Australia Hydraulic Cylinders Market Size, Share, Trends and Forecast by Function, Type, Bore Size, Application, End-Use Industry, and Region, 2025-2033

Australia Hydraulic Cylinders Market Overview:

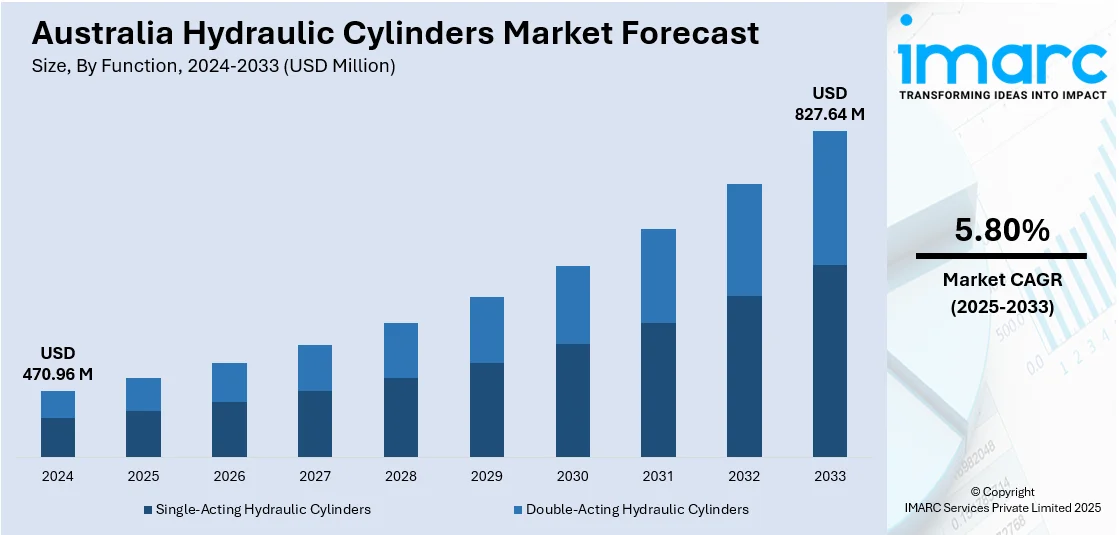

The Australia hydraulic cylinders market size reached USD 470.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 827.64 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is expanding due to rising infrastructure investments and the adoption of smart, energy-efficient machinery across key sectors like construction and agriculture. Further, automation and IoT integration continue to strengthen Australia hydraulic cylinders market share by enhancing operational efficiency and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 470.96 Million |

| Market Forecast in 2033 | USD 827.64 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Hydraulic Cylinders Market Trends:

Expansion of Service Networks and Technology Investments

The Australian hydraulic cylinder industry is experiencing significant expansion due to the strategic growth of service networks and investments in advanced technologies. Organizations in the hydraulic equipment industry are focusing on enhancing their local presence and offering improved services to meet the increasing demand for hydraulic solutions in primary industries such as mining, construction, and infrastructure. Through the expansion of their service networks, businesses can deliver improved customer service, more efficient maintenance, and quicker access to replacement parts, all of which are essential for operational effectiveness in various industries. For instance, in November 2024, H-E Parts International acquired Brake Supply's mining equipment component remanufacturing business, including hydraulic cylinder remanufacturing for mining equipment. This purchase allowed H-E Parts to expand its service network in the North American and Australian markets, enhancing the availability of superior remanufactured hydraulic cylinders. The action enhances the company's capacity to fulfill high demand and address the distinct requirements of the mining sector, where dependable hydraulic systems play a pivotal role. H-E Parts is playing a key role in solidifying the Australian hydraulic cylinders market with the expanded service capability in these markets, positioning itself as a vital player in the region's growing demand for sophisticated hydraulic solutions.

To get more information on this market, Request Sample

Technological Developments for Increased Lifting Capacity

Technological innovation in hydraulic systems is leading the Australian market, especially in industries with high-demand lifting and material handling applications. Construction, and infrastructure development, demand for hydraulic systems with higher lifting capacities continues to grow with the increasing complexity and scale of projects in civil engineering. Businesses are investing heavily in new technology to enhance the strength and durability of hydraulic cylinders, particularly in critical operating environments. A significant development on this front occurred in August 2024, when PHL Hydraulics UK invested in Enerpac SCJ-Series 100-ton cube jack technology, which significantly increased its hydraulic jacking system capacities. The investment expanded the company's offerings for civil engineering projects, providing innovative solutions to enhance the efficiency of lifting and handling heavy loads in large-scale construction projects. The availability of such advanced technologies is likely to make a positive difference in the Australian market, where large infrastructure projects have significant weight that needs to be carried out by robust hydraulic systems. As Australian companies adopt similar high-performance technologies, the demand for powerful hydraulic cylinders designed to handle heavy-duty tasks is likely to rise, driving Australia hydraulic cylinder market growth.

Australia Hydraulic Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on function, type, bore size, application, and end-use industry.

Function Insights:

- Single-Acting Hydraulic Cylinders

- Double-Acting Hydraulic Cylinders

The report has provided a detailed breakup and analysis of the market based on the function. This includes single-acting hydraulic cylinders and double-acting hydraulic cylinders.

Type Insights:

- Tie-Rod Cylinders

- Welded Cylinders

- Telescopic Cylinders

- Mill-Type Cylinders

The report has provided a detailed breakup and analysis of the market based on the type. This includes tie-rod cylinders, welded cylinders, telescopic cylinders, and mill-type cylinders.

Bore Size Insights:

- <50 MM

- 50–150 MM

- >150 MM

A detailed breakup and analysis of the market based on the bore size have also been provided in the report. This includes <50 MM, 50–150 MM, and >150 MM.

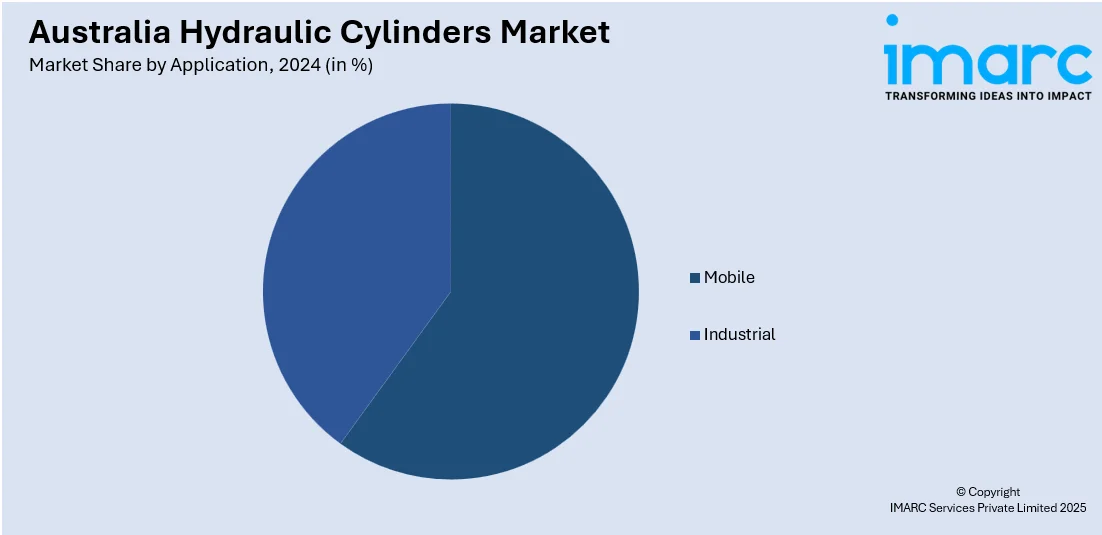

Application Insights:

- Mobile

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mobile and industrial.

End-Use Industry Insights:

- Construction

- Aerospace and Defense

- Material Handling

- Agriculture

- Automotive

- Mining

- Oil and Gas

- Marine

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, aerospace and defense, material handling, agriculture, automotive, mining, oil and gas, marine, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hydraulic Cylinders Market News:

- May 2025: LGH Australia expanded its operations by opening a new location in Somersby, New South Wales. This expansion included the introduction of hydraulic cylinders among other lifting and rigging equipment. The move positively impacted the hydraulic cylinders market by increasing regional availability and demand.

- February 2025: Hydreco Hydraulics showcased new hydraulic solutions at Bauma 2025 in Munich. This participation highlighted their advanced hydraulic cylinder technology, driving innovation in the market. The event bolstered the visibility and adoption of high-performance hydraulic cylinders, impacting the global industry, including Australia.

Australia Hydraulic Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Single-Acting Hydraulic Cylinders, Double-Acting Hydraulic Cylinders |

| Types Covered | Tie-Rod Cylinders, Welded Cylinders, Telescopic Cylinders, Mill-Type Cylinders |

| Bore Sizes Covered | <50 MM, 50–150 MM, >150 MM |

| Applications Covered | Mobile, Industrial |

| End-Use Industries Covered | Construction, Aerospace and Defense, Material Handling, Agriculture, Automotive, Mining, Oil and Gas, Marine, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hydraulic cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hydraulic cylinders market on the basis of function?

- What is the breakup of the Australia hydraulic cylinders market on the basis of type?

- What is the breakup of the Australia hydraulic cylinders market on the basis of bore size?

- What is the breakup of the Australia hydraulic cylinders market on the basis of application?

- What is the breakup of the Australia hydraulic cylinders market on the basis of end-use industry?

- What is the breakup of the Australia hydraulic cylinders market on the basis of region?

- What are the various stages in the value chain of the Australia hydraulic cylinders market?

- What are the key driving factors and challenges in the Australia hydraulic cylinders market?

- What is the structure of the Australia hydraulic cylinders market and who are the key players?

- What is the degree of competition in the Australia hydraulic cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hydraulic cylinders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hydraulic cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hydraulic cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)