Australia Industrial Boiler Market Size, Share, Trends and Forecast by Fuel, Application, and Region, 2025-2033

Australia Industrial Boiler Market Overview:

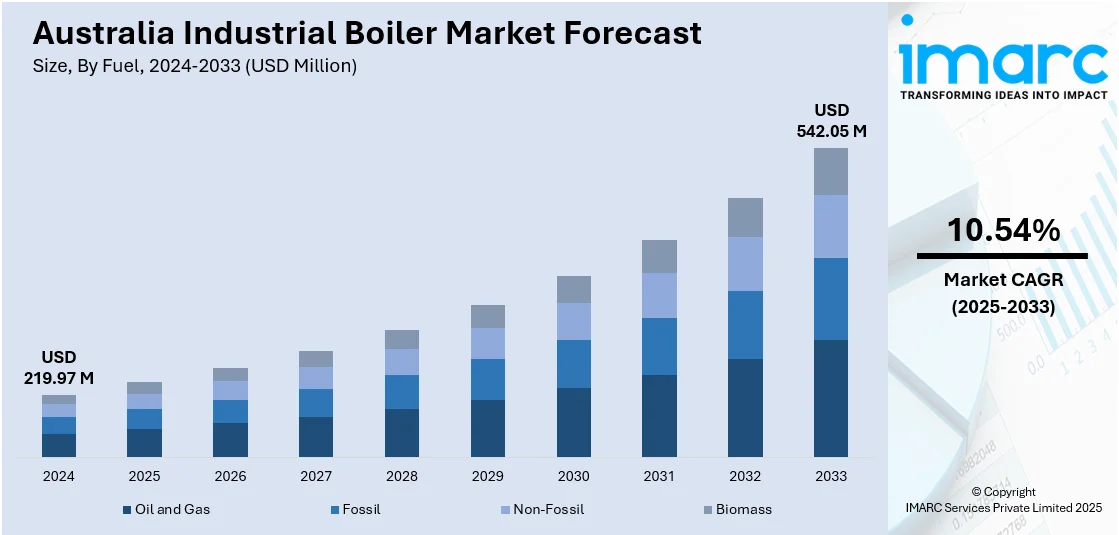

The Australia industrial boiler market size reached USD 219.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 542.05 Million by 2033, exhibiting a growth rate (CAGR) of 10.54% during 2025-2033. The market is driven by stringent environmental regulations, such as the NGER Scheme and Safeguard Mechanism, compelling industries to adopt energy-efficient, low-emission boilers. Rising operational costs and sustainability goals are accelerating demand for advanced combustion systems, smart controls, and biomass-fired boilers, particularly in food processing and mining sectors. Additionally, the need for cost-effective, scalable solutions is enhancing modular boiler adoption among SMEs, further augmenting the Australia industrial boiler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 219.97 Million |

| Market Forecast in 2033 | USD 542.05 Million |

| Market Growth Rate 2025-2033 | 10.54% |

Australia Industrial Boiler Market Trends:

Shift Towards Energy-Efficient and Low-Emission Boilers

The market is experiencing a growing demand for energy-efficient and low-emission boilers, driven by stringent environmental regulations and rising operational costs. During the fiscal year 2022–23, Australia's net energy use grew 2% to 23,294 PJ, with residential and industrial consumption growing 3% and 4%, respectively. At the same time, renewable sources grew by 12% to 325 PJ or 33% of the nation's electricity supply. Energy use from the transport sector jumped by 19% and agriculture by 12%, while manufacturing fell by 4%. With increasing energy intensity and demand in other sectors, the use of effective industrial boiler systems has become more important within the industrial setup of Australia. The Australian government has implemented policies such as the National Greenhouse and Energy Reporting (NGER) Scheme and the Safeguard Mechanism, pushing industries to adopt cleaner technologies. Companies are increasingly investing in condensing boilers, biomass-fired boilers, and advanced combustion systems to reduce carbon footprints and fuel consumption. Additionally, industries such as food processing, pharmaceuticals, and mining are prioritizing boilers with high thermal efficiency to cut energy expenses. Manufacturers are responding by integrating smart controls, IoT-based monitoring, and AI-driven optimization to enhance performance. With sustainability becoming a key business priority, the shift towards eco-friendly boilers is expected to accelerate, supported by incentives for renewable energy adoption and carbon-neutral initiatives.

To get more information on this market, Request Sample

Rising Adoption of Modular and Compact Boiler Systems

The increasing preference for modular and compact boiler systems, especially among small and medium-sized enterprises (SMEs) is propelling the Australia industrial boiler market growth. In June 2024, a study on steam boiler design underscored critical performance parameters for modular, compact systems. These included a volumetric capacity of 0.036 m³ and a peak pressure of 7 bar, in addition to heat transfer rates of 27,224 W/m²K for conduction and 66,878 W/m²K for convection. The geometric boiler had an efficiency rating of 79.7%, and MATLAB results showed that larger boilers can sustain higher pressures and offer better efficiency. The study highlights the importance of thermal efficiency and safety in the design of steam boiler systems for Australian industries, as it aligns with international trends towards more efficient, scalable, and sustainable solutions. These systems offer flexibility, scalability, and lower installation costs compared to traditional large-scale boilers. Industries with fluctuating steam demands, such as breweries, textiles, and chemical processing, benefit from modular designs that allow for easy capacity adjustments. Furthermore, compact boilers require less space and can be quickly deployed in remote or constrained sites, such as mining operations and temporary facilities. Advances in materials and design have also improved their durability and efficiency, making them a cost-effective alternative. As industries seek faster ROI and operational agility, the demand for modular boilers is projected to grow, supported by innovations in plug-and-play boiler solutions and hybrid energy integration.

Australia Industrial Boiler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on fuel and application.

Fuel Insights:

- Oil and Gas

- Fossil

- Non-Fossil

- Biomass

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes oil and gas, fossil, non-fossil, and biomass.

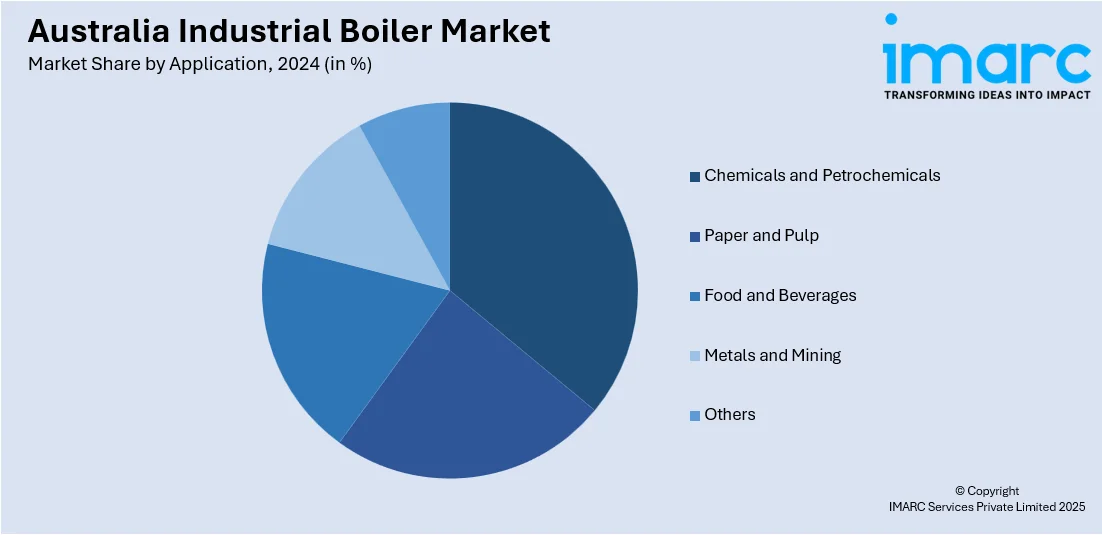

Application Insights:

- Chemicals and Petrochemicals

- Paper and Pulp

- Food and Beverages

- Metals and Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemicals and petrochemicals, paper and pulp, food and beverages, metals and mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Boiler Market News:

- April 30, 2025: Next Cycle launched the Maxa i-290 R290 inverter heat pump series in Australia, featuring 19 models that range from 6.2kW to 170kW, with a coefficient of performance (COP) of up to 4.94. This series is designed to address the HVAC needs of commercial and industrial applications. These advanced heat pumps provide scalable heating, cooling, and water solutions using refrigerants such as R290, which has a low global warming potential (GWP) of 3. This partnership with Maxa marks a significant step towards sustainable, high-efficiency systems for Australia's HVAC and industrial boiler markets, backed by a 7-year warranty and comprehensive training packages.

Australia Industrial Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuels Covered | Oil and Gas, Fossil, Non-Fossil, Biomass |

| Applications Covered | Chemicals and Petrochemicals, Paper and Pulp, Food and Beverages, Metals and Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial boiler market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial boiler market on the basis of fuel?

- What is the breakup of the Australia industrial boiler market on the basis of application?

- What is the breakup of the Australia industrial boiler market on the basis of region?

- What are the various stages in the value chain of the Australia industrial boiler market?

- What are the key driving factors and challenges in the Australia industrial boiler market?

- What is the structure of the Australia industrial boiler market and who are the key players?

- What is the degree of competition in the Australia industrial boiler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial boiler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial boiler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)