Australia Industrial Packaging Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

Australia Industrial Packaging Market Overview:

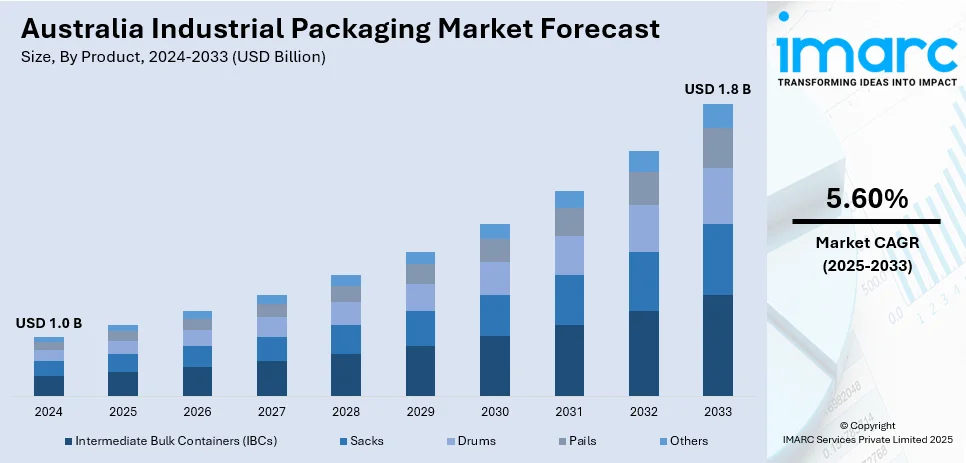

The Australia industrial packaging market size reached USD 1.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. Significant expansion in manufacturing sector, increase in exports, demand for specialized bulk containers, trade-driven compliance standards, sustainability-focused material innovation, growth in mining output, agricultural sector packaging needs, integration of digital tracking systems, rise in environmental compliance measures, and demand for high-resilience packaging formats are some of the factors positively impacting the Australia industrial packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.0 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Market Growth Rate 2025-2033 | 5.60% |

Australia Industrial Packaging Market Trends:

Expansion of Manufacturing and Export-Oriented Industries

The ongoing expansion in Australia’s manufacturing and export-oriented sectors remains a fundamental driver behind the rising significance of the industrial packaging market. This trend is supported by consistent demand for robust and specialized packaging solutions that meet the stringent standards of overseas markets, particularly in sectors such as chemicals, pharmaceuticals, and food processing. Companies are investing in innovative packaging materials to protect goods against environmental factors, contamination, and logistical handling. These developments directly correlate with the increasing Australia industrial packaging market demand held by industrial packaging suppliers catering to all these sectors. In parallel, Australia’s strategic geographic location has reinforced its role in regional trade, leading to growing import-export activities. As a result, firms in the industrial packaging space are aligning product development strategies to support global distribution needs, while simultaneously optimizing packaging logistics. Additionally, sustainability mandates are influencing material choices, prompting innovation in recyclable and biodegradable packaging alternatives that meet industrial scale requirements. On April 7, 2025, Ahlstrom announced that its Sulpack® flexible packaging products have received home compostability certification from the Australasian Bioplastics Association (ABA) in Australia and New Zealand. Sulpack® is a PFAS-free parchment paper designed for fresh and greasy food packaging, like butter wraps and cheese interlayers, offering a natural grease barrier. This certification, along with existing European and North American compostability certifications, enhances Ahlstrom’s commitment to sustainability and supports customers in meeting their environmental goals. These regulatory and operational trends have significantly influenced Australia industrial packaging market growth, prompting companies to explore flexible packaging architectures that balance strength, weight, and environmental considerations.

To get more information on this market, Request Sample

Growth in Mining and Agricultural Commodities Sector

The mining and agricultural sectors, two of Australia’s most prominent industries, are major contributors to the demand for industrial packaging solutions. As these sectors experience increased output, the need for secure and functional bulk packaging becomes critical. Mining operations utilize industrial packaging to transport minerals, ores, and chemicals safely, minimizing environmental hazards and adhering to safety regulations. These requirements have led to the introduction of packaging innovations such as UV-resistant bulk bags, sealed drums, and high-capacity flexible intermediate containers. The continuous rise in material volume transported across long distances underscores the growing Australia industrial packaging market outlook for specialized packaging systems tailored to these high-impact industries. Packaging vendors are responding by developing resilient packaging options that withstand rough handling, temperature fluctuations, and extended storage durations. On July 16, 2024, SIG introduced a new recycle-ready bag-in-box packaging for water in Australia, developed using SIG Terra RecShield, a polymer-based material that replaces aluminum. This innovation aligns with Australia's 2025 National Packaging Targets, promoting sustainable packaging practices and contributing to a circular packaging system. Moreover, digital supply chain technologies are being increasingly adopted within these industries, supporting demand forecasting and inventory planning that hinge on reliable packaging availability. As such, integrated packaging solutions embedded with track-and-trace technologies are being embraced to enhance supply chain visibility. Furthermore, environmental compliance continues to shape packaging strategies, with pressure mounting from both domestic regulations and international stakeholders. These dynamics indicate clear upward Australia industrial packaging market trends for tailored, high-strength, and eco-conscious packaging infrastructure that aligns with sector-specific logistics and environmental imperatives.

Australia Industrial Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Intermediate Bulk Containers (IBCs)

- Sacks

- Drums

- Pails

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes intermediate bulk containers (IBCs), sacks, drums, pails, and others.

Material Insights:

- Paperboard

- Plastic

- Metal

- Wood

- Fiber

The report has provided a detailed breakup and analysis of the market based on the material. This includes paperboard, plastic, metal, wood, and fiber.

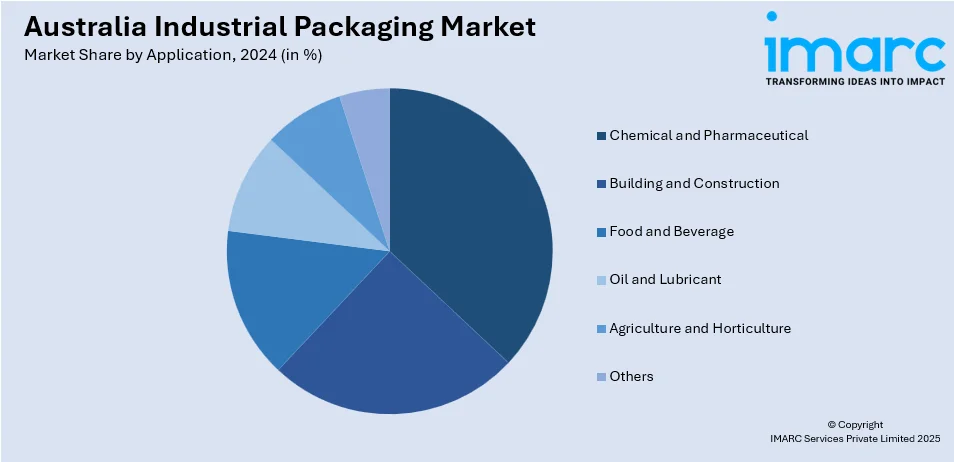

Application Insights:

- Chemical and Pharmaceutical

- Building and Construction

- Food and Beverage

- Oil and Lubricant

- Agriculture and Horticulture

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chemical and pharmaceutical, building and construction, food and beverage, oil and lubricant, agriculture and horticulture, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Abbe

- Amcor plc

- Favourite Packaging

- IPG Pty Ltd

- O F Packaging Pty Ltd

- Orora Packaging Australia Pty Ltd

- Pact Group

- Pro-Pac Packaging Limited

- UBEECO Packaging Solutions

- Visy

Australia Industrial Packaging Market News:

- On May 2, 2024, TricorBraun announced the acquisition of two Australian packaging distributors, UniquePak and Alplas Products, to expand its presence in the Australian and New Zealand markets. UniquePak specializes in premium glass packaging for the spirits, wine, food, and pharmaceutical industries, while Alplas provides industrial packaging solutions, including plastic drums, taps, and fittings. This strategic acquisition enhances TricorBraun’s capabilities in both spirits and industrial packaging across the region.

Australia Industrial Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Intermediate Bulk Containers (IBCs), Sacks, Drums, Pails, Others |

| Materials Covered | Paperboard, Plastic, Metal, Wood, Fiber |

| Applications Covered | Chemical and Pharmaceutical, Building and Construction, Food and Beverage, Oil and Lubricant, Agriculture and Horticulture, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Abbe, Amcor plc, Favourite Packaging, IPG Pty Ltd, O F Packaging Pty Ltd, Orora Packaging Australia Pty Ltd, Pact Group, Pro-Pac Packaging Limited, UBEECO Packaging Solutions, Visy, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial packaging market on the basis of product?

- What is the breakup of the Australia industrial packaging market on the basis of material?

- What is the breakup of the Australia industrial packaging market on the basis of application?

- What is the breakup of the Australia industrial packaging market on the basis of region?

- What are the various stages in the value chain of the Australia industrial packaging market?

- What are the key driving factors and challenges in the Australia industrial packaging market?

- What is the structure of the Australia industrial packaging market and who are the key players?

- What is the degree of competition in the Australia industrial packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)