Australia Industrial IoT Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2026-2034

Australia Industrial IoT Market Overview:

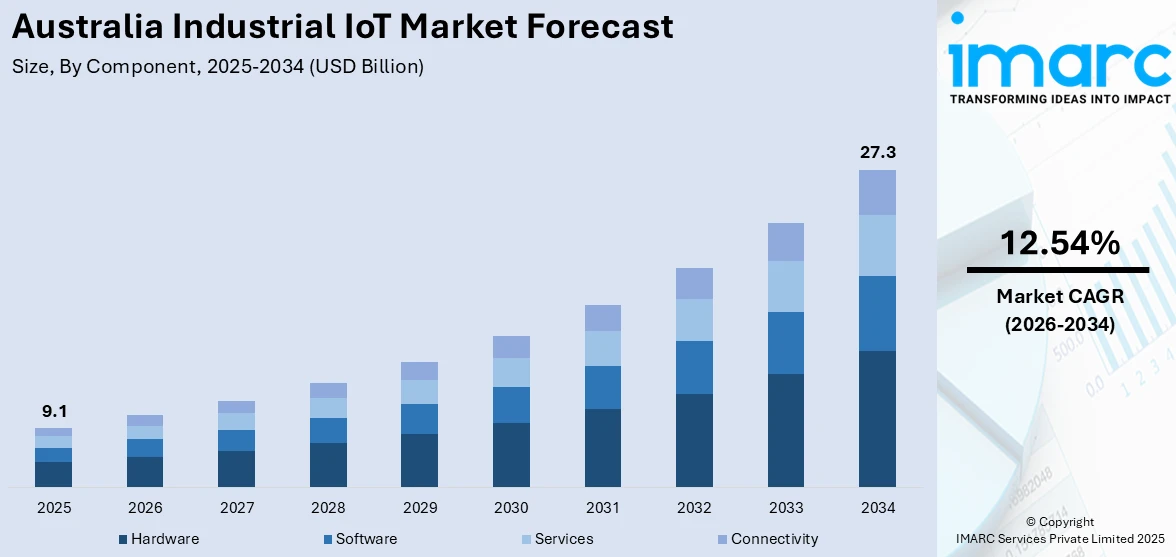

The Australia industrial IoT market size reached USD 9.1 Billion in 2025. Looking forward, the market is expected to reach USD 27.3 Billion by 2034, exhibiting a growth rate (CAGR) of 12.54% during 2026-2034. The market is driven by the growing focus on driving productivity, improving international competitiveness, and spurring job creation through technology adoption, heightened adoption of IIoT in the mining and resources industry, and increasing 5G networks and edge computing capabilities deployment in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.1 Billion |

| Market Forecast in 2034 | USD 27.3 Billion |

| Market Growth Rate 2026-2034 | 12.54% |

Key Trends of Australia Industrial IoT Market:

Government Initiatives and Digital Transformation Policies

Australia's state and federal governments are playing a crucial role in advancing digital innovation in industrial sectors. Initiatives like the Digital Economy Strategy 2030 and investment incentives through the Modern Manufacturing Strategy reflect a country-wide focus on smart technologies. In 2024, in support of the new industrial policy of the government, the 'Future Made in Australia' budget initiatives include a $22.7 billion package of commitments intended to maximize the economic and industrial advantages of the transition to net zero and put Australia on a path to becoming a leader in a transformed world. These initiatives seek to drive productivity, improve international competitiveness, and spur job creation through technology adoption. In addition, programs focusing on advanced manufacturing, intelligent logistics, and green energy reflect the government's goal of developing a digital-first industrial environment. This pledge is leading to fiscal incentives for businesses that invest in industrial Internet of Things (IIoT) infrastructure, especially in industries, such as mining, agriculture, and transportation. Regulatory environments promoting interoperability and data-sharing also facilitate IIoT adoption. Together, these policy initiatives facilitate the initial adoption of IIoT technologies while also providing long-term scalability and sustainability of digital transformation in Australia's industrial sectors.

To get more information on this market Request Sample

Strong Mining and Resources Sector Adoption

The heightened adoption of IIoT in the mining and resources industry is impelling the Australia industrial IoT market growth and development. The sector's capital-intensive large-scale operations, geographic spread, and high capital investment make it a prime target for IIoT solutions. Technologies like real-time monitoring, predictive maintenance, and remote asset management are increasingly being used to enhance operational efficiency and safety. Country mining companies are quickly adopting sensor networks, autonomous equipment, and data analytics to maximize production and minimize environmental footprints. For example, organizations are using IIoT for real-time fleet operations and remote operation centers. Such innovations enhance decision-making through actionable insights from huge amounts of operational data. In 2024, a unique remote operations facility was built for users of the Australian Automation and Robotics Precinct (AARP) in Perth’s north, presenting innumerable businesses the access to cutting-edge technology.

Emergence of 5G and Edge Computing Infrastructure

5G networks and edge computing capabilities deployment in Australia is a transformative enabler of IIoT adoption. 5G gives low latency and high-speed connectivity, crucial to real time industrial applications like autonomous machinery, remote diagnostics and augmented reality (AR) based maintenance. The technology is most useful in the manufacturing, logistics and utilities industries, where continuous data flow is vital for day-to-day operations. Edge computing is complemented by 5G, which enables data to be processed nearer to the point of origin, lessening the requirement to push information to cloud-based platforms. This enables quicker decision-making and improves the security of data and lowers bandwidth expense. With Australian businesses aiming to streamline operations using automation and data analytics, the development of 5G and edge technologies gives the backbone infrastructure for scalable IIoT solutions, which further supports the growth of Australia industrial IoT market demand. In 2024, ZEDEDA, the edge management and orchestration leader, announced strategic collaborations with Anthosa Consulting and Centreon to bring state-of-the-art operational technology (OT) advancements to Asia, Australia and New Zealand.

Growth Drivers of Australia Industrial IoT Market:

Rapid Digital Transformation of Key Industries

Australia's industrial IoT market is being largely propelled by the widespread digital transformation taking place across key industries like manufacturing, utilities, agriculture, and logistics. Companies within these sectors are making more significant investments in digital technologies to boost productivity, reduce the costs of operations, and establish competitive advantages in domestic and international markets. Real-time monitoring, automation, and predictive maintenance—all of which contribute to more efficient operations—are made possible by industrial IoT. Specifically, the move toward smart factories and connected assets is gaining importance for Australian manufacturing as businesses seek to address the changing needs of high-quality, customized production. Likewise, water utilities and utilities companies are implementing IIoT technologies to enhance infrastructure efficiency and resource utilization, particularly in regions experiencing drought or high demand. This broad digitization movement is building a solid ground for IIoT adoption in Australia, as companies look toward scalable, cloud-based technologies to transform age-old industrial processes.

Emphasis on Sustainability and Energy Efficiency

The increasing national interest in sustainability and energy efficiency is yet another strong inducement to the industrial IoT market in Australia. With increased environmental awareness and government policies with respect to emissions and energy consumption becoming increasingly stringent, industries are compelled to track and minimize their footprint on the environment. The IIoT technology provides instant data collection and analysis that enables industrial operators to monitor energy consumption, optimize equipment performance, and minimize waste. For instance, IIoT can be employed by manufacturers to optimize processes for less emission, while energy companies can improve the balancing of supply and demand using smart grid technology. Farming is also an industry where IIoT is utilized to track soil moisture, water consumption, and the health of crops—key in a nation plagued regularly by drought and climate fluctuation. The convergence of sustainability objectives and the capabilities of IIoT constitutes a strong incentive for businesses to attain compliance with the environment and cost reductions, rendering green technology a great motivator for IIoT deployment.

Rising Need for Supply Chain Efficiency and Transparency

Another strong driver for the growth of Australia industrial IoT market share is the rising need for supply chains to be more transparent, traceable, and efficient. As global trade patterns grow more sophisticated and consumer expectations increase, companies throughout Australia are looking to IIoT technologies to raise visibility throughout production, logistics, and inventory management. This applies specifically to industries such as food and beverages, pharmaceuticals, and agriculture—where supply chain integrity, temperature management, and real-time visibility all come into play. IIoT-enabled technologies like cloud-based analytics platforms, RFID tagging, and smart sensors assist companies in tracking assets along the entire supply chain, avoiding wastage, and minimizing the impact of disruption quickly. Furthermore, Australia's internal distance and geographical remoteness present additional logistical issues which can be solved using IIoT by streamlining transport routes, minimizing fuel consumption, and enhancing delivery times. As supply chain resilience becomes a national priority, especially in light of recent global disruptions, IIoT adoption is expected to accelerate across industries.

Opportunities of Australia Industrial IoT Market:

Enhancing Agricultural Productivity Through Smart Farming

There are a lot of prospects for industrial IoT (IIoT) applications in smart farming due to Australia's extensive and varied agricultural terrain. Considering the nation's dependence on agriculture as a principal sector of economic activity, and the effects of drought, unpredictable climates, and shortages of labor, there is increasing demand for effective, technology-based solutions. IIoT solutions can revolutionize conventional agricultural practices by facilitating remote monitoring of soil, crop condition, water usage, and livestock movement. In areas such as Western Australia and New South Wales, where extensive agriculture is practiced, networked sensors and smart irrigation systems can assist farmers in taking real-time decisions that maximize yields and minimize waste of resources. Integration with satellite imaging, drones, and weather forecasting equipment further adds to predictive senses, making agriculture more adaptive to environmental shifts. As demand for sustainable and traceable food production grows, IIoT provides a potent set of tools for transforming Australian agricultural operations and guaranteeing long-term industry expansion.

Opportunities in Modernizing Legacy Infrastructure

According to the Australia industrial IoT market analysis, the region’s challenge lies in its ageing industrial infrastructure in most industries, including utilities, transport, and energy. This presents a significant opportunity for IIoT solutions to aid in modernization processes using digitization and automation. For example, most regional water utilities continue to use manual systems for monitoring and maintenance. The integration of IIoT-enabled sensors and remote diagnostics can significantly enhance operational efficiency, lower maintenance expenses, and prolong asset life. Likewise, the power industry is shifting toward decentralized and renewable forms of power. IIoT is capable of making grid management smarter, allowing for real-time load balancing and improved integration of renewables like wind and solar into the national grid. Transport infrastructure, especially in freight and logistics, also gains from IIoT through smarter vehicle tracking, predictive maintenance, and real-time traffic information. These modernization initiatives are essential for enhancing performance and safety while also to address sustainability and regulatory objectives in the fast-changing industrial landscape of Australia.

Local Innovation and Export Potential

Australia's expanding network of tech startups, research centers, and high-tech manufacturers provides excellent potential for local innovation in the industrial IoT area. Indigenous firms are crafting customized IIoT solutions that target Australia-specific issues, including remote mining operations, environmental monitoring in agribusiness, and energy optimization in extreme environments. This localized know-how provides Australian businesses with a competitive advantage in developing hardened, scalable IIoT platforms appropriate to local conditions. Additionally, there is a great potential for the export of these technologies to foreign markets that have comparable geography and industry profiles, for example, portions of Southeast Asia, Africa, and Latin America. Innovation support from the government, as well as rising investment in STEM education and digital infrastructure, is assisting in developing a pipeline of talent and R&D capability. As international demand for industry automation and connectivity expands, Australia has a strong potential to become a leading adopter, producer and exporter of advanced IIoT solutions.

Government Support of Australia Industrial IoT Market:

National Strategies Encouraging Industry 4.0 Adoption

The Australian government has been proactive in the facilitation of Industrial IoT (IIoT) technology adoption as part of a wider initiative to develop Industry 4.0 capabilities throughout the country. Economic and productivity advantages of digital transformation being realized by the government, federal plans have been initiated to assist the traditional sectors in moving toward smart manufacturing and key linked operations. Federal schemes like Industry Growth Centres Initiative and the Modern Manufacturing Strategy are planned to grant funding, networking possibilities, and access to skill. These initiatives target priority industries such as advanced manufacturing, mining, and food and agribusiness, all of which are poised to gain from IIoT uptake. The government is also encouraging collaborations between research institutions and industry to drive technology development and adoption. By making access to innovation easier and pushing for knowledge sharing, Australia is developing an environment where medium and small businesses can adopt digital technologies and prepare their businesses for the future through IIoT integration.

Government Support for Regional and SME Digital Transformation

One of the main areas of government support for Australia's industrial IoT market is facilitating digital transformation for small and medium enterprises (SMEs) and regional companies. These companies are hindered by limited technical know-how, high capital costs at the point of purchase, and challenges in accessing innovative technology. In response to these issues, federal and state governments have launched specific grant programs, digital capability audits, and training programs for SMEs to implement IIoT and other smart technologies. For instance, digital innovation centers and regional technology precincts are being developed to link businesses with support networks, research collaborators, and pilot programs. These efforts are especially crucial in a nation such as Australia, where geographic dispersion and economic dependence on regional sectors make inclusive digital development a matter of national importance. In providing SMEs with the capabilities and understanding to adopt IIoT, the government is taking steps to ensure that innovation is made accessible across the economy rather than merely to large companies.

Regulatory Support and Standards Development

In addition to financing and training, the Australian government is also taking a key role in creating the regulatory and standards regime required for secure, safe, and efficient IIoT rollout. Organizations like Standards Australia and the Department of Industry, Science and Resources are collaborating to bring national policy into line with global standards on cybersecurity, data exchange, and system interconnection—critical issues in the industrial IoT sector. Such regulatory clarity is critical to establishing business trust in embracing IIoT technologies, especially in industries that deal with sensitive or mission-critical information such as energy, healthcare, and defense manufacturing. Furthermore, the government's role in influencing ethical and responsible use of technology, such as of AI and automation in IIoT systems, guarantees digital transformation in a manner that reconciles innovation with accountability. These initiatives contribute to a reliable climate for IIoT uptake, fostering investment and placing Australia on the cutting-edge of the industrial technology sphere.

Challenges of Australia Industrial IoT Market:

Limitations in Connectivity and Infrastructure in Rural and Remote Locations

Perhaps the biggest problem hindering the take-up of Industrial IoT (IIoT) in Australia is the unavailability of good connectivity in remote and rural areas. Most of Australia's industrial operation—especially in mining, agriculture, and energy—is concentrated in geographical far-flung locations that may not have regular access to high-speed internet or mobile networks. This constraint slows down the complete rollout of IIoT systems that depend on real-time data transmission, cloud computing, and far-end monitoring. While satellite internet and private network facilities are on the horizon, they may be costly and not always scalable to small operators. The urban-rural digital divide also generates uneven innovation and improvement in efficiency opportunities. If high-level infrastructure investment and policy enforcement in favor of rural connection are not forthcoming, the potential of IIoT in some of Australia's most economically critical industries may be left unexploited. This presents an obstacle to internal operational enhancements along with national competitiveness and productivity.

Skills Shortage and Workforce Readiness

Australia's industrial IoT market also suffers from a substantial shortage of skills, especially in data analytics, automation, cybersecurity, and systems integration. With advancing IIoT technologies becoming increasingly complex and pervasive, there is an increased need for a workforce that can manage, interpret, and secure the tremendous amount of data these systems produce. Yet many Australian traditional manufacturing industries remain to move away from manual or legacy systems, and there is a discernible shortage between existing talent and digital skills needed. This gap is particularly difficult for regional and small-to-medium businesses to deal with since they can find it hard to recruit or retain professional staff. While both government and schools are now increasing training in the areas of STEM fields, the rate of technology advancement tends to lag behind readiness of the workforce. Without specific action to reskill existing staff and include digital skills as part of vocational training, numerous Australian industries could fall behind IIoT adoption because of human resource issues.

Integrations with Existing Systems and High Costs of Implementation

Another significant impediment to IIoT adoption in Australia is the challenge of merging new technologies with legacy systems. The majority of industrial processes still make use of outdated software and gear that was not designed with connectivity or interoperability in mind. It can be costly and disruptive to upgrade or replace existing systems to accommodate IIoT capabilities, especially for businesses with narrow profit margins. In industries such as utilities, transportation, and manufacturing, the necessity of continuous operation makes it even more challenging to transition. Additionally, IIoT deployment tends to demand significant upfront investment in sensors, data platforms, cybersecurity solutions, and training, which can drive away smaller companies or those that are leery of long-term return on investment. Though the advantages of IIoT, predictive maintenance, energy efficiency, real-time decision-making, are obvious, the initial expenses and integration issues continue to hold back adoption. Until there are more scalable, affordable solutions and clearer migration paths, however, many Australian companies remain cautious about adopting industrial IoT technology in full.

Australia Industrial IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on component and end-user.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

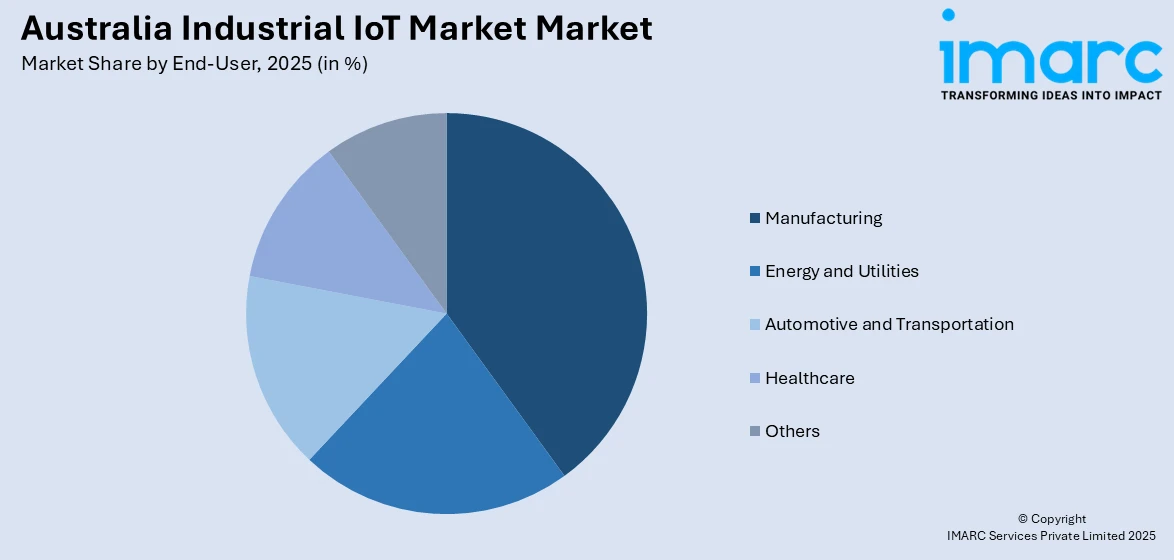

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes manufacturing, energy and utilities, automotive and transportation, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial IoT Market News:

- In September 2025, prominent industrial IoT firm M2M Connectivity introduced a fresh IoT service aimed at the solar sector in Australia. The service aims to facilitate the adoption of solar energy for homes and businesses while assisting retailers and installers in complying with changing connectivity standards. The service, referred to as M2M SolarConnect, merges data plans with equipment – enabling retailers to oversee energy generation from a distance. The introduction comes as a reaction to the swift expansion of the Australian solar sector, which has increased by an average of 21% since 2005 and presently constitutes 12.4% (March 2025) of Australia’s energy provision. It aims to help retailers and installers achieve compliance with stringent state-specific dynamic export limit (DEL) and CSIP-AUS regulations established by distributed network service providers (DNSPs), necessitating that energy consumption be remotely monitored and managed through LTE networks.

- In May 2025, Sateliot, the pioneering company providing 5G standard-based connectivity through non-terrestrial networks (NTNs) with its own LEO satellite constellation, officially launched in the Australian market, obtaining various contracts and getting ready to connect more than 300,000 IoT devices. These deployments equate to more than $15 million AUD in yearly recurring revenues. Having obtained regulatory approvals, Sateliot is now authorized for NTN services throughout Australia. This guarantees complete adherence to national communication regulations and facilitates extensive IoT implementations in rural and remote areas—regions where conventional networks are inadequate. The launch of commercial services is anticipated in the latter part of 2025.

- In August 2025, the Australia-based wireless tech firm received the esteemed 2025 IoT Emerging Technology Award from IoThinkTank for transforming wireless infrastructure with its advanced Wi-Fi HaLow solutions. At the heart of this acknowledgment is Morse Micro’s MM8108 chip, which consistently advances the limits of power-efficient, long-range, high-throughput IoT connectivity.

Australia Industrial IoT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End-Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial IoT market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial IoT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial IoT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia industrial IoT market was valued at USD 9.1 Billion in 2025.

The Australia industrial IoT market is projected to exhibit a CAGR of 12.54% during 2026-2034.

The Australia industrial IoT market is expected to reach a value of USD 27.3 Billion by 2034.

Key trends in Australia industrial IoT market include increased adoption of smart sensors, edge computing, and AI-driven analytics. There is growing focus on remote monitoring, predictive maintenance, and energy efficiency. Industries are also embracing cybersecurity measures and cloud integration to support scalable, data-driven operations across diverse and distributed environments.

The Australia industrial IoT market is driven by rapid digital transformation, a national push for sustainability, and modernization across sectors like agriculture, mining, and manufacturing. Government support, rising demand for automation, and increased focus on operational efficiency are also accelerating adoption of connected technologies across both urban and remote industrial environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)