Australia Hydraulic Equipment Market Size, Share, Trends and Forecast by Type, End-User Industry, and Region, 2025-2033

Australia Hydraulic Equipment Market Overview:

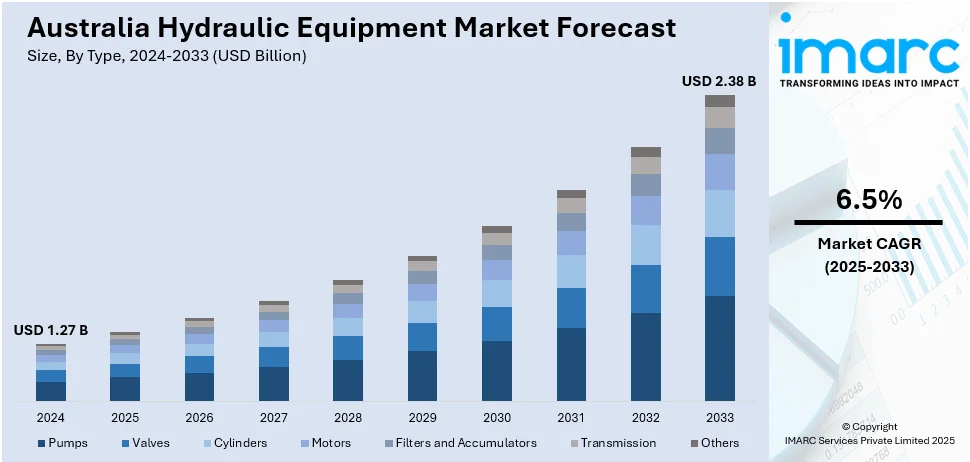

The Australia hydraulic equipment market size reached USD 1.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.38 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% during 2025-2033. Expanding mining and construction activities, rising demand for agricultural machinery, infrastructure development projects, and increased automation in industrial applications are some of the factors contributing to Australia hydraulic equipment market share. Government investments in public works and energy sectors also contribute to sustained market growth across diverse end-use industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.27 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Market Growth Rate 2025-2033 | 6.5% |

Australia Hydraulic Equipment Market Trends:

Digital Integration in Hydraulic Equipment Applications

There is growing integration of real-time environmental monitoring with hydraulic equipment used in Australia's mining sector. This shift is driven by increasing pressure to meet ESG standards and reduce environmental impact during resource extraction. Advanced software and monitoring platforms are being paired with heavy machinery to enable predictive maintenance, emissions tracking, and site-wide performance optimization. Such developments are transforming traditional hydraulic systems into smarter, data-enabled units that offer enhanced operational transparency. The move also reflects a broader push toward digitalization within Australia’s mining and industrial equipment landscape, with companies investing in automation, remote diagnostics, and connected technologies. This integration not only improves regulatory compliance but also boosts overall equipment efficiency and lifecycle performance across critical applications. These factors are intensifying the Australia hydraulic equipment market growth. For example, in September 2024, Hitachi Construction Machinery acquired a 12% equity stake in Australia-based Envirosuite Ltd for AUD 10 Million, becoming its largest shareholder. The move supports the integration of real-time environmental monitoring into mining operations, enhancing ESG compliance. This aligns with Hitachi’s broader strategy to strengthen digital solutions in hydraulic and mining equipment markets across Australia.

To get more information on this market, Request Sample

Expansion of Hydraulic Equipment Rental Services

Australia is witnessing a rise in specialized hydraulic equipment rental services, particularly for sectors like construction, mining, and energy. With new players establishing operations and offering hydraulic rams, hoists, clamps, and rigging gear for hire, businesses now have flexible access to high-performance tools without capital investment. This development supports project-based operations and remote site deployments, especially in regions like New South Wales, while also ensuring nationwide availability through scalable fleets. The rental model enables quicker response to market demand fluctuations and reduces downtime associated with equipment ownership and maintenance. As infrastructure development and resource projects continue to expand, demand for cost-effective and adaptable hydraulic solutions is expected to drive further growth in equipment leasing and rental services across the country. For instance, in May 2025, Lifting Gear Hire (LGH) entered the Australian market, opening its headquarters in Somersby, NSW. The company would offer hydraulic rams, hoists, clamps, and rigging gear for hire, targeting sectors like construction, mining, and energy. While initially focusing on New South Wales, LGH’s equipment fleet would be accessible nationwide, contributing to growth in Australia’s hydraulic equipment rental segment.

Australia Hydraulic Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use industry.

Type Insights:

- Pumps

- Valves

- Cylinders

- Motors

- Filters and Accumulators

- Transmission

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pumps, valves, cylinders, motors, filters and accumulators, transmission, and others.

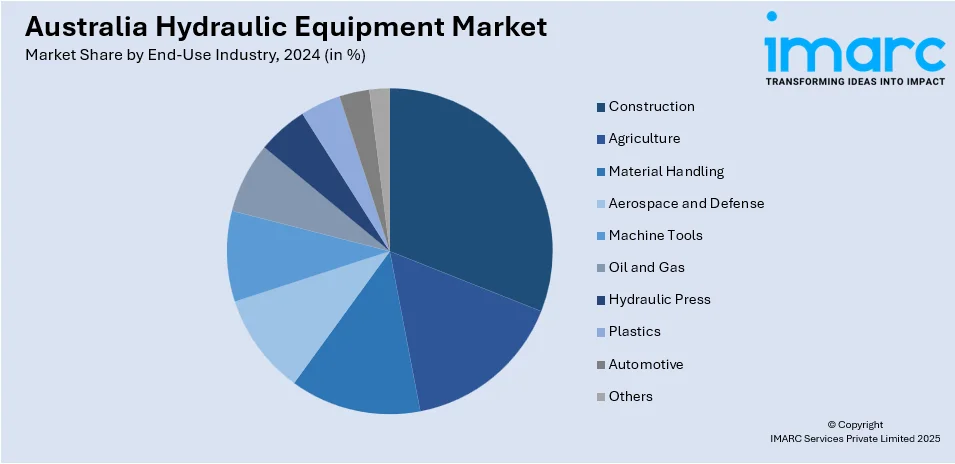

End-Use Industry Insights:

- Construction

- Agriculture

- Material Handling

- Aerospace and Defense

- Machine Tools

- Oil and Gas

- Hydraulic Press

- Plastics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction, agriculture, material handling, aerospace and defense, machine tools, oil and gas, hydraulic press, plastics, automotive, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hydraulic Equipment Market News:

- In May 2025, Hydreco Australia unveiled its latest hydraulic technologies at the 2025 Brisbane Truck Show, spotlighting the new Endurant and Euro PTOs and a compact high-performance water pump. These innovations cater to transport and mobile equipment needs. Strong engagement with OEMs and distributors at Stand 165 highlighted growing interest in advanced hydraulic solutions, reinforcing Hydreco’s role in supporting Australia’s evolving hydraulic equipment market.

Australia Hydraulic Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pumps, Valves, Cylinders, Motors, Filters and Accumulators, Transmission, Others |

| End-User Industries Covered | Construction, Agriculture, Material Handling, Aerospace and Defense, Machine Tools, Oil and Gas, Hydraulic Press, Plastics, Automotive, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hydraulic equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hydraulic equipment market on the basis of type?

- What is the breakup of the Australia hydraulic equipment market on the basis of end use industry?

- What is the breakup of the Australia hydraulic equipment market on the basis of region?

- What are the various stages in the value chain of the Australia hydraulic equipment market?

- What are the key driving factors and challenges in the Australia hydraulic equipment market?

- What is the structure of the Australia hydraulic equipment market and who are the key players?

- What is the degree of competition in the Australia hydraulic equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hydraulic equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hydraulic equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hydraulic equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)