Australia Industrial Valves Market Size, Share, Trends and Forecast by Product Type, Functionality, Material, Size, End Use Industry, and Region, 2025-2033

Australia Industrial Valves Market Overview:

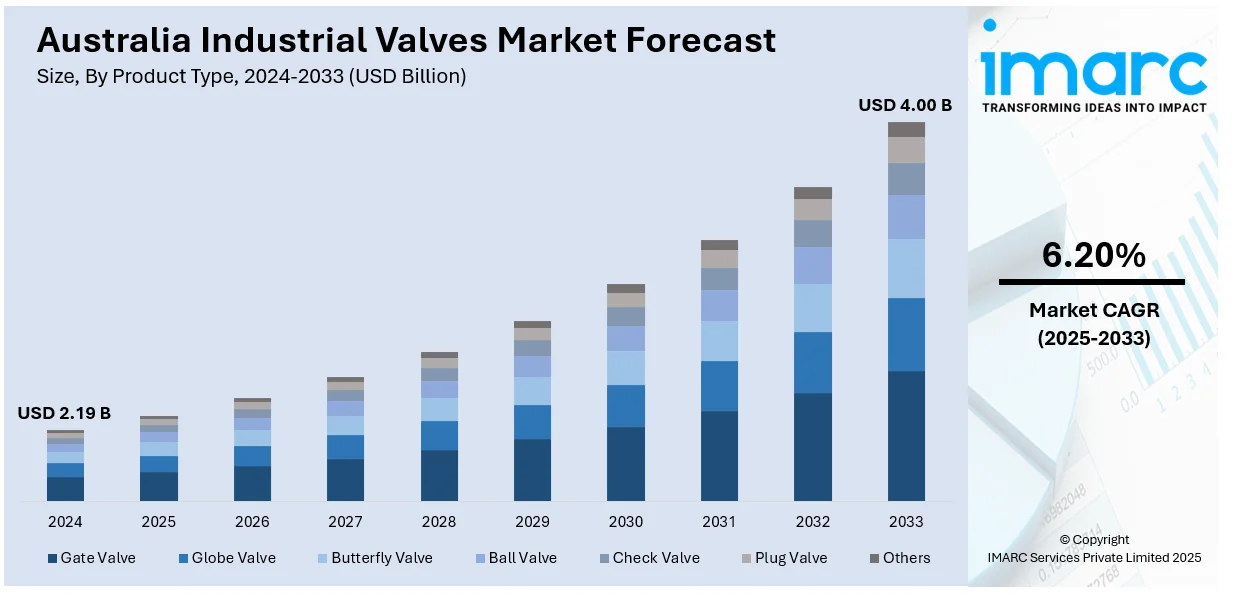

The Australia industrial valves market size reached USD 2.19 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.00 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is being driven by increased industrialization, expanding oil and gas exploration activities, rising infrastructure investments, and the adoption of advanced technologies for enhanced operational efficiency and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.19 Billion |

| Market Forecast in 2033 | USD 4.00 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

Australia Industrial Valves Market Trends:

Expansion of Water and Wastewater Infrastructure

Australia's focus on enhancing its water and wastewater infrastructure is driving growth in the industrial valves market. The government spends around USD 6 billion annually to water and wastewater treatment services, with additional investments earmarked for the National Water Grid Fund to support a decade-long infrastructure program initiated after the 2019 drought. These substantial capital allocations require advanced industrial valves to efficiently manage and control water flow. Valves are essential for ensuring the reliability and safety of water distribution and treatment systems, with the increasing complexity of infrastructure projects demanding higher durability and precision. Furthermore, urbanization and population expansion in places such as Sydney and Melbourne increase the demand for effective water management systems. Industrial valves are critical in tackling these issues because they enable efficient water distribution and wastewater treatment. As Australia prioritizes sustainable water management, the need for high-quality industrial valves is expected to increase, greatly contributing to the market's growth.

To get more information on this market, Request Sample

Growth in the Oil and Gas Sector

The expansion of Australia's oil and gas sector is a key driver for the growth of the industrial valves market. In 2022, the Australian government allocated USD 250 million to enhance domestic refineries and improve domestic oil supply, focusing on improving fuel standards and safety. This investment highlights the sector's growth and the increasing demand for reliable industrial components. Industrial valves play a critical role in oil and gas operations, ensuring the safe and efficient flow of hydrocarbons across exploration, production, refining, and transportation processes. As the sector expands, valves must be capable of withstanding high pressures and harsh, corrosive environments. Furthermore, Australia's emphasis on liquefied natural gas (LNG) production and export raises the demand for specialty valves that can operate successfully under severe temperatures and pressures. With continuous expenditures and advances in the oil and gas sector, demand for industrial valves is likely to stay high, contributing considerably to the market's sustained expansion.

Australia Industrial Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, functionality, material, size, and end use industry.

Product Type Insights:

- Gate Valve

- Globe Valve

- Butterfly Valve

- Ball Valve

- Check Valve

- Plug Valve

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes gate valve, globe valve, butterfly valve, ball valve, check valve, plug valve, and others.

Functionality Insights:

- On-Off/Isolation Valves

- Control Valves

A detailed breakup and analysis of the market based on functionality have also been provided in the report. This includes on-off/isolation valves and control valves.

Material Insights:

- Steel

- Cast Iron

- Alloy Based

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, cast iron, alloy based, and others.

Size Insights:

- Upto 1”

- 1”-6”

- 7”-25”

- 26”-50”

- 51” and Above

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes upto 1”, 1”-6”, 7”-25”, 26”-50”, and 51” and above.

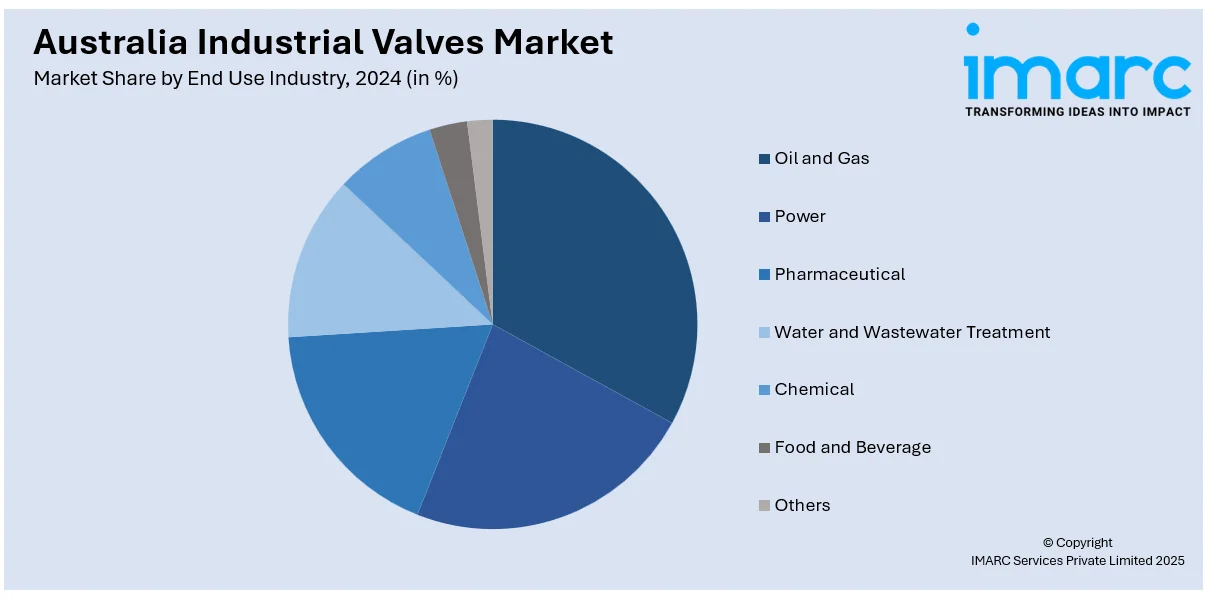

End Use Industry Insights:

- Oil and Gas

- Power

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Food and Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, power, pharmaceutical, water and wastewater treatment, chemical, food and beverage, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Valves Market News:

- March 2025: AMPO Poyam Valves secured a contract to supply 171 highly engineered subsea ball valves for a major topside substructure project off the coast of Western Australia. These valves—manual, hydraulic, and ROV-operated—were designed for installation at approximately 172 meters depth in the flooding and venting system of a subsea platform supporting an FLNG facility.

- May 2024: TechnipFMC signed an Integrated Engineering, Procurement, Construction, and Installation (iEPCI™) contract with Woodside Energy for its Xena Phase 3 development. The contract involved the design, manufacture, and installation of subsea production systems (in which industrial valves are integral components), flexible pipes, and umbilicals, utilizing TechnipFMC's Subsea 2.0® technology.

- February 2024: Reliance Worldwide Corporation (RWC) acquired Holman Industries for AUD 160 million, expanding its product portfolio and distribution channels in the Australian plumbing market. This strategic acquisition enhanced RWC's presence in the water-out sector, particularly in the industrial valves segment in plumbing solutions.

Australia Industrial Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gate Valve, Globe Valve, Butterfly Valve, Ball Valve, Check Valve, Plug Valve, Others |

| Functionalities Covered | On-Off/Isolation Valves, Control Valves |

| Materials Covered | Steel, Cast Iron, Alloy Based, Others |

| Sizes Covered | Upto 1”, 1”-6”, 7”-25”, 26”-50”, 51” and Above |

| End Use Industries Covered | Oil and Gas, Power, Pharmaceutical, Water and Wastewater Treatment, Chemical, Food and Beverage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial valves market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial valves market on the basis of product type?

- What is the breakup of the Australia industrial valves market on the basis of functionality?

- What is the breakup of the Australia industrial valves market on the basis of material?

- What is the breakup of the Australia industrial valves market on the basis of size?

- What is the breakup of the Australia industrial valves market on the basis of end use industry?

- What are the various stages in the value chain of the Australia industrial valves market?

- What are the key driving factors and challenges in the Australia industrial valves market?

- What is the structure of the Australia industrial valves market and who are the key players?

- What is the degree of competition in the Australia industrial valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)