Australia Industrial Robotics Market Size, Share, Trends and Forecast by Type, Function, End Use Industry, and Region, 2025-2033

Australia Industrial Robotics Market Overview:

The Australia industrial robotics market size reached USD 554.4 Million in 2024. Looking forward, the market is expected to reach USD 1,848.9 Million by 2033, exhibiting a growth rate (CAGR) of 12.80% during 2025-2033. The rising labor costs, growing demand for automation across manufacturing sectors, increased government support for Industry 4.0 initiatives, advancements in sensor and AI technologies, and a focus on enhancing productivity, precision, and workplace safety in industrial operations are some of the key factors driving market growth in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 554.4 Million |

| Market Forecast in 2033 | USD 1,848.9 Million |

| Market Growth Rate 2025-2033 | 12.80% |

Key Trends of Australia Industrial Robotics Market:

Adoption of Collaborative Robots (Cobots) in SMEs

In Australia, small and medium-sized enterprises (SMEs) are increasingly adopting collaborative robots, or cobots, to improve operational efficiency without the high costs typically associated with industrial automation. Unlike traditional robots that require caged environments and safety barriers, cobots are designed to work alongside human operators safely, which makes them suitable for space-constrained and dynamic production lines. According to industry reports, collaborative robots can enhance operational efficiency by up to 50% in the food and beverage industry. As a result, Australian SMEs, particularly in the food processing and packaging sectors, are increasingly adopting cobots to streamline production lines, reduce manual errors, and address labor shortages while maintaining consistent product quality. This is providing a boost to Australia industrial robotics market growth. The relatively low initial investment, easy programming interface, and shorter deployment timelines make cobots an attractive solution for businesses aiming to remain competitive in the face of global supply chain pressures and rising labor costs. Additionally, Australia’s aging workforce and skills shortages in manufacturing are prompting businesses to adopt technologies that can complement human labor rather than replace it. Educational partnerships and pilot programs are further supporting the diffusion of cobots into smaller manufacturing setups, contributing to a broader transformation of industrial practices at the grassroots level, and further contributing to the Australia industrial robotics market growth.

.webp)

To get more information on this market, Request Sample

Government Support and National Initiatives for Industrial Automation

Government support emerges as a key factor augmenting the Australia industrial robotics market share. Through a mix of financial incentives, policy reforms, and strategic programs, the federal and state governments aim to foster a competitive manufacturing sector by encouraging the adoption of robotics and smart automation. For instance, on June 19, 2024, Australia unveiled its inaugural National Robotics Strategy, aiming to establish the nation as a global leader in the development, manufacturing, and application of responsible robotics and automation technologies. The strategy focuses on enhancing national capabilities, increasing adoption, ensuring trust and inclusion, and supporting skills and diversity within the robotics sector. To support this initiative, the Australian government will leverage the AUD 15 Billion National Reconstruction Fund and the Industry Growth Program. The government's projections show that embracing robotics and automation could contribute an additional AUD 600 Billion annually to the country's GDP and drive a 150% increase in productivity growth. In addition to this, government-funded collaborations with research institutions further enhance the development of locally adapted robotic solutions, which creates a positive Australia industrial robotics market outlook. In regional areas, subsidies and pilot programs support the uptake of automation in agriculture and resource extraction, reducing the reliance on imported solutions.

Growth Drivers of Australia Industrial Robotics Market:

Growing Labor Shortages and Pressure for Automation

One of the most powerful forces behind the Australia industrial robotics market share is the nation's persistent labor shortages within key manufacturing and industrial industries. With a comparatively small population base and an ageing working-age population, Australian industries, most notably manufacturing, mining, agriculture, and logistics, are increasingly struggling to attract and hold onto skilled labor. To counter this, businesses are going for automation and robotics as a long-term strategy to sustain productivity and competitiveness. Industrial robots are being implemented to cover labor shortages and to minimize operating expenses and improve process dependability. For instance, in regional Australia's food processing factories and packaging houses, robots are assisting in sustaining production despite labor shortages. In addition, the COVID-19 crisis further highlighted weaknesses in operations reliant on manual labor, driving further investment in robotic technology. Companies are increasingly seeing automation as key to long-term viability, and industrial robots are now considered a strategic imperative and not a nicety.

Increased Use in Mining and Resources Sector

The region’s dominant position in the world mining and resources sector is significantly contributing to the Australia industrial robotics market demand. The mining industry has been a pioneer in embracing automated technologies to enhance efficiency, safety, and cost savings in distant and risky conditions. Australian mining firms are applying robotics for purposes like drilling, inspection, autonomous transportation, and maintenance, particularly in areas such as Western Australia and Queensland where major operations are usually located in distant areas. Interest in sophisticated robots with artificial intelligence and machine learning for predictive maintenance and real-time decision-making is being fueled by the country's emphasis on boosting resource recovery through technological innovation. With environmental and safety regulations increasingly becoming more restrictive, robots provide a mechanism to achieve compliance along with enhancing operational performance. Increased investment in industrial robotics will continue to be a key factor in the industry's growth, even if mining is still the foundation of the Australian economy.

Government Support and Industry 4.0 Initiatives

Government-sponsored programs and Australia's increased adoption of Industry 4.0 technologies are also major drivers of the industrial robotics space. Through state-wide initiatives and state-level grants, the government of Australia is promoting the digitalization of its industrial base through the development of advanced manufacturing technologies such as robotics and automation. Organizations such as the Advanced Robotics for Manufacturing (ARM) Hub in Queensland and other collaborative innovation hubs are facilitating the testing, creation, and implementation of robotics in the operations of local industries. These moves are especially targeting small and medium-sized businesses (SMEs), which constitute the majority of Australia's manufacturing base yet do not have the means for mass automation. In addition, educational programs and training initiatives for robotics and digital technologies are being implemented to equip the workforce with the necessary skills for an increasingly automated industrial environment. With strong policy alignment and institutional support, Australia is actively building an ecosystem where robotics can thrive, further accelerating market growth.

Opportunities of Australia Industrial Robotics Market:

Expansion into Agriculture and Food Processing

Australia’s vast agricultural sector presents significant untapped opportunities for industrial robotics adoption. With farms scattered over varied landscapes and, in many cases, remote areas, the automation of repetitive and manpower-intensive operations like harvesting, sorting, and packaging can make a huge difference to efficiency and minimize dependence on seasonal manpower. Robotics specific to the agricultural context, like self-driving tractors, robot arms for fruit harvesting, and automated milk collection systems, are becoming increasingly feasible owing to breakthroughs in AI, sensors, and machine learning. In addition, food and beverage processing is Australia's largest manufacturing sub-sector, and robotics can be instrumental in enhancing hygiene, consistency, and speed along production lines. With consumer demand for high-quality, safely processed food expected to increase domestically and overseas, particularly throughout Asia, automation of agriculture and food processing presents a significant opportunity for the growth of the industrial robotics market. Startups and tech companies specializing in agri-tech solutions are already taking off in Australia, further expanding this space.

Strengthen Domestic Manufacturing Competitiveness

The other major opportunity for industrial robots in Australia is to revive and enhance the domestic manufacturing sector. Australian manufacturers have traditionally struggled to compete against low-cost manufacturers in Asia because of relatively higher labor costs and no economies of scale. Yet, automation and robotics present an opportunity to close this gap by increasing productivity, minimizing errors, and enabling flexible, high-mix, low-volume production. Sophisticated robotics systems have the potential to make manufacturers produce more complicated products with competitive prices while ensuring high quality standards. Industries like aerospace, defense, electronics, and medical device manufacturing are especially well-positioned to take advantage of robotics due to their emphasis on precision and consistency. Government incentives for sovereign manufacturing capacity, particularly in the light of international supply chain disruptions, further reinforce the potential. Increasing interest in local production and reshoring makes taking up industrial robotics a compelling enabler to drive Australian manufacturing to be competitive and resilient internationally.

New Demand in Warehousing and Logistics

Increased e-commerce and logistics in Australia are creating new demand for industrial robotics as well. As consumers demand quicker delivery and precise order fulfillment, logistics firms are compelled to streamline business operations and scale at affordable costs. Robotics has transformative possibilities in warehousing, with autonomous guided vehicles (AGVs), robotic picking equipment, and intelligent conveyor systems speeding up and refining the order processing. Such technologies come in handy especially in Australia's massive distribution centers in outer city suburbs such as Sydney and Melbourne, where efficiency and high throughput are crucial. In addition, the geographical spread of the population and massive distances across urban and regional areas make having efficient logistics operations indispensable to the national economy. Robotics solutions that optimize space in warehouses and minimize turnaround times are becoming increasingly important. As companies invest in smart logistics buildings and digital supply chains, demand for industrial robotics in this space will accelerate strongly, creating major long-term opportunities.

Challenges of Australia Industrial Robotics Market:

High Upfront Costs and Limited Access for SMEs

According to the Australia industrial robotics market analysis, one of the main issues challenging the market is the high upfront cost of leading robotics systems. While the bigger companies can afford to implement such technology, small and medium-sized businesses (SMEs), which constitute the majority of Australia's industrial base, do not enjoy the capital or have the technical expertise to undertake robotics at scale. This unevenness slows down market penetration on a large scale. Most SMEs are reluctant to invest in robotics because of uncertainty regarding return on investment, upkeep costs, and the requirement of trained operators. Furthermore, Australia's geographic remoteness renders importing sophisticated robotic hardware and components more time-consuming and logistically expensive. Although government grants and assistance programs exist, access is often fragmented or restricted to industries or regions, which adds further obstacles to smaller businesses looking to implement robotics into their operations.

Skills Shortages and Workforce Transition

The industrial robotics industry in Australia is also hampered by a lack of trained personnel who can install, run, and service robotic systems. As the industries transition toward automation, the demand for technicians, engineers, and programmers with robotics, AI, and mechatronics expertise has increased considerably. Australia is faced with a gap in building a workforce with these specialized skills. The vocational training and education systems lag the level of technological progress, and the sector needs are left with a gap in available talent. This is especially the case in regional economies, where access to high-tech training centers and skilled labor is more constrained. Furthermore, automation can cause workforce pushback, particularly in industries that have long relied on traditional manufacturing and the workers may be afraid of losing their jobs. These issues need to be tackled through cooperation between industry, government, and schools to upgrade the skills of workers, retrain workers in falling jobs, and create a pipeline of talent ready for the future.

Integration Issues and Legacy Infrastructure

Integration of new robotic systems with legacy infrastructure is another key challenge in the Australian industrial robotics market. Most Australian manufacturing and processing plants have equipment that was never designed to be automated, which complicates retrofitting or integrating sophisticated robotics without significant changes in operations. This adds to the expenses and technical challenges, especially for older plants in industries such as food processing, textiles, and general manufacturing. In addition, variable standards and compatibility between various robotic platforms and software bases can result in non-smooth adoption. Companies also do not have in-house IT and systems engineering expertise necessary to handle such elaborate integrations. Furthermore, the spread industrial base of Australia, located across remote, regional, and urban areas, provides logistical and connectivity impediments, particularly when deploying network-dependent or cloud-based robotics. Integration problems hinder adoption and can also lead to less-than-optimal performance if systems are not correctly aligned or supported after installation.

Australia Industrial Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, function, and end use industry.

Type Insights:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Parallel Robots

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes articulated robots, cartesian robots, SCARA robots, cylindrical robots, parallel robots, and others.

Function Insights:

- Soldering and Welding

- Materials Handling

- Assembling and Disassembling

- Painting and Dispensing

- Milling, Cutting and Processing

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes soldering and welding, materials handling, assembling and disassembling, painting and dispensing, milling, cutting and processing, and others.

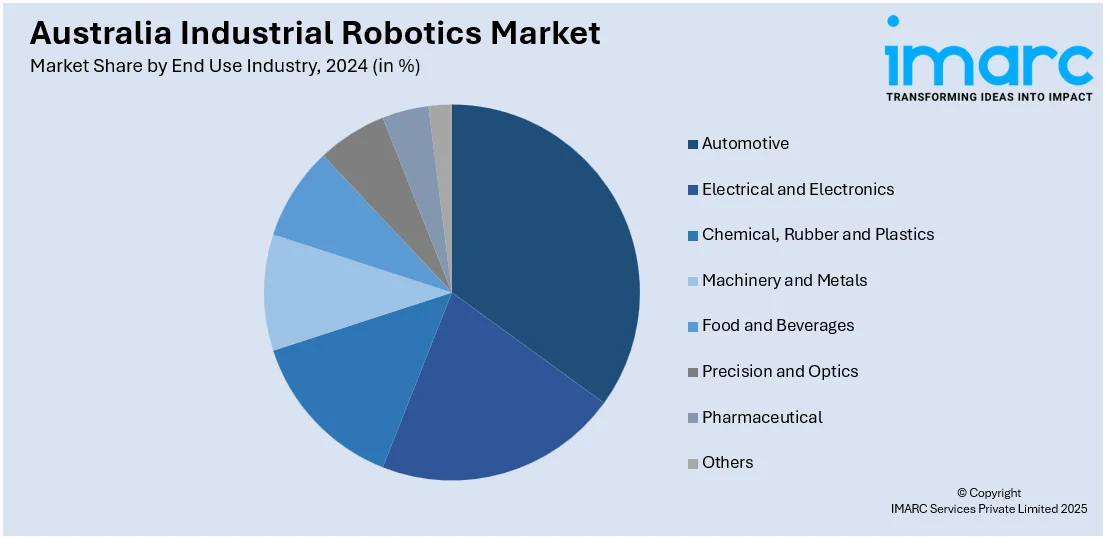

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Chemical, Rubber and Plastics

- Machinery and Metals

- Food and Beverages

- Precision and Optics

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electrical and electronics, chemical, rubber and plastics, machinery and metals, food and beverages, precision and optics, pharmaceutical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Robotics Market News:

- On March 13, 2025, Vision AI, an Australian company specializing in robotics and machine vision, was appointed as ABB Robotics Australia's newest Authorized Value Provider (AVP). This partnership enables Vision AI to access ABB’s advanced tools, including RobotStudio®, and receive expert support to enhance their automation solutions. Notably, Vision AI has developed a precision-driven fruit grading and packing system utilizing ABB’s IRB 1200 and IRB 1300 industrial robots, addressing labor shortages and optimizing operations for clients.

Australia Industrial Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Articulated Robots, Cartesian Robots, SCARA Robots, Cylindrical Robots, Parallel Robots, Others |

| Functions Covered | Soldering and Welding, Materials Handling, Assembling and Disassembling, Painting and Dispensing, Milling, Cutting and Processing, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Chemical, Rubber and Plastics, Machinery and Metals, Food and Beverages, Precision and Optics, Pharmaceutical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia industrial robotics market was valued at USD 554.4 Million in 2024.

The Australia industrial robotics market is projected to exhibit a CAGR of 12.80% during 2025-2033.

The Australia industrial robotics market is expected to reach a value of USD 1,848.9 Million by 2033.

The Australia industrial robotics market trends include growing adoption in agriculture, mining, and logistics, integration with AI and IoT technologies, and increased use of collaborative robots. Emphasis on local manufacturing resilience, sustainability, and remote monitoring capabilities is also shaping innovation, along with expanding robotics applications beyond traditional manufacturing environments.

The Australia industrial robotics market is driven by rising labor shortages, increasing automation in mining and agriculture, and strong government support for advanced manufacturing. The push for productivity, cost efficiency, and technological competitiveness, along with the adoption of Industry 4.0 practices, is accelerating the demand for robotics across key industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)