Australia Induction Cooktop Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Australia Induction Cooktop Market Overview:

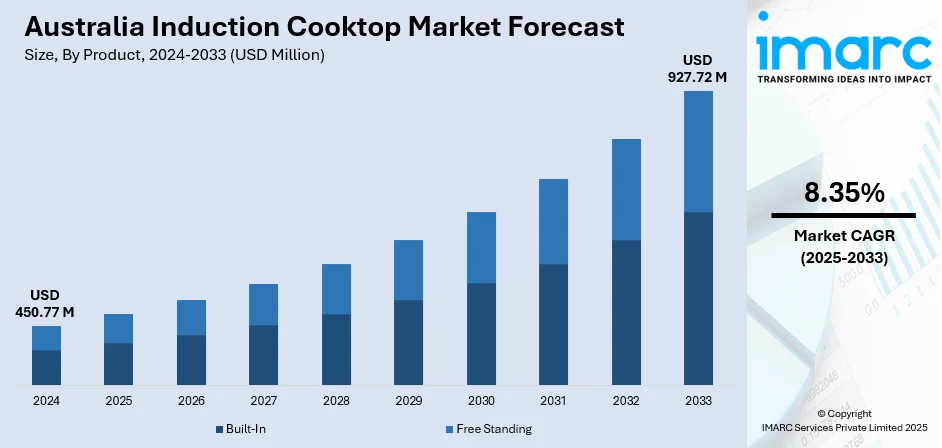

The Australia induction cooktop market size reached USD 450.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 927.72 Million by 2033, exhibiting a growth rate (CAGR) of 8.35% during 2025-2033. The market is propelled by growing demand for efficient appliances, smart home integration, and favorable electrification policies. Consumers favor induction cooktops due to their speed, safety, and eco-friendly compatibility. Smart technology such as app control and voice assistant is improving user experience, with government programs encouraging electric over gas options. These combined factors are driving market dynamics and supporting the expanding Australia induction cooktop market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 450.77 Million |

| Market Forecast in 2033 | USD 927.72 Million |

| Market Growth Rate 2025-2033 | 8.35% |

Australia induction cooktop Market Trends:

Growing Consumer Interest in Energy-Saving Cooking Technologies

Homeowners in Australia are increasingly looking for energy efficiency features in kitchen appliances, and this has resulted in a significant migration towards induction cooktops. For example, in May 2024, Whirlpool released the i300 induction cooktop at Eurocucina, helping Australia transition from gas to induction with Heat Control, CleanProtect coating, and adaptive Power Management options. Furthermore, they prefer the quick response time of these appliances along with their low energy use as opposed to conventional gas and electric cooktops. Heightening concern regarding environmental sustainability, along with increasing electricity prices, has prompted consumers to use technologies that ensure both environmental and financial savings. Induction cooktops fit these expectations perfectly with the ability to control temperature precisely and provide added safety through automatic shut-off. With customers looking to update their kitchens through smarter, more efficient technology, induction cooktop sales are bound to improve, especially among city residents. The pattern of growth in the Australia induction cooktop market mirrors this changing consumer concern with a more generalized national tendency toward eco-friendliness and new domestic technologies.

To get more information on this market, Request Sample

Integration with Smart Home Ecosystems

The convergence of induction cooktops into smart home ecosystems is becoming a top trend within the Australian market. With homes becoming more networked via Wi-Fi-connected devices and digital assistants, kitchen appliances are being demanded more and more to provide interoperability without any hassle. Induction cooktops with app-enabled controls, automated cooking programs, and voice-command compatibility are becoming favored among technology-enabled consumers. For instance, in September 2023, Samsung Electronics Australia rolled out its newest built-in cooking range, with advanced induction cooktops and AI-enabled appliances, with chef Andy Allen as its official brand ambassador. Moreover, these features not only add convenience but also encourage streamlined meal preparation through remote control and real-time monitoring. The popularity of smart appliances is especially high in new homes and refurbished buildings, where consumers value cutting-edge functionality. It illustrates the wider evolution of the kitchen into a digitally integrated environment, further solidifying the place of linked appliances within daily life. As adoption of technology continues to increase, the intelligent functions of induction cooktops will be critical to their long-term market presence in Australia.

Government and Urban Electrification Policies Favorable to Adoption

Electrification programs by governments and favorable energy policies are shaping the adoption of induction cooktops in Australia. Countrywide and state-level policies promoting minimizing gas reliance, especially in new housing constructions, have made electric cooking options more practical and desirable. Induction cooktops, being electric and efficient, fit well with these policy trends. Additionally, urban development initiatives for decarbonizing cities usually involve incentives for installing electric appliances such as rebates and compliance benefits. These trends are especially relevant in high-density areas, where electric infrastructure is more readily available and eco-friendly living is encouraged. Through this, consumer choices are highly conforming to government agendas, which are in turn leading to an increased trend toward clean technology energy in the residential market. Conformance between public policy and the adoption of sustainable appliances is anticipated to further enhance the penetration of induction cooktops in Australia.

Australia Induction Cooktop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Built-In

- Free Standing

The report has provided a detailed breakup and analysis of the market based on the product. This includes built-in, and free standing.

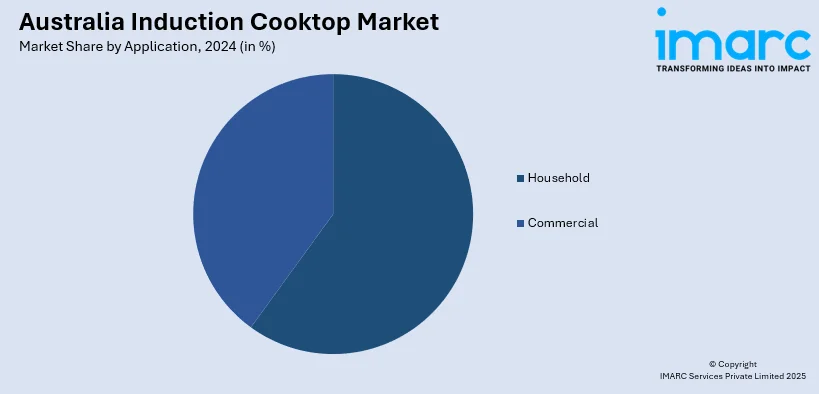

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household, and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, specialty stores, and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Induction Cooktop Market News:

- In September 2024, Electrolux launch its luxury AEG kitchen range at IFA, with advanced induction cooktops that boast AI-driven TasteAssist and CookSmart Touch Display. For release in Australia in 2025, energy-saving cooktops support growing demand for smart, sustainable cooking technologies to match Australia's green appliance market trends.

- In August 2024, LG Electronics Australia has ventured into the built-in cooking category with a new range consisting of four high-tech induction cooktops. Designed for Australian kitchens, the launch comes as demand for smart and efficient kitchen solutions continues to grow, and at the same time, it points toward increased adoption of induction cooktops in Australia.

Australia Induction Cooktop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Built-In, Free Standing |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia induction cooktop market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia induction cooktop market on the basis of product?

- What is the breakup of the Australia induction cooktop market on the basis of application?

- What is the breakup of the Australia induction cooktop market on the basis of distribution channel?

- What is the breakup of the Australia induction cooktop market on the basis of region?

- What are the various stages in the value chain of the Australia induction cooktop market?

- What are the key driving factors and challenges in the Australia induction cooktop?

- What is the structure of the Australia induction cooktop market and who are the key players?

- What is the degree of competition in the Australia induction cooktop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia induction cooktop market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia induction cooktop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia induction cooktop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)