Australia HVAC Ductwork Market Size, Share, Trends and Forecast by Type, Shape, Application, and Region, 2025-2033

Australia HVAC Ductwork Market Overview:

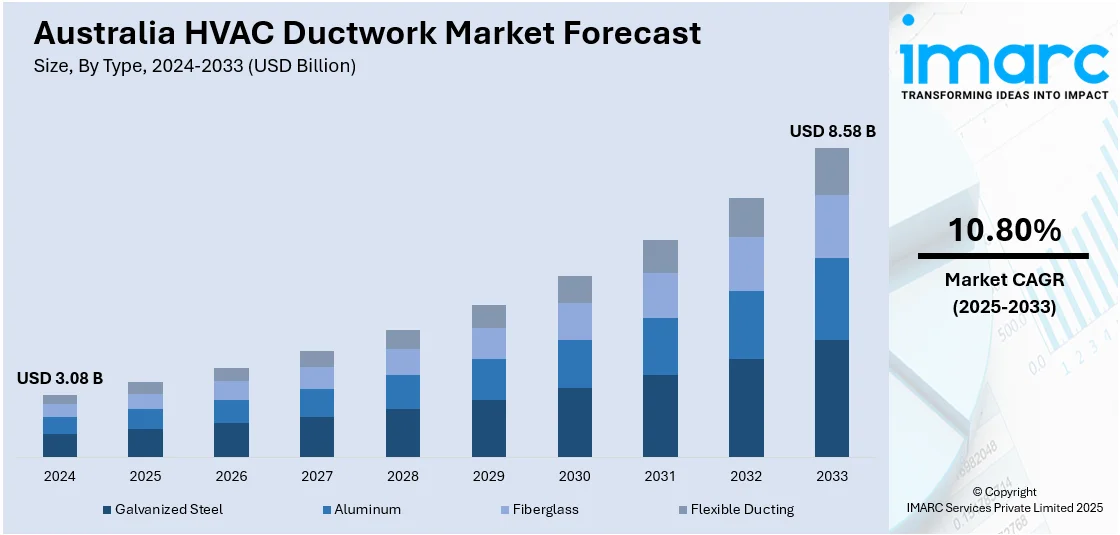

The Australia HVAC ductwork market size reached USD 3.08 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.58 Billion by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. The market is growing due to increased demand for energy-efficient buildings and improved indoor air quality. In addition, rising investments in commercial infrastructure and smart HVAC systems continue to support Australia HVAC ductwork market share across both new construction and retrofit projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.08 Billion |

| Market Forecast in 2033 | USD 8.58 Billion |

| Market Growth Rate 2025-2033 | 10.80% |

Australia HVAC Ductwork Market Trends:

Growing Adoption of Energy-Efficient HVAC Solutions

The demand for energy-efficient HVAC systems in Australia is accelerating, driven by rising energy costs, increasing environmental awareness, and government regulations aimed at reducing carbon footprints. Both residential and commercial sectors are turning towards solutions that combine high performance with lower operational costs. The growing emphasis on energy efficiency is becoming a critical factor for businesses and homeowners seeking to reduce their energy bills while contributing to sustainability goals. These systems are now integral to modern construction projects and retrofits, as they offer long-term savings and environmental benefits. In February 2025, Viessmann introduced air-to-air ductless heat pumps in Canada, designed for retrofits and homes that lack traditional ductwork. These units, ranging from 6,000 Btu/h to 58,000 Btu/h, offer an innovative approach to energy efficiency. These heat pumps can efficiently heat and cool spaces without requiring extensive ductwork, making them ideal for older homes or buildings with limited space for duct systems. This launch highlights the growing trend in Australia towards ductless, cost-effective, and energy-efficient HVAC solutions. Such innovations align with market needs, as customers seek simpler, more affordable systems with high performance and low maintenance costs. These developments represent a shift towards more sustainable HVAC options, especially in retrofit markets where minimizing installation complexity is critical.

To get more information on this market, Request Sample

Emphasis on Air Quality and Hygiene in HVAC Systems

The importance of indoor air quality and hygiene has risen in Australia, especially in commercial and public spaces. As health concerns and regulations surrounding air quality intensify, businesses are increasingly adopting HVAC systems designed to improve air circulation, filtration, and overall air safety. Customers are seeking systems that not only provide comfort but also address concerns related to bacterial growth, airborne pathogens, and overall air quality. This growing focus on hygiene and air quality is being reflected in the development of HVAC products tailored to meet these needs while maintaining energy efficiency. In October 2024, Panasonic’s Ziaino Air Treatment Unit received HACCP International certification, a global standard for ensuring food safety in manufacturing environments. This all-in-one air treatment system, capable of deodorizing, humidifying, dust collecting, and inhibiting bacterial growth, addresses the evolving demand for integrated solutions in the HVAC market. Its certification highlights a significant shift in the Australian market toward hygiene-focused HVAC products, especially in sectors such as food manufacturing, healthcare, and hospitality. These units offer not only energy-efficient solutions but also an additional layer of protection against airborne contaminants, making them essential for businesses prioritizing hygiene management. Panasonic’s certification further emphasizes the rising demand for products that help improve air quality and contribute to safer, healthier environments, influencing Australia HVAC ductwork market growth.

Australia HVAC Ductwork Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, shape, and application.

Type Insights:

- Galvanized Steel

- Aluminum

- Fiberglass

- Flexible Ducting

The report has provided a detailed breakup and analysis of the market based on the type. This includes galvanized steel, aluminum, fiberglass, and flexible ducting.

Shape Insights:

- Rectangular Ducts

- Round Ducts

- Oval Ducts

The report has provided a detailed breakup and analysis of the market based on the shape. This includes rectangular ducts, round ducts, and oval ducts.

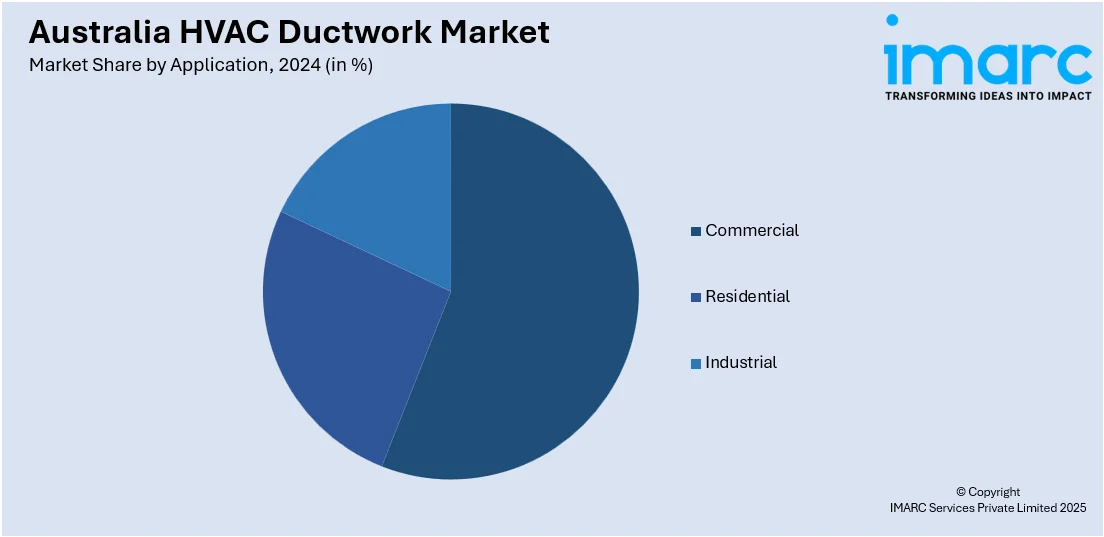

Application Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia HVAC Ductwork Market News:

- February 2025: Viessmann launched new air-to-air ductless heat pumps in Canada, ideal for retrofits and homes without ductwork. This innovation, with models ranging from 6,000 Btu/h to 58,000 Btu/h, impacted the HVAC ductwork market by offering cost-effective, energy-efficient solutions, reducing reliance on traditional duct systems.

- October 2024: Idealair Group became the exclusive distributor of Klimagiel’s textile and sheet metal ducting products in Australia. The Induction TEX Jet and Metal Jet ranges offer efficient air distribution, quick installation, and aesthetic flexibility, driving growth in the HVAC ductwork market across various sectors.

Australia HVAC Ductwork Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Galvanized Steel, Aluminum, Fiberglass, Flexible Ducting |

| Shapes Covered | Rectangular Ducts, Round Ducts, Oval Ducts |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia HVAC ductwork market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia HVAC ductwork market on the basis of type?

- What is the breakup of the Australia HVAC ductwork market on the basis of shape?

- What is the breakup of the Australia HVAC ductwork market on the basis of application?

- What is the breakup of the Australia HVAC ductwork market on the basis of region?

- What are the various stages in the value chain of the Australia HVAC ductwork market?

- What are the key driving factors and challenges in the Australia HVAC ductwork market?

- What is the structure of the Australia HVAC ductwork market and who are the key players?

- What is the degree of competition in the Australia HVAC ductwork market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia HVAC ductwork market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia HVAC ductwork market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia HVAC ductwork industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)