Australia Industrial Bearings Market Size, Share, Trends and Forecast by Bearing Type, End Use Industry, and Region, 2025-2033

Australia Industrial Bearings Market Size and Share:

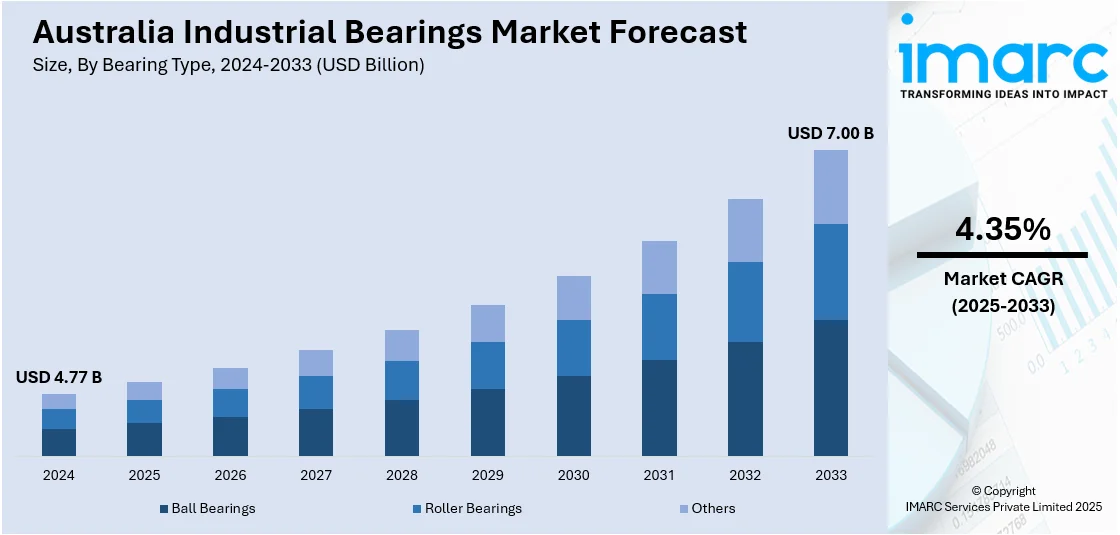

The Australia industrial bearings market size reached USD 4.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.00 Billion by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. The market is driven by increasing demand for energy-efficient and sustainable solutions across various industries in Australia. Growing investments in renewable energy, mining, and manufacturing sectors require advanced industrial bearings that reduce friction and enhance equipment reliability. Additionally, the adoption of smart technologies and automation boosts the need for precision-engineered bearings. These factors collectively fuel innovation and growth, strengthening the Australia industrial bearings market share as industries prioritize performance, durability, and environmental responsibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.77 Billion |

| Market Forecast in 2033 | USD 7.00 Billion |

| Market Growth Rate 2025-2033 | 4.35% |

Australia Industrial Bearings Market Trends:

Growing Demand from the Renewable Energy Industry

Australia's growing emphasis on renewable energy production is generating a huge demand for industrial bearings utilized in energy generation systems. For instance, in September 2024, NSK introduced a low-friction hub unit bearing that cuts friction by 40%, increases EV driving range by 1,000 km per year, with a 2026 global sales target of ¥20 billion. Furthermore, bearings play an important role in wind turbines and solar tracking systems, where they provide smooth performance under changing loads and severe environmental conditions. With Australia racing ahead of carbon reduction targets by installing wind and solar power, the demand for high-performance, long-lasting bearing solutions is increasing. The bearings need to provide long service life, corrosion resistance, and sustain continuous, vibration-intensive operations. With new leading projects unfolding across major states, land and offshore wind farms are witnessing increased bearing applications. Technological innovations in bearing materials and closed bearing technology are emerging to be crucial for maintaining reliability in such challenging conditions. Australia industrial bearings market growth is increasingly fueled by the renewable industry's focus on efficiency and longevity. This trend is a reflection of the wider convergence of industrial technologies with the country's renewable energy objectives and environmental sustainability measures.

To get more information on this market, Request Sample

Mining and construction activities expansion

Mining and construction are the traditional pillars of Australia's economic prowess, and in turn directly affect the requirement for industrial bearings. Industrial bearings are critical in heavy plant equipment like crushers, conveyors, loaders, and excavators, subject to high working loads and harsh operating conditions. Continued infrastructure growth, such as transportation investment and resource mining projects, is driving steady demand for durable bearing solutions that can endure dust, water, and mechanical shock. According to the sources, in April 2024, Newtown Bearing Co expanded its QCB brand, enhancing product line and international coverage, including Australia's industrial bearings market, by introducing the 'QCB Extreme Series' Vibratory Screen Bearings from their Telford facility. Moreover, with mining activities expanding to deeper and more distant areas, there is a growing demand for high-endurance bearings providing greater load-carrying ability and durability. In support of such applications, companies are focusing on product development in sealing technologies, lubrication effectiveness, and thermal endurance. On-going expansion of construction and mining activity in Australia guarantees a continued market for performance-critical bearings. This is a reflection of the strategic value of dependable mechanical elements in ensuring uptime and productivity in Australia's heavy industries.

Automation and Integration of Smart Manufacturing

The industrial sector in Australia is experiencing digitalization, with the use of automation and smart manufacturing systems having an impact on industrial bearing design and operation. In automated production lines and robot systems, bearings need to handle accurate, high-speed motion with reliability and reduced maintenance requirements. The growth of predictive maintenance is driving adoption of smart bearings that are integrated with sensors to monitor temperature, vibration, and loading conditions. The sensors facilitate online performance monitoring and early fault detection, minimizing downtime and maximizing equipment lifespan. As more Australian manufacturers adopt Industry 4.0 technologies, demand for smart bearing systems is likely to increase. These intelligent pieces of equipment are not only enhancing the efficiency of machinery but also finding their place towards overall goals of productivity improvement and cost reduction. The integration of data-based maintenance policies represents a major turn towards bearing applications, making them influential drivers of operational intelligence in Australian industries.

Australia Industrial Bearings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on bearing type and end use industry.

Bearing Type Insights:

- Ball Bearings

- Roller Bearings

- Others

The report has provided a detailed breakup and analysis of the market based on the bearing type. This includes ball bearings, roller bearings, and others.

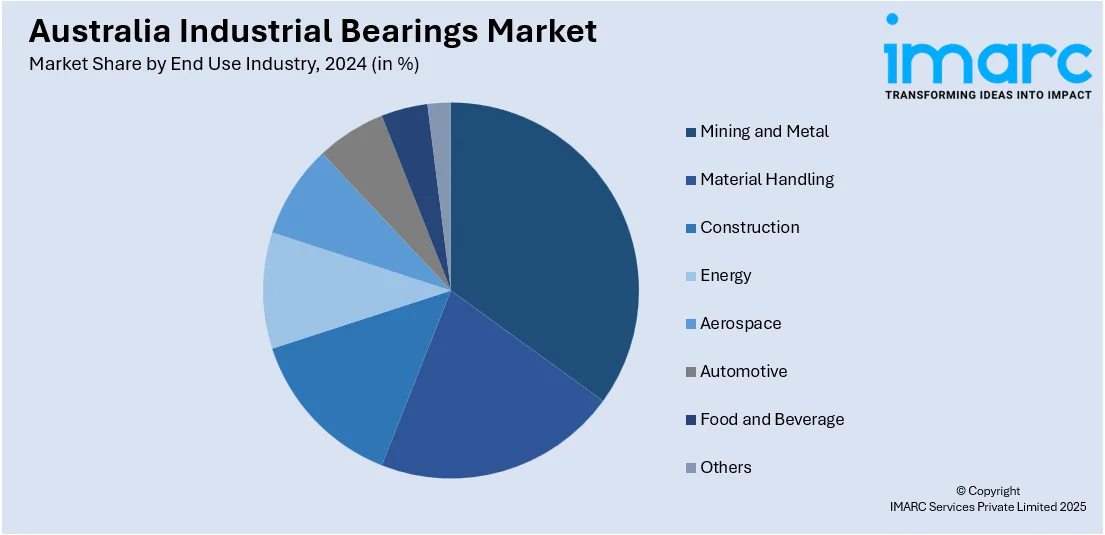

End Use Industry Insights:

- Mining and Metal

- Material Handling

- Construction

- Energy

- Aerospace

- Automotive

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes mining and metal, material handling, construction, energy, aerospace, automotive, food and beverage, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Bearings Market News:

- In October 2024, NTN rolled out a grease-lubricated bearing lubricating unit for machine tool spindle applications. With a dmn value of 1.9 million, it prolongs the life of grease in high-speed operations, does away with the requirement of external power, and ensures energy efficiency—facilitating a transition from air-oil to grease lubrication in carbon-neutral manufacturing.

Australia Industrial Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bearing Type Covered | Ball Bearings, Roller Bearings, Others |

| End Use Industries Covered | Mining and Metal, Material Handling, Construction, Energy, Aerospace, Automotive, Food and Beverage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial bearings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial bearings market on the basis of bearing type?

- What is the breakup of the Australia industrial bearings market on the basis of end use industry?

- What is the breakup of the Australia industrial bearings market on the basis of region?

- What are the various stages in the value chain of the Australia industrial bearings market?

- What are the key driving factors and challenges in the Australia industrial bearings?

- What is the structure of the Australia industrial bearings market and who are the key players?

- What is the degree of competition in the Australia industrial bearings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial bearings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial bearings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial bearings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)