Australia Industrial Gas Cylinders Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Australia Industrial Gas Cylinders Market Overview:

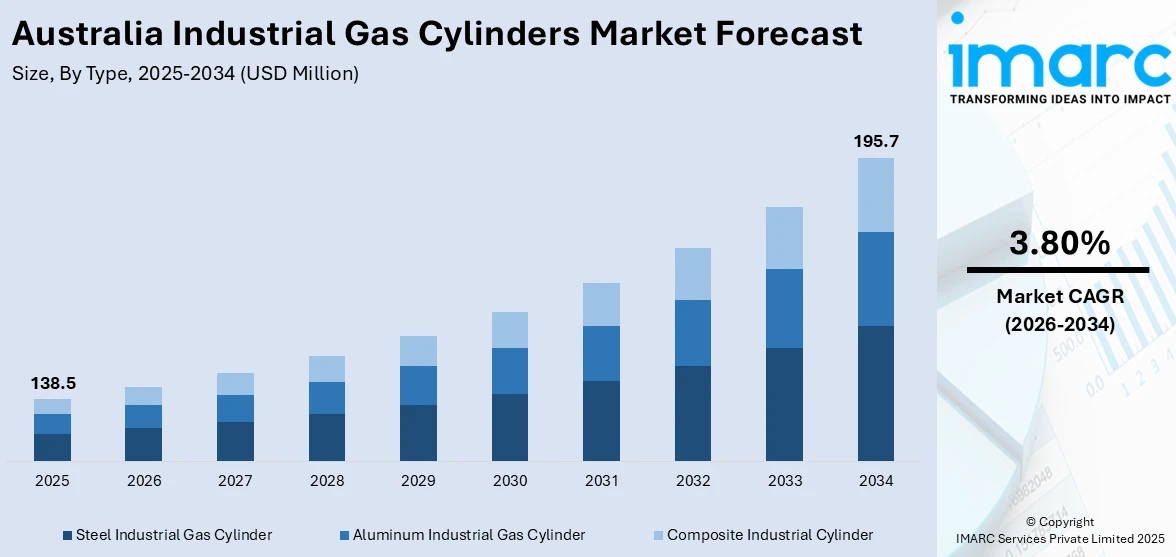

The Australia industrial gas cylinders market size reached USD 138.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 195.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.80% during 2026-2034. The market is driven by rising demand from manufacturing and healthcare sectors, where high-pressure cylinders are essential for welding, medical oxygen, and industrial gas applications. Additionally, the shift toward sustainable solutions, including lightweight composite cylinders and hydrogen-compatible designs, is accelerating due to environmental policies and cost-efficient refillable models. Australia’s focus on clean energy and industrial expansion is further augmenting the Australia industrial gas cylinders market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 138.5 Million |

| Market Forecast in 2034 | USD 195.7 Million |

| Market Growth Rate 2026-2034 | 3.80% |

Australia Industrial Gas Cylinders Market Trends:

Increasing Demand for High-Pressure Gas Cylinders in Manufacturing and Healthcare

The market is experiencing a rise in demand for high-pressure cylinders, driven by growth in the manufacturing and healthcare sectors. Industries such as metal fabrication, automotive, and aerospace rely heavily on gases, including oxygen, argon, and nitrogen for welding, cutting, and inerting applications. Additionally, the healthcare sector’s need for medical oxygen cylinders has risen due to aging populations and increased hospital admissions. Australia's aging population is increasing, with the population in the 65 years and above category making up 16% of the population in 2020, and it is projected to rise between 21% and 23% by 2066. The percentage of individuals aged 85 and older has increased from 0.5% in 1970 to 2.1% in 2020, with further increases projected. This demographic change, combined with the mounting need for healthcare and energy solutions, underscores the growing importance of industries such as industrial gas cylinders in providing environmentally friendly energy solutions to support Australia's aging population. Manufacturers are focusing on lightweight, durable cylinders made from advanced materials such as carbon fiber composites to improve portability and safety. Strict government regulations regarding gas storage and transportation are also pushing companies to adopt high-quality, compliant cylinders. As industrial activities expand and medical needs grow, the demand for high-pressure gas cylinders is expected to rise steadily, presenting opportunities for suppliers to innovate and capture a larger market share.

To get more information on this market Request Sample

Shift Toward Sustainable and Eco-Friendly Gas Cylinder Solutions

Sustainability is propelling the Australia industrial gas cylinders market growth, with companies prioritizing eco-friendly materials and recycling initiatives. Traditional steel cylinders, while durable, have a high carbon footprint due to energy-intensive production processes. In response, manufacturers are introducing cylinders made from recyclable aluminum and composite materials that reduce weight and emissions during transportation. Refillable and reusable cylinder models are gaining traction, minimizing waste and lowering operational costs for end-users. Additionally, the growing adoption of hydrogen as a clean energy source is driving demand for specialized cylinders designed for hydrogen storage and transport. Australia's hydrogen industry is experiencing rapid expansion, with 76 major projects currently under development, of which three are already under construction, all geared toward a clean energy future. By 2023, the country's hydrogen capacity has touched 459 tonnes per year, backed by over $200 billion in investments. This growth highlights the crucial role played by sectors such as industrial gas cylinders in facilitating Australia's transition to a low-emission economy, given their importance in enabling the storage and transportation of hydrogen. Government incentives promoting green energy and circular economy practices further support this shift. As environmental regulations tighten and industries seek sustainable alternatives, the market is expected to see increased investment in innovative, eco-conscious gas cylinder solutions.

Australia Industrial Gas Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Steel Industrial Gas Cylinder

- Aluminum Industrial Gas Cylinder

- Composite Industrial Cylinder

The report has provided a detailed breakup and analysis of the market based on the type. This includes steel industrial gas cylinder, aluminum industrial gas cylinder, and composite industrial cylinder.

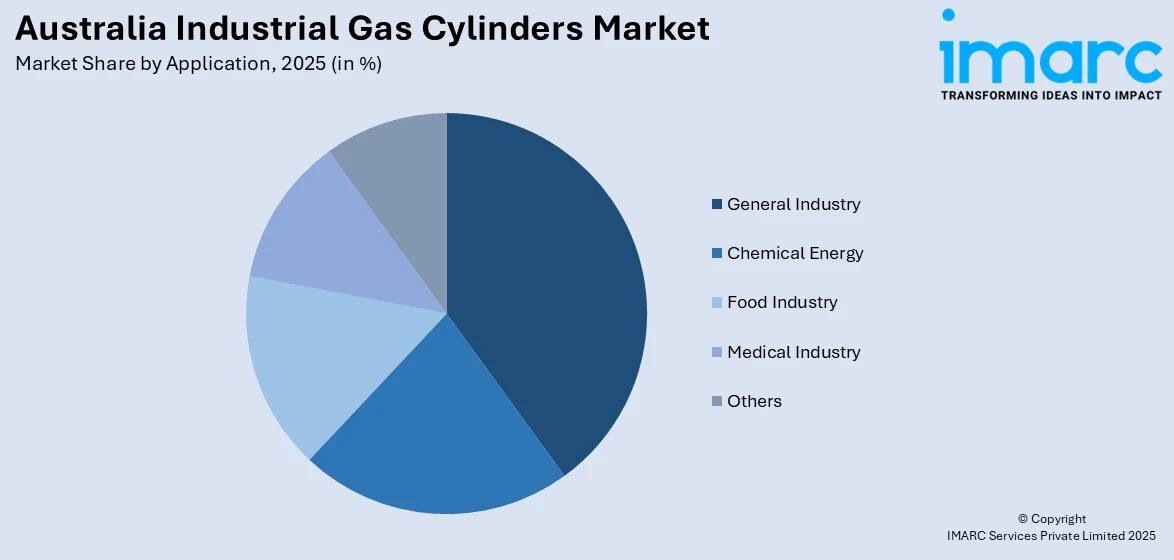

Application Insights:

Access the comprehensive market breakdown Request Sample

- General Industry

- Chemical Energy

- Food Industry

- Medical Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general industry, chemical energy, food industry, medical industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Gas Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steel Industrial Gas Cylinder, Aluminum Industrial Gas Cylinder, Composite Industrial Cylinder |

| Applications Covered | General Industry, Chemical Energy, Food Industry, Medical Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial gas cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial gas cylinders market on the basis of type?

- What is the breakup of the Australia industrial gas cylinders market on the basis of application?

- What is the breakup of the Australia industrial gas cylinders market on the basis of region?

- What are the various stages in the value chain of the Australia industrial gas cylinders market?

- What are the key driving factors and challenges in the Australia industrial gas cylinders market?

- What is the structure of the Australia industrial gas cylinders market and who are the key players?

- What is the degree of competition in the Australia industrial gas cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial gas cylinders market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial gas cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial gas cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)