Australia Hormone Replacement Therapy Market Size, Share, Trends and Forecast by Product, Route of Administration, Type of Disease, and Region, 2026-2034

Australia Hormone Replacement Therapy Market Summary:

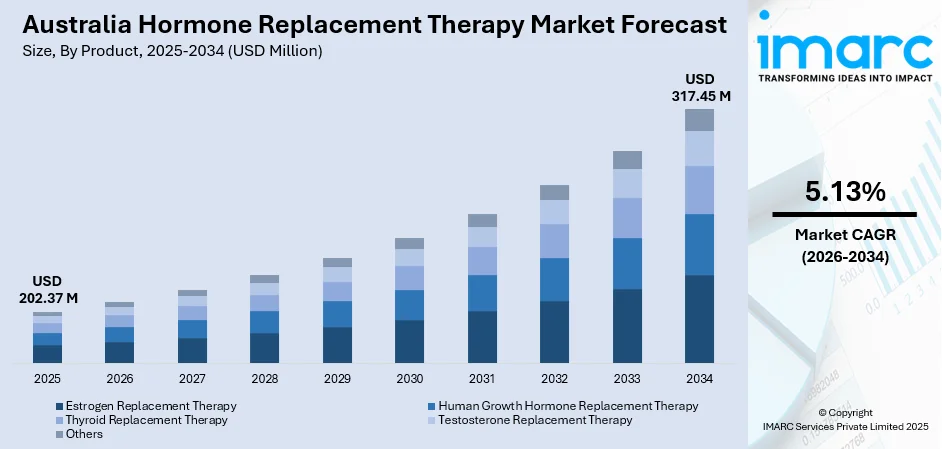

The Australia hormone replacement therapy market size was valued at USD 202.37 Million in 2025 and is projected to reach USD 317.45 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

The Australia hormone replacement therapy market is witnessing sustained expansion driven by the country's aging female population and increasing recognition of menopausal health needs. Rising awareness about the physiological impact of hormonal deficiencies, coupled with evolving treatment paradigms, has elevated demand for effective therapeutic solutions. The market benefits from improved accessibility through government healthcare initiatives and growing acceptance of hormone management as an essential component of women's preventive healthcare, supporting the Australia hormone replacement therapy market share.

Key Takeaways and Insights:

- By Product: Estrogen Replacement Therapy dominates the market with a share of 44.7% in 2025, driven by widespread prescription for managing menopausal symptoms and preventing osteoporosis in postmenopausal women.

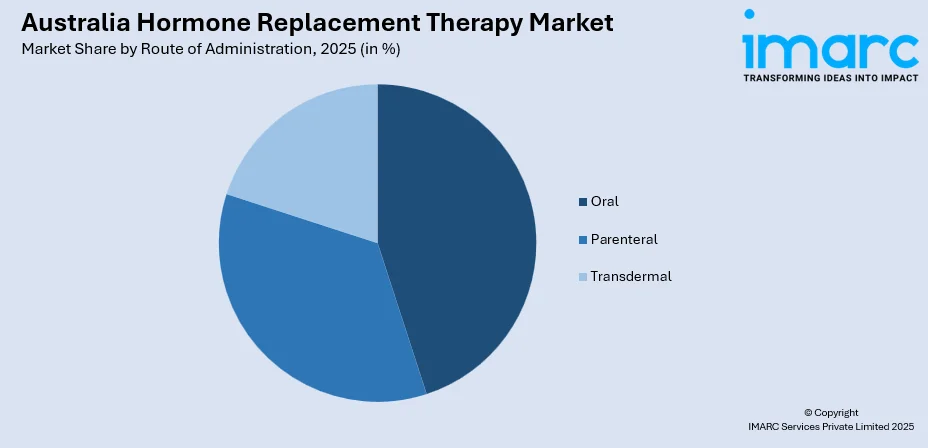

- By Route of Administration: Oral leads the market with a share of 39.9% in 2025, owing to patient convenience, established efficacy profiles, and broad availability across pharmaceutical outlets.

- By Type of Disease: Menopause represents the largest segment with a market share of 49.7% in 2025, attributed to the substantial population of women experiencing menopausal symptoms requiring therapeutic intervention.

- By Region: Australia Capital Territory & New South Wales dominates with 35.0% share in 2025, supported by concentrated urban populations, superior healthcare infrastructure, and higher specialist availability.

- Key Players: The Australia hormone replacement therapy market exhibits a consolidated competitive structure with multinational pharmaceutical corporations maintaining significant presence through established product portfolios and extensive distribution networks across metropolitan and regional healthcare facilities.

To get more information on this market Request Sample

The Australia hormone replacement therapy market continues gaining momentum as healthcare paradigms shift toward proactive management of hormonal deficiencies. With nearly seven million Australian women currently in perimenopause or menopause, the addressable patient population represents substantial market potential. In 2025, the Australian Government, through the Pharmaceutical Benefits Scheme (PBS), added key menopausal hormone therapies such as Estrogel, Prometrium, and the combination pack Estrogel Pro to subsidised status, improving nationwide access. The market is characterized by growing physician confidence in prescribing modern hormone formulations following updated clinical guidelines that emphasize individualized treatment approaches. Healthcare infrastructure developments, including the emergence of specialized menopause clinics and telehealth consultations, are expanding patient access beyond traditional metropolitan centers, supporting market penetration across diverse geographic regions throughout Australia.

Australia Hormone Replacement Therapy Market Trends:

Expansion of Government Pharmaceutical Subsidies

Australian federal health authorities are increasingly subsidizing modern hormone replacement formulations through the Pharmaceutical Benefits Scheme. In 2025, the Australasian Menopause Society (AMS) welcomed a major policy decision by the Pharmaceutical Benefits Scheme (PBS). From 1 March 2025, three menopausal hormone therapies became subsidised for the first time in over 20 years, broadening access to modern MHT solutions for Australian women. The inclusion of body-identical estrogen gels and micronized progesterone products has significantly reduced out-of-pocket costs for patients, shifting annual expenses from hundreds of dollars to nominal monthly payments. This policy shift reflects recommendations from parliamentary inquiries emphasizing equitable access to contemporary menopause treatments, driving adoption of newer therapeutic options.

Growing Preference for Body-Identical Hormone Formulations

Clinical evidence demonstrating favorable safety profiles of body-identical hormone preparations is driving prescribing patterns toward these formulations. For instance, a 2023 real-world study reported that combined oral estradiol and micronized progesterone was associated with a significantly lower incidence of venous thromboembolism compared with traditional conjugated equine estrogens plus medroxyprogesterone acetate, reinforcing their safer cardiometabolic profile. Healthcare providers increasingly recommend estradiol and micronized progesterone combinations due to their molecular similarity to endogenous hormones and associated lower cardiometabolic risks. This therapeutic evolution reflects broader clinical acceptance of hormone therapy following updated research clarifying risk-benefit profiles for appropriately selected patients.

Rise of Telehealth Menopause Services

Digital healthcare platforms specializing in menopause management are transforming patient access across Australia. According to reports, in 2024, the private telehealth provider WellFemme expanded nationwide services, offering online menopause assessments, virtual consultations, and prescription delivery to women in regional and remote areas. These telehealth services enable women in regional and remote areas to consult specialized practitioners without geographical constraints, addressing historical gaps in menopause care accessibility. The integration of virtual consultations with direct medication delivery is streamlining treatment initiation and ongoing management, expanding the patient base beyond traditional healthcare touchpoints.

Market Outlook 2026-2034:

The Australia hormone replacement therapy market outlook remains positive as demographic trends and healthcare policy evolution support sustained growth. Continued government investment in women's health infrastructure and expanding clinical education programs addressing menopause management will enhance treatment uptake. Product innovation focusing on convenient delivery mechanisms and personalized dosing options is expected to drive patient adherence and market penetration. The market generated a revenue of USD 202.37 Million in 2025 and is projected to reach a revenue of USD 317.45 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

Australia Hormone Replacement Therapy Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Estrogen Replacement Therapy | 44.7% |

| Route of Administration | Oral | 39.9% |

| Type of Disease | Menopause | 49.7% |

| Region | Australia Capital Territory & New South Wales | 35.0% |

Product Insights:

- Estrogen Replacement Therapy

- Human Growth Hormone Replacement Therapy

- Thyroid Replacement Therapy

- Testosterone Replacement Therapy

- Others

The estrogen replacement therapy dominates with a market share of 44.7% of the total Australia hormone replacement therapy market in 2025.

Estrogen replacement therapy maintains commanding market position as the primary treatment modality for managing menopausal symptoms affecting Australian women. The segment benefits from extensive clinical validation demonstrating efficacy in alleviating vasomotor symptoms, preventing bone density loss, and improving overall quality of life during the menopausal transition. Australian prescribing guidelines position estrogen therapy as first-line treatment for symptomatic women without contraindications.

The therapeutic segment encompasses diverse formulations including oral tablets, transdermal patches, and topical gels, enabling individualized treatment approaches. In March 2025, three body-identical estrogen products, Estrogel®, Prometrium®, and Estrogel® Pro, were added to the Pharmaceutical Benefits Scheme, significantly improving affordability and access for Australian women. Recent expansion of PBS coverage for body-identical estrogen preparations has enhanced patient access while reducing financial barriers. Healthcare provider confidence in modern estrogen formulations continues strengthening following updated clinical evidence clarifying cardiovascular and oncologic risk profiles for appropriately selected patients.

Route of Administration Insights:

Access the comprehensive market breakdown Request Sample

- Oral

- Parenteral

- Transdermal

The oral leads with a share of 39.9% of the total Australia hormone replacement therapy market in 2025.

Oral hormone replacement therapy maintains market leadership owing to patient familiarity, ease of administration, and established therapeutic protocols. Tablet formulations provide predictable dosing and convenient daily regimens that integrate seamlessly into patient routines. In 2025, several leading oral HRT products, including body-identical estradiol and micronized progesterone tablets, became subsidised under the Pharmaceutical Benefits Scheme, enhancing affordability and supporting their widespread use. The segment benefits from extensive product availability across community pharmacies and competitive pricing structures supporting widespread accessibility throughout metropolitan and regional Australia.

Healthcare providers frequently initiate hormone therapy through oral routes due to simplified dosing adjustments and patient monitoring protocols. The segment encompasses both combined estrogen-progestogen preparations and standalone hormone products, accommodating diverse clinical scenarios including hysterectomized patients. Continued product innovation focusing on improved formulations and combination therapies sustains segment competitiveness despite growing interest in alternative delivery mechanisms.

Type of Disease Insights:

- Menopause

- Hypothyroidism

- Male Hypogonadism

- Growth Hormone Deficiency

- Others

The menopause dominates with a market share of 49.7% of the total Australia hormone replacement therapy market in 2025.

Menopause-related hormone therapy commands market dominance reflecting the substantial population of Australian women experiencing symptomatic menopausal transition. With approximately seven million women currently in perimenopause or menopause, and over two million experiencing moderate to severe symptoms, the addressable patient population supports sustained segment growth. In October 2025, the Australian Government Department of Health announced the launch of a tender process to develop the country’s first-ever national clinical guidelines for perimenopause and menopause, a key step toward standardising care and improving diagnosis and treatment across the nation. Therapeutic interventions address vasomotor symptoms, urogenital atrophy, sleep disturbances, and mood alterations affecting patient quality of life.

The segment benefits from evolving clinical paradigms emphasizing individualized treatment approaches and extended therapy duration when clinically appropriate. Recent federal government initiatives including parliamentary inquiries and PBS expansions have elevated menopause as a healthcare priority, reducing stigma and encouraging treatment-seeking behavior. Specialized menopause clinics and enhanced practitioner education programs are improving diagnostic rates and treatment initiation across diverse demographic groups.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales exhibits a clear dominance with a 35.0% share of the total Australia hormone replacement therapy market in 2025.

Australia Capital Territory and New South Wales maintain regional market leadership supported by concentrated urban populations and superior healthcare infrastructure. Sydney's status as Australia's largest metropolitan area provides extensive specialist availability, including endocrinologists and menopause-focused practitioners who drive treatment adoption. The region benefits from multiple tertiary healthcare facilities offering specialized women's health services and clinical research programs advancing treatment protocols.

Healthcare accessibility throughout the region is enhanced by dense pharmacy networks and emerging telehealth services reaching suburban and semi-rural communities. The region's higher median household incomes support private healthcare utilization and treatment adherence, while comprehensive public health services ensure equitable access for diverse socioeconomic populations. Ongoing infrastructure investments in women's health services continue strengthening the region's market leadership position.

Market Dynamics:

Growth Drivers:

Why is the Australia Hormone Replacement Therapy Market Growing?

Aging Female Population and Expanding Treatment-Eligible Demographics

Australia's demographic trajectory presents substantial growth opportunities as the population ages and life expectancy extends. With Australian women now spending approximately one-third of their lives post-menopause, the duration requiring hormonal support has lengthened considerably. In 2025, the Australian Bureau of Statistics reported that over 3.5 million women were experiencing menopausal transition, highlighting a large, clinically relevant population for targeted interventions. Healthcare systems increasingly recognize the economic productivity implications of untreated menopausal symptoms, motivating proactive intervention strategies that expand the treatment-seeking population beyond historically engaged demographics.

Government Healthcare Policy Support and Pharmaceutical Subsidies

Federal government commitment to improving women's health access is catalyzing market expansion through policy mechanisms and pharmaceutical subsidies. In 2025, the Australian Government allocated $4.4 million under a women’s‑health package for Medicare rebates, national menopause guidelines with professional training, and a public awareness campaign, aiming to improve access, raise awareness, and standardise perimenopause and menopause care nationwide. This policy framework works alongside the expansion of the Pharmaceutical Benefits Scheme (PBS) for modern hormone formulations, lowering cost barriers; and supports growth in the broader hormone therapy market by increasing demand via better diagnosis, education and affordability.

Evolving Clinical Guidelines and Practitioner Education Enhancement

Contemporary clinical evidence rehabilitating hormone replacement therapy's reputation following earlier concerns is driving renewed prescriber confidence. In 2023, AMS published an updated Practitioner’s Toolkit for Managing the Menopause, endorsed by major societies, providing evidence‑based guidance on MHT and helping rebuild clinician confidence in hormone therapy. Updated guidelines from endocrine and gynecological societies emphasize individualized treatment approaches without arbitrary duration limitations, enabling extended therapeutic relationships. Medical education initiatives are addressing historical gaps in menopause training, producing practitioners confident in hormone therapy prescription and management. Professional organizations including the Australasian Menopause Society provide ongoing education resources supporting evidence-based clinical practice and expanded treatment adoption.

Market Restraints:

What Challenges the Australia Hormone Replacement Therapy Market is Facing?

Supply Chain Disruptions and Product Shortages

Ongoing supply shortages affecting hormone replacement therapy products, particularly transdermal patches, are constraining market growth and patient access. Manufacturing limitations and increased global demand have created persistent availability challenges expected to continue through extended periods. Healthcare authorities have implemented substitution protocols and approved overseas-registered alternatives, though supply uncertainty complicates treatment planning and patient continuity.

Persistent Cancer Risk Perceptions Among Patients and Practitioners

Historical concerns regarding breast cancer associations stemming from earlier clinical studies continue influencing patient decisions and practitioner prescribing patterns. Despite subsequent research clarifying risk-benefit profiles and formulation-specific considerations, residual apprehension persists among both healthcare providers and potential patients. Overcoming these perceptions requires ongoing education efforts and individualized counseling during clinical consultations.

Insufficient Menopause Training Among Healthcare Providers

Limited menopause-specific education within medical training curricula creates knowledge gaps affecting diagnosis rates and treatment initiation. Many general practitioners lack confidence in hormone therapy prescription and management, contributing to undertreatment of symptomatic patients. Addressing these educational deficiencies requires systematic curriculum integration and ongoing professional development opportunities supporting practitioner competency.

Competitive Landscape:

The Australia hormone replacement therapy market demonstrates a consolidated competitive structure characterized by multinational pharmaceutical corporations maintaining established market positions. Leading participants leverage extensive product portfolios encompassing diverse formulations and delivery mechanisms to address varied patient requirements. Competition centers on product innovation, manufacturing reliability, and distribution network strength. Market participants increasingly differentiate through patient support programs and healthcare provider education initiatives. Strategic partnerships between international manufacturers and local distributors enhance market access across metropolitan and regional healthcare facilities.

Recent Developments:

- In July 2025, a new “virtual menopause hub” was launched for south‑west Sydney, offering telehealth and in‑person care for women undergoing perimenopause or menopause, and expected to serve up to 200 women monthly across Western Sydney, the Blue Mountains and Riverina.

Australia Hormone Replacement Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Estrogen Replacement Therapy, Human Growth Hormone Replacement Therapy, Thyroid Replacement Therapy, Testosterone Replacement Therapy, Others |

| Route of Administrations Covered | Oral, Parenteral, Transdermal |

| Type of Diseases Covered | Menopause, Hypothyroidism, Male Hypogonadism, Growth Hormone Deficiency, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia hormone replacement therapy market size was valued at USD 202.37 Million in 2025.

The Australia hormone replacement therapy market is expected to grow at a compound annual growth rate of 5.13% from 2026-2034 to reach USD 317.45 Million by 2034.

Estrogen replacement therapy dominated the market with 44.7% share, driven by its established efficacy in managing menopausal symptoms and preventing osteoporosis among Australian women.

Key factors driving the Australia hormone replacement therapy market include the aging female population, government healthcare initiatives expanding PBS coverage, evolving clinical guidelines supporting individualized treatment approaches, and increasing menopause awareness.

Major challenges include persistent supply chain disruptions affecting transdermal products, residual cancer risk perceptions among patients and practitioners, insufficient menopause-specific training within medical curricula, and regional disparities in specialist healthcare access.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)