Australia Industrial Paints & Coatings Market Size, Share, Trends and Forecast by Product Type, Type, Application, End User, and Region, 2025-2033

Australia Industrial Paints & Coatings Market Overview:

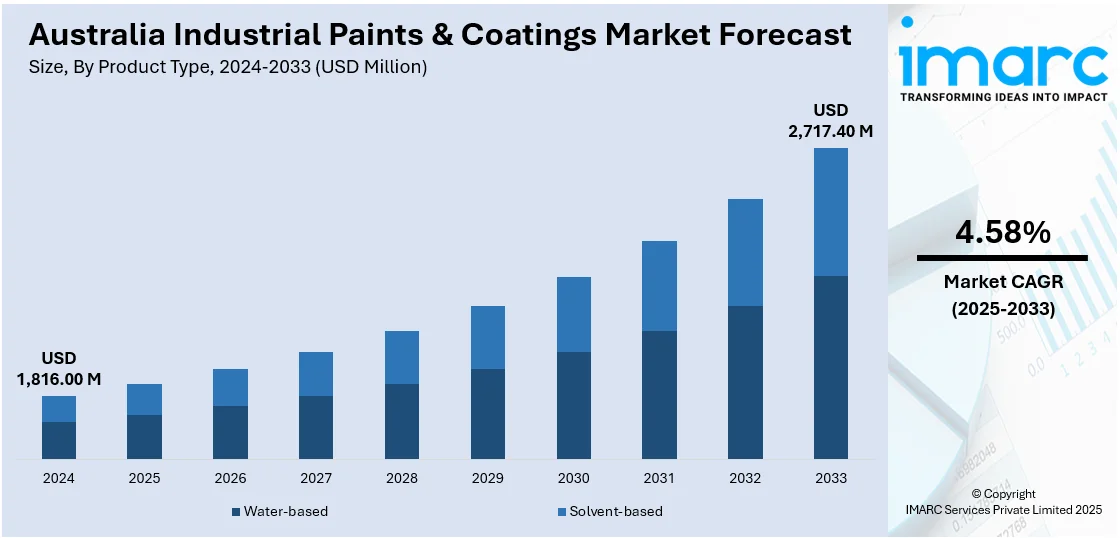

The Australia industrial paints & coatings market size reached USD 1,816.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,717.40 Million by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. The market is fueled by growth in the construction industry, due to urbanization and infrastructure development, which has stimulated demand for protective and decorative coatings. The growth in the automotive industry also requires high-performance coatings to ensure vehicle durability and appearance. Environmental sustainability is another significant driver, with increasing demand for eco-friendly, low-VOC, and water-based coatings that have less environmental footprint. Advances in technology and growth in manufacturing sectors, such as electronics and aerospace, has also boosted the increase in Australia industrial paints & coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,816.00 Million |

| Market Forecast in 2033 | USD 2,717.40 Million |

| Market Growth Rate 2025-2033 | 4.58% |

Australia Industrial Paints & Coatings Market Trends:

Focus on Sustainability and Environmental-Friendly Paints

Australia's paints and coatings industry is experiencing a significant shift toward sustainability, driven by stringent environmental regulations and heightened customer demand for green products. Australia is achieving remarkable strides in utilizing renewable energy, especially in solar and wind energy. Thanks to its plentiful sunlight, the nation boasts one of the highest global rates of rooftop solar panel setups. Over 30% of Australian homes currently produce their electricity from solar energy, aiding in the reduction of dependence on fossil fuels and decreasing carbon emissions. Besides solar, wind energy is significantly contributing as extensive wind farms are functioning across the country, especially in South Australia and Victoria. These efforts contribute to the larger objective of transforming Australia’s energy network to embrace more sustainable energy sources, targeting net-zero emissions by 2050. The paints and coatings industry is hence increasingly adopting waterborne, powder, and bio-based technologies with less VOC emissions and toxicity. These green solutions are regulation compliant as well as in tune with the movement toward sustainable practice in many industries. The construction industry is also seeing growth in the use of low-VOC and waterborne coatings, as these products enable healthier indoor air quality and a reduced environmental footprint. This is further aided by government programs and policies for promoting the use of sustainable materials in construction activities. As a result, the eco-industrial coatings market will continue on its upward curve, which in turn will spur product innovation as well as influence market trends.

To get more information on this market, Request Sample

Technological Advances in Coating Solutions

Advancements in technology are among the key drivers influencing the Australia industrial paints & coatings market growth. Development of nanotechnology-based coatings has led to the formation of products that have improved properties such as better scratch resistance, self-cleaning characteristics, and better durability. These technologies are particularly useful in sectors such as the automotive, aerospace, and maritime industries, where performance and longevity matter significantly. The creation of smart coatings that can respond to environmental stimuli such as temperature or humidity is also growing. These coatings offer proactive maintenance and protection, reducing the need for frequent touch-ups and optimizing the lifespan of coated surfaces. Moreover, the application of digital technologies, such as cutting-edge color-matching systems and automated process application, is improving efficiency and accuracy in coating application. Hence, these developments are driving the market for high-performance coatings that are responding to the evolving requirements of various industries.

Growth in End-Use Industries and Infrastructure Development

The expansion of major end-use markets is playing an important role in driving the increase in demand for industrial paints and coatings in Australia. The building and construction industry, driven by urbanization and infrastructure development schemes, requires coatings that offer durability, corrosion resistance, and appearance. Similarly, the automotive market is also witnessing a shift toward light materials and electric vehicles, which necessitates specialty coatings offering corrosion protection and energy efficiency enhancement. The mining sector, which is subject to adverse environmental conditions, relies on coatings to protect equipment and infrastructure against wear and corrosion. The oil and gas sector also requires coatings that can withstand high temperatures and corrosive chemicals. Other than this, the increasing focus on infrastructure projects such as roads, bridges, and commercial buildings adds to the accelerated demand for industrial coatings that provide durability and safety.

Australia Industrial Paints & Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, type, application, and end user.

Product Type Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the product type. This includes water-based and solvent-based.

Type Insights:

- Automotive and Refinish Coating

- Protective Coating

- Powder Coating

- General Industrial Coating

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes automotive and refinish coating, protective coating, powder coating, general industrial coating, and others.

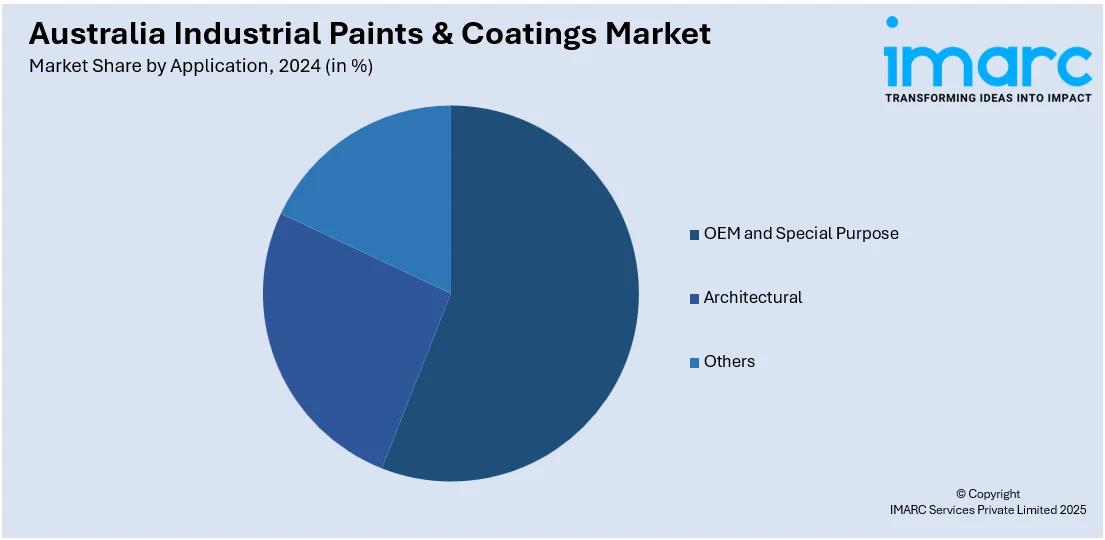

Application Insights:

- OEM and Special Purpose

- Architectural

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes OEM and special purpose, architectural, and others.

End User Insights:

- Automotive

- Marine

- General Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, marine, general industries, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Paints & Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Water-based, Solvent-based |

| Types Covered | Automotive and Refinish Coating, Protective Coating, Powder Coating, General Industrial Coating, Others |

| Applications Covered | OEM and Special Purpose, Architectural, Others |

| End Users Covered | Automotive, Marine, General Industries, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial paints & coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial paints & coatings market on the basis of product type?

- What is the breakup of the Australia industrial paints & coatings market on the basis of type?

- What is the breakup of the Australia industrial paints & coatings market on the basis of application?

- What is the breakup of the Australia industrial paints & coatings market on the basis of end user?

- What is the breakup of the Australia industrial paints & coatings market on the basis of region?

- What are the various stages in the value chain of the Australia industrial paints & coatings market?

- What are the key driving factors and challenges in the Australia industrial paints & coatings?

- What is the structure of the Australia industrial paints & coatings market and who are the key players?

- What is the degree of competition in the Australia industrial paints & coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial paints & coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial paints & coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial paints & coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)