market size reached USD 98.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 249.60 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is expanding due to rising interest in natural remedies, preventive healthcare, and clean-label formulations. In addition, growing consumer awareness and innovation in supplement delivery formats continue to support Australia homeopathic supplements market share across wellness-focused and aging population segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 98.00 Million |

| Market Forecast in 2033 | USD 249.60 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Homeopathic Supplements Market Trends:

Increased Demand for Natural Wellness

The market is growing due to rising consumer demand for natural and herbal health solutions. Australians are seeking homeopathic supplements for both prevention and the management of long-term conditions, driven by a growing awareness of total wellness. Growing concerns about side effects from synthetic drugs and a growing preference for alternative treatments influence this. Furthermore, the growing elderly population and increased lifestyle diseases have necessitated the need for gentle, non-surgical remedies. The trend for personalized wellness regimens and clean-label foods has complemented the use of homeopathic preparations. In more recent news, the August 2024 launch of SRW's Cel Essential brought a longevity-driven supplement on the market that adheres to these consumer values, further solidifying the trend towards cellular well-being and natural aging mitigation. The market also benefits from expanded retail availability and online distribution channels, which increase the accessibility of products. Furthermore, a rigorous emphasis on ingredient transparency and sustainable sourcing continues to drive Australia's homeopathic supplements market share in both urban and regional consumer bases.

To get more information on this market, Request Sample

Innovation and Flavor-Driven Formats

The market is witnessing a shift toward innovative supplement formats that enhance user experience. Consumers are increasingly favoring gummies, powders, and chewable over traditional tablets, driven by a preference for convenience and taste. This trend is particularly strong among younger demographics and wellness-focused individuals seeking enjoyable ways to maintain daily health routines. The demand for flavor-forward, functional supplements has led to the integration of botanicals and traditional herbs into modern delivery systems. In February 2025, Kerry Group’s launch of the 2025 Supplement Taste Charts highlighted this evolution, showcasing regional flavor trends and the growing appeal of non-pill formats. These developments are reshaping product innovation strategies and encouraging manufacturers to invest in sensory appeal alongside efficacy. The inclusion of familiar and exotic flavors, such as turmeric, ginger, and lychee, is helping bridge traditional wellness with modern consumer expectations. This shift toward experiential wellness products continues to drive in Australia homeopathic supplements market growth, positioning the sector for sustained expansion through product differentiation and enhanced consumer engagement.

Australia Homeopathic Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type, source, application, distribution channel, potency, and end-user.

Product Type Insights:

- Tablets

- Liquids

- Ointments/Creams

- Globules

- Powders

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tablets, liquids, ointments/creams, globules, and powders.

Source Insights:

- Plant-Based

- Animal-Based

- Mineral-Based

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant-based, animal-based, and mineral-based.

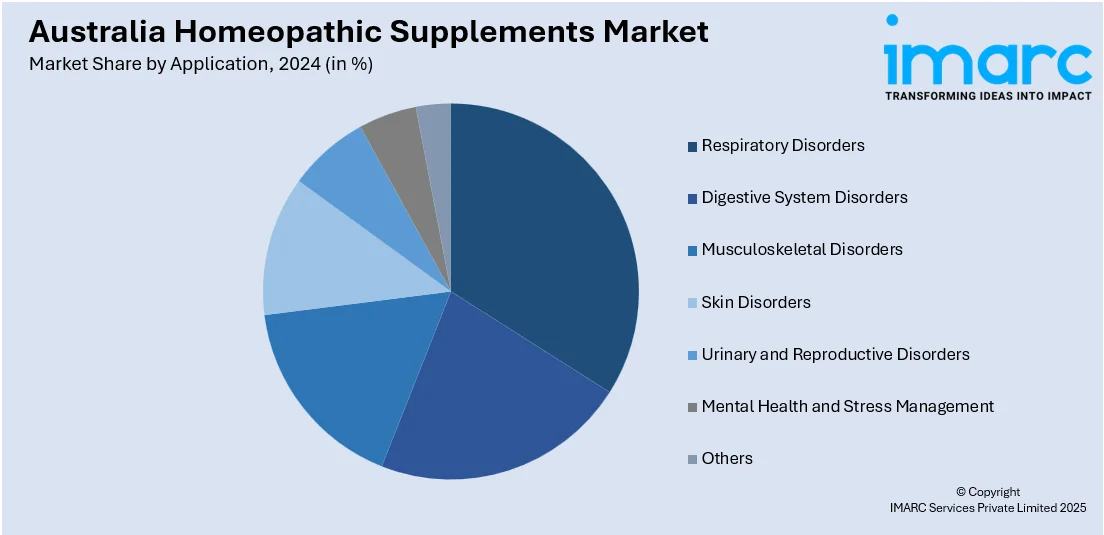

Application Insights:

- Respiratory Disorders

- Digestive System Disorders

- Musculoskeletal Disorders

- Skin Disorders

- Urinary and Reproductive Disorders

- Mental Health and Stress Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes respiratory disorders, digestive system disorders, musculoskeletal disorders, skin disorders, urinary and reproductive disorders, mental health and stress management, and others.

Distribution Channel Insights:

- Homeopathic Clinics

- Retail Pharmacies

- Online Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes homeopathic clinics, retail pharmacies, online stores, and specialty stores.

Potency Insights:

- Low Potency

- Medium Potency

- High Potency

The report has provided a detailed breakup and analysis of the market based on the potency. This includes low potency, medium potency, and high potency.

End-User Insights:

- Adults

- Pediatrics

- Geriatrics

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes adults, pediatrics, and geriatrics.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Homeopathic Supplements Market News:

- February 2025: Kerry Group launched its 2025 Supplement Taste Charts in Australia, spotlighting flavour trends in wellness products. This initiative supported the homeopathic supplements market by promoting flavour-forward, non-pill formats like gummies and powders, enhancing consumer appeal and driving innovation in natural health solutions.

- August 2024: SRW launched Cel Essential in Australia, a longevity-focused supplement supporting cellular health and micronutrient balance. Its natural, wellness-oriented formulation aligned with consumer demand for holistic aging solutions, boosting innovation and expanding the premium homeopathic supplements market segment.

Australia Homeopathic Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tablets, Liquids, Ointments/Creams, Globules, Powders |

| Sources Covered | Plant-Based, Animal-Based, Mineral-Based |

| Applications Covered | Respiratory Disorders, Digestive System Disorders, Musculoskeletal Disorders, Skin Disorders, Urinary and Reproductive Disorders, Mental Health and Stress Management, Others |

| Distribution Channels Covered | Homeopathic Clinics, Retail Pharmacies, Online Stores, Specialty Stores |

| Potencies Covered | Low Potency, Medium Potency, High Potency |

| End-Users Covered | Adults, Pediatrics, Geriatrics |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia homeopathic supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia homeopathic supplements market on the basis of product type?

- What is the breakup of the Australia homeopathic supplements market on the basis of source?

- What is the breakup of the Australia homeopathic supplements market on the basis of application?

- What is the breakup of the Australia homeopathic supplements market on the basis of distribution channel?

- What is the breakup of the Australia homeopathic supplements market on the basis of potency?

- What is the breakup of the Australia homeopathic supplements market on the basis of end-user?

- What is the breakup of the Australia homeopathic supplements market on the basis of region?

- What are the various stages in the value chain of the Australia homeopathic supplements market?

- What are the key driving factors and challenges in the Australia homeopathic supplements market?

- What is the structure of the Australia homeopathic supplements market and who are the key players?

- What is the degree of competition in the Australia homeopathic supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia homeopathic supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia homeopathic supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia homeopathic supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)