Australia Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2025-2033

Australia Ice Cream Market Size and Share:

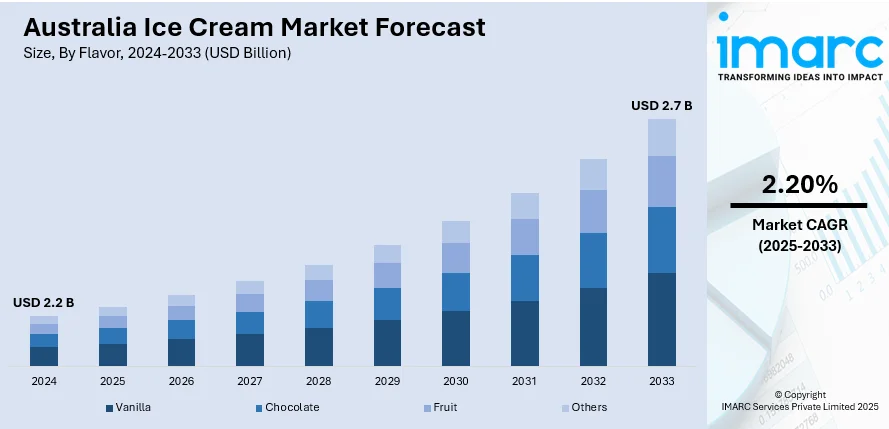

The Australia ice cream market size reached USD 2.2 Billion in 2024. Looking forward, the market is expected to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 2.20% during 2025-2033.The market is growing consistently as customers look for quality, variety, and convenience backed by changing eating habits, better retail availability, and growing emphasis on indulgence, health, and ease of consumption across regions and diverse groups of consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 2.20% |

Key Trends of Australia Ice Cream Market:

Rising Demand for Premium and Artisanal Ice Cream

Australian consumers are also shifting towards premium and artisan ice cream offerings that highlight quality ingredients, specialty flavors, and small batches. For example, in April 2024, Connoisseur launched its 'Thrill Your Senses' campaign in Australia, highlighting its upmarket ice cream range through sensory-led storytelling about indulgent textures, rich flavors, and the brand's unique gourmet experience. Furthermore, this is being fueled by changing taste patterns and increased desire for indulgent experiences. Australian consumers are demonstrating a willingness to pay more for ice creams with value-added offerings such as organic ingredients, local milk sourcing, or creative flavor pairings. Heightened focus on the richness of texture, creaminess, and presentation has spurred growth in the premium segment in terms of hand-crafted varieties and slow-churned processes. They are also capturing more shelf space in specialty stores and gourmet food outlets as a consequence of mounting popularity. Seasonal and limited-edition flavors are becoming the focus of attention, which is leading to consumer interaction and repeated purchases. The premiumization trend continues to redefine market demands and product development strategies throughout the ice cream category in Australia.

To get more information on this market, Request Sample

Growing Popularity of Plant-Based and Dairy-Free Ice Cream

The growing shift among Australian consumers toward plant-based and dairy-free diets has fueled significant growth in alternative ice cream products. Almond, coconut, oat, and soy milk-based products are becoming increasingly popular as both health-focused and environmentally conscious purchasers look for alternatives to conventional dairy-based ice cream. They are no longer confined to speciality shelves but can now be found in mainstream retail stores and are aimed at lactose intolerance, veganism, or clean-label eating preferences. The popularity of these alternatives is also boosted by better taste, texture, and diversity being made available, bridging the gap between plant-based and traditional products. Market innovation is concentrating on producing a creamy mouthfeel and nuanced flavors without incorporating animal-based ingredients. Consumer demand is also broadening to encompass products using natural sweeteners and free-from attributes, which adds to the growth of demand in Australian frozen dessert shelves.

Increasing Preference for Convenient and On-the-Go Formats

Convenience is a major driver of ice cream eating habits in Australia, with high demand for on-the-go, single-serve formats that are appropriate for active lifestyles. Stick bars, cones, and mini cups are becoming highly popular across all age groups due to their convenience to eat, mess-free packaging, and appropriateness for outdoor or impulse eating. For instance, in July 2024, Norco introduced its Cape Byron ice cream sticks in Australia with oversized inclusions up to 2 cm—Choco Lava Brownie, Affogato, and Classic Cookie Dough—providing a uniquely rich, indulgent frozen treat experience. Moreover, this transition is complemented by evolving snacking habits in which frozen desserts are being selected as convenience treats as opposed to formal dessert choices. Product lines are being extended by manufacturers to include more handheld forms, such as bite-sized packs, stacked textures, and multi-packs for family requirements. Retailers and convenience stores are creating greater visibility of these formats through stand-alone freezer space and promotional discounts. These developments mirror the direction in which consumer habits and buying patterns are shifting towards flexible, convenient indulgences, thus affirming the applicability of portable ice cream solutions in the Australian market.

Growth Drivers of Australia Ice Cream Market:

Seasonal Climate and Lifestyle Alignment

Australia’s warm climate and outdoor-oriented lifestyle contribute significantly to the steady demand for ice cream. With long summers, frequent heatwaves, and a strong beach and leisure culture, frozen desserts are naturally aligned with consumer behavior. Ice cream is viewed not only as a treat but also as a cooling refreshment, making it a frequent choice during social gatherings, barbecues, or casual outdoor events. This seasonally favorable environment sustains year-round consumption, especially in northern and coastal regions. Additionally, Australia’s cultural tendency toward relaxed, recreational activities creates ongoing opportunities for impulse purchases. The synergy between lifestyle and climate conditions creates a dependable foundation for the ice cream market to thrive, particularly in urban and tourist-heavy locations.

Strong Out-of-Home and Foodservice Integration

The integration of ice cream into the Australian foodservice and hospitality sector is driving the Australia ice cream market growth. Restaurants, quick-service chains, cafes, and specialty dessert outlets increasingly offer unique ice cream-based creations, such as affogatos, ice cream sandwiches, or frozen cocktails, enhancing visibility and consumer experimentation. Collaborations between brands and foodservice operators allow for seasonal promotions, co-branded desserts, and exclusive menu items that attract both regular and impulse buyers. Moreover, the growing café culture in Australia amplifies opportunities for premium dessert pairings. These out-of-home consumption occasions help drive frequency and broaden usage beyond traditional grocery channels. As dining out and takeaway habits grow, so does the role of ice cream as a versatile and accessible indulgence.

Innovation in Flavors, Textures, and Cultural Fusion

Flavor and texture innovation is playing a pivotal role in expanding the appeal of ice cream across diverse consumer segments. Australian brands are experimenting with bold, unconventional combinations, such as spiced caramel, balsamic strawberry, or native bush foods, to excite adventurous eaters. Additionally, unique textures like chewy mochi shells, layered inclusions, and mix-ins (cookies, candies, syrups) provide a multisensory experience. Multicultural influences, driven by Australia's diverse population, are inspiring fusion flavors such as Thai tea swirl, kulfi-inspired pistachio, or yuzu sorbet, attracting both local consumers and tourists. These dynamic offerings enhance brand storytelling and create social media buzz, especially among younger audiences seeking novelty. Such innovation not only differentiates products on shelves but also encourages repeat purchases and category expansion.

Opportunities of Australia Ice Cream Market:

Functional and Better-for-You Ice Cream Segments

A significant opportunity lies in developing ice cream products with added functional benefits. With consumers increasingly focused on health and wellness, there's rising interest in ice creams offering nutritional enhancements—such as added protein, probiotics, prebiotics, vitamins, or collagen. These variants appeal to fitness-conscious individuals and aging populations looking for indulgence without compromising health. Additionally, there’s room for expansion into low-GI, diabetic-friendly, or digestive-aid-focused ice cream. These offerings can position ice cream as a part of a balanced lifestyle, not just an occasional treat. Backed by transparent labeling and scientific validation, functional ice creams could carve out a premium health niche in supermarkets, pharmacies, and health food stores, while also attracting consumers seeking guilt-free indulgence.

Expansion Through Regional and Local Sourcing Appeal

Australian consumers are increasingly valuing locally sourced ingredients and products that support regional communities. Ice cream brands that highlight the use of local dairy, fruits, nuts, and native botanicals, like finger lime or wattleseed, can build strong emotional connections with buyers. According to the Australia ice cream market analysis, this farm-to-freezer approach appeals to sustainability-minded and patriotic shoppers, particularly when coupled with support for small-scale Australian farmers or eco-friendly production practices. Additionally, regional storytelling and transparent sourcing offer unique marketing advantages. Brands can elevate their products by associating them with specific Australian landscapes or agricultural traditions, gaining an edge in both domestic and tourism-driven markets. This trend supports rural economies and aligns well with broader movements in ethical consumption, origin traceability, and regional brand loyalty.

Experiential Retail and Ice Cream Tourism

Experiential retail presents a growing opportunity for ice cream brands in Australia. Pop-up parlors, mobile ice cream vans, and branded dessert lounges offer immersive experiences that extend beyond taste. These activations allow brands to engage directly with consumers through sampling, custom flavor creation, or interactive events. Locations near beaches, parks, and festivals can leverage high foot traffic and enhance brand memorability. Moreover, regions known for dairy production (like Tasmania or Victoria) could develop ice cream tourism trails, pairing tastings with local attractions. Creating such destination experiences helps brands deepen consumer loyalty, generate social media engagement, and differentiate in a saturated market. As consumers seek shareable, offline experiences, experiential strategies can become a vital driver of both footfall and brand storytelling.

Characteristics of Australia Ice Cream Market:

Diverse Consumer Base with Age-Driven Preferences

Australia’s ice cream market caters to a wide demographic, with differing preferences across age groups. While children and families tend to favor classic flavors and fun formats (e.g., cones, sticks, or character-based novelties), millennials and Gen Z are more drawn to adventurous, limited-edition options and culturally inspired recipes. Meanwhile, older consumers often seek nostalgia, simplicity, and subtle sweetness. This diversity compels brands to segment their offerings accordingly, using tailored packaging, portion sizes, and messaging to target specific age groups. It also creates room for both traditional and contemporary brands to coexist. Understanding these generational preferences helps brands design effective marketing campaigns and broaden their appeal without diluting brand identity.

Strong Supermarket and Private Label Dominance

Major supermarket chains like Woolworths, Coles, and ALDI hold a significant share of Australia’s ice cream market, especially through their extensive private label offerings. These store brands often undercut national and global players on price while offering surprisingly good quality, which appeals to value-conscious consumers. The strength of supermarket control over shelf space and promotions gives them considerable influence over consumer choice and brand visibility. For independent and premium brands, gaining retail placement is competitive and costly. As a result, many smaller players turn to alternative distribution channels, such as direct-to-consumer or specialty retail. This dominance of supermarket brands shapes market dynamics by intensifying price competition and setting a high standard for product quality at lower price points.

Regional Seasonality and Urban-Rural Consumption Variance

The Australian ice cream market experiences notable regional and seasonal fluctuations in demand. Warmer states like Queensland and Western Australia see more consistent, year-round sales, while cooler southern states observe strong peaks in summer and a noticeable dip in winter. Additionally, consumption patterns differ between urban and rural areas. Urban markets exhibit higher demand for novelty and premium formats due to broader access and exposure to trends, while rural areas often favor family-size tubs and traditional varieties. Distribution logistics, storage capabilities, and consumer preferences must therefore be adapted to suit specific geographic profiles. Understanding these regional nuances is essential for effective inventory planning, marketing strategy, and product assortment tailored to local tastes and consumption habits.

Challenges of Australia Ice Cream Market:

Increasing Focus on Sustainability and Environmental Impact

As environmental awareness grows in Australia, ice cream brands face mounting pressure to reduce their ecological footprint. Concerns about single-use plastics, high water usage in dairy farming, and emissions from refrigerated transport have brought the industry under scrutiny. Consumers are increasingly evaluating products based on packaging recyclability, energy-efficient production, and ethical ingredient sourcing. For manufacturers, transitioning to sustainable practices—like using compostable packaging or implementing carbon-neutral logistics—requires significant investment. Smaller producers often struggle with the cost and scale of these changes. Moreover, failing to meet rising consumer expectations around environmental responsibility can lead to reputational damage. Balancing eco-conscious innovation with affordability and product integrity presents a complex challenge, especially in a price-sensitive and environmentally vigilant market like Australia.

Fluctuating Raw Material Prices and Global Supply Chain Volatility

The Australian ice cream market is highly sensitive to global price shifts and supply chain disruptions, especially for key ingredients such as milk, cocoa, sugar, and emulsifiers. Natural disasters, geopolitical tensions, and trade restrictions can all lead to cost surges or inventory shortages. These fluctuations make it difficult for producers to maintain consistent product pricing, potentially affecting profitability and long-term planning. Additionally, reliance on imported specialty ingredients, such as certain flavorings or inclusions, makes premium product lines vulnerable to shipping delays and currency fluctuations. To remain competitive, brands must either absorb costs, reformulate, or pass expenses onto consumers, all of which risk negative backlash. This constant unpredictability in procurement places strain on operations, inventory management, and supplier relationships.

Evolving Consumer Expectations and Market Saturation

Australian consumers are becoming more sophisticated in their ice cream preferences, demanding novelty, clean labels, and ethical sourcing—all while expecting competitive pricing. This evolution places significant pressure on manufacturers to consistently innovate while upholding quality and transparency. At the same time, the market is increasingly saturated with a wide array of local startups, private labels, and global giants offering similar products. Differentiating a brand in such a crowded space is challenging, especially when consumer loyalty is low and switching costs are minimal. Continuous innovation cycles, high marketing costs, and shelf competition in supermarkets and convenience stores further increase barriers to sustained success. Brands must constantly balance trend alignment with core value propositions or risk becoming obsolete amid rapidly shifting consumer demands.

Australia Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cup, stick, cone, brick, tub, and others.

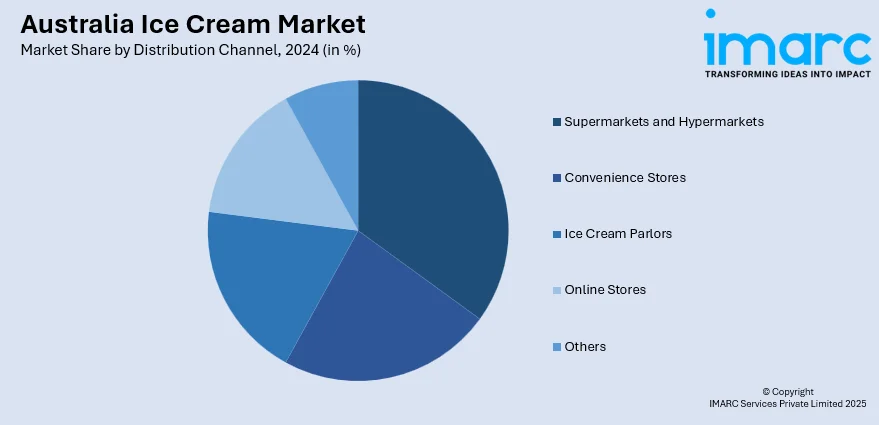

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ice Cream Market News:

- In September 2024, Frosty Fruits introduced a reduced-sugar version of its tropical frozen treat, made with real fruit juice and no artificial additives, addressing increasing consumer demand for healthier, refreshing snack options across Australian supermarkets.

- In March 2024, Unilever hired creative agency Emotive to oversee the reinvigoration of its Weis ice cream brand, introducing the 'Have a Bar of This' campaign to enhance brand visibility and regain market share during Australia's summer ice cream season.

- In January 2024, Chinese tea and ice cream brand Mixue began operations in Australia with the opening of its initial store at Sydney's World Square. The company sells a range of bubble teas, blended beverages, and soft-serve ice cream, and has expansion plans in Brisbane and Melbourne in subsequent quarters.

Australia Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ice cream market in Australia was valued at USD 2.2 Billion in 2024.

The Australia ice cream market is projected to exhibit a CAGR of 2.20% during 2025-2033.

The Australia ice cream market is projected to reach a value of USD 2.7 Billion by 2033.

The market is witnessing trends like flavor fusion with global influences, limited-time collaborations, and nostalgic reintroductions. Consumers favor locally inspired ingredients, storytelling-focused branding, and experiential formats. Visual appeal, social media influence, and demand for personalized treats are also shaping preferences, particularly among younger, trend-conscious, and experience-driven audiences.

The Australia ice cream market is fueled by its extended warm seasons, rising out-of-home consumption, and strong retail integration. Growing household incomes improved cold chain logistics, and expansion into regional markets enhances accessibility. Additionally, strategic brand collaborations and increasing demand for treat-based snacking are accelerating market penetration across demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)