Australia Hospital Equipment Market Size, Share, Trends and Forecast by Equipment Type, Distribution Channel, End User, and Region, 2025-2033

Australia Hospital Equipment Market Overview:

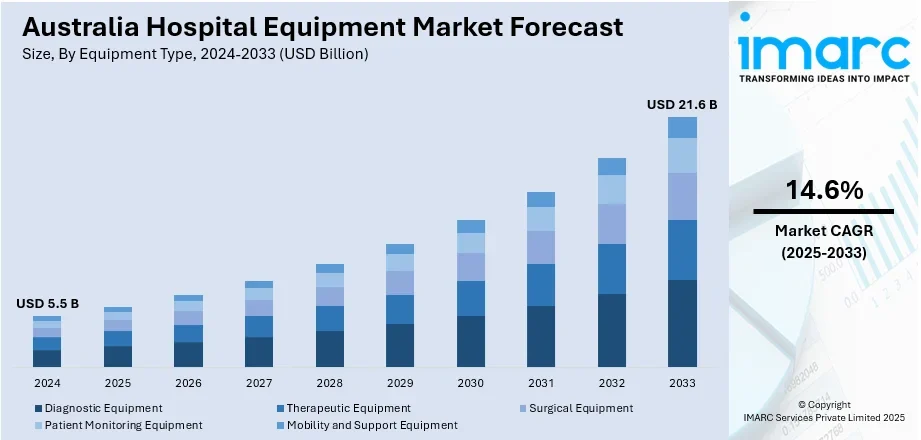

The Australia hospital equipment market size reached USD 5.5 Billion in 2024. Looking forward, the market is projected to reach USD 21.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.6% during 2025-2033. The market is driven by the increasing demand for advanced medical technology aimed at efficiency in treatment. Moreover, an increasing aging population coupled with widespread chronic diseases has created a huge demand for advanced hospital equipment. Further, there is growing awareness pertaining to quality healthcare treatments that require instrumental aid, which adds up to market demand. Apart from this, government health reforms and healthcare infrastructure investment have also increased the adoption of state-of-the-art hospital equipment across the nation, further expanding the Australia hospital equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Market Growth Rate (2025-2033) | 14.6% |

Key Trends of Australia Hospital Equipment Market:

Increasing Demand for Advanced Diagnostic Equipment

The industry is experiencing growing demand for high-tech diagnostic devices, including magnetic resonance imaging (MRI) machines, computed tomography (CT) scanners, and ultrasound machines. Market demand is driven by the growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, which require precise diagnostic equipment to enable efficient management and early diagnosis. According to an industry report, by 2034, it is projected that Australia will experience approximately 209,000 new cases of cancer, driven by increase in population and an anticipated rise in cancer rates. As a result, the market is likely to see a large increase in the requirement for high-end diagnostic technologies, which are critical for the early detection and treatment of chronic diseases. Further, the healthcare sector is adopting advanced technologies to improve patient results and reduce diagnostic mistakes, which is propelling Australia hospital equipment market growth. Additionally, governments' provision of incentives and financial assistance for healthcare equipment has also helped drive the adoption of advanced diagnostic equipment. In addition, hospitals and healthcare facilities are also prioritizing the purchase of advanced diagnostic systems to enhance their service levels and remain competitive in the evolving healthcare landscape.

To get more information on this market, Request Sample

Expansion of Telemedicine and Remote Monitoring Equipment

Telemedicine and remote patient monitoring systems are crucial elements of the Australian health system, especially after the COVID-19 pandemic. According to an industry report released in August 2024, over 25% of Australians have undertaken at least one telehealth consultation over the last month, reflecting the growing acceptance of digital health services. With healthcare facilities and professionals working to provide care to patients in rural and remote areas, telemedicine solutions and remote monitoring equipment are in demand. This trend covers an immense range of technologies, from wearable monitoring devices for observing vital signs to mobile health software and telehealth systems for conducting virtual consultations between patients and doctors. These technologies allow for ongoing patient monitoring and deliver real-time data for healthcare professionals, allowing them to make well-informed decisions about patient treatment, which is instrumental in the management of chronic disease. In addition to this, government initiatives to enhance digital healthcare services, such as telemedicine infrastructure funding and reimbursement for remote consultations, have boosted the take-up of telehealth technology by hospitals and clinics. With telemedicine and remote monitoring systems are leading the charge to transform the healthcare landscape, the market is positioned for sustained growth in the coming years.

Rising Focus on Minimally Invasive Technology

The Australian hospital equipment market is seeing a large shift towards minimally invasive technology as healthcare providers and hospitals place great importance on patient safety and operational efficiency. Minimally invasive procedures result in fewer complications, shorter hospital stays, and faster recovery times compared to traditional surgeries, making them appealing to both doctors and patients. This shift is increasing the need for specialized surgical equipment, imaging technology, and accurate diagnostic equipment intended to enable these sophisticated techniques. As more patients opt for less invasive treatment options, hospitals are investing in laparoscopic, robotic, and image-guided systems. This movement also favors the goal of reducing healthcare spending, with minimally invasive procedures reducing postoperative care costs while promoting better overall treatment outcomes.

Growth Factors of Australia Hospital Equipment Market:

Increasing Healthcare Expenditure

The growth of the Australia hospital equipment market is significantly influenced by rising healthcare expenditure. Steady investments from both government and private sectors are focused on enhancing healthcare infrastructure, expanding hospital facilities, and upgrading medical equipment. Public funding initiatives seek to improve accessibility, affordability, and the overall quality of healthcare services. At the same time, private hospitals are making substantial investments in advanced diagnostic imaging systems, surgical devices, and monitoring tools to satisfy increasing patient expectations. This financial investment allows hospitals to modernize their equipment, embrace digital health technologies, and implement smart solutions that enhance efficiency and patient care. As a result, increased expenditure directly fuels stronger demand for hospital equipment throughout the country.

Growing Burden of Chronic Diseases

The rising occurrence of chronic diseases like cardiovascular disorders, respiratory illnesses, diabetes, and cancer is fueling the demand for advanced hospital equipment in Australia. Factors such as lifestyle changes, an aging population, and environmental influences contribute to the escalating burden of these long-term conditions. Consequently, hospitals are emphasizing the use of diagnostic imaging systems, critical care devices, and surgical equipment that facilitate early detection, improved management, and better treatment outcomes. The importance of continuous monitoring equipment and advanced surgical tools is particularly pronounced in effectively dealing with these chronic conditions. The requirement for specialized care, along with government initiatives aimed at managing chronic disease prevalence, strongly boosts market growth for modern hospital equipment.

Expansion of Private and Public Hospitals

The ongoing growth and modernization of both private and public hospitals in Australia serve as a crucial driver for hospital equipment demand. Government-supported initiatives aimed at enhancing healthcare access in urban and rural areas are resulting in the establishment of new facilities and upgrades to existing ones. Additionally, private healthcare providers are broadening their networks to accommodate increasing patient volumes and demand for advanced treatments. This expansion necessitates the acquisition of updated surgical instruments, patient monitoring systems, diagnostic tools, and life-support equipment. The focus on developing well-equipped, technologically proficient hospitals leads to improved patient outcomes and accelerates the procurement of cutting-edge hospital equipment nationwide.

Opportunities of Australia Hospital Equipment Market:

Focus on Green and Sustainable Equipment

The growing emphasis on sustainability within healthcare is creating opportunities for eco-friendly hospital equipment in Australia. Hospitals are increasingly adopting energy-efficient devices, low-emission imaging systems, and reusable or recyclable surgical tools to meet green standards. This transition reduces environmental impact and helps institutions lower operational costs in the long term. Government incentives and stricter regulations regarding sustainability in healthcare further motivate hospitals to incorporate environmentally responsible technologies. Medical equipment manufacturers that innovate with biodegradable materials, energy-saving technology, and waste-minimization features stand to gain significantly. The shift toward greener healthcare solutions positions sustainability as a vital opportunity for the future growth of the Australian hospital equipment market.

Expansion of Specialized Care Units

The growing incidence of chronic diseases like cancer, cardiovascular conditions, and respiratory illnesses has led to a higher need for specialized healthcare units throughout Australia. Hospitals are committing resources to oncology wards, cardiology centers, and advanced critical care facilities that necessitate cutting-edge medical equipment. For instance, oncology units require precision diagnostic imaging and radiation therapy devices, while cardiology departments need advanced monitoring and surgical systems. This expansion creates opportunities for suppliers providing specialized, high-performance hospital equipment tailored for complex treatments. Additionally, an aging population contributes to increased patient admissions for specialized care, ensuring continuous demand. Manufacturers catering to specialized unit requirements will discover a growing market segment to explore in Australia.

Collaborations with Global Manufacturers

Collaborations with international medical device manufacturers allow hospitals in Australia to access the latest innovations and next-generation healthcare equipment. Partnerships with leading global firms facilitate the transfer of advanced technology, knowledge sharing, and quicker adoption of cutting-edge medical solutions such as AI-powered diagnostic systems, robotic surgical tools, and smart monitoring devices. These collaborations also enhance Australia’s capability to maintain world-class healthcare standards while ensuring competitive pricing for advanced equipment. Furthermore, global partnerships open avenues for joint research and development, helping local healthcare providers adapt solutions to meet the specific needs of Australian patients. As the healthcare sector becomes more globalized, such collaborations present a significant opportunity to accelerate modernization and innovation in hospital equipment.

Challenges of Australia Hospital Equipment Market:

High Cost of Advanced Equipment

One significant challenge in the Australia hospital equipment market is the substantial expense tied to advanced diagnostic and surgical tools. Sophisticated machines like robotic surgical systems, MRI scanners, and high-end imaging devices require considerable upfront investments, often putting a strain on hospital budgets. While well-funded urban hospitals can typically afford such equipment, smaller and rural healthcare facilities find it difficult to allocate resources for procurement. Additionally, ongoing expenses related to maintenance, calibration, and staff training contribute to the financial burden. This uneven affordability creates a disparity in healthcare access across various regions, limiting the availability of cutting-edge treatments for patients outside metropolitan areas.

Skilled Workforce Shortage

The increasing complexity of modern hospital equipment presents another issue: the lack of skilled professionals capable of operating, maintaining, and managing these advanced systems. Australia’s healthcare sector is experiencing a rising demand for technicians, biomedical engineers, and specialized personnel trained in the use of high-end devices. Without adequate expertise, hospitals can struggle to maximize the effectiveness and efficiency of their equipment, leading to underutilization and potential inefficiencies in operations. Additionally, rural and regional healthcare facilities often face greater challenges in attracting and retaining skilled professionals, widening the gap in healthcare service delivery. Addressing this issue necessitates stronger investment in training programs, professional development, and incentives to cultivate a capable and sustainable workforce.

Regulatory and Compliance Pressures

The Australia hospital equipment market is significantly influenced by strict regulatory frameworks and compliance requirements. Before new medical devices can be implemented in hospitals, they must undergo lengthy approval processes to ensure safety, quality, and efficacy. While these regulations serve to protect patients, they often hinder the swift adoption of innovative technologies. Smaller companies and hospitals may also find it challenging to manage the high administrative costs and complexities involved in meeting compliance standards. Furthermore, continuous updates to international medical device standards add another layer of difficulty for local healthcare providers. Consequently, delays in equipment availability and the added costs associated with compliance impede the overall modernization of healthcare facilities throughout the country.

Australia Hospital Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, distribution channel, and end user.

Equipment Type Insights:

- Diagnostic Equipment

- X-ray Machines

- MRI Scanners

- CT Scanners

- Ultrasound Devices

- Endoscopy Equipment

- Therapeutic Equipment

- Ventilators

- Dialysis Machines

- Infusion Pumps

- Laser Therapy Devices

- Surgical Equipment

- Electrosurgical Devices

- Surgical Navigation Systems

- Endoscopic Instruments

- Patient Monitoring Equipment

- ECG Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Fetal Monitoring Systems

- Mobility and Support Equipment

- Wheelchairs and Stretchers

- Hospital Beds

- Patient Lifting Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes diagnostic equipment (X-ray machines, MRI scanners, CT scanners, ultrasound devices, and endoscopy equipment), therapeutic equipment (ventilators, dialysis machines, infusion pumps, and laser therapy devices), surgical equipment (electrosurgical devices, surgical navigation systems, and endoscopic instruments), patient monitoring equipment (ECG monitors, blood pressure monitors, pulse oximeters, and fetal monitoring systems), and mobility and support equipment (wheelchairs and stretchers, hospital beds, and patient lifting equipment).

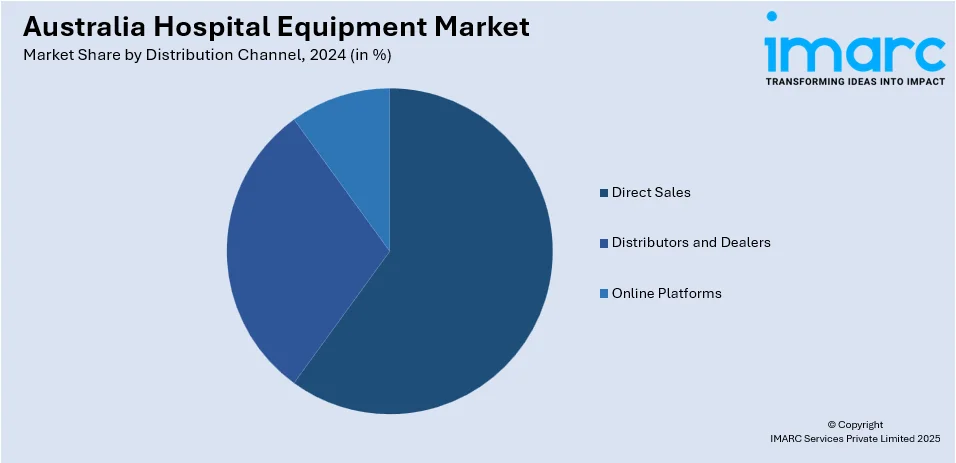

Distribution Channel Insights:

- Direct Sales

- Distributors and Dealers

- Online Platforms

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, distributors and dealers, and online platforms.

End User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic centers, ambulatory surgical centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- B. Braun Australia Pty Ltd

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health

- Fisher & Paykel Healthcare Limited

- Medline Australia

- ResMed

- Stryker Corporation

- Zimmer Biomet Pty Ltd

Australia Hospital Equipment Market News:

- On November 15, 2023, Brandon Medical, a UK-based medical technology firm, and Device Technologies announced a strategic partnership aimed at introducing advanced medical equipment to Australia, New Zealand, and Southeast Asia. This collaboration is founded on shared values such as innovation, quality, and a commitment to enhancing patient care environments across the Asia-Pacific region. By combining Brandon Medical's expertise in SMART healthcare systems with Device Technologies' extensive regional network, the partnership seeks to deliver state-of-the-art solutions to healthcare professionals and improve patient outcomes.

Australia Hospital Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors and Dealers, Online Platforms |

| End Users Covered | Hospitals and Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | B. Braun Australia Pty Ltd, Becton, Dickinson and Company, Boston Scientific Corporation, Cardinal Health, Fisher & Paykel Healthcare Limited, Medline Australia, ResMed, Stryker Corporation, Zimmer Biomet Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hospital equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hospital equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hospital equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hospital equipment market in Australia was valued at USD 5.5 Billion in 2024.

The Australia hospital equipment market is projected to exhibit a compound annual growth rate (CAGR) of 14.6% during 2025-2033.

The Australia hospital equipment market is expected to reach a value of USD 21.6 Billion by 2033.

The key trends of the Australia hospital equipment market include the growing adoption of digital health technologies, with hospitals embracing AI-based diagnostics, robotic-assisted surgery, and telemedicine tools. There is also an increasing shift toward minimally invasive devices and the integration of smart monitoring systems to improve patient outcomes and hospital efficiency.

The market is driven by expanding healthcare infrastructure, rising investments in modernization of hospitals, and greater demand for technologically advanced equipment. Increasing patient expectations for high-quality care, coupled with government support for medical innovation and the growing prevalence of complex health conditions, further accelerate equipment procurement and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)