Australia Industrial Motors Market Size, Share, Trends and Forecast by Type of Motor, Voltage, End Use, and Region, 2025-2033

Australia Industrial Motors Market Overview:

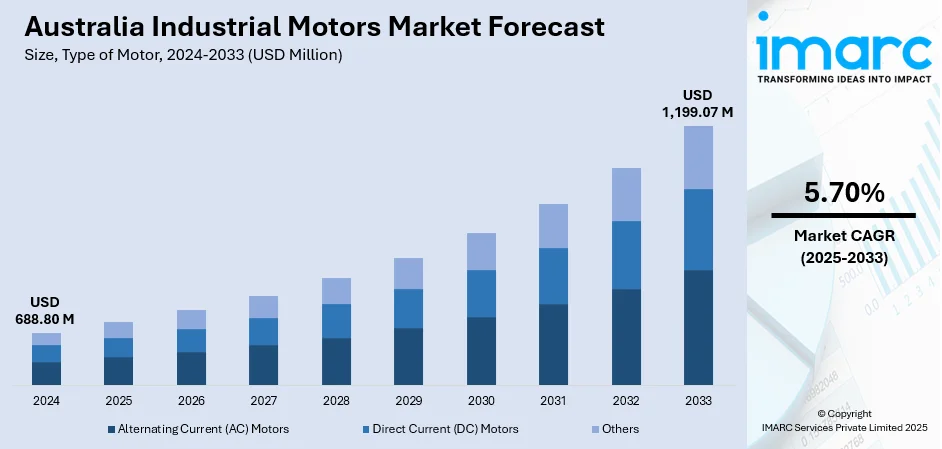

The Australia industrial motors market size reached USD 688.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,199.07 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. Increasing application of automation and digitalization, innovation in renewable energy projects, and motor technology development are propelling the market. Further, the escalating demand for energy-efficient solutions, electric vehicle growth, rising mining activities, infrastructural development, and the shift towards predictive maintenance are promoting market development. Apart from this, food and beverages industry development, manufacturing and robotics investment, government support for local industries, environmental policies, and the need for high-performance motors in various applications are boosting the Australia industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 688.80 Million |

| Market Forecast in 2033 | USD 1,199.07 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Australia Industrial Motors Market Trends:

Industrial Automation and Digitalization Trends

The trend towards industrial automation is one of the key drivers of the Australian industrial motors market. As industries across segments adopt automation systems to improve efficiency, accuracy, and productivity, the demand for high-performance industrial motors has increased. In manufacturing plants, for instance, robot-based, conveyor belt, and machine-based automated systems require motors that can run smoothly and with minimal downtime. These systems are today powered by intelligent, high-performance motors that have the ability to adapt to challenging tasks. Further, the integration of digital technologies such as artificial intelligence (AI) and the Internet of Things (IoT) in manufacturing processes necessitates the use of motors with high-end control features and remote monitoring. Digitalization enables ease of operations, reduces human errors, and streamlines energy consumption, which encourages manufacturers to invest in motors that are compatible with these advancements in technology. Apart from this, as industries aim to optimize their overall productivity while keeping operating costs at a bare minimum, the trend of automation is only set to rise, fueling demand for improved and more sophisticated industrial motor solutions, further boosting the development of the Australia industrial motors market growth.

To get more information on this market, Request Sample

Renewable Energy Projects

Australia's focus on investing in renewable energy projects, including wind and solar power, has also contributed significantly to the growth of the industrial motors market. Industrial motors form an integral component of renewable energy generation, particularly in wind turbines and solar power units, where motors are utilized to drive various components such as fans, generators, and trackers. As Australia works to expand its renewable energy capabilities and reduce its carbon footprint, it is generating an increasing demand for high-performance motors to enable these technologies. Wind turbines, for instance, employ dedicated motors to transform wind energy into electricity, and solar power installations use motors to follow the path of the sun and maximize energy uptake. The government's renewable energy targets, along with clean energy investments by the private sector, have given a favorable climate for the uptake of industrial motors. This push for cleaner, more sustainable energy not only supports the growth of the industrial motors market but also energizes innovation in motor technology as manufacturers develop more efficient and sustainable products for the applications of the renewable energy sector.

Advancements in Motor Technology

Technological progress in the field of motor design and operation is a key driver of the growth of Australia's industrial motors market. Over time, new technologies such as the development of brushless motors and permanent magnet synchronous motors (PMSMs) have revolutionized the market. Brushless motors, which consume no brushes and commutators, are more efficient, offer a higher working life, and involve less maintenance compared to traditional motors. These are thus optimally suited for uses requiring high performance and dependability. Permanent magnet synchronous motors (PMSMs) do offer higher torque density, efficiency, and control across various speeds, and they are consequently used extensively in uses such as robotics, heating, ventilation, and air conditioning systems, and automotive industries. The focus on energy efficiency is driving motor manufacturers to develop increasingly more advanced, low-energy consuming solutions that fit the increasingly stringent energy standards. Notably, in 2024, Schneider Electric announced the launch of its new IE5-class ultra-premium efficiency motors in the Australian market, aimed at helping industries cut energy consumption and operational costs while boosting sustainability. With ongoing innovation in motor technology, industries can today have motors that not only are more efficient and reliable but also can be embedded with smart systems for enhanced control and automation.

Australia Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of motor, voltage, and end use.

Type of Motor Insights:

- Alternating Current (AC) Motors

- Direct Current (DC) Motors

- Others

The report has provided a detailed breakup and analysis of the market based on the type of motor. This includes alternating current (AC) motors, direct current (DC) motors, and Others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

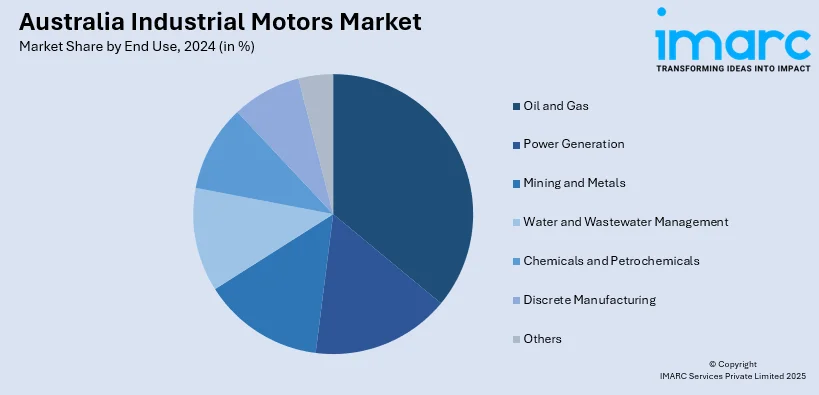

End Use Insights:

- Oil and Gas

- Power Generation

- Mining and Metals

- Water and Wastewater Management

- Chemicals and Petrochemicals

- Discrete Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Motors Market News:

- In 2025, Kite Magnetics, a local startup in Victoria, is establishing a state-of-the-art manufacturing facility in Melbourne’s southeast. The facility will scale production of its Aeroperm® technology, which enables ultra-efficient electric motors. This move, backed by the Victorian Government, positions Victoria as a leader in clean technologies.

Australia Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Motors Covered | Alternating Current (AC) Motors, Direct Current (DC) Motors, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Uses Covered | Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial motors market on the basis of type of motor?

- What is the breakup of the Australia industrial motors market on the basis of voltage?

- What is the breakup of the Australia industrial motors market on the basis of end use?

- What is the breakup of the Australia industrial motors market on the basis of region?

- What are the various stages in the value chain of the Australia industrial motors market?

- What are the key driving factors and challenges in the Australia industrial motors market?

- What is the structure of the Australia industrial motors market and who are the key players?

- What is the degree of competition in the Australia industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)