Australia Hot Melt Adhesive Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Hot Melt Adhesive Market Overview:

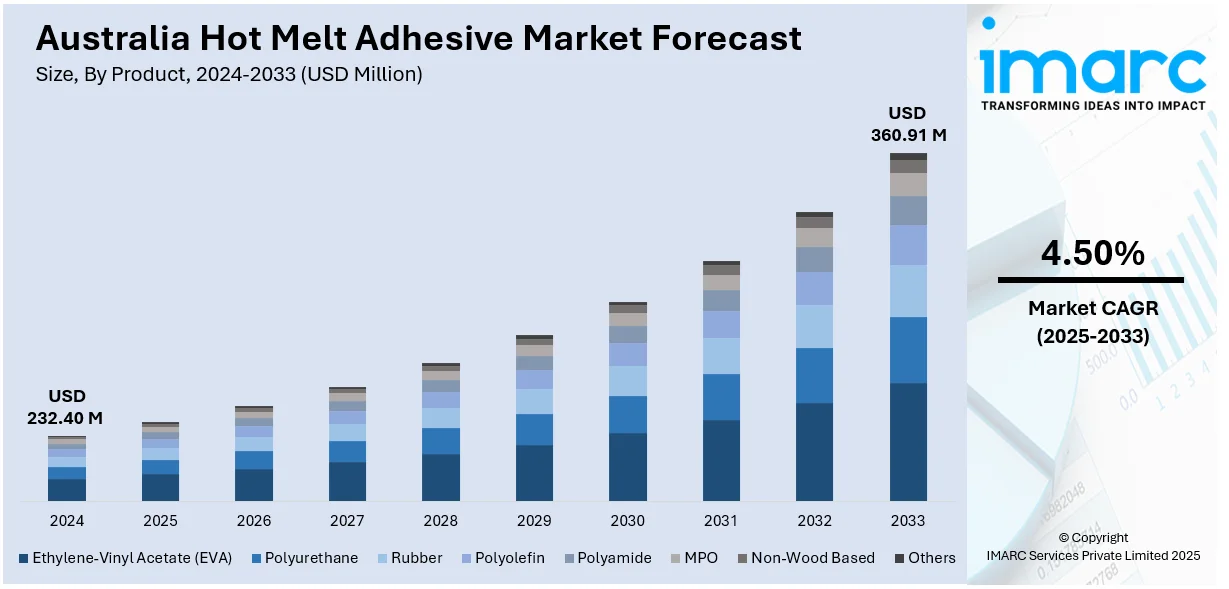

The Australia hot melt adhesive market size reached USD 232.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 360.91 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The Australia hot melt adhesives market is being driven by elevating product demand in the packaging, automotive, and construction sectors, along with a growing focus on sustainable, eco-friendly products, technological advancements in adhesive formulations, and the rising popularity of customized products, especially in the furniture and packaging industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 232.40 Million |

| Market Forecast in 2033 | USD 360.91 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Australia Hot Melt Adhesive Market Trends:

Growth in Sustainable Packaging Solutions

One of the most vital drivers for the Australian hot melt adhesive market is the increasing demand for sustainable and eco-friendly packaging. With heightened environmental awareness among consumers, regulatory bodies, and companies, the packaging sector is witnessing a considerable shift. Solvent-based adhesives are being quickly replaced by hot melt adhesives as the latter are more environmentally friendly because they are solvent-free, and the curing process is energy-efficient. Hot melt adhesives are well-suited for joining biodegradable and recyclable substrates, which makes them a good choice for green packaging. As Australia tightens plastic usage and landfill contribution policies, like the 2025 National Packaging Targets implemented by the Australian Packaging Covenant Organization (APCO), there is increasing pressure on packaging producers to move towards greener alternatives. HMAs enable manufacturers to reduce their carbon footprint without diminishing performance. Additionally, online shopping has ballooned the number of parcels and packaging materials used, prompting businesses to shift toward HMAs due to their rapid setting characteristics and capacity to seal most materials such as corrugated boxes and flexible films. This is complemented by increased use of plant-based and compostable hot melt adhesives driven by Australia's circular economy push. Consequently, hot melt adhesives are becoming the go-to adhesive for businesses that are seeking to achieve both operational and environmental standards.

To get more information on this market, Request Sample

Expanding Automotive and Transportation Sector

Another key driver of the Australian hot melt adhesive market is the growth of the automotive and transportation sectors, which increasingly uses sophisticated adhesive technology for lightweighting and modular assembly. In contrast to conventional mechanical fastening technologies, HMAs provide weight saving, vibration damping, and flexibility, which are essential in current vehicle design and performance. Australia's commitment to local electric vehicle production and components manufacturing, fostered by national plans such as the Future Fuels Strategy, has added impetus to demand for high-performance adhesives for bonding disparate substrates like plastics, metals, and composites. Hot melt adhesives are essential in applications from interior trim and infotainment system assembly to headlamp assemblies and battery pack assemblies. Moreover, public transport and rail network upgrading within states such as Victoria and New South Wales have enhanced the application of modular construction materials where HMAs are crucial because of their strength, clean processing, and resistance to weather. The adhesives also satisfy strict safety conditions, such as low VOC emissions and flame resistance, rendering them suitable for enclosed or sensitive spaces such as car cabins.

Australia Hot Melt Adhesive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and region.

Product Insights:

- Ethylene-Vinyl Acetate (EVA)

- Polyurethane

- Rubber

- Polyolefin

- Polyamide

- MPO

- Non-Wood Based

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ethylene-vinyl acetate (EVA), polyurethane, rubber, polyolefin, polyamide, MPO, non-wood based, and others.

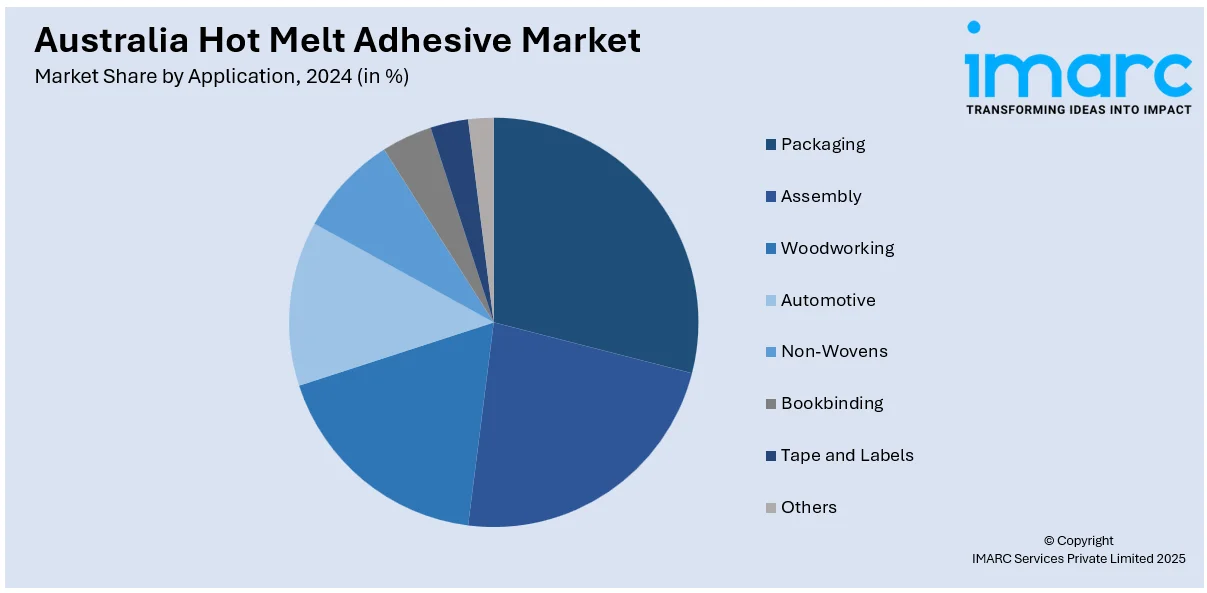

Application Insights:

- Packaging

- Assembly

- Woodworking

- Automotive

- Non-Wovens

- Bookbinding

- Tape and Labels

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging, assembly, woodworking, automotive, non-wovens, bookbinding, tape and labels, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hot Melt Adhesive Market News:

- July 2024: SIG introduced a recycle-ready water bag in Australia using its new Terra RecShield, a polymer-based structure that replaces aluminum. This shift to flexible, mono-material packaging demands strong, compatible bonding solutions like hot melt adhesives. As more local manufacturers adopt such formats, demand for hot melt adhesives is expected to grow.

- June 2024: Scandinavian furniture brand Bolia announced plans to enter the Australian market with a flagship store in Melbourne, offering personalized, eco-conscious furniture. The brand’s focus on sustainable and durable design is expected to drive demand for reliable adhesives in furniture manufacturing. Hot melt adhesives, known for their strong bonding and efficiency, will support this growth, boosting the market as local production or customization needs increase.

Australia Hot Melt Adhesive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ethylene-Vinyl Acetate (EVA), Polyurethane, Rubber, Polyolefin, Polyamide, MPO, Non-Wood Based, Others |

| Applications Covered | Packaging, Assembly, Woodworking, Automotive, Non-Wovens, Bookbinding, Tape and Labels, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hot melt adhesive market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hot melt adhesive market on the basis of product?

- What is the breakup of the Australia hot melt adhesive market on the basis of application?

- What is the breakup of the Australia hot melt adhesive market on the basis of region?

- What are the various stages in the value chain of the Australia hot melt adhesive market?

- What are the key driving factors and challenges in the Australia hot melt adhesive market?

- What is the structure of the Australia hot melt adhesive market and who are the key players?

- What is the degree of competition in the Australia hot melt adhesive market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hot melt adhesive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hot melt adhesive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hot melt adhesive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)