Australia Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2026-2034

Australia Industrial Gases Market Size and Share:

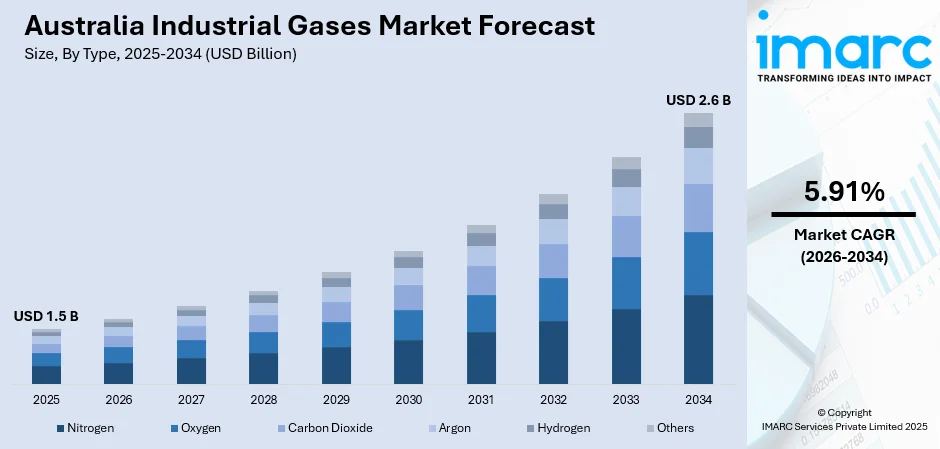

The Australia industrial gases market size reached USD 1.5 Billion in 2025. Looking forward, the market is expected to reach USD 2.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.91% during 2026-2034. The market is driven by the expansion of manufacturing and industrial sectors, the increasing demand for sustainable and green technologies like hydrogen and carbon capture, and technological advancements in gas distribution systems, which enhance efficiency, reduce costs, and ensure more reliable gas delivery across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.6 Billion |

| Market Growth Rate (2026-2034) | 5.91% |

Key Trends of Australia Industrial Gases Market:

Expansion of Manufacturing and Industrial Sectors

Australia's industrial gases market is growing, influenced by the growth of manufacturing and industrial activities. Demand for gases like oxygen, nitrogen, and carbon dioxide in sectors including steel, food processing, and chemicals is increasing. As the nation shifts toward boosting its industrial output and diversifying production, especially in advanced manufacturing, demand for industrial gases increases. This growth is supplemented by the use of automation, which increases production efficiency, further increasing the demand for different gases for welding, cutting, and chemical reactions. The government's initiative for infrastructure development and industrial innovation is also a contributing factor.

To get more information on this market Request Sample

Focus on Sustainability and Green Technologies

The transition to sustainability is a major impetus in the Australia industrial gases market growth. With industries and consumers becoming more environmentally conscious, there is greater emphasis on gases that facilitate green technologies like hydrogen for energy storage, carbon capture, and renewable energy applications. The government's initiative for net-zero emissions by 2050 has propelled investment in technologies that minimize carbon footprints, such as the application of industrial gases in cleaner production technology development. The demand for gases such as carbon dioxide in carbon capture technology and hydrogen for clean energy generation places the market on the path of significant change towards sustainability in the years to come.

Technological Advancements in Gas Distribution Systems

Advancements in technology for gas distribution systems are fueling Australia industrial gases market share. Introduction of better gas handling, storage, and delivery technologies with higher efficiency and safety standards lowers the operational cost and boosts operational efficiency. Integration of digital technologies like automation and real-time monitoring is making supply chain management more efficient, minimizing downtime, and enabling accurate delivery of gas to industries. This trend is especially important in industries such as healthcare and manufacturing, where a continuous supply and tight quality control are essential. In addition, improvements in cryogenic technologies for the liquefaction of gases are making it more economic to transport industrial gases, particularly into remote areas in Australia.

Growth Drivers of Australia Industrial Gases Market:

Rising Demand from Healthcare and Medical Sector

Australia’s healthcare and medical industries are experiencing growing demand for industrial gases such as oxygen, nitrogen, and various specialty gases. The gases are a necessity in various applications, and some of them include respiratory care, surgery, sterilization, as well as medical diagnosis. This has increased the demand for high-purity and consistent supply of medical gases about the growth of hospitals, aged care facilities, and clinics, which can be attributed to the increased government spending on health and to the aging population. Moreover, the current progress of biotechnology, pharmaceuticals, and medical research is developing new applications of specialty gases in labs and manufacturing operations. With the continued focus on healthcare innovation, medical gas suppliers are scaling up their production and distribution capabilities to meet the stringent requirements of the sector, contributing significantly to the Australia industrial gases market demand.

Surge in Mining and Resource Extraction Activities

Australia’s dominant position in the global mining industry is driving consistent demand for industrial gases across exploration, extraction, and refining processes. Oxygen is widely used in metal cutting and smelting, while nitrogen and inert gases play critical roles in preventing oxidation and enabling safe extraction in underground operations. Acetylene and hydrogen are also frequently utilized in welding and metallurgical applications. As international markets call for more critical minerals like lithium, iron ore, copper, and rare earth elements, the volume of gas required in mining support operations continues to grow. Additionally, government backing for mining infrastructure and exploration has further intensified the need for industrial gas solutions. The mining sector’s expansion is thereby reinforcing the industrial gases market and creating long-term growth opportunities for suppliers.

Growing Use in Food and Beverage Processing

The food and beverage industry in Australia is increasingly turning to industrial gases to meet rising consumer expectations for quality, safety, and extended shelf life. Gases such as nitrogen and carbon dioxide are essential in modified atmosphere packaging (MAP), carbonation of drinks, and in preserving freshness during chilling and freezing. With domestic production on the rise and food exports expanding into global markets, demand for reliable and food-grade gas solutions is steadily increasing. These gases help maintain product integrity during transport and storage, reducing spoilage and improving overall supply chain efficiency. Moreover, the growing popularity of ready-to-eat and processed food items is pushing manufacturers to adopt advanced gas-based preservation technologies. This widespread application is significantly contributing to the industrial gases market's development within the food sector.

Government Initiatives of Australia Industrial Gases Market:

Support for Clean Energy and Hydrogen Projects

The Australian government is strongly backing the transition to clean energy, with hydrogen identified as a key pillar in its long-term sustainability goals. Major investments have been directed toward the development of hydrogen hubs, production facilities, and supporting infrastructure. Industrial gases such as hydrogen and oxygen are integral to renewable energy systems, including fuel cells and water electrolysis. Government funding and policy support have encouraged gas companies to ramp up production capacity while adopting greener and more efficient technologies. These efforts are accelerating the commercialization of hydrogen as a viable alternative fuel, stimulating research and private investment across the sector. As a result, Australia is positioning itself as a global leader in clean hydrogen, simultaneously boosting the overall industrial gases market through innovation and low-emission solutions.

Regulatory Frameworks Encouraging Industrial Safety and Quality

The Australian government has implemented stringent regulations to uphold safety, quality, and environmental standards across the industrial gases sector. According to the Australia industrial gases market analysis, these frameworks govern the production, handling, transportation, and storage of gases, ensuring adherence to best practices and minimizing operational risks. Such measures are especially vital in high-sensitivity sectors like healthcare, food, and electronics, where only high-purity, certified gases can be used. The emphasis on compliance has driven manufacturers to adopt advanced monitoring systems, automated filling processes, and traceability technologies to meet regulatory demands. Additionally, regular audits and certification programs incentivize continuous improvement in quality and efficiency. These policies not only protect end users but also elevate industry standards, fostering innovation and helping maintain the global competitiveness of Australia’s industrial gases market.

Incentives for Infrastructure Development in Remote Areas

To improve service accessibility and economic development in remote and regional locations, the Australian government is offering financial incentives such as grants, low-interest loans, and tax benefits for infrastructure projects. These programs are encouraging industrial gas companies to expand their logistics, storage, and distribution networks into underserved areas. Enhanced infrastructure allows providers to supply gases to rural mining operations, remote healthcare facilities, and small-scale manufacturing units with greater efficiency. As a result, companies can tap into new customer bases, while local industries benefit from reliable gas availability. This government-led push is improving regional connectivity, reducing supply chain constraints, and ultimately boosting the domestic penetration of industrial gases. It also ensures balanced market development by bridging the urban-rural service gap, contributing to nationwide industrial growth.

Australia Industrial Gases Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, application, and supply mode.

Type Insights:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others.

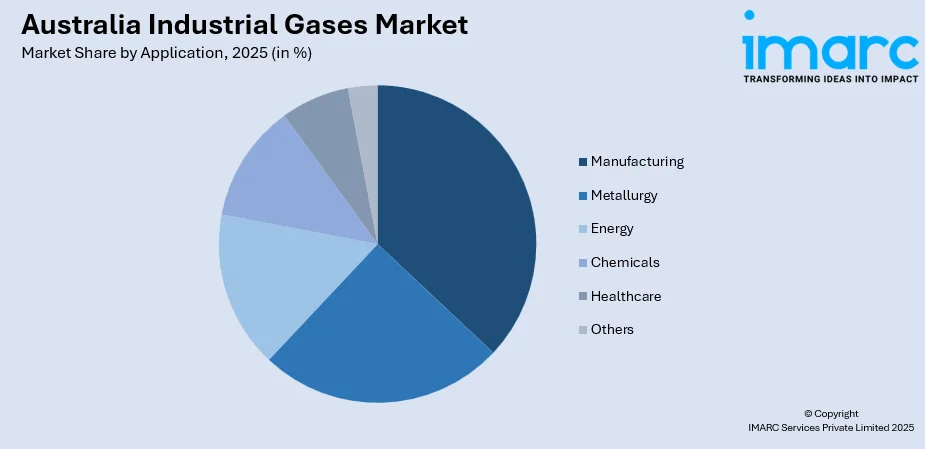

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manufacturing, metallurgy, energy, chemicals, healthcare, and others.

Supply Mode Insights:

- Packaged

- Bulk

- On-Site

The report has provided a detailed breakup and analysis of the market based on the supply mode. This includes packaged, bulk, on-site.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Gases Market News:

- In April 2024, Oxair introduced a new underground rental nitrogen generator designed for use in mining operations at any depth. This innovation eliminates the need for a complex network of piping to deliver nitrogen, offering significant cost savings for mining companies. The generators enhance safety by inerting the air in mine shafts and promote efficiency by generating gases on-site, reducing transportation costs and environmental impact associated with delivering raw materials over long distances.

- In February 2024, EnergyAustralia and GE Vernova launched Australia's first dual-fuel power plant, the Tallawarra B Power Station in New South Wales. The plant uses a blend of natural gas and 5% green hydrogen, aiming for full hydrogen integration by 2025. This 320 MW facility enhances grid reliability, replaces part of the Liddell coal plant’s capacity, and offers rapid startup capabilities while reducing emissions with hydrogen use.

Australia Industrial Gases Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial gases market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial gases market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial gases market in Australia was valued at USD 1.5 Billion in 2025.

The Australia industrial gases market is projected to exhibit a CAGR of 5.91% during 2026-2034.

The Australia industrial gases market is projected to reach a value of USD 2.6 Billion by 2034.

Australia’s industrial gases market is witnessing rising demand from the healthcare, mining, and food sectors. Adoption of high-purity gases in electronics, integration of hydrogen in clean energy projects, and automation in gas distribution are also emerging trends. Sustainability and localized production are further shaping supply chains and technology investments across the industry.

The market growth is driven by expanding industrial activities, rising healthcare needs, and increased food processing. Government investments in hydrogen and green energy infrastructure are accelerating demand. Additionally, the growing use of specialty gases in electronics and pharmaceuticals, alongside strict quality regulations, is fostering innovation and supporting long-term development across multiple sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)