Australia Immunity Boosting Food Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Immunity Boosting Food Products Market Overview:

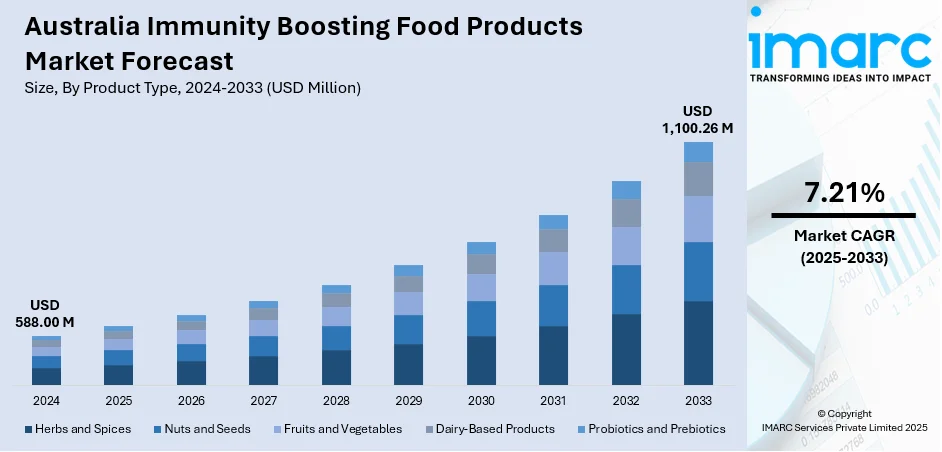

The Australia immunity boosting food products market size reached USD 588.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,100.26 Million by 2033, exhibiting a growth rate (CAGR) of 7.21% during 2025-2033. At present, the growing focus on proactive health management is encouraging innovations in the food industry, with brands introducing new products that emphasize immune-supporting benefits. Besides this, the broadening of e-commerce portals that aid in increasing item accessibility is fueling the Australia immunity boosting food products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 588.00 Million |

| Market Forecast in 2033 | USD 1,100.26 Million |

| Market Growth Rate 2025-2033 | 7.21% |

Australia Immunity Boosting Food Products Market Trends:

Increasing awareness about preventive healthcare and wellness

The growing awareness about preventive healthcare and wellness is positively influencing the market in Australia. People are understanding the role of nutrition in supporting a strong immune system, leading them to incorporate nutrient-rich food items into their daily diets. Ingredients known for immune benefits, such as ginger, turmeric, garlic, citrus fruits, and leafy greens, are gaining popularity among health-conscious consumers. Functional foods and beverages (F&Bs) fortified with vitamins C, D, and zinc are experiencing rising demand, as people are actively seeking products that support immune strength. This shift in mindset is facilitated by health campaigns, fitness influencers, and wellness content on social media, which aid in promoting the importance of daily immunity care. People are showing interest in organic, clean-label, and natural products, further propelling the market growth. The rising trend of proactive health management is fueling innovation in the food industry, with brands launching new items that highlight immune-boosting properties. Parents are also focusing on strengthening their children's immunity, driving the demand for kid-friendly options. As more emphasis is being placed on health and wellness, immunity boosting food products are becoming a regular choice for Australians. According to the IMARC Group, the Saudi Arabia health and wellness market is set to attain USD 81,109.5 Million by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

To get more information on this market, Request Sample

Expansion of e-commerce sites

The broadening of e-commerce portals is impelling the Australia immunity boosting food products market growth. Online platforms allow people to explore a wide range of health-focused food items without visiting physical stores. People can easily compare ingredients, prices, and benefits of various products before making informed decisions. Immunity boosting food items, such as supplements, herbal teas, and fortified snacks, are widely available on popular e-commerce sites. This accessibility supports increased consumption, especially among busy professionals and health-conscious individuals. Subscription services and doorstep delivery further enhance the shopping experience, encouraging repeat purchases. Influencers and wellness experts are using digital platforms to promote these items, creating awareness and driving demand. E-commerce also supports small and niche brands that focus on natural and organic offerings, providing them with a wider audience. With the growing trust in online shopping, digital promotions, and easy payment options, e-commerce plays a crucial role in expanding the reach of immunity boosting food products in the country. As per industry reports, the e-commerce market in Saudi Arabia, valued at USD 24.67 Billion in 2024, is projected to expand at a CAGR of 12.10% from 2025 to 2033, ultimately achieving USD 68.94 Billion by 2033.

Australia Immunity Boosting Food Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Herbs and Spices

- Nuts and Seeds

- Fruits and Vegetables

- Dairy-Based Products

- Probiotics and Prebiotics

The report has provided a detailed breakup and analysis of the market based on the product type. This includes herbs and spices, nuts and seeds, fruits and vegetables, dairy-based products, and probiotics and prebiotics.

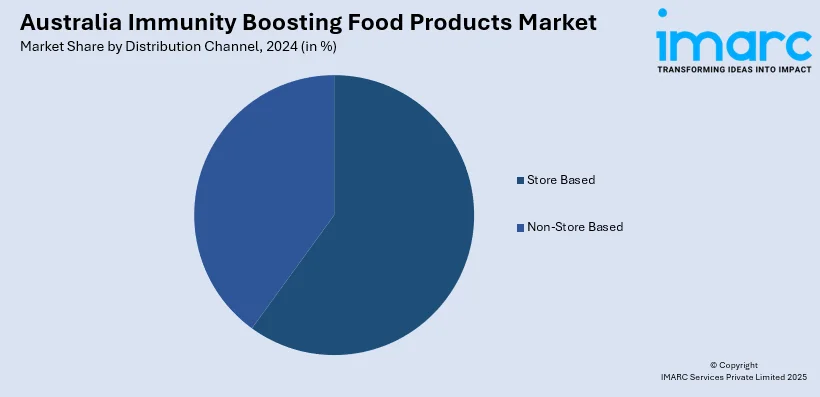

Distribution Channel Insights:

- Store Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store based and non-store based.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Immunity Boosting Food Products Market News:

- In February 2025, Biome Australia Limited established a co-investment collaboration with Australia’s Food and Beverage Accelerator (FaBA) to accelerate the advancement of Biome’s innovative probiotic strain, Lactobacillus plantarum BMB18. Initial in vitro research on BMB18 demonstrated its capacity to influence immune responses, decrease oxidative stress, and improve gut health by preserving the integrity of the intestinal barrier.

- In August 2024, Craig Silbery announced plans to create Australia’s first comprehensive probiotics manufacturer on the Gold Coast. Supported by private equity firm H&S Investments, Silbery obtained the assets of Probiotics Australia, which went into administration in February. The investors intended to invest as much as USD 40 Million in enhancing the company's manufacturing plant, as the partners aimed to capitalize on the surging demand for probiotics in domestic and Asian markets.

Australia Immunity Boosting Food Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbs and Spices, Nuts and Seeds, Fruits and Vegetables, Dairy-Based Products, Probiotics and Prebiotics |

| Distribution Channels Covered | Store Based, Non-Store Based |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia immunity boosting food products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia immunity boosting food products market on the basis of product type?

- What is the breakup of the Australia immunity boosting food products market on the basis of distribution channel?

- What is the breakup of the Australia immunity boosting food products market on the basis of region?

- What are the various stages in the value chain of the Australia immunity boosting food products market?

- What are the key driving factors and challenges in the Australia immunity boosting food products market?

- What is the structure of the Australia immunity boosting food products market and who are the key players?

- What is the degree of competition in the Australia immunity boosting food products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia immunity boosting food products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia immunity boosting food products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia immunity boosting food products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)