Australia Industrial Pumps Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Australia Industrial Pumps Market Overview:

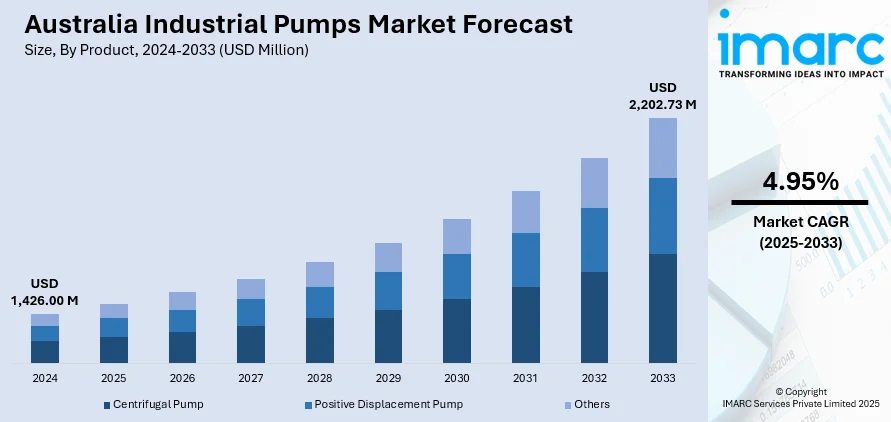

The Australia industrial pumps market size reached USD 1,426.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,202.73 Million by 2033, exhibiting a growth rate (CAGR) of 4.95% during 2025-2033. The market is developing in terms of energy-efficient technologies, upgrading water infrastructure, and increasing integration with mining industry automation. Such trends align with national visions of sustainability, climate resilience, and digital transformation in essential industries. Advanced pump technology is making operations smarter, more energy-efficient, and better at managing water. All of these developments together drive the Australia industrial pumps market share, which grows steadily year by year in the main sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,426.00 Million |

| Market Forecast in 2033 | USD 2,202.73 Million |

| Market Growth Rate 2025-2033 | 4.95% |

Australia Industrial Pumps Market Trends:

Expansion of Energy-Efficient Pumping Systems

Australia is observing a robust trend towards energy-efficient industrial pumps, spurred by increasing environmental concerns and the high cost of energy-hungry operations. Industrial players are also increasingly turning to variable-speed drives and intelligent pump systems that can automatically control flow and pressure based on real-time demand. For instance, in August 2023, Grundfos introduced its NK and NKE end-suction pumps in Australia with advanced energy efficiency, smart connectivity, and improved durability to enable sustainable and intelligent city development. Moreover, this is not only intended to cut costs but also resonates with larger national initiatives regarding sustainability and carbon reduction. Intelligent pumping systems are also equipped with digital monitoring devices to enhance performance, identify inefficiencies, and minimize maintenance cycles. Water treatment, mining, and oil and gas industries are prominent adopters of this technology. Australia industrial pumps growth is facilitated by the intersection of energy efficiency and digital control, making up-to-date pump systems vital in industrial infrastructure development. As these developments mature, they are likely to become the norm in new projects and retrofitted projects all over the country.

To get more information on this market, Request Sample

Growing Application in Water Infrastructure Upgrades

Water infrastructure upgrading throughout Australia is fueling high demand for safe and high-performance industrial pumps. Federal and state government investments in desalination, wastewater handling, and flood control systems have required strong pump technologies that are able to cater to high water volumes under adverse environmental conditions. Industrial pumps are being utilized in conjunction with sophisticated filtration, treatment, and monitoring technologies, leading to an overall transformation of water resource management systems. The vulnerability of the country to droughts and shifting climatic patterns further underscores the importance of effective pump systems in ensuring water resilience. This is especially evident in arid and semi-arid areas where infrastructure deficits are being filled through consistent public and private investment. The incorporation of pump technologies in these large-scale endeavors highlights their importance in the delivery of critical services as well as city planning. With ongoing climate adaptation high on Australia's agenda, industrial pump systems are still part of the country's long-term water security plans.

Increased Integration with Mining and Resource Sector Automation

Automation of Australia's mining and resources sector is promoting greater integration of industrial pumps in intelligent operational systems. Since the industry moves in the direction of digitally integrated and autonomous processes, pumps are now not independent components but are an integral part of broader process efficiency frameworks. They facilitate real-time data acquisition, predictive maintenance, and centralized command, making continuous material handling and fluid transfer achievable in sophisticated setups. The focus on safety, operational efficiency and minimal human intervention aligns with the more general automation agenda in which pump technologies are chosen for compatibility with supervisory control and data acquisition (SCADA) systems. Slurry pumps for high-pressure operations, dewatering pumps, and chemical transfer pumps are now supplied with sensors and analytics instrumentation that enables intelligent decision-making. For example, in May 2024, Calpeda Pumps released bespoke MXVL pumps for the Australian mining sector that were tailored to address specific site requirements with efficient, long-lasting solutions for dealing with tough environments, enhancing operating efficiency and safety. Furthermore, this addition not only increases productivity but also reduces intermit-tencies in the high-risk zones of extraction. The outcome is a robust, digitally operated pumping infrastructure supporting the modernisation of Australia's key resource sectors.

Australia Industrial Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and application.

Product Insights:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating

- Rotary

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes centrifugal pump (axial flow pump, radial flow pump, and mixed flow pump), positive displacement pump (reciprocating, rotary, and others), and others.

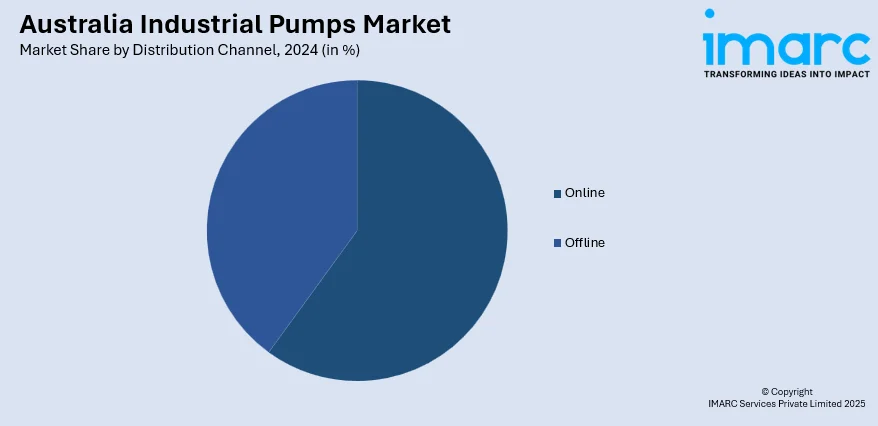

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Oil and Gas

- Chemicals

- Construction

- Power Generation

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, chemicals, construction, power generation, water and wastewater, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Pumps Market News:

- In September 2024, Habermann Aurum Pumpen presented its new development at MINExpo 2024, with emphasis on robust and efficient pump technology for demanding applications. These new developments, such as the HPK and KB-series pumps, are designed to meet the demands of industries such as mining and mineral processing, meeting Australia's growing need for high-performance industrial pumps in challenging conditions.

- In June 2024, Roto Pumps launched the AC Dosing Pump, which is suitable for aggressive chemicals. Made of high-tech materials like CPVC and Glass Filled PTFE, the pump boasts high endurance and resistance, making it a trustworthy option for rigorous chemical dosing applications in various industries.

Australia Industrial Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Oil and Gas, Chemicals, Construction, Power Generation, Water and Wastewater, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial pumps market on the basis of product?

- What is the breakup of the Australia industrial pumps market on the basis of distribution channel?

- What is the breakup of the Australia industrial pumps market on the basis of application?

- What is the breakup of the Australia industrial pumps market on the basis of region?

- What are the various stages in the value chain of the Australia industrial pumps market?

- What are the key driving factors and challenges in the Australia industrial pumps?

- What is the structure of the Australia industrial pumps market and who are the key players?

- What is the degree of competition in the Australia industrial pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)