Australia Household Cleaners Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Ingredient, Application, and Region, 2025-2033

Australia Household Cleaners Market Overview:

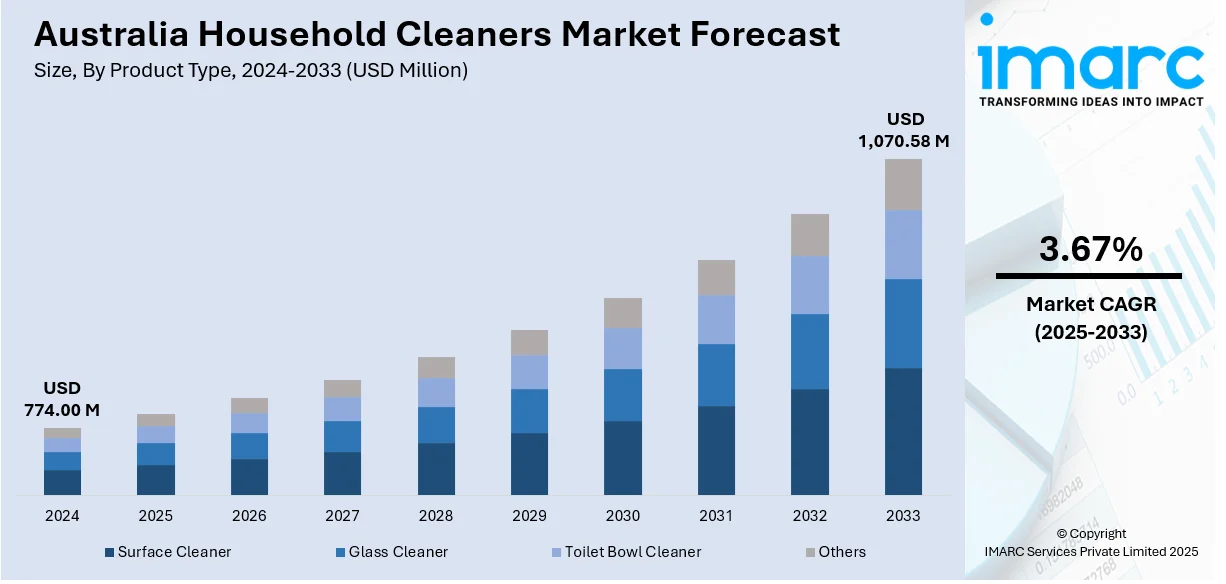

The Australia household cleaners market size reached USD 774.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,070.58 Million by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033. The sector is fueled by growing demand for chemical-free and green products from consumers, as well as growing interest in specialized cleaning services. New technologies such as OZONO's chemical-free cleaning unit and the expansion of WashRite are revamping the sector, contributing to the growth of Australia household cleaners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 774.00 Million |

| Market Forecast in 2033 | USD 1,070.58 Million |

| Market Growth Rate 2025-2033 | 3.67% |

Australia Household Cleaners Market Trends:

Growing Demand for Eco-Friendly Cleaning Solutions

Growing demand for environmental and sustainable products is a leading trend influencing the Australian household cleaners industry. As consumers become more environmentally aware and health-conscious, there has been a clear trend toward products that not only clean well but also ensure the home and the environment are safe. Increasingly, more families are going out of their way to find chemical-free and non-toxic substitutes for conventional cleaning compounds, out of fear of the health and environmental damage caused by chemicals. In November 2024, OZONO made its debut in Australia with the launch of its innovative OZPro cleaning device. This device uses aqueous ozone technology, which generates ozone using air and electricity, offering a powerful yet chemical-free cleaning solution. It thoroughly sanitizes, deodorizes, and kills microorganisms without leaving behind any toxic residues, thus being a highly suitable option for families with kids or those having sensitive skin. OZONO's release will have a tremendous effect on the Australian market by increasing demand for environmentally friendly cleaning options. With the rise in concern towards sustainability and health, OZONO's launch in the market syncs with the changing consumer desire for products that can clean effectively but do less damage to the environment. The company's launch is likely to stimulate more innovation and competition within the eco-cleaning category.

To get more information on this market, Request Sample

Increasing Competition in the Household Cleaners Market

As the Australia household cleaners market continues to expand, competition is intensifying with new entrants offering specialized products and services. Companies are diversifying their offerings and focusing on niche segments, which is fueling innovation and improving the quality of services. In particular, the exterior cleaning sector is witnessing a surge in demand, driven by growing consumer interest in maintaining clean and well-maintained homes and commercial spaces. As a result, businesses are adapting by enhancing their product and service ranges, focusing on innovation to meet evolving consumer preferences. In November 2024, WashRite, a New Zealand-based exterior washing company, expanded into the Australian market. This marked its first international venture, driven by the increasing demand for specialized cleaning services in Australia. WashRite’s expansion highlights a growing trend within the Australian household cleaners market, where consumers are increasingly opting for professional exterior cleaning services. WashRite’s entry into the market is expected to raise the competitive bar, prompting existing businesses to refine their service offerings and improve customer satisfaction. The company’s growth reflects the demand for efficient and reliable exterior cleaning, especially in commercial and residential sectors. As more companies join the market, it is anticipated that innovation will increase, creating new opportunities for both interior and exterior cleaning services, thus further boosting the Australia household cleaners market growth.

Australia Household Cleaners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, ingredient, and application.

Product Type Insights:

- Surface Cleaner

- Glass Cleaner

- Toilet Bowl Cleaner

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surface cleaner, glass cleaner, toilet bowl cleaner, and others.

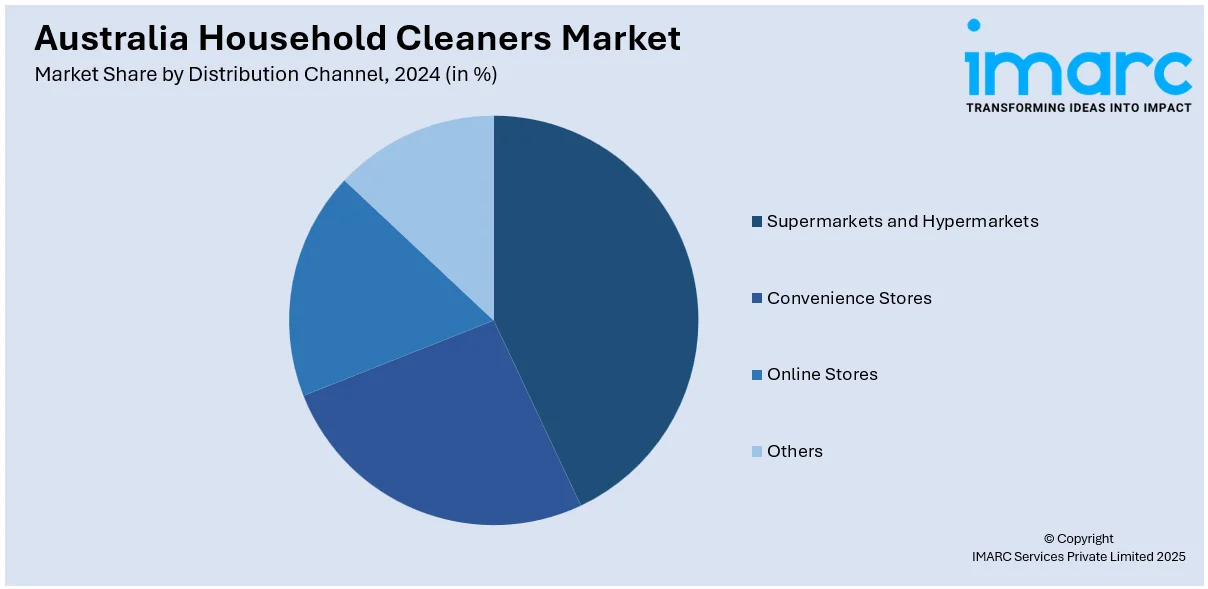

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Ingredient Insights:

- Surfactants

- Builders

- Solvents

- Antimicrobials

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes surfactants, builders, solvents, antimicrobials, and others.

Application Insights:

- Bathroom

- Kitchen

- Floor

- Fabric

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bathroom, kitchen, floor, fabric, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Household Cleaners Market News:

- May 2025: MOVA Tech launched innovative cleaning solutions, including the X4 Pro Wet and Dry Vacuum and the Z50 Ultra Robot Vacuum in Australia. These next-generation products, designed to enhance home cleaning, are expected to impact the Australian household cleaners market by driving demand for smarter, more efficient appliances.

- March 2025: Roborock launched its advanced cleaning solutions, introducing the Saros Series, F25 Series, and Qrevo EdgeC in Australia. These intelligent robotic cleaners feature next-gen automation and powerful suction, marking a significant shift towards smarter, more efficient home cleaning, impacting the Australian household cleaners market.

Australia Household Cleaners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surface Cleaner, Glass Cleaner, Toilet Bowl Cleaner, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Ingredients Covered | Surfactants, Builders, Solvents, Antimicrobials, Others |

| Applications Covered | Bathroom, Kitchen, Floor, Fabric, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria & Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia household cleaners market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia household cleaners market on the basis of product type?

- What is the breakup of the Australia household cleaners market on the basis of distribution channel?

- What is the breakup of the Australia household cleaners market on the basis of ingredient?

- What is the breakup of the Australia household cleaners market on the basis of application?

- What is the breakup of the Australia household cleaners market on the basis of region?

- What are the various stages in the value chain of the Australia household cleaners market?

- What are the key driving factors and challenges in the Australia household cleaners market?

- What is the structure of the Australia household cleaners market and who are the key players?

- What is the degree of competition in the Australia household cleaners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia household cleaners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia household cleaners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia household cleaners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)