Australia Hotel Market Report by Hotel Type (Business/Commercial Hotels, Boutique Hotels, Resort Hotels, Casino Hotels, Transit Hotels, Bed and Breakfast Hotels, and Others), Business Model (Independent, Chain), Room Capacity (Small, Medium, Large, Very Large), Price Level (Luxury, Upscale, Midscale, Economy), and Region 2025-2033

Australia Hotel Market Size and Share:

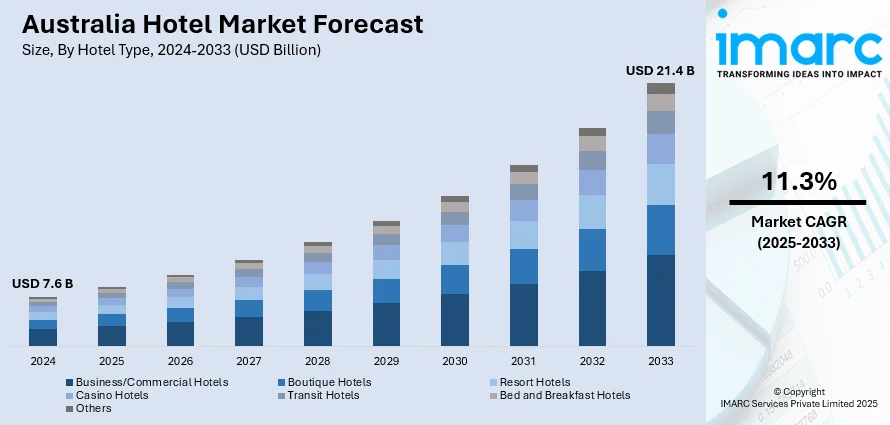

The Australia hotel market size reached USD 7.6 Billion in 2024. Looking forward, the market is projected to reach USD 21.4 Billion by 2033, exhibiting a growth rate (CAGR) of 11.3% during 2025-2033. The market is propelled by growth in international travel, rise of staycations, government’s investment in infrastructure development, and increased demand for luxury hotels, serviced apartments, and conference facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.6 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Market Growth Rate 2025-2033 | 11.3% |

Key Trends of Australia Hotel Market:

Expanding Tourism Industry

Tourism development and growth in international travel contribute to the significant rise of Australia's hotel market. As per Australian Bureau of Statistics, in February 2023, there were 600,710 short-term visitor arrivals and an annual increase of 510,250 trips in Australia. The wide diversity of landscapes, iconic attractions, and unique wildlife have kept Australia at the top destinations list of travelers. With the easing of travel restrictions, tourists from regions such as the Asia-Pacific and Europe will eventually lead to high occupancy rates for hotels. International events, festivals, and natural wonders in Australia attract millions of visitors each year, fueling demand for accommodation. This resorting to tourism is strengthening the hotel industry and attracting more investments in both luxury and budget hotels across the nation.

To get more information of this market, Request Sample

Infrastructure Development

The Australian government’s investment in infrastructure development is a strong catalyst for growth in the hotel sector. According to the Department of Infrastructure, Transport, Regional Development, Communication and Arts, the Australian government has committed to a 10-year, $120 billion infrastructure investment pipeline, assuring a steady stream of sustainable land transport infrastructure projects. As of the 2024-25 Budget, the government has committed $96.5 billion to nation-building projects through the Infrastructure Investment Program during a 10-year period beginning. Major cities like Sydney, Melbourne, and Brisbane are seeing upgrades in airports, transport systems, and tourist facilities, which directly impact the hospitality industry. The expansion of regional airports has opened up new areas to tourism, increasing hotel occupancy in previously untapped markets. Additionally, international hotel chains and investors are taking advantage of these developments, establishing new properties to meet rising demand. This influx of investments is further boosting the quality and quantity of accommodation options available.

Rise of Business Travel

Business travel is a significant driver for the Australian hotel market. Major cities in the country have emerged as favorite corporate destinations due to their reputation for business events. Equipped with modern, well-equipped convention facilities, Australia is one of the favorite countries for business meetings and is also gaining ground as an international conference destination. This, in turn, has bumped up demand for five-star hotels, serviced apartments, and conference centers. Besides, since the pandemic, international business trips have picked up to further drive the sector as companies resume face-to-face meetings and events.

Growth Drivers of Australia Hotel Market:

Increased Disposable Income

The rise in disposable income among Australians and international tourists is significantly propelling growth in the Australian hotel sector. As people experience higher income levels, they increasingly spend on premium offerings such as luxury accommodations, gourmet dining, and high-end amenities. This trend has resulted in a heightened demand for upscale lodging, particularly in major urban areas and sought-after tourist locations. International visitors from wealthier markets also contribute to this increased expenditure on luxury hotel experiences. Consequently, hotels can broaden their services to cater to both budget-conscious guests and those in pursuit of exclusive experiences. With the ongoing recovery and growth of the economy, the role of disposable income remains a vital factor in the expansion of the high-end hotel market. Australia hotel market share is anticipated to benefit from this change in consumer spending habits.

Expansion of International Hotel Chains

The influx of international hotel brands into Australia is intensifying competition and diversifying accommodation options for travelers. These global hotel chains introduce established reputations, international loyalty programs, and a wealth of operational expertise that appeal to local and international guests alike. As these chains establish themselves within Australia, they set new benchmarks for service, innovation, and amenities, prompting local hotels to enhance their offerings. This expansion also results in a broader array of hotel choices, ranging from luxury accommodations to more economical mid-range and budget options, catering to various consumer preferences. The presence of renowned global brands boosts Australia’s attractiveness as a premier travel destination, positively impacting tourism and the overall hotel industry. According to Australia hotel market analysis, this trend is expected to persist, further solidifying the country's standing in the global hospitality sector.

Urbanization and Development

High urbanization rates and continuous development schemes are contributing significantly to the growth of the Australian hotel industry. With the expansion of major cities and overall development of regional regions, the demand for hotels and resorts grows as a result of increased business activities, tourism, and population expansion. Urban centers such as Sydney, Melbourne, and Brisbane are still experiencing population growth, prompting the development of new hotels to cater to local and international tourists. Regional tourist sites are also experiencing rapid tourism growth, with resorts and boutique hotels being developed to accommodate tourists. This development promotes a broader choice of accommodations from high-end places to low-cost options. With continued urbanization and expansion, the need for quality and affordable hotel options will remain instrumental in fueling market growth. Based on Australia hotel market demand insights, this trend is expected to escalate in the forthcoming years.

Australia Hotel Market Outlook:

Growing Demand for Luxury and Premium Accommodations

The rise in disposable income among Australians and international travelers is fueling interest in luxury and premium hotels, particularly in major urban centers and sought-after tourist spots. More individuals are willing to indulge in upscale lodging, prompting hotels to cater to this demographic with exclusive amenities, personalized experiences, and unique offerings. This luxury trend is especially noticeable in cities like Sydney, Melbourne, and the Great Barrier Reef, where affluent visitors seek comfort and elegance. This move towards luxury is not solely about lavishness; travelers are interested in quality experiences, looking for hotels that provide distinctive, memorable stays. As this trend progresses, significant growth is anticipated in the high-end segment of the Australian hotel market.

Expansion into Regional Areas

With regional tourism gaining traction, there is a notable increase in the development of hotels and resorts in non-metropolitan locations to accommodate the rising number of visitors. Tourists are venturing beyond major cities, seeking unique experiences in coastal towns, national parks, and rural areas. This trend is leading to investments in boutique hotels, eco-resorts, and family-friendly lodging options. Regional destinations are becoming more appealing due to a surge in domestic travel, offering both relaxation and adventure outside urban environments. Enhanced infrastructure is improving access to these areas, contributing to a growing demand for hotels and resorts in non-metropolitan regions, thus presenting hotel brands with opportunities to diversify and enter new markets.

Emphasis on Sustainability

Sustainability is now a vital focus within the Australian hotel industry, as travelers increasingly prefer eco-friendly options. Due to increasing awareness of environmental concerns, hotels are adopting eco-friendly practices. These include installing energy-efficient lighting, implementing water-saving systems, minimizing waste, and utilizing sustainable materials. Many establishments are also prioritizing local, organic food sourcing for their restaurants and adopting carbon offset programs. This commitment to sustainability not only attracts environmentally aware travelers but also allows hotel brands to distinguish themselves in a competitive marketplace. As the importance of eco-friendly practices continues to grow among consumers, hotels that emphasize these initiatives will increasingly appeal to guests seeking responsible travel options, shaping the future of the Australian hotel sector.

Australia Hotel Market News:

- In July 2024, Accor, Australia's leading hotel operator, has inked partnership renewal agreements for over 40 hotels totaling 5,500 keys across the country, demonstrating the Group's strong relationships with some of the country's most significant hotel owners.

- In September 2023, as per preliminary August 2023 data from CoStar, Sydney's hotel business posted its highest monthly performance levels since March 2023, assisted by the FIFA Women's World Cup.

Australia Hotel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on hotel type, business model, room capacity, and price level.

Hotel Type Insights:

- Business/Commercial Hotels

- Boutique Hotels

- Resort Hotels

- Casino Hotels

- Transit Hotels

- Bed and Breakfast Hotels

- Others

The report has provided a detailed breakup and analysis of the market based on the hotel type. This includes business/commercial hotels, boutique hotels, resort hotels, casino hotels, transit hotels, bed and breakfast hotels and others.

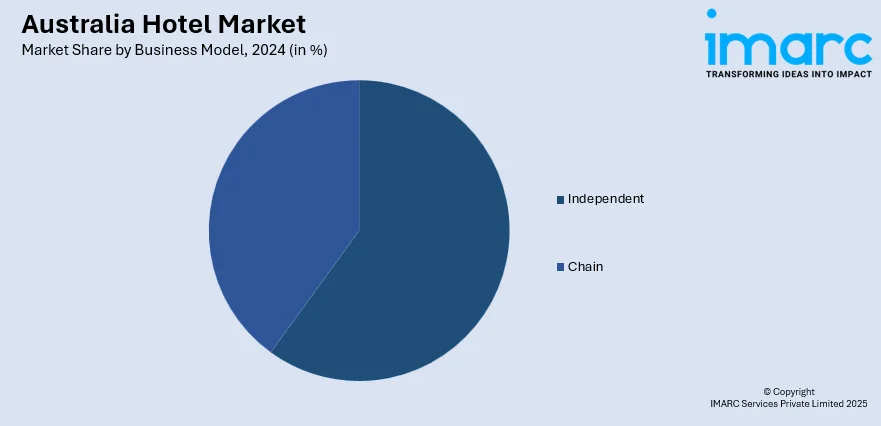

Business Model Insights:

- Independent

- Chain

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes independent, and chain.

Room Capacity Insights:

- Small

- Medium

- Large

- Very Large

The report has provided a detailed breakup and analysis of the market based on the room capacity. This includes small, medium, large, and very large.

Price Level Insights:

- Luxury

- Upscale

- Midscale

- Economy

A detailed breakup and analysis of the market based on the price level have also been provided in the report. This includes luxury, upscale, midscale, and economy.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hotel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Hotel Types Covered | Business/Commercial Hotels, Boutique Hotels, Resort Hotels, Casino Hotels, Transit Hotels, Bed and Breakfast Hotels, Others |

| Business Models Covered | Independent, Chain |

| Room Capacities Covered | Small, Medium, Large, Very Large |

| Price Levels Covered | Luxury, Upscale, Midscale, Economy |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hotel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hotel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hotel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hotel market in the Australia was valued at USD 7.6 Billion in 2024.

The Australia hotel market is projected to exhibit a compound annual growth rate (CAGR) of 11.3% during 2025-2033.

The Australia hotel market is expected to reach a value of USD 21.4 Billion by 2033.

Growth in domestic tourism, recovery in international arrivals, and rising business travel are driving the market. Major events and investments in tourism infrastructure are boosting demand. Increasing digital bookings, improved air connectivity, and government initiatives supporting tourism promotion are also playing a significant role in fueling market expansion.

The Australia hotel market is seeing a rise in boutique and lifestyle hotels, increased focus on personalized guest experiences, and integration of contactless technologies. Eco-conscious travel is influencing green hotel operations. Additionally, extended-stay formats and hybrid hospitality spaces are becoming increasingly popular among both business and leisure travelers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)