Australia In Vitro Fertilization Market Size, Share, Trends and Forecast by Product, Procedure Type, Cycle Type, End User, and Region, 2025-2033

Australia In Vitro Fertilization Market Overview:

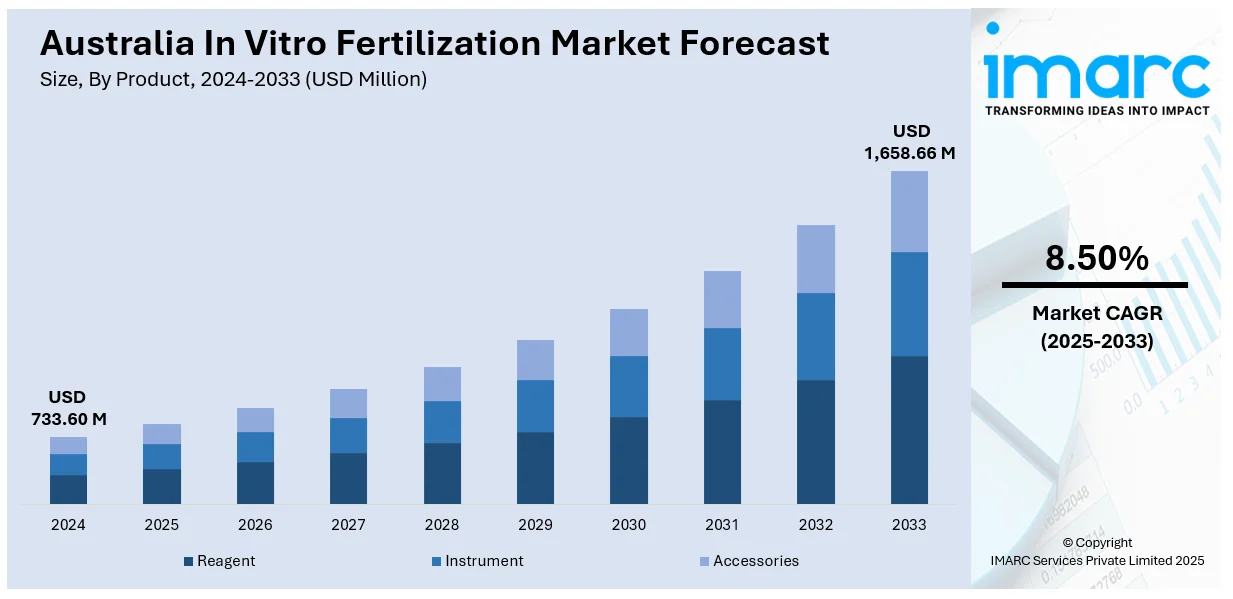

The Australia in vitro fertilization market size reached USD 733.60 Million in 2024. Looking forward, the market is expected to reach USD 1,658.66 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is witnessing significant growth mainly due to delayed parenthood, rising infertility rates, and strong government support through Medicare rebates and state subsidies. Technological innovations, growing acceptance among same-sex couples and single parents, and increased demand for genetic testing are also contributing to the increasing Australia in vitro fertilization market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 733.60 Million |

| Market Forecast in 2033 | USD 1,658.66 Million |

| Market Growth Rate 2025-2033 | 8.50% |

Key Trends of Australia In Vitro Fertilization Market:

Rising Government Support and Rebates

Government initiatives have significantly improved access to IVF services across Australia. Medicare offers partial rebates for assisted reproductive treatments, helping reduce out-of-pocket expenses for couples facing fertility challenges. For instance, in March 2025, the Australian Government announced new PBS listings for women's contraception, endometriosis treatments, and IVF, improving access and affordability. Key inclusions are the progestogen-only pill Slinda® and endometriosis treatment Ryeqo®. Additionally, women can access more IVF medication earlier, potentially saving thousands in healthcare costs. Additionally, several states have introduced their own support programs. Victoria and New South Wales, for instance, provide extra financial subsidies, including cash rebates and low-cost public IVF services. Similarly, Victoria operates Australia’s first publicly funded IVF clinics to improve equity in fertility care. These efforts aim to ease the financial burden, particularly for lower-income families, and support broader demographic goals such as increasing birth rates. As a result, more Australians are now able to pursue fertility treatments without being deterred by high treatment costs, which further increases the Australia in vitro fertilization market demand as well.

To get more information on this market, Request Sample

Technological Advancements

The Australia In Vitro Fertilization (IVF) market is benefiting from rapid technological innovation that is improving both clinical outcomes and operational efficiency. Time-lapse embryo imaging allows embryologists to monitor embryo development continuously without disturbing the culture environment, enabling more accurate selection of viable embryos. Artificial Intelligence (AI) is being integrated into embryo assessment, using algorithms trained on thousands of images to predict which embryos have the highest potential for successful implantation. Additionally, improved culture media formulations are supporting healthier embryo development and higher success rates. For instance, in November 2024, a new microchip developed by Monash University researchers measures embryo energy, enhancing selection for IVF. This device, smaller than a dollar coin, promises safer, faster embryo assessment compared to traditional methods, potentially increasing IVF success rates while reducing costs and invasiveness. These technologies enhance pregnancy outcomes and reduce the number of cycles needed per patient, lowering overall treatment costs. Australian fertility clinics are adopting these advancements quickly, staying competitive globally. This technology-driven shift is a key factor contributing to the sustained Australia in vitro fertilization market growth.

Growth Drivers of Australia In Vitro Fertilization Market:

Delayed Parenthood and Evolving Social Norms

In Australia, the most significant factor driving market growth in IVF is delayed parenthood. A lot of couples are delaying childbearing on account of career interests, personal ambitions, economic stress, and lifestyle choices. With the delay comes added age-related fertility issues, compelling more Australians to pursue assisted reproductive technology. Alongside that, social attitudes toward family structure are evolving—there’s growing acceptance of single parenthood, same-sex parenting, and use of donor gametes and surrogacy—making fertility services more relevant to a broader segment of the population. Moreover, fertility awareness and education have expanded; more people understand that fertility declines with age, or with certain health conditions, which encourages earlier consultation with specialists. These social norm changes, coupled with altered family planning horizons, are driving demand for IVF procedures in urban and rising regional Australia.

Increase in Fertility Preservation and Oncofertility Demand

According to the Australia in vitro fertilization market analysis, increased demand for fertility preservation, especially by those receiving medical treatments, that can compromise reproductive health, is another factor responsible for the growth of the industry. Cancer patients, for example, are increasingly being referred for egg or sperm freezing ahead of undergoing chemotherapy or radiation. This convergence of oncology and fertility—termed oncofertility—is fast emerging as a specialty area of service in Australian reproductive health. Aside from medical indication, an increasing number of Australians are opting for elective egg or sperm freezing for non-medical reasons, including waiting until the late 30s or 40s to establish a family. As awareness about fertility choice grows among the public, clinics have opened up customized services for preservation, providing adaptive plans and longer storage capacities. This expansion in fertility preservation also reflects the growing trend of personalized medicine, with individuals becoming more independent in making decisions over their reproductive futures, hence giving a boost to the IVF market beyond mere infertility issues.

Greater Multinational and Private Sector Involvement

The Australian IVF industry is also growing as a result of greater participation by multinational companies and private equity investors in funding fertility clinics and healthcare networks. Investments have resulted in consolidation and chain expansion of clinics, enabling improved infrastructure, access to new technologies, and increased geographic reach. Some Australian fertility providers have also joined international healthcare networks, allowing them to tap into global expertise and collaborative research. This has facilitated quicker uptake of emerging technologies like AI-aided embryo selection, advanced genetic screening, and minimally invasive techniques. Private investors are also making competitive pricing models, digital platform creation, and patient-focused innovations that enhance the quality of the treatment experience. As the market increases its commercial strength and level of technology, patients enjoy greater options and better service quality, enabling long-term expansion in the IVF market throughout Australia.

Opportunities of Australia In Vitro Fertilization Market:

Expansion into Rural Communities & Underserved Regions

Australia offers a compelling opportunity for extending IVF access from large metropolitan areas into regional, rural, and underserved communities. A number of remote or rural locations have no nearby specialist fertility clinics, so potential parents have to travel considerable distances, pay for accommodation, and endure logistical hassle over multiple cycles of treatment. The technologies of telemedicine and mobile health service have the potential to overcome these barriers: distant consultations, follow‑ups, monitoring, and counselling can alleviate the necessity for multiple face‑to‑face visits, enhancing patient comfort and retention. Further, collaboration with local hospitals or health service organizations may enable satellite clinics or outreach programs that bring the services closer to those who are enduring long travel. In addition to this, government health policy focused on eliminating geographical disparity opens doors for players that can implement scalable, decentralized IVF service models. This can result in more market penetration in states or territories that are presently under-served, supporting both public and private clinic expansion.

Building Complementary Services & Fertility Preservation

There is also a potential in the Australian IVF market to expand complementary fertility‑related services, particularly fertility preservation and reproductive genetic technologies. With increasingly more people opting for delayed childbearing due to social, professional, or medical reasons, egg, sperm, or embryo freezing demand is growing. Clinics with or that add preservation services can tap into this segment. In addition, combining genetic diagnosis and screening—preimplantation genetic testing—provides couples with choices regarding hereditary disease susceptibility, embryo health, or choosing embryos of higher viability. Such value‑added services can differentiate clinics, reinforce patient confidence, and potentially boost success rates. It is also possible to introduce diagnostic innovations for male factor infertility, wellness programs related to fertility (nutrition, lifestyle, preconception counseling), and psychological support services. For those patients receiving cancer or other treatments that can damage fertility, improved access to onco‑fertility programmes is a chance. Addressing these integrated needs can fuel market growth by appealing to buyers wanting more than mere IVF.

Medical & Technological Innovation and Medical Tourism

With its solid base in high‑tech reproductive medicine and innovative technology, Australia creates opportunities in medical and technological innovation. IVF providers can embrace and extend innovations like enhanced embryo culture method developments, non‑invasive assessment of embryos, AI‑sustained decision support tools, individualised stimulation protocols, and advances in cryopreservation. These technological advancements can enhance success rates, limit cycle numbers required, lower risks, and make the overall patient experience better—so IVF becomes more attractive. Additionally, Australia's image of high health standards makes it desirable for foreign patients. There is potential to increase cross‑border IVF or assisted reproduction services demand, particularly from adjacent Asia Pacific countries where individuals might seek quality, regulated treatment abroad. Providing packages including fertility treatment with travel, accommodation, and follow‑up care can reap medical tourism. Clinics that establish clear service pathways for international patients, with cost‑transparent offerings, streamlined visa‑related protocols, and remote consultation options before arrival, may gain competitive advantage in this arena.

Challenges of Australia In Vitro Fertilization Market:

High Treatment Costs and Limited Affordability

One of the most persistent challenges facing the IVF market in Australia is the high cost of treatment, which can be a significant barrier for many individuals and couples. While some government rebates and Medicare support are available, these often only partially cover the expenses, leaving patients with substantial out-of-pocket costs. This financial burden disproportionately affects lower-income families and those without access to comprehensive private health insurance. In regional and rural areas, the lack of nearby fertility clinics adds travel and accommodation expenses, compounding the affordability issue. For many Australians, the expense of multiple cycles of IVF, typically required for success, can soon become prohibitive. In addition, although the public health system delivers access to fertility services in some regions, waiting lists are long, and service availability is poor. These cost factors can impede or prevent individuals from getting fertility treatment, hence impeding the growth of the IVF market altogether even in the face of growing demand.

Regulatory Complexity and Ethical Considerations

Australia's IVF sector functions in a highly regulated yet intricate legal and ethical environment, which can be operationally challenging for providers and clinics. State and territory legislation differs regarding conditions such as embryo storage time, donor anonymity, surrogacy, and access for single parents or same-sex couples. Such discrepancies can cause uncertainty for patients and restrict the consistency of services throughout the nation. Additionally, changing controversies over the ethical application of reproductive technology, like embryo genetic screening, sex selection, or donation of embryos, can impact public opinion and policy shifts. Clinics have to manage rigorous compliance, along with changing public expectations and bioethical norms. Finally, regulatory barriers can even slow the implementation of new technologies or methods, like AI-based embryo choice or novel genetic testing techniques. Providers are required to spend considerable resources on legal compliance, training, and ethical monitoring, all of which raise the complexity of operations and slow down innovation in an otherwise rapidly developing industry.

Geographic Disparities and Workforce Limitations

Another issue facing the IVF market in Australia is the disparate availability of fertility services and trained personnel across the nation. The majority of highly developed IVF clinics are located in major cities such as Sydney, Melbourne, and Brisbane, with regional and remote communities frequently having limited access to specialist services. Geographic disadvantage restricts treatment accessibility for a major section of the population and may lead to delayed treatment or having to travel over lengthy distances. Moreover, less populated areas lack adequately trained embryologists, fertility consultants, and support staff. Attracting and keeping competent personnel in rural clinics is challenging because of the small professional networks, reduced training opportunities, and lifestyle choices. The constraints of these workforces undermine the scalability of fertility services and further exert pressure on available clinics, especially as demand keeps increasing. Closing these geographic and human capital gaps will be vital to building a fairer and more effective IVF industry in Australia.

Australia In Vitro Fertilization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, procedure type, cycle type, and end user.

Product Insights:

- Reagent

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Instrument

- Imaging Systems

- Incubators

- Cryosystems

- IVF Cabinet

- Ovum Aspiration Pump

- Sperm Separation Systems

- Micromanipulator Systems

- Others

- Accessories

The report has provided a detailed breakup and analysis of the market based on the product. This includes reagent (cryopreservation media, embryo culture media, ovum processing media, and sperm processing media), instrument (imaging systems, incubators, cryosystems, IVF cabinet, ovum aspiration pump, sperm separation systems, micromanipulator systems, and others), and accessories.

Procedure Type Insights:

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

A detailed breakup and analysis of the market based on the procedure type have also been provided in the report. This includes fresh donor, frozen donor, fresh non-donor, and frozen non-donor.

Cycle Type Insights:

- Conventional IVF

- IVF with ICSI

- IVF with Donor Eggs

A detailed breakup and analysis of the market based on the cycle type have also been provided in the report. This includes conventional IVF, IVF with ICSI, and IVF with donor eggs.

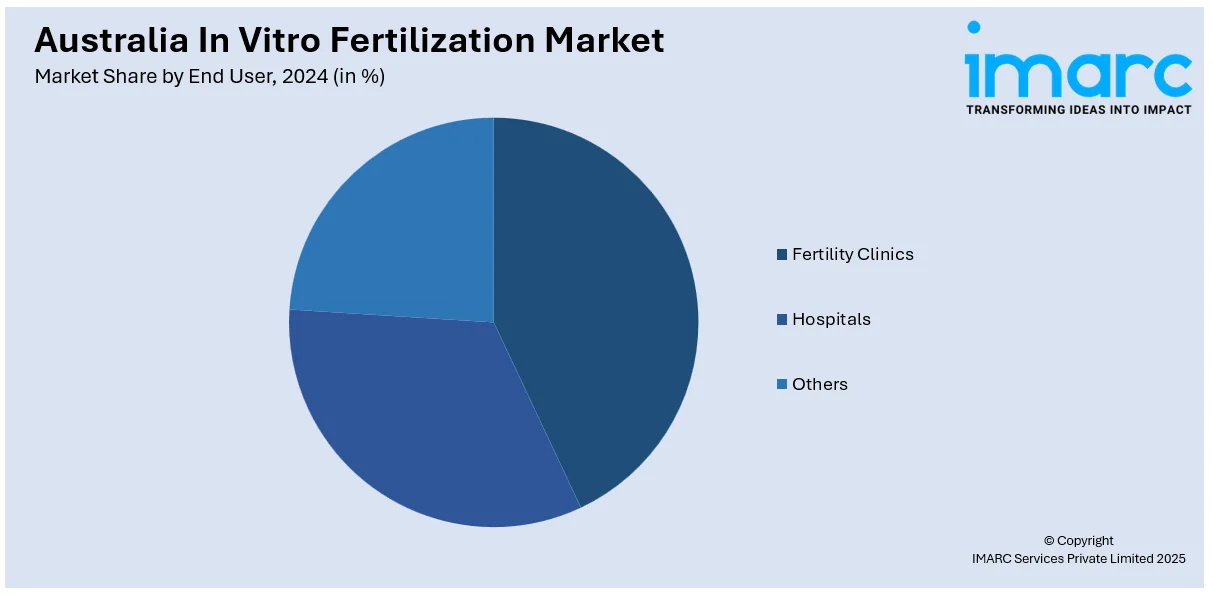

End User Insights:

- Fertility Clinics

- Hospitals

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes fertility clinics, hospitals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia In Vitro Fertilization Market News:

- In February 2025, the Sydney Swans announced its partnership with leading IVF clinic Adora Fertility, marking the first fertility collaboration in AFL history. The two-year agreement names Adora as the official partner for both AFL and AFLW teams, aiming to raise awareness about infertility and promote accessible, low-cost fertility treatments for all Australians.

- In December 2024, Gameto announced its partnership with IVFAustralia, enhancing IVF options by offering its innovative product, Fertilo, at select clinics. Fertilo, derived from iPSC, allows for natural egg maturation with significantly reduced hormonal injections. Led by fertility experts, this initiative aims to improve patient experiences in reproductive health.

Australia In Vitro Fertilization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Procedure Types Covered | Fresh Donor, Frozen Donor, Fresh Non-donor, Frozen Non-donor |

| Cycle Types Covered | Conventional IVF, IVF with ICSI, IVF with Donor Eggs |

| End Users Covered | Fertility Clinics, Hospitals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia in vitro fertilization market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia in vitro fertilization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia in vitro fertilization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia in vitro fertilization market was valued at USD 733.60 Million in 2024.

The Australia in vitro fertilization market is projected to exhibit a CAGR of 8.50% during 2025-2033.

The Australia in vitro fertilization market is expected to reach a value of USD 1,658.66 Million by 2033.

Key trends in the Australia in vitro fertilization market include rising demand for fertility preservation, increased use of genetic screening, and adoption of AI-assisted embryo selection. There is also growing acceptance of single and same-sex parenthood, along with expansion of telehealth and regional clinic networks to improve nationwide access to IVF services.

The Australia in vitro fertilization market is driven by delayed parenthood, increased fertility awareness, and growing acceptance of diverse family structures. Advancements in reproductive technology, supportive healthcare policies, and rising demand for fertility preservation also contribute to market growth. Expanding access in regional areas further supports market growth across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)