Australia Image Recognition Market Size, Share, Trends and Forecast by Component, Technology, Application, Deployment Type, End Use Industry, and Region, 2025-2033

Australia Image Recognition Market Overview:

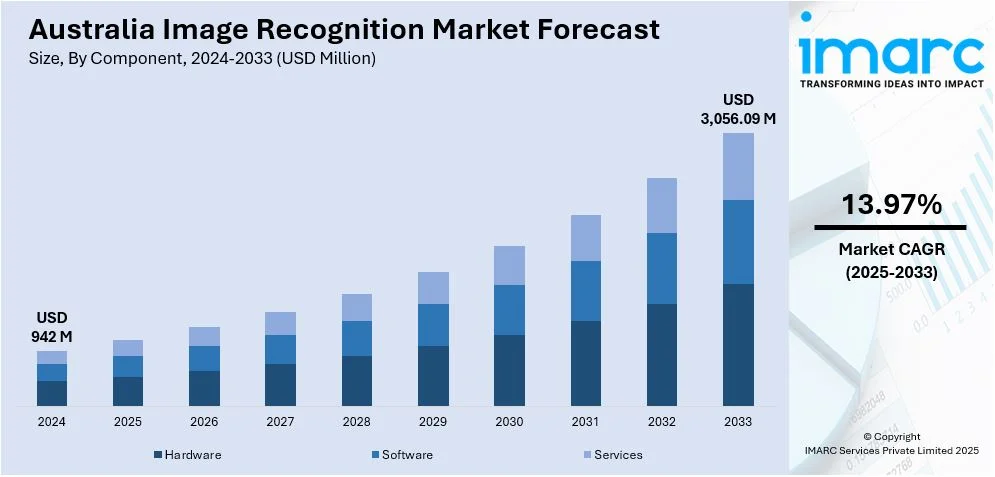

The Australia image recognition market size reached USD 942 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,056.09 Million by 2033, exhibiting a growth rate (CAGR) of 13.97% during 2025-2033. Increased adoption in security and surveillance, retail automation, and healthcare diagnostics, along with advancements in artificial intelligence, deep learning, and smartphone integration, are some of the factors contributing to Australia image recognition market share. Government investments in smart cities and digital transformation initiatives also support market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 942 Million |

| Market Forecast in 2033 | USD 3,056.09 Million |

| Market Growth Rate 2025-2033 | 13.97% |

Australia Image Recognition Market Trends:

Facial Recognition Expanding into Public Safety Applications

Facial recognition systems are seeing broader deployment in Australia's public safety and social welfare domains. Recent regulatory initiatives propose their use to identify and restrict individuals with gambling problems from accessing gaming machines. These systems are being adapted to support exclusion registers managed by venue operators and third parties, with added layers of human oversight to confirm matches. Data usage is being tightly controlled under new draft codes, which limit facial recognition solely to exclusion enforcement, reflecting increasing attention to privacy protections. This application signals growing governmental confidence in AI-driven visual technologies to address behavioral risks, while also shaping new standards for ethical use and oversight in commercial environments beyond traditional security functions. These factors are intensifying the Australia image recognition market growth. For example, in February 2025, New South Wales sought public input on proposed gambling reforms, which included mandatory facial recognition technology to enforce a statewide exclusion register in venues with gaming machines. The plan introduced a third-party exclusion scheme, allowing relatives or venues to request bans for individuals facing gambling issues. A draft Code of Practice outlined privacy safeguards, requiring human verification of matches and restricting data use solely to identifying excluded patrons.

To get more information on this market, Request Sample

Privacy-Centric Advancements in Facial Recognition

Based on the Australia image recognition market outlook, Australia is sharpening its focus on privacy safeguards in facial recognition as part of a broader shift toward secure digital identification. A new multi-year strategy underscores the move to create identity verification systems that are both voluntary and minimally invasive. These initiatives prioritize reduced data sharing, aligning biometric applications with stricter regulatory oversight. The approach reflects a push to balance innovation in image recognition technologies with heightened privacy protections, particularly as adoption grows across government and commercial sectors. This development is shaping how biometric tools are deployed, encouraging designs that offer users more control over their personal information while still enabling accurate, secure authentication across digital platforms. For instance, in September 2024, Australia’s privacy regulator, the OAIC, released a three-year plan focusing on digital ID and facial recognition. The strategy aims to protect privacy as digital ID systems expand, offering secure and voluntary identity verification while minimizing data sharing.

Australia Image Recognition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, application, deployment type, and end use industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Technology Insights:

- Object Detection

- QR/Barcode Recognition

- Facial Recognition

- Pattern Recognition

- Optical Character Recognition

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes object detection, QR/barcode recognition, facial recognition, pattern recognition, optical character recognition, and others.

Application Insights:

.webp)

- Scanning and Imaging

- Security and Surveillance

- Image Searching

- Augmented Reality

- Marketing and Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes scanning and imaging, security and surveillance, image searching, augmented reality, marketing and advertising, and others.

Deployment Type Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud-based.

End Use Industry Insights:

- BFSI

- Media and Entertainment

- IT and Telecom

- Government

- Healthcare

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, media and entertainment, IT and telecom, government, healthcare, transportation and logistics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Image Recognition Market News:

- In April 2025, Synology launched its AI-powered CC400W Wi-Fi camera in Australia, boosting the local image recognition market. The device supports facial recognition, license plate detection, and people counting when paired with Synology’s Deep Video Analytics systems. Aimed at small businesses and retailers, it offers 1440p resolution, HDR, and smart surveillance features like intrusion alerts and auto-tracking, positioning AI-driven video tech as a growing trend in Australia's security landscape.

Australia Image Recognition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technologies Covered | Object Detection, QR/Barcode Recognition, Facial Recognition, Pattern Recognition, Optical Character Recognition, Others |

| Applications Covered | Scanning and Imaging, Security and Surveillance, Image Searching, Augmented Reality, Marketing and Advertising, Others |

| Deployment Types Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Media and Entertainment, IT and Telecom, Government, Healthcare, Transportation and Logistics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia image recognition market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia image recognition market on the basis of component?

- What is the breakup of the Australia image recognition market on the basis of technology?

- What is the breakup of the Australia image recognition market on the basis of application?

- What is the breakup of the Australia image recognition market on the basis of deployment type?

- What is the breakup of the Australia image recognition market on the basis of end use industry?

- What is the breakup of the Australia image recognition market on the basis of region?

- What are the various stages in the value chain of the Australia image recognition market?

- What are the key driving factors and challenges in the Australia image recognition market?

- What is the structure of the Australia image recognition market and who are the key players?

- What is the degree of competition in the Australia image recognition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia image recognition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia image recognition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia image recognition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)