Australia Identity Verification Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Australia Identity Verification Market Overview:

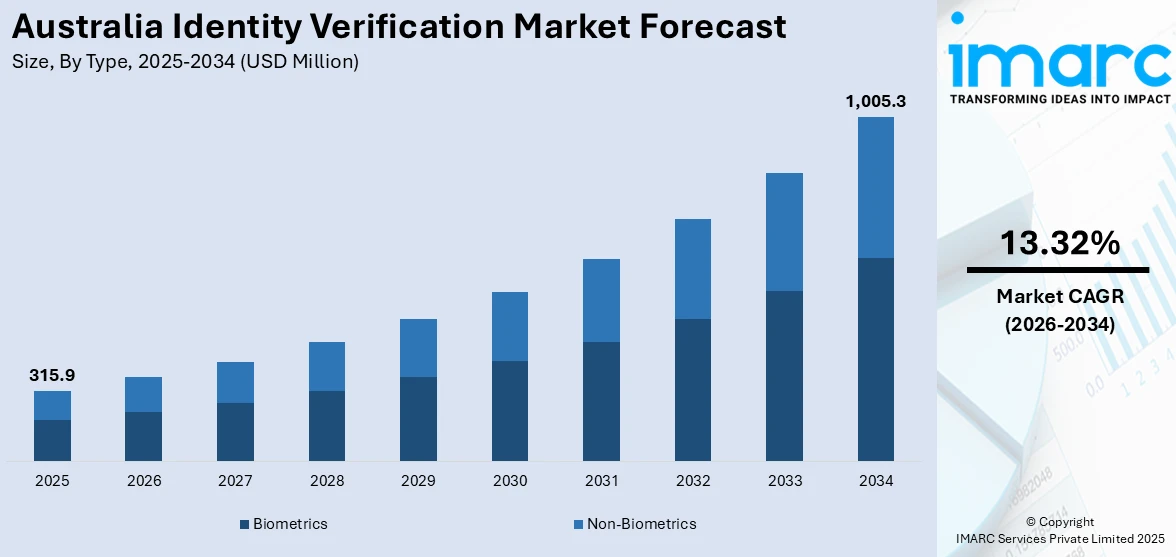

The Australia identity verification market size reached USD 315.9 Million in 2025. Looking forward, the market is expected to reach USD 1,005.3 Million by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034. Increasing concerns over data security, fraud prevention, and compliance with stringent government regulations drive the market. In addition to this, the rising adoption of digital services, e-commerce, and online banking and continual advancements in biometric technologies are fueling the demand for secure identity verification solutions across various industries, which is also augmenting Australia identity verification market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 315.9 Million |

| Market Forecast in 2034 | USD 1,005.3 Million |

| Market Growth Rate 2026-2034 | 13.32% |

Key Trends of Australia Identity Verification Market:

Growing Demand for Biometric Authentication

Biometric authentication is a vital component in the market, as there is a growing preference for systems that ensure greater security and convenience for users. Moreover, the use of technologies like facial recognition, fingerprint scanning, and iris recognition has been gradually on the rise across industries like banking, healthcare, and government services. Biometric authentication has been regarded as a safer option compared to the conventional approach of passwords and PINs since it uses distinct physical features that cannot be imitated. According to industry reports, about 97% of Australian professionals are satisfied with biometric authentication results, demonstrating its continued importance in organizational security. Biometric systems like fingerprint (78%) and facial recognition (68%) are essential in multi-factor authentication techniques and closely match global norms. This high level of satisfaction highlights the effectiveness and reliability of biometric systems in enhancing security protocols, reinforcing their growing adoption across various sectors in Australia. Apart from this, the increasing issues related to breaches and identity theft, and also to provide seamless user experience. Additionally, advances in biometric technology, including facial recognition algorithms based on AI, enhance the effectiveness and precision of such systems, which is providing a boost to Australia identity verification market growth. Furthermore, the Australian government is also deploying biometric-based digital identification initiatives with the goal of increasing security and customer experience across public services.

To get more information on this market Request Sample

Growing Use of AI and Machine Learning for Fraud Detection

The incorporation of machine learning (ML) and artificial intelligence (AI) in identity verification solutions is revolutionizing the market by developing the capabilities to detect fraud. For instance, an industry report shows that the Commonwealth Bank of Australia has implemented AI-based safety and security features that have reduced customer scam losses by 50% and introduced suspicious transaction alerts powered by generative artificial intelligence (Gen AI) that have reduced customer-reported frauds by 30%. AI algorithms examine vast amounts of data and recognize patterns and behaviors indicative of possible fraudulent activity, including identity theft, synthetic identity generation, and account takeover. Machine learning platforms upgrade automatically over time by learning from fresh data and detecting emerging fraud patterns, becoming increasingly capable of detecting sophisticated attempts at fraud. This trend is vital for financial institutions, online stores, and governmental agencies, as they are constantly pushed to secure sensitive user information from emerging cyber threats. Besides this, AI-based solutions support real-time authentication, which accelerates the verification process without lowering the security standards. With the evolving nature of fraud techniques, companies are pouring a lot of money into AI and ML in order to cope with the dynamic nature of the cybersecurity threat scenario and regulatory requirements for compliance.

Growth Drivers of Australia Identity Verification Market:

Stringent Regulatory Compliance Requirements

Australia’s identity verification market is largely propelled by the need to comply with stringent regulatory mandates, especially in financial services and regulated industries. Laws related to Anti-Money Laundering (AML), Counter-Terrorism Financing (CTF), and Know Your Customer (KYC) impose strict obligations on institutions to accurately verify customer identities. Non-compliance can result in heavy penalties, legal repercussions, and reputational damage, prompting firms to invest in robust verification systems. Regulatory bodies such as AUSTRAC have heightened oversight, pushing organizations to adopt digital tools that can validate identities in real time while minimizing errors and fraud. Additionally, ongoing amendments to privacy and digital identity laws are further tightening compliance requirements, making advanced, automated verification technologies essential for achieving secure, efficient, and legally compliant onboarding processes across sectors.

Rise in Identity Theft and Cybersecurity Concerns

Increasing instances of data breaches, phishing attacks, and online fraud have made identity theft one of the most pressing concerns in Australia’s digital economy, driving the Australia identity verification market growth. Criminals are using increasingly advanced methods to impersonate individuals, steal personal data, and commit financial crimes. As a result, organizations are prioritizing secure, multi-layered identity verification systems to safeguard both user data and brand integrity. Financial institutions, e-commerce platforms, and government services are especially vulnerable and are investing in solutions that verify identities in real-time and flag anomalies. Public concern over cybersecurity has also prompted businesses to adopt transparent verification processes to foster trust. In this climate, robust identity verification is no longer optional; it is a fundamental requirement for risk mitigation, regulatory compliance, and long-term digital resilience.

Digital Transformation Across Sectors

The rapid acceleration of digital transformation in Australia has expanded the need for reliable identity verification across numerous sectors. As more services—banking, healthcare, telecommunications, insurance, and public administration—transition to online platforms, the necessity for secure and seamless user verification is becoming universal. Remote onboarding, online access, and digital transactions require identity checks that are fast, accurate, and user-friendly. Businesses are adopting automated identity verification tools that minimize friction while meeting legal and security requirements. This shift is not limited to large enterprises; even startups and SMEs are integrating digital ID systems to enhance customer trust and improve operational efficiency. As digital infrastructure grows nationwide, the demand for smart, scalable identity verification solutions will continue to rise, making it a cornerstone of the digital economy.

Opportunities of Australia Identity Verification Market:

Expansion of Digital Identity Initiatives

Australia’s push toward a national digital identity infrastructure presents significant opportunities for private sector involvement. Government-led platforms such as myGovID, along with enhancements to the Document Verification Service (DVS) and Face Verification Service (FVS), are creating a standardized and secure framework for digital identity. These systems are not only improving efficiency in public service delivery but also enabling private technology providers to develop integrated, value-added solutions. Companies specializing in identity verification, authentication, and cybersecurity can align their offerings with these platforms to streamline customer onboarding and KYC processes. As the government continues to invest in secure digital ID systems and promote interoperability, there is growing room for private innovation in identity-related services, especially in areas such as financial access, e-signatures, and citizen verification.

Rising Adoption in Non-Financial Sectors

While financial services have historically driven demand for identity verification, other sectors in Australia are rapidly embracing these technologies due to increasing digitalization and regulatory needs. Industries such as online education, telehealth, e-commerce, telecommunications, and real estate are now relying on digital identity solutions to authenticate users, prevent fraud, and streamline access. For instance, real estate platforms use identity checks to verify tenants and buyers, while telehealth providers need secure login systems for patient privacy and compliance. As these industries expand their online presence, the demand for efficient, secure, and scalable verification tools grows accordingly. This diversification of applications broadens the total addressable market for identity verification providers and opens new revenue streams beyond traditional banking and financial services.

Cross-Border Verification and Regional Integration

Australia’s increasing economic and digital integration with Asia-Pacific nations offers considerable potential for cross-border identity verification services. As trade, e-commerce, and workforce mobility expand regionally, businesses and government agencies require reliable identity verification systems that operate seamlessly across jurisdictions. This creates demand for interoperable platforms capable of verifying international identities while complying with both Australian and foreign data protection laws. Digital travel credentials, remote work authentication, and cross-border banking all benefit from streamlined, secure verification processes. Providers that can deliver multi-country verification solutions—combining real-time authentication with robust compliance—stand to gain a competitive edge. Furthermore, initiatives to align digital identity standards across the region could foster even greater adoption, allowing Australia-based firms to scale their solutions internationally while enhancing regional cybersecurity and trust.

Challenges of Australia Identity Verification Market:

Privacy and Data Protection Concerns

Privacy remains a central challenge in the adoption of identity verification technologies in Australia. Consumers are increasingly aware of how their data is collected, processed, and stored, and many express concerns about potential misuse or breaches. These apprehensions are amplified by the rising number of cyberattacks and unauthorized data disclosures globally. Australia’s Privacy Act imposes strict obligations on organizations to handle data responsibly, requiring consent, transparency, and secure storage practices. Non-compliance can lead to legal penalties and reputational damage. As a result, companies implementing identity verification systems must adopt privacy-by-design principles and communicate data practices to build trust. Without robust privacy protections and clear user education, adoption may stall, especially in sectors dealing with sensitive information like healthcare and finance.

High Implementation and Integration Costs

One of the most significant barriers to the widespread adoption of identity verification technology in Australia is the high upfront cost, particularly for small and medium-sized enterprises (SMEs) and organizations with outdated legacy systems. According to the Australia identity verification market analysis, these companies often lack the financial resources and technical expertise required for successful implementation. Integration of advanced verification tools, such as real-time ID checks, biometric authentication, and document scanning, may require significant upgrades to existing IT infrastructure. In addition, ongoing maintenance, licensing fees, and staff training add to the total cost of ownership. These expenses can deter businesses from adopting newer, more secure identity systems, particularly in low-margin industries. Without accessible, cost-effective solutions or government incentives, many organizations may delay implementation, limiting the overall growth potential of the identity verification market.

User Experience and Accessibility Issues

Creating a seamless and inclusive user experience remains a key challenge in the identity verification space. While security is paramount, overly complex or time-consuming verification steps can frustrate users and lead to abandonment during onboarding or transaction processes. In digital environments, even minor friction can result in customer churn. Additionally, identity systems must be accessible to users with limited digital literacy, those in remote areas, or individuals who lack traditional forms of identification. For example, older adults, people with disabilities, and non-citizens may encounter barriers in accessing or completing digital verification steps. Ensuring multilingual support, mobile-first design, and alternative verification pathways is critical. Striking the right balance between security, ease of use, and inclusivity is essential for widespread adoption and long-term trust in identity systems.

Australia Identity Verification Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, component, deployment mode, organization size, and vertical.

Type Insights:

- Biometrics

- Non-Biometrics

The report has provided a detailed breakup and analysis of the market based on the type. This includes biometrics and non-biometrics.

Component Insights:

- Solutions

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes solutions and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

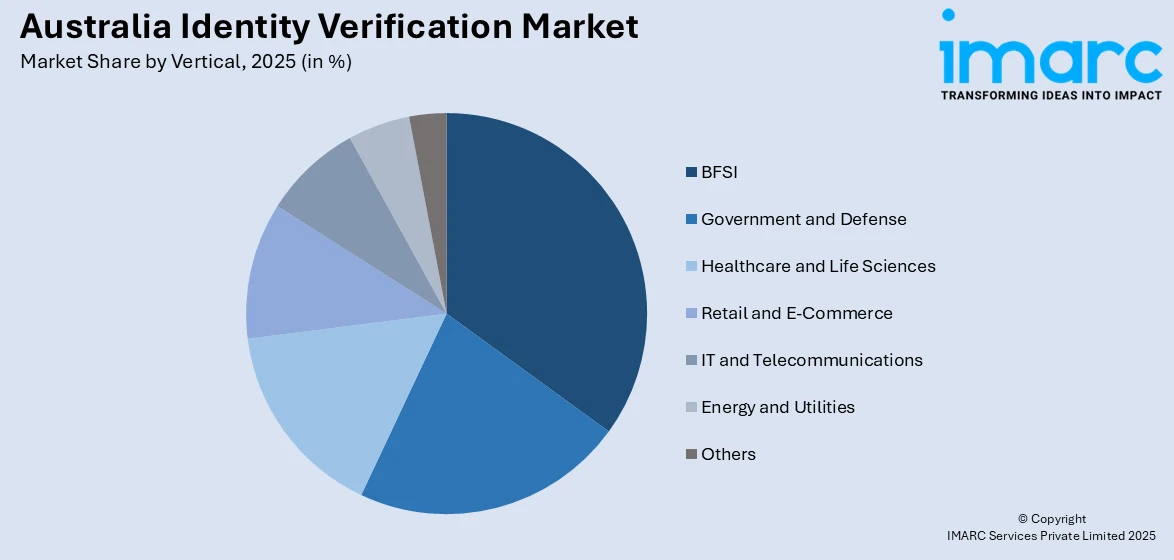

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunications

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, government and defense, healthcare and life sciences, retail and e-commerce, IT and telecommunications, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Identity Verification Market News:

- On May 15, 2024, Sydney-based identity verification firm Data Zoo secured USD 22.7 Million (AUD 35 Million) in Series A funding from Ellerston JAADE, marking its first external investment. The capital will support global expansion and further development of its platform, which offers real-time verification across over 170 countries, enhancing KYC/KYB compliance and fraud prevention.

- On February 6, 2025, Sumsub launched its document verification service (DVS) in Australia, offering real-time, government-backed validation of identity documents such as passports, driving licenses, and visas to assist businesses in complying with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This initiative responds to a 138% increase in identity fraud in Australia and aligns with the Australian government's Scam Prevention Framework.

Australia Identity Verification Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunications, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia identity verification market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia identity verification market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia identity verification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The identity verification market in Australia was valued at USD 315.9 Million in 2025.

The Australia identity verification market is projected to exhibit a CAGR of 13.32% during 2026-2034.

The Australia identity verification market is projected to reach a value of USD 1,005.3 Million by 2034.

Australia’s identity verification market is evolving rapidly due to the increasing adoption of biometric authentication (facial, fingerprint, iris) across banking, government, and healthcare; AI/ML-driven fraud detection enhances security in real-time; and government digital ID services, including myID and revamped DVS/FVS frameworks, are standardizing secure verification.

The growth drivers of the market include surging digital services demand, tightened AML/CTF and KYC regulations, and rising identity theft. Concerns over data breaches and cyber threats propel investments in secure verification. Increasing integration of biometrics, AI-powered systems, mobile onboarding, and government-backed digital ID frameworks further fuels the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)