Australia Industrial Sand Market Size, Share, Trends and Forecast by Product Type, Grade, Application, End Use, and Region, 2025-2033

Australia Industrial Sand Market Size Overview:

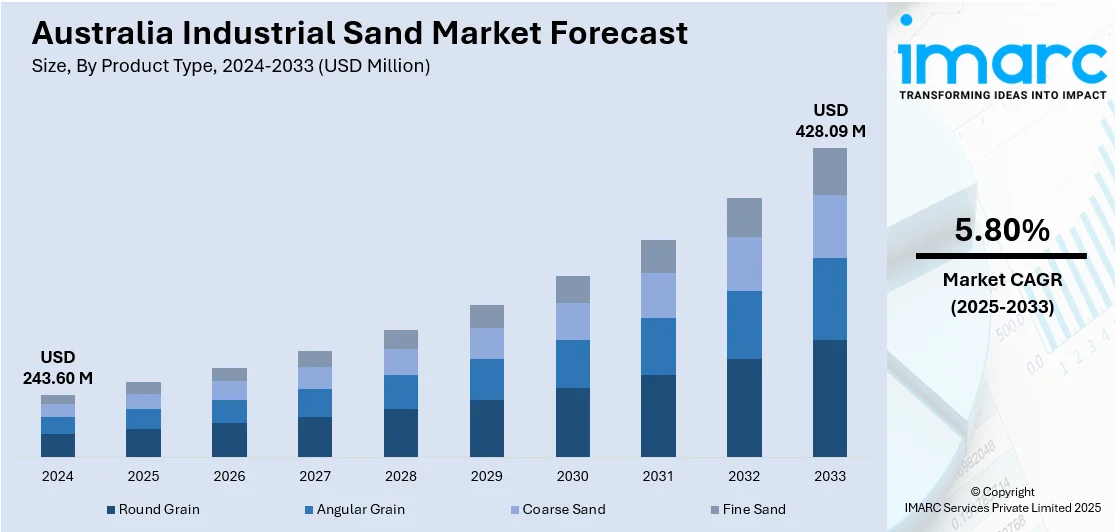

The Australia industrial sand market size reached USD 243.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 428.09 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by the sustained demand for silica sand in construction and infrastructure projects across major Australian cities. The domestic glass manufacturing sector, including solar and architectural applications, supports long-term consumption of high-purity sand, thereby fueling the market. Rising global demand, particularly from Asia-Pacific countries, is transforming Australia into a key export supplier, further augmenting the Australia industrial sand market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 243.60 Million |

| Market Forecast in 2033 | USD 428.09 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Industrial Sand Market Trends:

Export-Oriented Mining and Rising Global Demand for Silica Sand

Australia is emerging as a major supplier of high-purity silica sand to the Asia-Pacific region, driven by strong demand from countries such as China, Japan, South Korea, and Vietnam. These markets are seeking consistent, high-grade sand for electronics, glass production, and foundry applications, at a time when domestic sources in Southeast Asia are depleting or restricted due to environmental regulations. Australian mining companies are responding by expanding exploration and export capacities, particularly in Western Australia and Queensland, where deposits of industrial-grade sand are abundant. New entrants and established players are securing export licenses and forming long-term supply contracts with offshore buyers, backed by rising interest in greenfield sand mining projects. The country’s political stability, high environmental standards, and efficient port infrastructure enhance its credibility as a strategic export hub. Additionally, the Australian government’s trade support frameworks are facilitating investment into mineral commodities including silica sand. On July 8, 2024, the University of Queensland’s Sustainable Minerals Institute advanced its Ore-sand initiative, which produces construction- and industrial-grade sand from mineral ores. With global sand demand nearing 50 billion tons and 13 billion tons of tailings generated annually, Ore-sand offers a scalable alternative to river and marine sand extraction while reducing mining waste. This upward trajectory in global demand, coupled with local capacity enhancements, is positioning the nation as a key international supplier. Export-driven extraction and processing continue to play a pivotal role in shaping the industry outlook. These factors collectively anchor Australia industrial sand market growth, particularly as infrastructure expansion maintains momentum in both urban and regional sectors.

To get more information on this market, Request Sample

Rising Demand from the Glass Manufacturing Industry

Australia’s glass manufacturing sector represents a steady end-use channel for industrial sand, particularly silica-rich variants. This industry consumes large volumes of sand as a primary raw material for producing flat glass, container glass, and specialty products used in solar panels, electronics, and architectural applications. The surge in solar photovoltaic installations across Australian rooftops and utility-scale solar farms has indirectly increased the requirement for high-purity silica used in solar glass. Additionally, the construction of energy-efficient buildings has driven the production of insulated and laminated glass, further boosting demand. Australian glass manufacturers increasingly seek local sources of silica sand that meet stringent purity thresholds to reduce reliance on imports and enhance supply chain resilience. On July 8, 2024, Diatreme Resources announced it had secured a 71.2% stake in Metallica Minerals, effectively creating Australia’s largest silica sand miner. The combined entity will control a silica resource base exceeding 450 million tons across northern Queensland, with a pro-forma market capitalization of approximately AUD 110 million (USD 73 million). This consolidation marks a significant shift in the Australia industrial sand market, boosting capacity to meet rising domestic and export demand for high-purity silica sand used in solar PV manufacturing, glass, and advanced industrial applications. Moreover, the development of sustainable, recyclable glass products has aligned with nationwide goals for waste reduction and circular manufacturing practices. With localized processing and beneficiation technologies improving, domestic sand producers are better equipped to meet the chemical composition and particle size requirements of the glass industry. This alignment of technological, environmental, and industrial needs ensures that glassmaking remains a stable and growing consumer of industrial sand in the Australian market.

Australia Industrial Sand Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, application, and end use.

Product Type Insights:

- Round Grain

- Angular Grain

- Coarse Sand

- Fine Sand

The report has provided a detailed breakup and analysis of the market based on the product type. This includes round grain, angular grain, coarse sand, and fine sand.

Grade Insights:

- Industrial Grade

- Specialty Grade

- High Purity Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes industrial grade, specialty grade, and high purity grade.

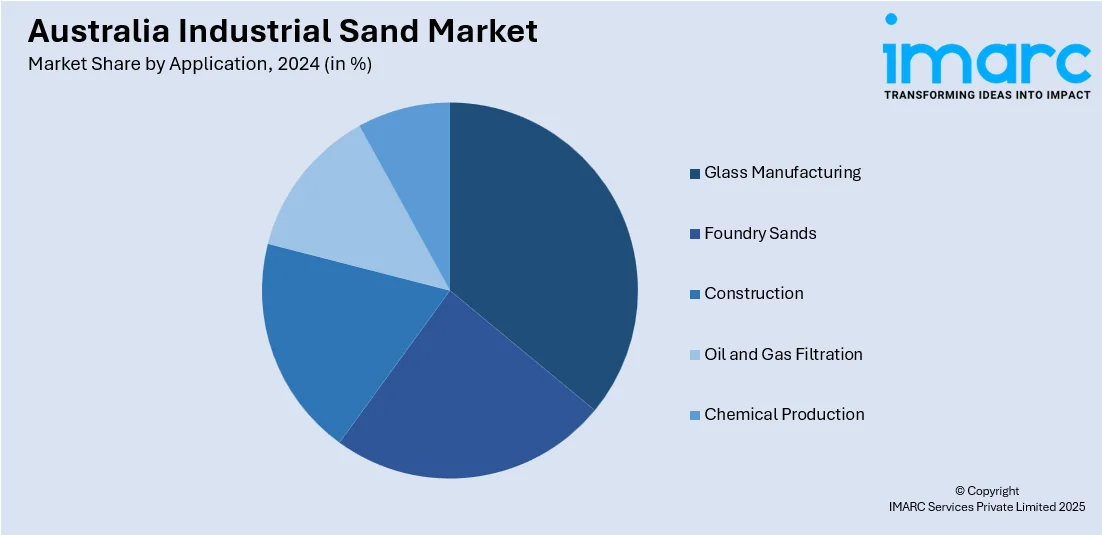

Application Insights:

- Glass Manufacturing

- Foundry Sands

- Construction

- Oil and Gas Filtration

- Chemical Production

The report has provided a detailed breakup and analysis of the market based on the application. This includes glass manufacturing, foundry sands, construction, oil and gas filtration, and chemical production.

End Use Insights:

- Construction

- Automotive

- Glass and Ceramics

- Oil and Gas

- Electronics

The report has provided a detailed breakup and analysis of the market based on the end use. This includes construction, automotive, glass and ceramics, oil and gas, and electronics.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Sand Market News:

- On March 3, 2025, Boral Limited announced the acquisition of Sand Supplies Pty Ltd, securing two sand quarries in Glen Forbes and Grantville, Victoria, approximately 100 km southeast of Melbourne. The acquisition strengthens Boral’s position in the Australia industrial sand market by enhancing supply security for high-quality sand used in concrete and asphalt production, especially for infrastructure projects around Melbourne. These quarries, located near a new processing plant and long-term sand reserves, will support Boral’s vertically integrated operations.

Australia Industrial Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Round Grain, Angular Grain, Coarse Sand, Fine Sand |

| Grades Covered | Industrial Grade, Specialty Grade, High Purity Grade |

| Applications Covered | Glass Manufacturing, Foundry Sands, Construction, Oil and Gas Filtration, Chemical Production |

| End Uses Covered | Construction, Automotive, Glass and Ceramics, Oil and Gas, Electronics |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial sand market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial sand market on the basis of product type?

- What is the breakup of the Australia industrial sand market on the basis of grade?

- What is the breakup of the Australia industrial sand market on the basis of application?

- What is the breakup of the Australia industrial sand market on the basis of end use?

- What is the breakup of the Australia industrial sand market on the basis of region?

- What are the various stages in the value chain of the Australia industrial sand market?

- What are the key driving factors and challenges in the Australia industrial sand market?

- What is the structure of the Australia industrial sand market and who are the key players?

- What is the degree of competition in the Australia industrial sand market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial sand market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial sand market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)