Australia Industrial Coatings Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

Australia Industrial Coatings Market Overview:

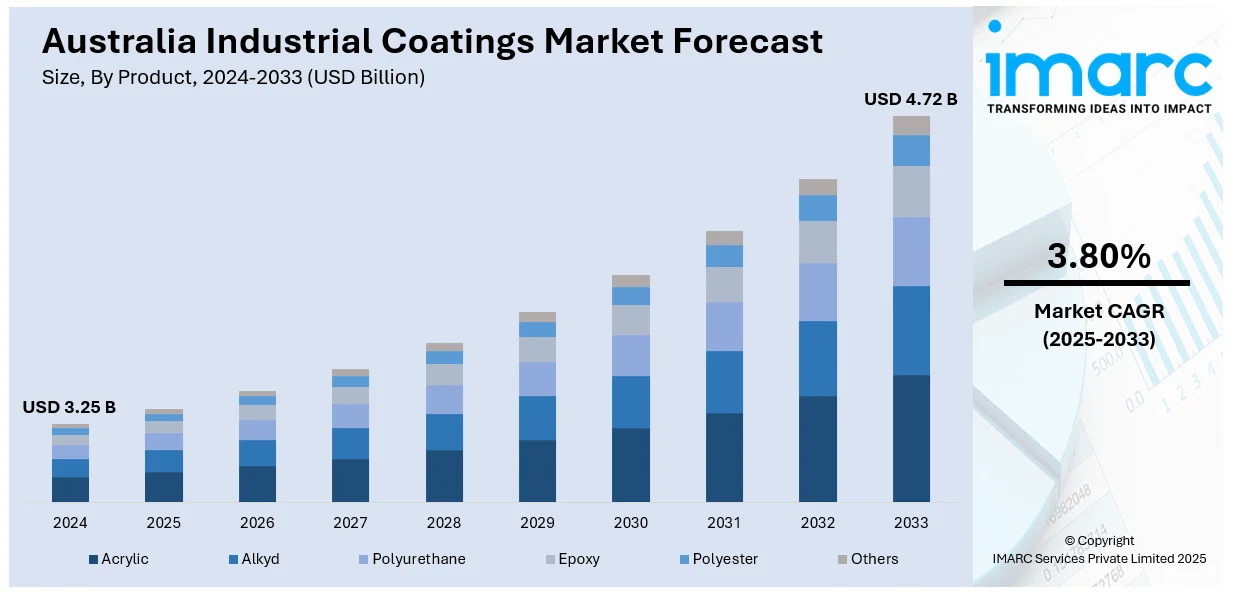

The Australia industrial coatings market size reached USD 3.25 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.72 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. Increasing demand for durable coatings in the construction and automotive industries, rising infrastructure development, and the growing need for protective coatings in mining and manufacturing sectors are facilitating the market growth. Moreover, innovations in eco-friendly, low- volatile organic compound (VOC) coatings, advancements in nanotechnology, and stringent environmental regulations are supporting the market growth. Apart from this, the expansion of the marine sector, the automotive industry's shift towards electric vehicles (EVs), and escalating demand for corrosion-resistant coatings are boosting the Australia industrial coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.25 Billion |

| Market Forecast in 2033 | USD 4.72 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

Australia Industrial Coatings Market Trends:

Increasing Demand for Protective Coatings

The need for protective and durable coatings in the construction and automotive sectors is one of the main drivers of the Australia industrial coatings market. Within the construction industry, coatings have a vital role to play in increasing the longevity and structural soundness of buildings, roads, and infrastructure. With growth in urbanization and ongoing development of residential and commercial property, coatings play a crucial role in offering protection against Australia's harsh climate, such as high UV exposure and saltwater along the coastlines. Just like in the automobile sector, coatings play a vital role in keeping cars resistant to wear and tear, including corrosion through moisture and atmospheric pollutants. Car manufacturers are increasingly taking on high-end coatings that offer protection as well as enhancing beauty, including color stability and high gloss finishes. Further expansion in both industries due to infrastructure and vehicle manufacturing will keep driving the market for high-performance coatings.

To get more information on this market, Request Sample

Rising Infrastructure Development

The market is mostly benefiting from the robust growth in Australia's infrastructure. Development of public infrastructure projects, such as roads, bridges, airports, and government buildings, through government investments have established a continuous demand for coating with durability, corrosion-resistant, and ultraviolet (UV) protection features and hence are enhancing market growth even further. This is supported by the growing interest in coatings which are wear-resistance and durable against long-term degradation in extremely harsh outdoor applications. In addition, the sudden climatic changes within the nation—from humid coastal regions to desert interior—contributed to the need for specialized paints that have the ability to provide protection in harsh weather and temperature fluctuations, are fueling market growth. Apart from this, ongoing infrastructure development is likely to generate a demand for high-performance long-lasting coatings that can protect these structures for years to come, thereby initiating market growth.

Growth of the Automotive Sector and the Need for Advanced Coatings

The growing automotive sector in Australia is a primary factor driving the industrial coatings market. Stable production volumes and regular maintenance requirements have surged the demand for coatings that upgrade vehicle function and appeal, providing a boost to market growth. Coatings help protect vehicles from natural and other elements, such as rust, ultraviolet (UV) rays, and saltwater, while also ensuring structural longevity. In line with this, the growing trend of self-healing and hydrophobic automotive coatings, as well as the burgeoning consumer demand for superior performance coatings, are additional growth-inducing factors. Furthermore, the surging popularity of electric vehicles (EVs) and the trend toward environmentally friendly manufacturing technologies have boosted the demand for low-VOC paints, driving the Australian industrial coatings market growth.

Australia Industrial Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, and end user.

Product Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

Technology Insights:

- Solvent Borne

- Water Borne

- Powder Based

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes solvent borne, water borne, powder based, and others.

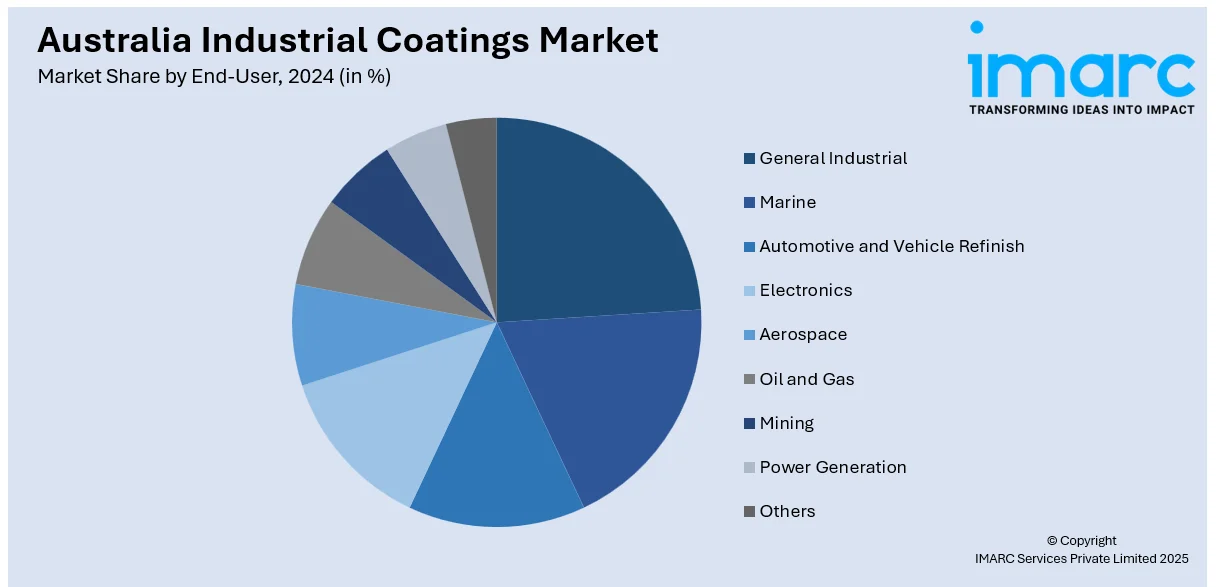

End-User Insights:

- General Industrial

- Marine

- Automotive and Vehicle Refinish

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes general industrial, marine, automotive and vehicle refinish, electronics, aerospace, oil and gas, mining, power generation, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Coatings Market News:

- In 2024, DuluxGroup introduced the 'EnvirO2' line of water-based industrial coatings, emphasizing low-VOC content and sustainable formulations. This initiative aligns with the growing demand for eco-friendly products in the Australian market.

Australia Industrial Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Technologies Covered | Solvent Borne, Water Borne, Powder Based, Others |

| End Users Covered | General Industrial, Marine, Automotive and Vehicle Refinish, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial coatings market on the basis of product?

- What is the breakup of the Australia industrial coatings market on the basis of technology?

- What is the breakup of the Australia industrial coatings market on the basis of end user?

- What is the breakup of the Australia industrial coatings market on the basis of region?

- What are the various stages in the value chain of the Australia industrial coatings market?

- What are the key driving factors and challenges in the Australia industrial coatings market?

- What is the structure of the Australia industrial coatings market and who are the key players?

- What is the degree of competition in the Australia industrial coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)