Australia Hybrid Vehicles Market Size, Share, Trends and Forecast by Hybrid Vehicle Type, Vehicle Type, and Region, 2026-2034

Australia Hybrid Vehicles Market Summary:

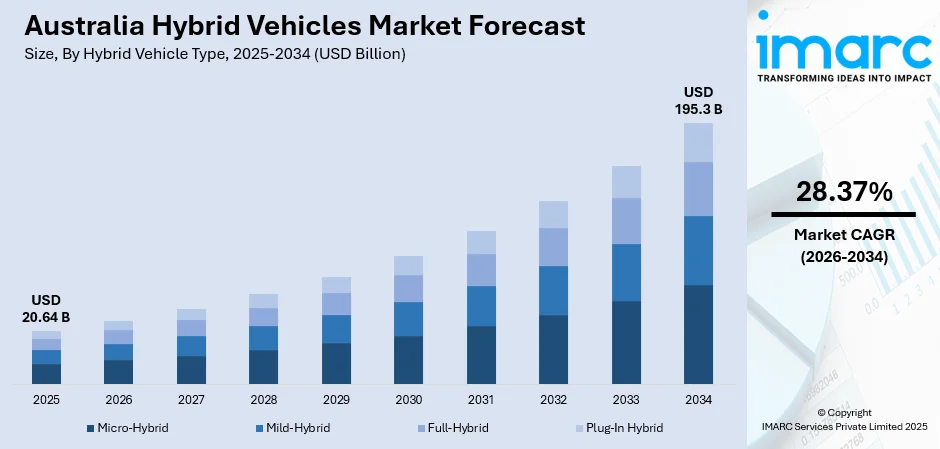

The Australia hybrid vehicles market size was valued at USD 20.64 Billion in 2025 and is projected to reach USD 195.3 Billion by 2034, growing at a compound annual growth rate of 28.37% from 2026-2034.

The Australian hybrid vehicles market is experiencing unprecedented expansion driven by escalating fuel prices, heightened environmental consciousness, and robust government initiatives promoting sustainable transportation. The implementation of the New Vehicle Efficiency Standard (NVES) from January 2025 is compelling automakers to diversify their portfolios with fuel-efficient alternatives. Consumer preference for vehicles offering the reliability of combustion engines combined with electric propulsion benefits is accelerating adoption. The expanding charging infrastructure network, including over 1,300 public fast-charging sites nationwide, is supporting plug-in hybrid growth and contributing to the Australia hybrid vehicles market share.

Key Takeaways and Insights:

- By Hybrid Vehicle Type: Full-hybrid dominates the market with a share of 55% in 2025, driven by superior fuel efficiency, self-charging capabilities, and widespread availability from manufacturers of all hybrid registrations.

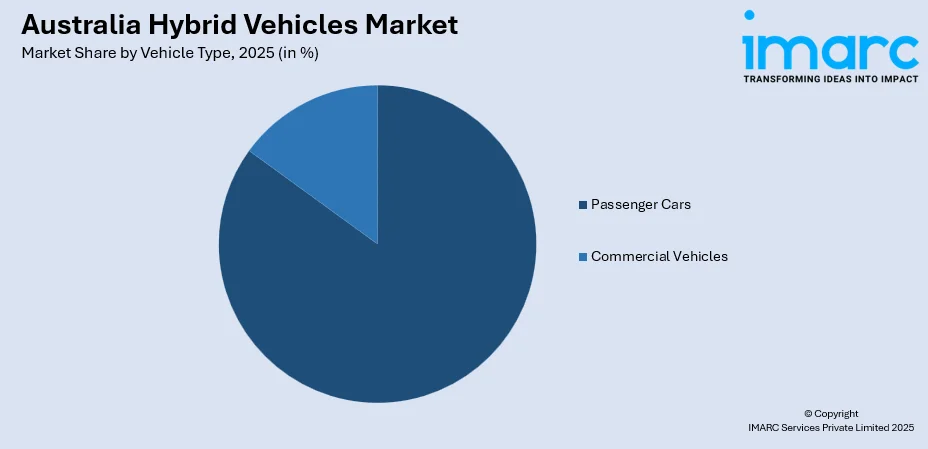

- By Vehicle Type: Passenger cars lead the market with a share of 85% in 2025, reflecting strong consumer preference for hybrid SUVs and sedans, which achieved record sales.

- Key Players: The Australian hybrid vehicles market exhibits moderate-to-high competitive intensity, with established automakers competing alongside emerging Chinese manufacturers. New entrants are expanding offerings in previously underserved segments like plug-in hybrid utes.

To get more information on this market Request Sample

The Australian hybrid vehicles market demonstrates robust fundamentals underpinned by favourable regulatory frameworks and shifting consumer preferences. This trajectory is supported by Australia's commitment to reducing transport emissions through the NVES, which mandates progressive emission intensity reductions across manufacturer fleets. Industry investment in charging infrastructure has accelerated, with the federal government allocating funding through the Driving the Nation program to establish nationwide fast-charging networks. Hybrid models are filling critical gaps in the transition to electrification, particularly in segments where battery-electric alternatives remain limited. The removal of Fringe Benefits Tax exemptions for plug-in hybrids from April 2025 may temporarily moderate PHEV growth, though conventional hybrids continue capturing market share from traditional petrol and diesel vehicles.

Australia Hybrid Vehicles Market Trends:

Accelerating Shift from Pure Petrol to Hybrid Powertrains

Australian consumers are increasingly transitioning from conventional petrol vehicles to hybrid alternatives as fuel economy concerns intensify. This shift reflects growing awareness of long-term ownership costs and environmental impacts. Manufacturers are responding to evolving consumer preferences by expanding hybrid offerings across sedan, hatchback, and SUV segments nationwide.

Expansion of Hybrid Offerings in Commercial and Utility Segments

The emergence of plug-in hybrid utes and commercial vehicles is addressing a significant gap in Australia's electrification pathway. This segment growth is particularly important given Australia's unique market where utes consistently rank among top-selling vehicles. In June 2024, GWM announced the launch of the POER Sahar in Australia, marking the first hybrid electric vehicle-powered off-road pickup in the market, featuring a powerful hybrid powertrain and 3.5-ton towing capacity.

Rising Fleet Adoption and Corporate Sustainability Commitments

Corporate fleet operators are increasingly integrating hybrid vehicles to meet sustainability targets and reduce operational costs. Australian finance companies provided over $6.17 Billion in funding for hybrid and electric vehicles in 2024, with 60,083 hybrids financed compared to 44,752 fully electric vehicles. This financing trend reflects practical corporate decisions favouring vehicles with petrol backup for diverse operational requirements. Government fleets across multiple states are also transitioning to hybrid vehicles as part of broader emissions reduction strategies and public sector sustainability mandates.

Market Outlook 2026-2034:

The Australian hybrid vehicles market is positioned for sustained expansion as regulatory pressures intensify and consumer acceptance broadens. The implementation of the NVES from January 2025, targeting significant reductions in emissions intensity for passenger vehicles by 2030, will compel manufacturers to accelerate hybrid portfolio expansion. According to the Federal Chamber of Automotive Industries, hybrids represented 17.8% of total vehicle sales in October 2025, with year-to-date hybrid sales increasing by 12%, demonstrating the technology's growing maturation and widespread consumer acceptance. The market generated a revenue of USD 20.64 Billion in 2025 and is projected to reach a revenue of USD 195.3 Billion by 2034, growing at a compound annual growth rate of 28.37% from 2026-2034.

Australia Hybrid Vehicles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Hybrid Vehicle Type | Full-Hybrid | 55% |

| Vehicle Type | Passenger Cars | 85% |

Hybrid Vehicle Type Insights:

- Micro-Hybrid

- Mild-Hybrid

- Full-Hybrid

- Plug-In Hybrid

The full-hybrid dominates with a market share of 55% of the total Australia hybrid vehicles market in 2025.

Full-hybrid vehicles represent the cornerstone of Australia's hybrid market, commanding the largest share due to their practical balance of fuel efficiency and operational convenience. These vehicles feature sophisticated powertrains capable of operating in pure electric mode for short distances while seamlessly transitioning to petrol power for extended range. The self-charging capability eliminates range anxiety concerns while delivering substantial fuel economy improvements over equivalent petrol models, making them attractive to mainstream consumers.

The segment's strength is further reinforced by leading manufacturers' strategic decisions to transition core models to hybrid-only configurations. Popular sedan, SUV, and crossover nameplates now offer exclusively hybrid powertrains in the Australian market, reflecting strong consumer preference for this proven technology. According to Toyota Australia, the company delivered over 118,081 hybrid electric vehicles during calendar year 2024, with hybrid models accounting for nearly half of the brand's total sales.

Vehicle Type Insights:

Access the comprehensive market breakdown Request Sample

- Passenger Cars

- Commercial Vehicles

The passenger cars lead the market with a share of 85% of the total Australia hybrid vehicles market in 2025.

Passenger cars encompassing sedans, hatchbacks, and SUVs constitute the overwhelming majority of hybrid vehicle sales in Australia, driven by robust consumer demand for fuel-efficient personal transportation. The medium SUV category has emerged as particularly significant, with the Toyota RAV4 achieving global recognition as the world's best-selling car, surpassing competitors to claim the top position worldwide. With more than half of the brand's total sales being hybrid electric cars (HEVs) and more than 10,000 HEV deliveries in a single month, Toyota's RAV4 was Australia's best-selling car last month, allowing the market leader to accomplish two industry firsts.

The passenger cars segment benefits from extensive model availability across multiple price points and body styles. Manufacturers are expanding their hybrid offerings to capture growing demand. The segment's appeal is reinforced by practical considerations including lower running costs, reduced service requirements compared to complex diesel systems, and seamless integration into existing fuelling infrastructure. Consumer research indicates that fuel savings, environmental considerations, and total cost of ownership are primary purchase motivators, with hybrid technology delivering tangible benefits across all three criteria for passenger car buyers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales region witnesses high demand for hybrid vehicles, benefiting from dense urban populations, higher average incomes, and progressive policy frameworks. The concentration of metropolitan areas including Sydney and Canberra drives strong demand for fuel-efficient transportation solutions among commuters and environmentally conscious consumers.

Victoria maintains its position as a significant hybrid market, supported by Melbourne's extensive urban sprawl and commuter patterns favouring fuel-efficient vehicles. Tasmania's smaller market demonstrates growing hybrid adoption, particularly among environmentally conscious consumers in regional centres seeking practical alternatives to traditional petrol vehicles.

Queensland, also known as the Sunshine State represents a substantial hybrid vehicle market driven by its unique geography featuring long coastal corridors and dispersed regional centres. These characteristics make hybrid vehicles particularly attractive for their extended range capabilities and fuel economy benefits on longer journeys between population centres.

Northern Territory & Southern Australia regions demonstrate emerging hybrid adoption patterns shaped by their distinctive geographic challenges. The vast distances and limited charging infrastructure in these areas make self-charging hybrids particularly practical for consumers requiring reliable long-distance transportation capabilities without dependence on external charging networks.

Western Australia shows growing hybrid adoption among Perth metropolitan consumers seeking fuel-efficient alternatives. The state's extensive mining and resources sector presents opportunities for commercial hybrid vehicle adoption, while urban consumers increasingly favour hybrids for their fuel economy benefits amid volatile petrol prices.

Market Dynamics:

Growth Drivers:

Why is the Australia Hybrid Vehicles Market Growing?

Implementation of New Vehicle Efficiency Standard (NVES)

The Australian government's implementation of the New Vehicle Efficiency Standard from January 2025 represents a watershed moment for hybrid vehicle adoption. The regulation mandates that vehicle suppliers achieve fleet-wide average emissions intensities for passenger vehicles and light commercial vehicles, with progressive annual reductions. Non-compliant suppliers face financial penalties per gram over target per vehicle, creating strong incentives for portfolio diversification toward hybrid and electric alternatives. According to the Department of Climate Change, Energy, the Environment and Water, the NVES is projected to reduce greenhouse gas emissions by approximately 321 Million Tons by 2050 while saving Australian motorists about $95 Billion in fuel costs. This regulatory framework is compelling manufacturers to accelerate hybrid model introductions and expand availability across all vehicle segments.

Sustained Fuel Price Volatility and Consumer Cost Sensitivity

Australian petrol prices have demonstrated significant volatility over recent years, with periodic peaks placing sustained pressure on household budgets. This ongoing price instability is fundamentally reshaping consumer purchasing decisions toward more fuel-efficient alternatives. Hybrid vehicles offer tangible fuel economy improvements, with full-hybrids typically delivering substantially better consumption than equivalent petrol models. The cost-of-living pressures affecting Australian households have amplified sensitivity to running costs, making the lower total cost of ownership proposition of hybrid vehicles increasingly compelling. Regional and rural consumers, who typically drive longer distances, stand to benefit most significantly from hybrid fuel savings, further broadening the market appeal across diverse geographic and demographic segments.

Expanding Charging Infrastructure and Government Investment

The Australian government and private sector are investing substantially in charging infrastructure to support electrified vehicle adoption. The federal Driving the Nation program is deploying significant funding to establish a nationwide backbone of EV charging stations connecting all capital cities at regular intervals. State governments are complementing federal initiatives with targeted investments in metropolitan and regional charging networks. In February 2025, the Australian Renewable Energy Agency (ARENA) committed $2.4 Million in funding to EVX Australia for the rollout of 250 public kerbside electric vehicle chargers across New South Wales, Victoria, and South Australia. While primarily benefiting battery-electric vehicles, this infrastructure expansion also supports plug-in hybrid adoption by reducing range anxiety and providing convenient charging options for PHEV owners seeking to maximise electric driving range.

Market Restraints:

What Challenges the Australia Hybrid Vehicles Market is Facing?

Removal of Fringe Benefits Tax Exemption for Plug-In Hybrids

The expiration of the Commonwealth Government's Fringe Benefits Tax exemption for plug-in hybrid vehicles from April 2025 has significantly impacted PHEV sales. The exemption previously provided substantial tax advantages for novated lease arrangements, and its removal has resulted in notable registration declines, demonstrating this segment's sensitivity to government policy incentives.

Price Premium Over Conventional Vehicles

Hybrid vehicles typically command price premiums over equivalent petrol-only models, creating affordability barriers for price-sensitive consumers. While total cost of ownership calculations often favor hybrids, the higher upfront purchase price remains a deterrent, particularly during periods of economic uncertainty and cost-of-living pressures affecting Australian households.

Supply Chain Constraints and Limited Model Availability

Global supply chain disruptions and semiconductor shortages have constrained hybrid vehicle availability in Australia, with some popular models experiencing wait times extending to 24 months. The limited availability of hybrid variants in certain segments, particularly light commercial vehicles and performance-oriented models, restricts consumer choice and market penetration potential.

Competitive Landscape:

The Australian hybrid vehicles market demonstrates a concentrated competitive landscape characterized by the dominance of established Japanese automakers alongside increasing participation from Korean and Chinese manufacturers. Japanese brands have leveraged their pioneering hybrid technology heritage and extensive dealer networks to maintain market leadership, with strategic decisions to transition core model lineups to hybrid-only configurations further consolidating their commanding position. Korean manufacturers are systematically expanding their hybrid portfolios, introducing competitive offerings across sport utility vehicle and passenger car segments to capture growing consumer demand for fuel-efficient alternatives. Meanwhile, emerging Chinese manufacturers are actively disrupting traditional market dynamics by introducing competitively priced plug-in hybrid vehicles targeting segments previously underserved by electrified options, particularly the utility vehicle category that remains highly popular among Australian consumers. This evolving competitive environment is intensifying innovation, broadening consumer choice, and accelerating the overall transition toward electrified transportation solutions across the Australian automotive market.

Recent Developments:

- May 2025: Chery announced plans to launch its first hybrid cars in Australia, including Tiggo 7 and Tiggo 8 Super Hybrid SUVs, expanding the range of hybrid options available to Australian consumers from Chinese manufacturers.

Australia Hybrid Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Hybrid Vehicle Types Covered | Micro-Hybrid, Mild-Hybrid, Full-Hybrid, Plug-In Hybrid |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia hybrid vehicles market size was valued at USD 20.64 Billion in 2025.

The Australia hybrid vehicles market is expected to grow at a compound annual growth rate of 28.37% from 2026-2034 to reach USD 195.3 Billion by 2034.

Full-hybrid dominates the Australia hybrid vehicles market with a 55% share in 2025, driven by self-charging capabilities, superior fuel efficiency, and extensive model availability from manufacturers of all hybrid registrations in the country.

Key factors driving the Australia hybrid vehicles market include the implementation of the New Vehicle Efficiency Standard from January 2025, sustained fuel price volatility prompting consumers to seek fuel-efficient alternatives, expanding charging infrastructure supporting plug-in hybrids, and growing corporate fleet adoption for sustainability compliance.

Major challenges include the removal of Fringe Benefits Tax exemptions for plug-in hybrids from April 2025, price premiums over conventional vehicles creating affordability barriers, supply chain constraints limiting model availability, and consumer hesitation due to technology complexity compared to traditional petrol vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)