Australia Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

Australia Hot Sauce Market Overview:

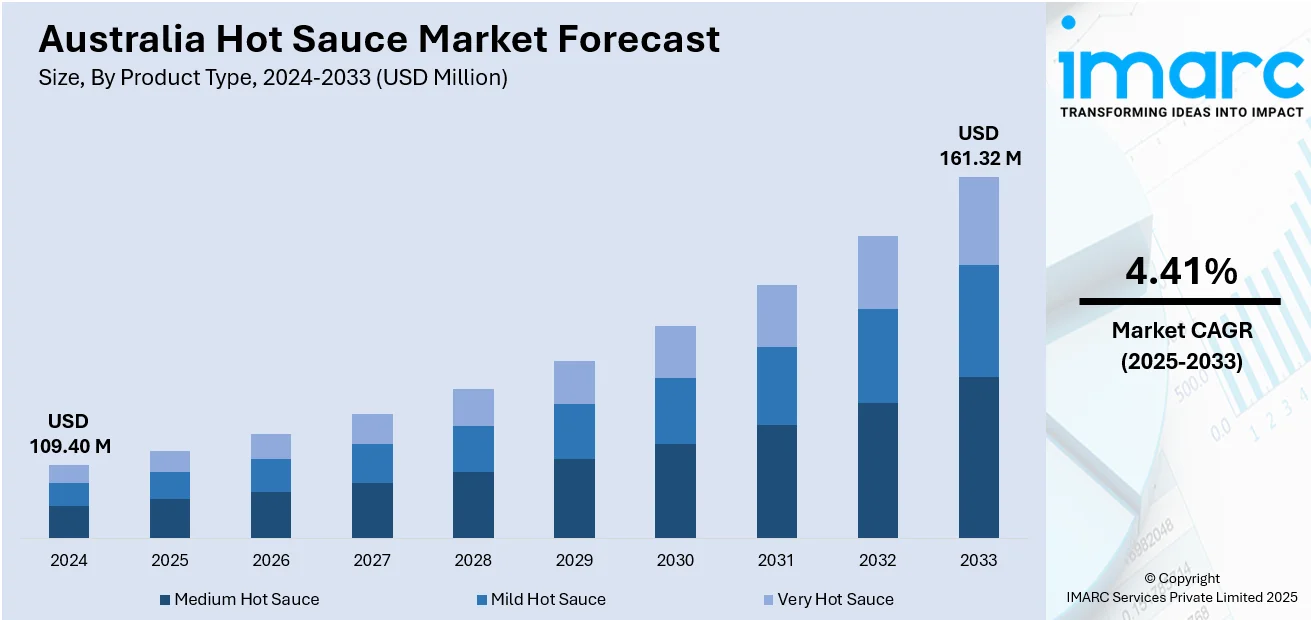

The Australia hot sauce market size reached USD 109.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 161.32 Million by 2033, exhibiting a growth rate (CAGR) of 4.41% during 2025-2033. There is an increase in multicultural food exposure in Australia, which is largely influencing consumer palates. Additionally, consumers are looking for convenient, ready-to-use condiments that add to meals without the need for additional preparation, thereby supporting the market growth. Moreover, the rise in small-batch, artisan, and premium sauce manufacturers is expanding the Australia hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 109.40 Million |

| Market Forecast in 2033 | USD 161.32 Million |

| Market Growth Rate 2025-2033 | 4.41% |

Australia Hot Sauce Market Trends:

Emergence of Multicultural Influence on Food Choices

There is an increase in multicultural food exposure in Australia, which is largely influencing consumer palates. With continued immigration from several countries, there is a high demand for spicy, strong-tasting, and flavorful food products. Hot sauce is being incorporated into home cooking as Australians test new world cuisines, ranging from Thai and Mexican to Korean and Indian. Food service outlets, especially in city centers such as Sydney and Melbourne, are more frequently adding spicy meals to their menus, encouraging consumers to adapt to a taste for heat. This growing exposure not only mainstreams authentic hot sauces but also creates opportunities for fusion versions that combine local ingredients with international spice profiles. As more families embrace adventurous eating habits, hot sauce is evolving from a specialty condiment to a pantry staple embedded in home cuisine and restaurant culture. Owing to this, companies are launching various products to cater to the tastes of consumers. In 2024, BINGE partnered with Thinkerbell to introduce a pair of hot sauces inspired by the hit series 'House of the Dragon'. The sauces, titled 'REVENGE' (Green) and 'DRACARYS' (Black), enable fans to show their support for the Green and Black Councils featured in the series. The sauces were developed following the favorable response to the debut of 'House of the Dragon' season two in Australia.

To get more information on this market, Request Sample

Increased Demand for Convenient, Strong-Flavored Condiments

Australian consumers are increasingly looking for convenient, ready-to-use condiments that add to meals without the need for additional preparation, thereby supporting the Australia hot sauce market growth. Hot sauce is appropriate for this trend with its ability to provide an instant flavor and zing to cooked and ready-to-eat foods. With hectic lifestyles and double-income households being the new norm, there is little time available for elaborate food preparation. As a result, there is a corresponding demand for plain, quick-preparation meal enhancers. Hot sauce offers a quick and powerful means to personalize meals, which is appealing to every age category. Additionally, young consumers, particularly millennials and Gen Z, are preferring strong, bold flavor profiles, driving the spicy condiment market. Social media trends, including food challenges, recipes, and taste tests of spicy foods, are also driving the trend. Therefore, brands and retailers are building up their hot sauce lines to cater to various taste profiles and spiciness levels. In 2025, KFC Australia launched its Habanero Hot & Crispy range for a limited time from April 22 to June 2, 2025. The package provided boneless chicken with a crispy, golden coating, accompanied by a Habanero sauce.

Growth of Premium, Craft, and Locally Produced Hot Sauce Brands

There is an increase in Australia's small-batch, artisan, and premium hot sauce manufacturers who are concentrating on quality ingredients, novel flavor profiles, and local sourcing. Consumers are becoming increasingly aware about the provenance and composition of their foods, and this is driving the demand for clean-label products, fewer preservatives, and sustainable sourcing. Local brands are tapping into this by stressing their Australian-made status, indigenous ingredients such as finger lime or pepperberry from Tasmania, and hand-crafted manufacture. This movement is cultivating a culture of hot sauce aficionado-ship, as consumers are eager to invest in unique products with an identity. Food festivals, farmers' markets, and specialty shops are also bringing these premium products into the spotlight so that small brands can compete with global leaders. With growing awareness and appreciation for handcrafted condiments, the premium category is contributing value to Australia's hot sauce industry, fueling innovation and diversity.

Australia Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

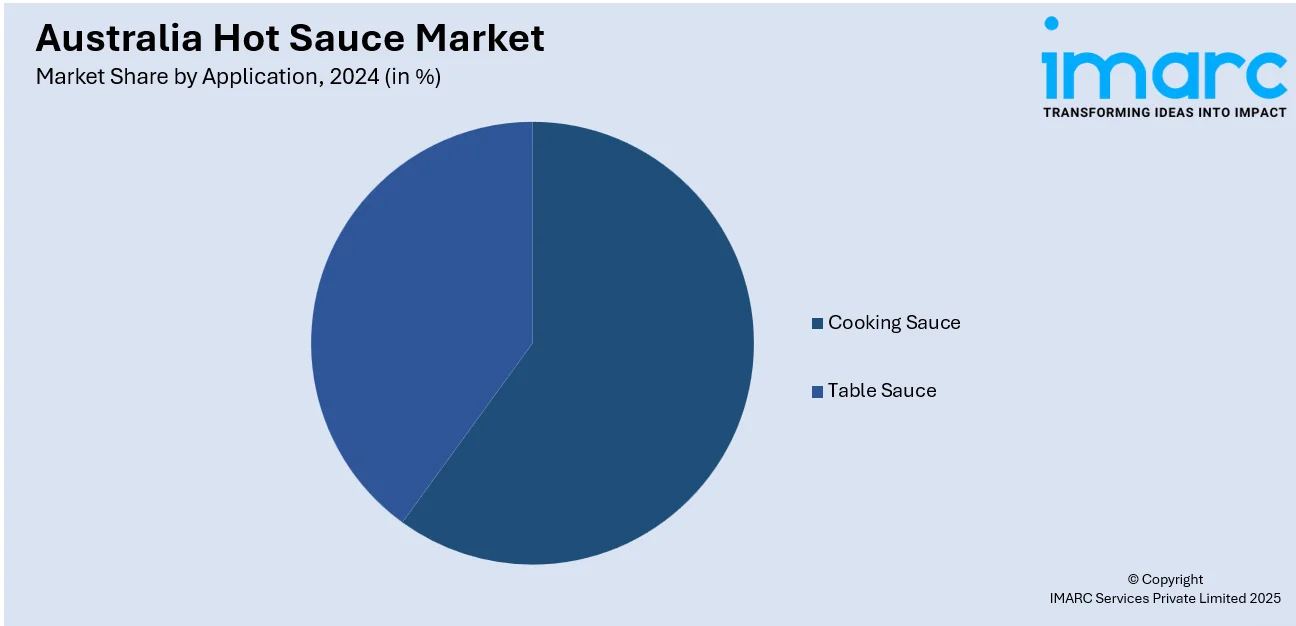

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hot sauce market on the basis of product type?

- What is the breakup of the Australia hot sauce market on the basis of application?

- What is the breakup of the Australia hot sauce market on the basis of packaging?

- What is the breakup of the Australia hot sauce market on the basis of distribution channel?

- What is the breakup of the Australia hot sauce market on the basis of end use?

- What is the breakup of the Australia hot sauce market on the basis of region?

- What are the various stages in the value chain of the Australia hot sauce market?

- What are the key driving factors and challenges in the Australia hot sauce market?

- What is the structure of the Australia hot sauce market and who are the key players?

- What is the degree of competition in the Australia hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)