Australia Hosiery Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Australia Hosiery Market Summary:

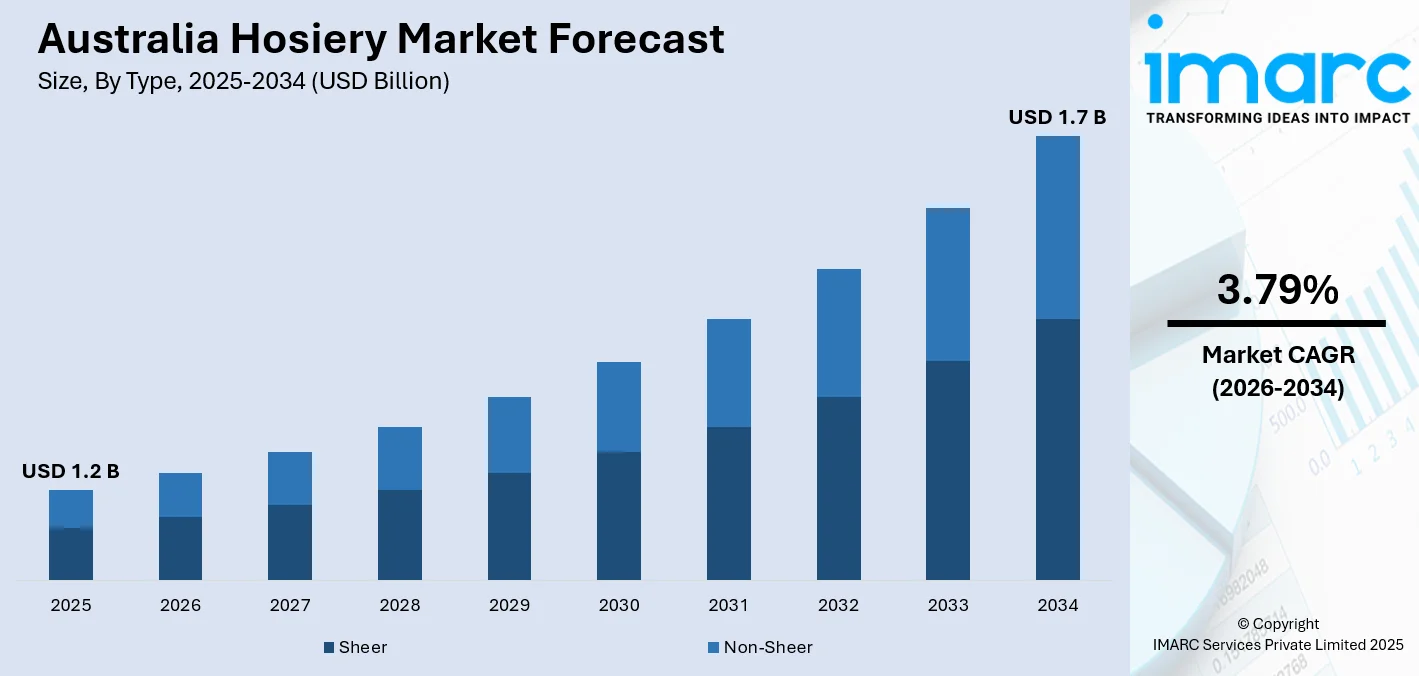

The Australia hosiery market size was valued at USD 1.2 Billion in 2025 and is projected to reach USD 1.7 Billion by 2034, growing at a compound annual growth rate of 3.79% from 2026-2034.

The Australia hosiery market is experiencing steady growth, driven by evolving fashion trends, rising consumer preference for comfortable legwear, and the increasing adoption of sustainable hosiery products. Growing demand from corporate professionals requiring polished workwear essentials and the expansion of digital retail channels are strengthening market penetration. Innovations in fabric technology, rising disposable incomes, and heightened fashion consciousness among urban consumers are reshaping purchasing patterns, positioning Australia as a promising market for diverse hosiery offerings across multiple consumer segments.

Key Takeaways and Insights:

- By Type: Sheer dominates the market with a share of 64% in 2025, owing to its aesthetic appeal for professional and formal occasions, lightweight breathability during warmer months, and versatility in complementing diverse outfit styles. Rising demand for polished workwear legwear is fueling this segment's expansion.

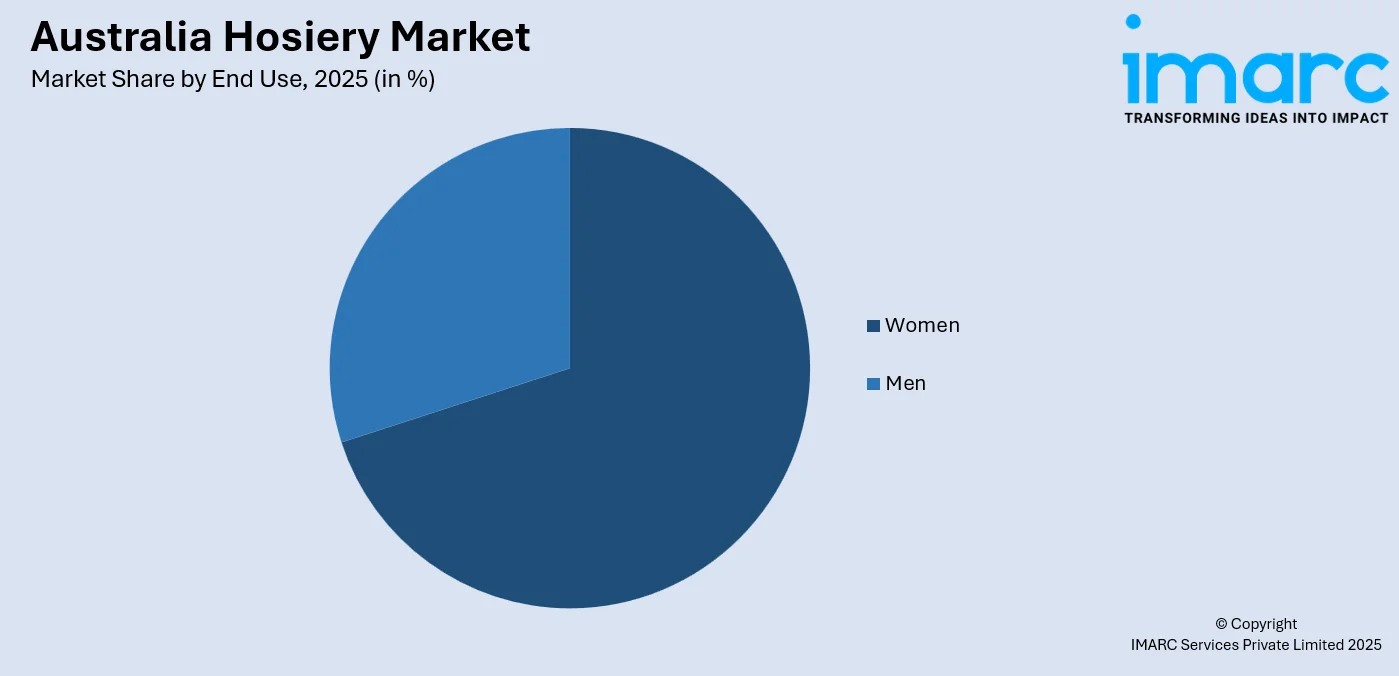

- By End Use: Women lead the market with a share of 70% in 2025. This dominance is driven by heightened fashion consciousness, professional wardrobe requirements, and growing preference for legwear accessories that enhance personal presentation while providing comfort and support.

- By Region: Australia Capital Territory & New South Wales comprises the largest region with 28% share in 2025, driven by the concentration of corporate professionals, thriving retail ecosystems in Sydney, high fashion consciousness among urban consumers, and robust e-commerce infrastructure supporting diverse purchasing preferences.

- Key Players: Key players drive the Australia hosiery market by expanding product portfolios, enhancing fabric technologies, and strengthening omnichannel distribution networks. Their investments in sustainable materials, digital marketing strategies, and partnerships with fashion retailers boost brand awareness and accelerate adoption across diverse consumer demographics.

To get more information on this market Request Sample

The Australia hosiery market continues to evolve, as consumers increasingly prioritize both functionality and fashion in their legwear choices. The contemporary urban lifestyle, characterized by emphasis on personal presentation and professional requirements, is driving significant demand among metropolitan consumers. Rising participation of women in the workforce creates sustained demand for polished, comfortable hosiery suitable for extended wear during professional engagements. The market benefits from Australia's position as one of the largest per capita users of textiles globally, with average annual textile consumption reaching 27 Kilograms per person in 2024. Growing environmental awareness is reshaping purchasing decisions, with consumers gravitating towards sustainable hosiery options crafted from recycled materials and eco-friendly fibers. Digital retail channels are transforming market accessibility, enabling consumers to explore diverse product ranges while benefiting from convenient home delivery services.

Australia Hosiery Market Trends:

Rising Adoption of Sustainable and Eco-Friendly Hosiery Products

Australian consumers are increasingly gravitating towards sustainable hosiery options as environmental consciousness reshapes purchasing decisions across the fashion industry. Brands are responding by introducing products manufactured from recycled polyamide, organic cotton, and regenerated fibers derived from post-consumer waste. This shift is supported by greater transparency around sourcing and production practices, which strengthens consumer trust. Eco-friendly dyes and low-impact manufacturing processes are also gaining traction among hosiery brands. As sustainability becomes a key differentiator, ethical product positioning is increasingly influencing brand loyalty and repeat purchases.

Digital Retail Transformation and E-Commerce Expansion

The digital transformation of retail channels is revolutionizing how Australian consumers are discovering and purchasing hosiery products. Online platforms are providing unprecedented product accessibility, enabling consumers to explore diverse international brands from home. As per IMARC Group, the Australia e-commerce market size was valued at USD 604.1 Billion in 2025, with hosiery representing a significant contribution to this expanding digital marketplace through convenient delivery and seamless return policies.

Fashion-Forward Statement Hosiery and Bold Design Preferences

Contemporary Australian fashion trends are embracing hosiery as statement accessories rather than merely functional undergarments. Runway influences from international fashion weeks are driving demand for bold patterns, vibrant colors, and intricate lace detailing that elevate everyday ensembles. The emphasis on self-expression through legwear is encouraging consumers to experiment with diverse styles, ranging from geometric patterns to metallic accents, transforming hosiery into focal fashion elements across formal and casual occasions.

Market Outlook 2026-2034:

The Australia hosiery market outlook remains positive, as sustained demand from fashion-conscious consumers and evolving workplace dress codes continue to drive market expansion. The market generated a revenue of USD 1.24 Billion in 2025 and is projected to reach a revenue of USD 1.7 Billion by 2034, growing at a compound annual growth rate of 3.79% from 2026-2034. Rising consumer awareness regarding product quality, growing preference for premium and durable hosiery options, and expanding distribution through both physical retail networks and digital platforms are supporting steady growth trajectories. The integration of sustainable manufacturing practices and innovative fabric technologies positions the Australian market favorably for capturing emerging consumer preferences while addressing environmental concerns.

Australia Hosiery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Sheer |

64% |

| End Use | Women |

70% |

| Region | Australia Capital Territory & New South Wales |

28% |

Type Insights:

- Sheer

- Non-Sheer

Sheer dominates with a market share of 64% of the total Australia hosiery market in 2025.

Sheer maintains its commanding market position due to its essential role in professional wardrobes and formal occasions across Australian workplaces. These lightweight, translucent products offer versatility that complements diverse outfit styles while providing a polished, refined appearance suitable for corporate environments. The aesthetic appeal of sheer hosiery, combined with its breathability during Australia's warmer climate periods, makes it the preferred choice for fashion-conscious consumers seeking elegance without compromising comfort throughout extended wear.

The sheer hosiery segment continues expanding as fashion trends increasingly embrace transparent legwear as statement accessories. Additionally, sheer hosiery is widely available across price points, enabling broad consumer adoption across income segments. Innovations in yarn technology have improved durability and ladder resistance, addressing traditional wearability concerns. The rise of premium fashion brands and growing emphasis on personal grooming further reinforce demand. Seasonal events, corporate dress codes, and social occasions continue to sustain consistent purchase cycles, strengthening sheer hosiery’s leadership within the market.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Men

- Women

Women lead with a share of 70% of the total Australia hosiery market in 2025.

Women constitute the predominant consumer segment in the Australia hosiery market, driven by strong emphasis on personal presentation and professional wardrobe requirements. Female consumers demonstrate heightened fashion consciousness and view hosiery as essential accessories for completing polished ensembles across casual and formal occasions. Additionally, frequent style updates and seasonal fashion trends encourage repeat purchases within this segment. Strong influence of social media, fashion influencers, and retail promotions further shapes women’s hosiery buying behavior in Australia.

The women's hosiery segment benefits from diverse product requirements spanning professional workwear, evening occasions, and athleisure applications. Rising participation of women in the workforce creates sustained demand for comfortable, durable hosiery suitable for extended professional wear. In Australia, the participation of women in the workforce hit a historic peak of 63.5% in 2025. Additionally, growing preference for compression hosiery among women experiencing prolonged standing during work hours addresses functional health requirements while maintaining aesthetic appeal, further strengthening segment dominance across Australia.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 28% share of the total Australia hosiery market in 2025.

Australia Capital Territory & New South Wales retains its dominance in the market due to its stronghold on being the country's key business center and fashion-forward metropolitan. The concentration of corporate headquarters, financial institutions, and professional services firms generates sustained demand for quality hosiery products suitable for business environments. Sydney's retail market is diverse, including upscale department stores, specialty shops, and adequate online shopping platforms for different purchasing preferences.

The region's fashion-conscious consumer base, combined with high disposable income levels among urban professionals, supports premium hosiery purchases and brand loyalty. Additionally, the presence of international fashion brands and growing sustainable fashion movements in Sydney drive innovation in hosiery offerings while expanding consumer awareness of quality legwear options. Strong population density and ongoing urban employment growth further contribute to consistent hosiery consumption. As of December 2023, the population density in the Greater Sydney region was 429 individuals for every square kilometer. Seasonal events, corporate dress norms, and frequent social engagements also reinforce regular purchase cycles across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Hosiery Market Growing?

Expanding E-Commerce Channels and Digital Retail Penetration

The rapid expansion of e-commerce platforms is significantly improving hosiery retail accessibility across Australia by removing geographical constraints and broadening brand exposure. Online channels allow consumers to browse extensive product assortments from both domestic and international brands, supported by detailed descriptions, size guidance, and customer reviews that enhance purchase confidence. Fashion remains a key driver of online retail activity, making hosiery a natural fit for digital sales. Retailers are strengthening their online presence through user-friendly interfaces, virtual product visualization, and personalized recommendations. Flexible delivery options, easy return policies, and subscription-based models further improve customer convenience and loyalty. Social commerce features that enable direct purchasing through digital platforms are also gaining traction, increasing consumer engagement. Collectively, these developments are reshaping hosiery distribution strategies, accelerating online sales growth, and expanding market reach across urban and regional areas in Australia.

Rising Fashion Consciousness and Professional Wardrobe Requirements

Growing fashion consciousness among Australian consumers is driving increased demand for quality hosiery products that complement evolving wardrobe preferences across professional and casual occasions. The return to workplace environments following extended remote working periods has renewed emphasis on polished professional attire, with hosiery representing essential components of corporate dress codes. Data from CBRE for the initial quarter of 2024 indicated that Australia's CBD office occupancy rate averaged 76% of pre-COVID levels in Q1 2024, rising from 70% in Q4 2023 and 67% from 2023. Urban consumers increasingly view hosiery as fashion accessories capable of elevating ensembles rather than merely functional undergarments. Social media influences and fashion runway trends are shaping consumer preferences towards diverse hosiery styles, including bold patterns, vibrant colors, and innovative textures.

Growing Consumer Preference for Sustainable and Ethical Hosiery Products

Environmental consciousness is increasingly shaping hosiery purchasing behavior in Australia, as consumers place greater emphasis on sustainability and ethical production. Shoppers are actively seeking products made from recycled and renewable materials, along with brands that demonstrate transparency across their supply chains. Commitment to responsible sourcing, reduced waste, and lower environmental impact is becoming a key factor in brand selection. Hosiery manufacturers are responding by developing collections using recycled polyamide, organic cotton, and regenerated fibers sourced from post-consumer and industrial waste. Circular economy practices, including recycling initiatives and closed-loop production models, are gaining traction within the industry. Retailers are also supporting this shift by expanding sustainable product lines and introducing take-back or recycling programs to address textile waste concerns. Collectively, these efforts are strengthening consumer trust, differentiating brands, and positioning sustainability as a core driver of long-term growth of the Australia hosiery market.

Market Restraints:

What Challenges the Australia Hosiery Market is Facing?

Intense Competition from Low-Cost Imported Products

The Australia hosiery market faces significant competitive pressure from low-cost imported products sourced from manufacturing regions with lower labor and production costs. International fast-fashion retailers offering affordable hosiery alternatives challenge domestic manufacturers and premium brands seeking to maintain pricing power and market share. This challenge compresses profit margins and limits the ability of domestic players to invest aggressively in innovation and marketing.

Changing Workplace Dress Codes and Casualization Trends

The growing casualization of workplace attire and relaxed dress codes in many professional environments is reducing traditional demand for formal hosiery products. Remote working arrangements and flexible workplace policies have diminished occasions requiring polished legwear, affecting consumption patterns particularly among younger professional demographics. This shift reduces repeat purchase frequency for formal hosiery, weakening long-term demand stability for traditional product lines.

Seasonal Demand Fluctuations and Climate Considerations

Australia's predominantly warm climate creates seasonal demand challenges for traditional hosiery products, with consumers preferring lighter or bare-leg options during extended summer periods. Regional climate variations across Australian states contribute to inconsistent demand patterns requiring retailers to manage inventory carefully across different product categories. This volatility increases forecasting complexity and raises the risk of inventory imbalances across seasons and regions.

Competitive Landscape:

The Australia hosiery market exhibits a moderately fragmented competitive landscape with a mix of international premium brands, domestic manufacturers, and emerging sustainable fashion labels competing for consumer attention. Established global players leverage brand recognition, extensive distribution networks, and diverse product portfolios to maintain market positioning, while local brands differentiate through ethical manufacturing practices and Australian-designed collections. Competition is increasingly driven by investments in sustainable materials, digital marketing capabilities, and omnichannel retail strategies that integrate physical and online shopping experiences. Strategic partnerships between hosiery brands and fashion retailers are fostering innovations, accelerating product launches, and improving market accessibility.

Australia Hosiery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheer, Non-Sheer |

| End Uses Covered | Men, Women |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia hosiery market size was valued at USD 1.24 Billion in 2025.

The Australia hosiery market is expected to grow at a compound annual growth rate of 3.79% from 2026-2034 to reach USD 1.7 Billion by 2034.

Sheer dominated the market with a share of 64%, owing to its aesthetic appeal for professional settings, lightweight breathability, and versatility in complementing diverse outfit styles for fashion-conscious consumers.

Key factors driving the Australia hosiery market include expanding e-commerce channels, rising fashion consciousness, growing demand for sustainable products, increasing workforce participation among women, and innovations in fabric technology.

Major challenges include intense competition from low-cost imported products, changing workplace dress codes favoring casual attire, seasonal demand fluctuations due to warm climate conditions, and price sensitivity among cost-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)