Australia Industrial Air Blowers Market Size, Share, Trends and Forecast by Type, Business Type, End User, and Region, 2026-2034

Australia Industrial Air Blowers Market Summary:

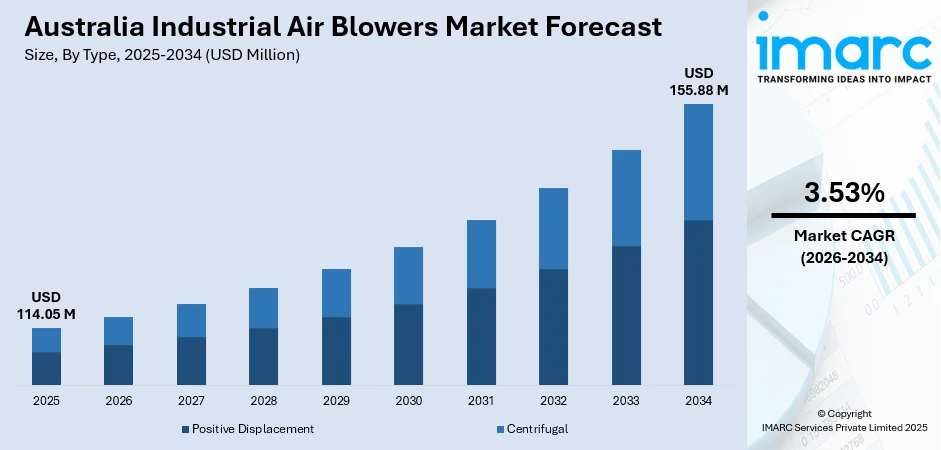

The Australia industrial air blowers market size was valued at USD 114.05 Million in 2025 and is projected to reach USD 155.88 Million by 2034, growing at a compound annual growth rate of 3.53% from 2026-2034.

The market is experiencing steady expansion driven by Australia's emphasis on sustainable mining practices, increasing investments in wastewater treatment infrastructure, and growing demand from the food and beverage processing sector. The shift toward energy-efficient ventilation solutions across industrial facilities, coupled with stricter environmental regulations mandating improved air quality standards, is accelerating adoption. Rising infrastructure development and the expansion of smart manufacturing capabilities further contribute to the Australia industrial air blowers market share.

Key Takeaways and Insights:

- By Type: Centrifugal blowers dominate the market with a share of 70% in 2025, owing to their superior efficiency in high-volume applications, lower maintenance requirements, and versatility across diverse industrial processes.

- By Business Type: Equipment Sales leads the market with a share of 76% in 2025, driven by ongoing industrial expansion, facility upgrades, and growing replacement demand across manufacturing and processing sectors.

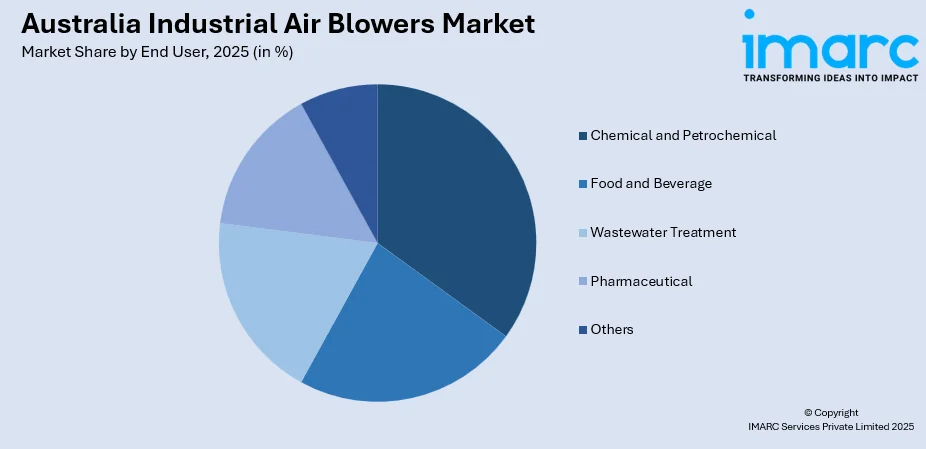

- By End User: Chemical and Petrochemical represents the largest segment with a market share of 30% in 2025, reflecting the sector's critical need for reliable air handling systems for ventilation, exhaust, and process applications in hazardous environments.

- Key Players: The Australia industrial air blowers market exhibits moderate competitive intensity, with established international manufacturers and regional specialists competing across various price segments. Major players focus on product innovation, energy efficiency improvements, and comprehensive service offerings to maintain market position.

To get more information on this market, Request Sample

Australia's industrial air blowers market is characterized by growing emphasis on energy-efficient solutions and predictive maintenance technologies. For instance, in March 2025, CAPS Australia launched CAPS Care, a comprehensive predictive maintenance program featuring four tailored plans designed to reduce equipment downtime through advanced diagnostics, scheduled servicing, and analytics. The initiative addresses the increasing demand for maximizing asset life and operational efficiency across mining, manufacturing, and food processing sectors. Australian industries are increasingly adopting Electronically Commutated (EC) fans that deliver electricity consumption reductions of 30% to 75%, aligning with corporate sustainability objectives and environmental compliance requirements. This technological transition, combined with the growing integration of IoT-enabled monitoring systems, is reshaping how industries approach ventilation infrastructure management.

Australia Industrial Air Blowers Market Trends:

Adoption of Predictive Maintenance Technologies

The Australian industrial air blowers market is experiencing growing adoption of predictive maintenance technologies as industries focus on operational efficiency and cost management. In line with this, The Australia predictive maintenance market size reached USD 254.00 Million in 2024. Looking forward, the market is expected to reach USD 1,620.05 Million by 2033, exhibiting a growth rate (CAGR) of 22.86% during 2025-2033. Companies are implementing smart monitoring systems that use real-time data to anticipate potential equipment issues, allowing timely intervention. Programs like CAPS Australia’s CAPS Care, offering diagnostic analytics and early fault detection, highlight this trend. Such initiatives across manufacturing, mining, and food processing sectors demonstrate a commitment to smarter asset management and minimized unplanned downtime.

Transition to Energy-Efficient Ventilation Solutions

Australian industries are increasingly embracing energy-efficient ventilation technologies as environmental compliance and corporate sustainability take center stage. The use of Electronically Commutated (EC) fans is expanding across industrial facilities due to their reduced power consumption. Manufacturers are designing products with eco-friendly materials and intelligent features to meet evolving market expectations. The growing adoption of smart ventilation systems is boosting demand for advanced blowers with variable speed drives and energy-recovery functionalities.

Integration of IoT and Smart Control Systems

The integration of Internet of Things (IoT) capabilities and smart control systems in industrial air blowers is transforming operational management across Australian facilities. Modern blowers increasingly feature programmable logic controllers (PLCs), touchscreen interfaces, and remote monitoring capabilities for enhanced system control. In July 2024, Sprintex Ltd achieved a significant milestone with the successful integration of its Programmable Logic Controller (PLC) into the G15 Turbo Blower, enhancing compatibility with various industrial communication standards. These advancements facilitate real-time performance monitoring, automatic surge control, and demand-responsive operation, enabling facilities to optimize energy consumption while maintaining operational reliability.

Market Outlook 2026-2034:

The Australia industrial air blowers market demonstrates promising growth prospects through 2033, supported by sustained investment in industrial infrastructure, environmental compliance requirements, and technological advancement. The Australian Government's National Water Grid Fund, a USD 2.5 billion rolling infrastructure program, is expected to drive significant demand for aeration blowers in wastewater treatment facilities. Additionally, approximately 85% of the country's underground mines are upgrading their ventilation systems to meet stringent safety regulations, creating substantial opportunities for blower manufacturers. The market generated a revenue of USD 114.05 Million in 2025 and is projected to reach a revenue of USD 155.88 Million by 2034, growing at a compound annual growth rate of 3.53% from 2026-2034.

Australia Industrial Air Blowers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Centrifugal | 70% |

| Business Type | Equipment Sales | 76% |

| End User | Chemical and Petrochemical | 30% |

Type Insights:

- Positive Displacement

- Centrifugal

The centrifugal segment dominates with a market share of 70% of the total Australia industrial air blowers market in 2025.

Centrifugal blowers command the largest market share in Australia owing to their superior operational efficiency, ability to handle high-volume airflow requirements, and lower maintenance needs compared to positive displacement alternatives. These blowers are extensively utilized across HVAC applications, power generation facilities, and chemical processing plants where consistent, high-pressure airflow is essential. The technology's compatibility with variable frequency drives enables precise flow control and significant energy savings, making it the preferred choice for energy-conscious industrial operations.

The segment's dominance is further reinforced by advancements in aerodynamic impeller designs and motor efficiency improvements. Australian manufacturers and end-users increasingly favor centrifugal blowers for their quiet operation, compact footprint, and extended service life. The Australia centrifugal pump market, valued at USD 672 Million in 2024, reflects the technology's widespread acceptance across industries. The HVAC segment plays a major role in overall demand, driven by the increasing need for energy-efficient building ventilation systems.

Business Type Insights:

- Equipment Sales

- Services

The equipment sales segment leads with a share of 76% of the total Australia industrial air blowers market in 2025.

Equipment sales dominate the Australian industrial air blowers market, driven by ongoing industrial expansion, infrastructure development projects, and the replacement cycle of aging ventilation systems. The growth in urbanization and industrialization across developing regions of Australia has increased industrial processing and packaging activities, subsequently driving demand for new blower installations. Rising investments in wastewater treatment facilities and food processing plants particularly contribute to equipment sales growth.

The services segment, while smaller, represents a growing opportunity as industries increasingly prioritize equipment optimization and lifecycle management. Service providers are developing comprehensive offerings including technical support, troubleshooting, preventive maintenance, and training programs. The integration of predictive maintenance capabilities and IoT-enabled monitoring is enhancing service value propositions, with programs like CAPS Care demonstrating the industry's evolution toward holistic asset management solutions that extend equipment life and maximize operational efficiency.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Food and Beverage

- Wastewater Treatment

- Pharmaceutical

- Chemical and Petrochemical

- Others

The chemical and petrochemical segment holds the largest share with 30% of the total Australia industrial air blowers market in 2025.

The chemical and petrochemical sector's leading position reflects its critical dependence on reliable air handling systems for process ventilation, hazardous gas exhaust, and environmental control applications. Industrial blowers in this sector must meet stringent API, ASME, and ISO specifications, with specialized requirements for corrosion-resistant materials, explosion-proof designs, and precise airflow control. The demands of chemical processing environments require close adherence to international industry and safety standards, driving demand for custom-engineered solutions.

Australia’s food and beverage processing industry continues to expand, creating strong growth prospects for industrial air blowers. The sector’s increasing production capabilities and rising demand for efficient processing equipment are driving the need for reliable air movement systems across various applications. The sector utilizes blowers for pneumatic conveying, drying, cooling, and maintaining hygiene in production lines. As food safety regulations become more stringent, adoption of oil-free, quiet-operation blowers ensures contamination-free environments, while the wastewater treatment sector benefits from major infrastructure investments, including the Canberra facility upgrade featuring membrane bioreactor treatment capacity of 97 megalitres daily.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The demand for industrial air blowers in the ACT and NSW is driven by expanding manufacturing operations, stricter air-quality compliance requirements, and the region’s strong wastewater treatment infrastructure. Growth in food processing, pharmaceuticals, and advanced manufacturing is boosting the need for efficient aeration and ventilation systems. Additionally, upgrades in municipal wastewater treatment plants and ongoing infrastructure development projects continue to support blower adoption across multiple industrial applications.

In Victoria and Tasmania, industrial air blower demand is influenced by the growth of the food and beverage industry, rising investments in clean energy projects, and increasing environmental performance standards. Wastewater treatment upgrades by regional councils are fueling the adoption of high-efficiency blowers. The presence of diverse industrial clusters, including chemicals, textiles, and packaging, also boosts the need for reliable drying, pneumatic conveying, and process ventilation systems across small and large facilities.

Queensland’s industrial air blowers market is supported by the state's expanding mining, mineral processing, and LNG sectors, which require durable blowers for ventilation, pneumatic conveying, and gas-handling applications. Growth in agriculture and food processing also increases demand for aeration systems. Furthermore, investments in wastewater infrastructure across regional towns and stricter workplace safety regulations are prompting industries to adopt high-efficiency, low-noise blowers to enhance operational reliability.

In the Northern Territory and South Australia, demand is driven by strong activity in mining, defence manufacturing, and energy projects. Industries rely on robust blower systems for dust control, ventilation, and process aeration in remote and harsh environments. Water treatment facilities across both regions are upgrading to energy-efficient blower technologies. Additionally, industrial diversification initiatives and investment in hydrogen and renewable energy projects are contributing to market growth.

Western Australia’s booming mining and mineral refining sectors remain the largest drivers of industrial air blower demand, requiring high-capacity systems for ventilation, ore processing, and dust management. Expanding port logistics, construction activity, and large-scale wastewater treatment projects further support market expansion. The state’s remote industrial operations also encourage the adoption of durable, energy-efficient blowers capable of handling demanding conditions while reducing maintenance and operational downtime.

Market Dynamics:

Growth Drivers:

Why is the Australia Industrial Air Blowers Market Growing?

Expansion of Food and Beverage Manufacturing Sector

Australia’s food and beverage processing sector continues to expand, supported by rising export opportunities and a growing domestic population. The industry depends heavily on industrial air blowers for essential functions such as pneumatic conveying, efficient product drying and cooling, and maintaining hygienic production conditions throughout manufacturing processes. In August 2024, Coca-Cola Europacific Partners invested USD 105.5 million in a new bottling line at its Moorabbin, Victoria plant, boosting capacity by 23% to produce up to 17.8 million unit cases annually. Such investments in food manufacturing infrastructure directly stimulate demand for advanced blower systems. As food safety regulations become increasingly stringent, manufacturers are adopting oil-free, low-noise blowers with energy recovery systems to ensure contamination-free operations while optimizing production efficiency.

Growing Investment in Wastewater Treatment Infrastructure

Substantial investments in water and wastewater treatment infrastructure are driving demand for aeration blowers across Australia. The Australian Government's National Water Grid Fund, a USD 2.5 billion rolling infrastructure program, supports major water infrastructure investments addressing the continent's water security challenges. The Woodman Point Water Resource Recovery Facility in Perth, the city's largest wastewater treatment plant, is undergoing significant upgrades to increase organic matter processing capacity from 78 to 120 tons daily. Additionally, a major Canberra wastewater treatment facility upgrade will construct a new membrane bioreactor with a treatment capacity of 97 megalitres daily. These infrastructure investments create substantial opportunities for industrial blower manufacturers specializing in aeration and process air applications.

Stringent Mining Safety Regulations and Ventilation Requirements

Australia's mining sector faces increasingly stringent safety regulations mandating comprehensive ventilation systems in underground operations. Australia’s Department of Industry, Science, Energy, and Resources highlights that a majority of underground mining operations are expected to modernize their ventilation systems to comply with increasingly stringent safety requirements. As the underground mining equipment sector expands, ventilation technology continues to be a key focus area. Mining companies are placing greater emphasis on high-efficiency fans, variable speed drives, and energy-recovery systems to reduce power usage while ensuring full safety compliance. The adoption of Ventilation on Demand (VOD) technology and real-time air quality monitoring systems further drives demand for sophisticated blower installations capable of dynamic airflow management. For instance, in January 2025, Minetek Australia unveiled its newest innovation in underground mining ventilation, the Raptor Series. Engineered with advanced technology, the series is designed to provide exceptional efficiency, performance, and operational versatility. It is specifically developed to meet the demanding conditions of hard-rock and metalliferous mining environments across global operations.

Market Restraints:

What Challenges the Australia Industrial Air Blowers Market is Facing?

High Capital Investment and Maintenance Costs

The significant capital expenditure required for advanced industrial blower systems poses a barrier for smaller operations and budget-constrained facilities. High-performance centrifugal blowers with smart control systems and energy-efficient features command premium pricing, while specialized equipment for hazardous environments requires additional investment in corrosion-resistant materials and explosion-proof components. Ongoing maintenance costs and the need for trained technicians further impact total cost of ownership.

Intense Competition from International Manufacturers

Australian blower manufacturers face intensifying competition from international suppliers, particularly those based in Asia-Pacific markets offering competitive pricing. The market structure shows increased import penetration, with global manufacturers establishing local distribution networks and service capabilities. This competitive pressure challenges domestic manufacturers to differentiate through superior service offerings, customization capabilities, and localized support while maintaining price competitiveness.

Cyclical Nature of Key End-Use Industries

The industrial air blowers market is influenced by the cyclical nature of key end-use sectors, particularly mining and construction. Fluctuations in commodity prices, economic conditions, and investment cycles can lead to variable demand patterns. Periods of reduced mining activity or construction slowdowns directly impact equipment procurement decisions, creating uncertainty for manufacturers and requiring adaptive business strategies to navigate market volatility.

Competitive Landscape:

The Australia industrial air blowers market shows moderate competitive intensity, with a mix of established global manufacturers and specialized regional companies. The market structure includes large enterprises with broad product portfolios and extensive service networks, mid-sized firms targeting specific application areas, and local specialists offering tailored solutions for Australian operating conditions. Competition primarily revolves around product innovation, improvements in energy efficiency, service reliability, and overall cost-effectiveness. Strategic mergers and acquisitions are influencing market dynamics by consolidating market positions and broadening product ranges. Increasingly, manufacturers are differentiating through advanced features such as predictive maintenance, IoT-enabled monitoring, and strong sustainability credentials.

Recent Developments:

- September 2024: Volution Group PLC acquired Fantech Australasia from Elta Group for an initial consideration of AUD$220 million, with additional deferred consideration of AUD$60 million payable twelve months after completion. The acquisition, Volution's largest to date, brings established brands including Ideal Air, Air Design, NCS Acoustics, and Systemaire under its umbrella. Fantech reported AUD$177 million in revenue for the financial year ending March 2024, and the acquisition positions Australasia to represent over 30% of Volution's total revenue.

Australia Industrial Air Blowers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Centrifugal |

| Business Types Covered | Equipment Sales, Services |

| End Users Covered | Food and Beverage, Wastewater Treatment, Pharmaceutical, Chemical and Petrochemical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia industrial air blowers market size was valued at USD 114.05 Million in 2025.

The Australia industrial air blowers market is expected to grow at a compound annual growth rate of 3.53% from 2026-2034 to reach USD 155.88 Million by 2034.

Centrifugal blowers dominate the market with a 70% share, driven by their superior efficiency in high-volume applications, lower maintenance requirements, and compatibility with variable frequency drives for energy optimization across HVAC, power generation, and chemical processing applications.

Key factors driving the Australia industrial air blowers market include expansion of food and beverage manufacturing, growing investment in wastewater treatment infrastructure supported by the National Water Grid Fund, stringent mining safety regulations mandating ventilation upgrades, and increasing adoption of energy-efficient solutions aligned with corporate sustainability objectives.

Major challenges include high capital investment requirements for advanced blower systems, intensifying competition from international manufacturers offering competitive pricing, the cyclical nature of key end-use industries like mining and construction, and the need for specialized maintenance capabilities for sophisticated IoT-enabled equipment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)