Australia Industrial Safety Equipment Market Size, Share, Trends and Forecast by Product Type, End-Use Industry, and Region, 2025-2033

Australia Industrial Safety Equipment Market Overview:

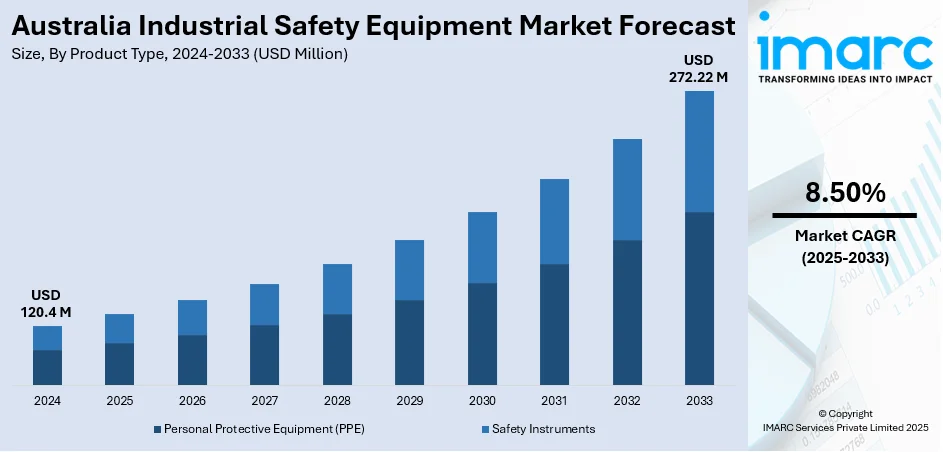

The Australia industrial safety equipment market size reached USD 120.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 272.22 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The heightened implementation of occupational health and safety (OHS) regulations is impelling the growth of the market. Apart from this, Australia is undergoing continuous expansion of its infrastructure projects, which is catalyzing the need for comprehensive safety measures. Moreover, the rising importance of workplace safety and employee well-being is expanding the Australian industrial safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 120.4 Million |

| Market Forecast in 2033 | USD 272.22 Million |

| Market Growth Rate 2025-2033 | 8.50% |

Australia Industrial Safety Equipment Market Trends:

Strengthening Occupational Health and Safety Regulations

The Australian Government is continuously reinforcing occupational health and safety (OHS) regulations, which is significantly driving the demand for industrial safety equipment. Regulatory bodies such as Safe Work Australia are enforcing stricter compliance protocols across industries to mitigate workplace hazards. These efforts are encouraging companies to invest more in protective gear, detection systems, and safety infrastructure to avoid penalties and reduce liability. New laws are also emphasizing proactive risk management, motivating industries to adopt advanced safety solutions. The mining, construction, and manufacturing sectors, in particular, are experiencing intensified scrutiny due to their high-risk operations, resulting in heightened demand for personal protective equipment (PPE), fall protection systems, and respiratory safety products. This ongoing regulatory emphasis is fostering a safety-first culture across the industrial landscape, ensuring continuous developments for equipment manufacturers and suppliers.

To get more information on this market, Request Sample

Increasing Infrastructure Development

Australia is undergoing continuous expansion of its infrastructure projects, which is catalyzing the need for comprehensive safety measures. In the 2025-26 Federal Budget of Australia, $17.1 billion is sanctioned for new and existing road and rail projects, $20 million for a new session of the On Farm Connectivity Program, $16.9 million to improve maritime industry skills and training, and a lot more. Major investments in transportation, energy, and public utilities are creating high-risk work environments that necessitate reliable safety equipment. The construction of roads, railways, and energy facilities is accelerating, thereby increasing the number of workers exposed to hazardous conditions. To maintain workforce safety in such dynamic settings, companies are procuring advanced PPE, environmental monitoring systems, and site safety installations. The rising complexity and scale of these projects are also promoting the integration of smart safety technologies, including Internet of Things (IoT)-enabled wearables and artificial intelligence (AI)-driven monitoring systems. As industrial and infrastructural activities continue to grow, the adoption of modern safety equipment is becoming a critical component of operational planning, thereby impelling the Australia industrial safety equipment market growth.

Rising Awareness of Workplace Safety and Employee Welfare

Organizations across Australia are placing importance on workplace safety and employee well-being, which is positively influencing the market. Management teams are recognizing that a safe working environment enhances productivity, reduces downtime, and promotes a positive organizational image. As corporate social responsibility (CSR) becomes an integral trait of business strategy, employers are investing in safety training, ergonomic protective gear, and comprehensive safety protocols. This cultural shift is supported by increased media coverage of workplace incidents and a socially informed workforce that demands better protection. Employee unions and advocacy groups are also playing a role by lobbying for safer work conditions, thereby motivating companies to exceed regulatory requirements. This heightened awareness is not only driving the demand for standard safety gear but also encouraging the adoption of customized and technologically advanced solutions tailored to specific occupational hazards. In 2024, the first AI-powered tool, Safety Professional Assistant and Resource Knowledge-Base (SPARK), was developed to enhance workplace safety. This tool was capable of reading through innumerable pages of legislation and rules spontaneously.

Australia Industrial Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end-use industry.

Product Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Hearing Protection

- Respiratory Protection

- Hand Protection

- Protective Clothing

- Foot Protection

- Safety Instruments

- Safety Sensors

- Safety Controllers/Relays

- Safety Valves

- Emergency Shutdown Systems (ESD)

- Fire and Gas Monitoring Systems

- High Integrity Pressure Protection Systems (HIPPS)

- Burner Management Systems (BMS)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes personal protective equipment (PPE) (head protection, eye and face protection, hearing protection, respiratory protection, hand protection, protective clothing, and foot protection) and safety instruments (safety sensors, safety controllers/relays, safety valves, emergency shutdown systems (ESD), fire and gas monitoring systems, high integrity pressure protection system (HIPPS), and burner management systems (BMS)).

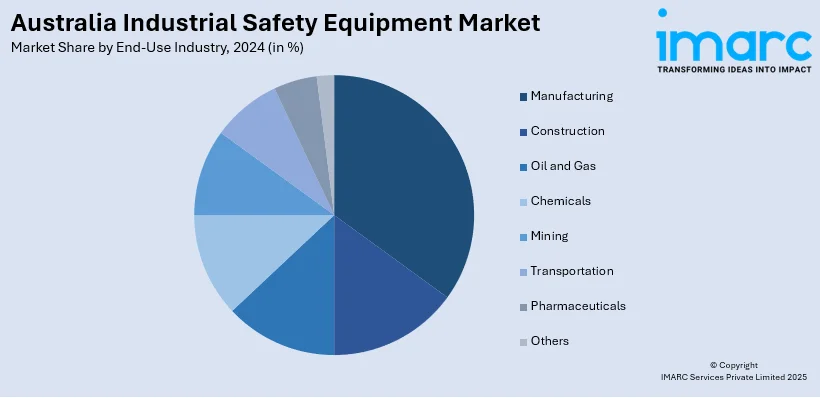

End-Use Industry Insights:

- Manufacturing

- Construction

- Oil and Gas

- Chemicals

- Mining

- Transportation

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing, construction, oil and gas, chemicals, mining, transportation, pharmaceuticals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-Use Industries Covered | Manufacturing, Construction, Oil and Gas, Chemicals, Mining, Transportation, Pharmaceuticals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial safety equipment market on the basis of product type?

- What is the breakup of the Australia industrial safety equipment market on the basis of end-use industry?

- What is the breakup of the Australia industrial safety equipment market on the basis of region?

- What are the various stages in the value chain of the Australia industrial safety equipment market?

- What are the key driving factors and challenges in the Australia industrial safety equipment market?

- What is the structure of the Australia industrial safety equipment market and who are the key players?

- What is the degree of competition in the Australia industrial safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial safety equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)