Australia Industrial Welding Machines Market Size, Share, Trends and Forecast by Welding Technology, Automation Level, Power Source Type, Sales Channel, End Use Industry, and Region, 2025-2033

Australia Industrial Welding Machines Market Overview:

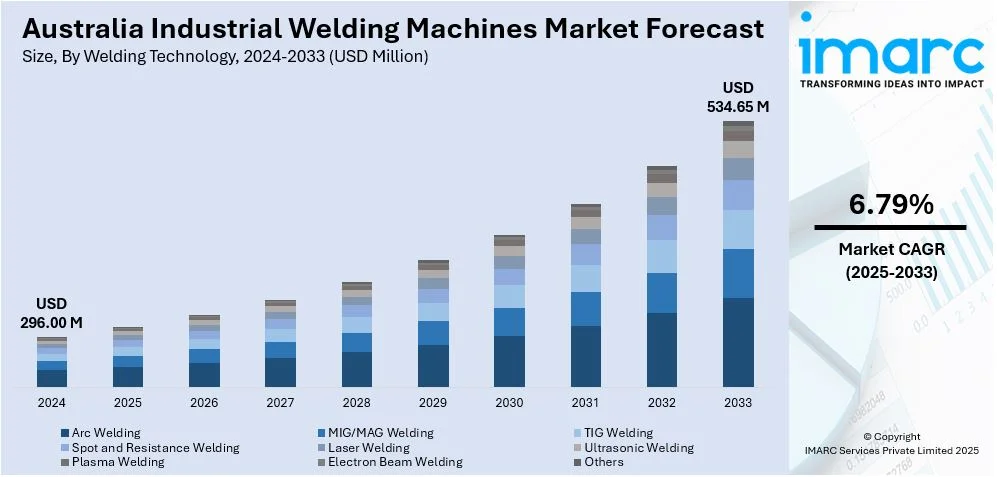

The Australia industrial welding machines market size reached USD 296.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 534.65 Million by 2033, exhibiting a growth rate (CAGR) of 6.79% during 2025-2033. Strong demand across multiple sectors, infrastructure development, growth in mining and energy industries, and increasing automation in manufacturing are factors propelling the market growth. Additionally, skilled labor shortages encouraging toward user-friendly machines, rising defense and shipbuilding investments, and renewable energy project demands are supporting the market growth. Furthermore, transportation network upgrades, focus on workplace safety, advancements in welding technology, and supportive government policies for domestic manufacturing are fostering the Australia industrial welding machines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 296.00 Million |

| Market Forecast in 2033 | USD 534.65 Million |

| Market Growth Rate 2025-2033 | 6.79% |

Australia Industrial Welding Machines Market Trends:

Infrastructure Development and Construction Growth

Australia's growing infrastructure and construction activities serve as a major driver for the industrial welding machines market. Significant public and private investment in infrastructure, ranging from road and rail upgrades to commercial building projects, has increased the demand for high-performance welding equipment. For instance, in May 2023, Novarc Technologies introduced its Spool Welding Robot (SWR™) and SWR+HyperFill® at Australian Manufacturing Week, enhancing productivity by 3-5x for carbon steel and 12x for stainless steel welding. Moreover, welding machines are essential in joining structural components, reinforcing frameworks, and ensuring long-term durability of construction outputs. With projects such as the Inland Rail, Western Sydney Airport, and various residential and commercial developments underway, contractors and engineering firms require reliable welding solutions that can deliver efficiency and precision under demanding site conditions. Additionally, government-led initiatives aimed at modernizing infrastructure post-COVID have sustained the momentum for equipment procurement. This increased activity drives market competition and innovation, encouraging manufacturers to offer more durable, cost-effective, and user-friendly welding systems.

To get more information on this market, Request Sample

Expansion in Mining and Oil and Gas Sectors

Australia's oil and gas and mining industries are key contributors to the industrial welding machines market, particularly since they require strong and resilient equipment. These sectors involve complex operations such as structural maintenance, pipeline welding, and equipment fabrication, which demand industrial-grade welders that can operate in harsh and remote conditions. Regions like Queensland and Western Australia, where mineral production and gas processing occur, are continuously experiencing heavy machinery operation, leading to constant demand for welding solutions. The working conditions, often entailing portability, ruggedness, and high productivity, make advanced welding machines a working requirement. Additionally, new exploration and production operations and emphasis on working efficiency and safety further justify investment in newest weld machines. This industry-specific requirement enhances the development of specialized welding technology to match heavy industries' needs, ultimately making the overall welding machine supplier's market position strong in Australia.

Automation and Advanced Manufacturing Trends

The integration of automation in Australia’s manufacturing sector is another key factor accelerating the adoption of modern welding machines. As businesses strive to improve production speed, consistency, and cost efficiency, there is an increasing shift toward programmable and semi-automated welding systems. For example, in January 2024, Infinite Robotics assisted a major farm equipment supplier to increase efficiency and weld quality by incorporating robotics. The solution maximized the utilization of expert labor, improved productivity, and automated repetitive welding in high-output production. Furthermore, these machines help minimize human error, reduce material waste, and support lean manufacturing practices. Small- to medium-sized enterprises (SMEs), as well as larger manufacturers, are beginning to recognize the long-term value in upgrading to automated welding equipment that can perform repetitive tasks with minimal oversight. Apart from this, the growing awareness and accessibility of automated solutions position welding machinery as an important investment for manufacturers, which is further driving the Australia industrial welding machines market growth.

Australia Industrial Welding Machines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on welding technology, automation level, power source type, sales channel, and end use industry.

Welding Technology Insights:

- Arc Welding

- MIG/MAG Welding

- TIG Welding

- Spot and Resistance Welding

- Laser Welding

- Ultrasonic Welding

- Plasma Welding

- Electron Beam Welding

- Others

The report has provided a detailed breakup and analysis of the market based on the welding technology. This includes arc welding, MIG/MAG welding, TIG welding, spot and resistance welding, laser welding, ultrasonic welding, plasma welding, electron beam welding, and others.

Automation Level Insights:

- Manual Welding Machines

- Semi-Automatic Welding Machines

- Fully Automatic Welding Machines

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding machines, semi-automatic welding machines, and fully automatic welding machines.

Power Source Type Insights:

- Electric Welding Machines

- Gas Welding Machines

- Hybrid Welding Machines

The report has provided a detailed breakup and analysis of the market based on the power source type. This includes electric welding machines, gas welding machines, and hybrid welding machines.

Sales Channel Insights:

.webp)

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Automotive

- Transportation

- Construction and Infrastructure

- Shipbuilding

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Heavy Machinery and Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, transportation, construction and infrastructure, shipbuilding, aerospace and defense, oil and gas, energy and power, heavy machinery and equipment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Welding Machines Market News:

- In November 2024, Kemppi launched the Minarc T 223 ACDC GM in Australia, combining TIG welding and electrolytic weld cleaning in a single portable unit. This innovation streamlines operations, reduces equipment needs, and enhances productivity for welders.

- In June 2024, Lincoln Electric acquired Danish company Inrotech, known for its adaptive intelligence software and vision-based automated welding systems. This acquisition aims to expand Lincoln's capabilities in shipbuilding, energy, and heavy industries.

Australia Industrial Welding Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Welding Technologies Covered | Arc Welding, MIG/MAG Welding, TIG Welding, Spot and Resistance Welding, Laser Welding, Ultrasonic Welding, Plasma Welding, Electron Beam Welding, Others |

| Automation Levels Covered | Manual Welding Machines, Semi-Automatic Welding Machines, Fully Automatic Welding Machines |

| Power Source Types Covered | Electric Welding Machines, Gas Welding Machines, Hybrid Welding Machines |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Automotive, Transportation, Construction and Infrastructure, Shipbuilding, Aerospace and Defense, Oil and Gas, Energy and Power, Heavy Machinery and Equipment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial welding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial welding machines market on the basis of welding technology?

- What is the breakup of the Australia industrial welding machines market on the basis of automation level?

- What is the breakup of the Australia industrial welding machines market on the basis of power source type?

- What is the breakup of the Australia industrial welding machines market on the basis of sales channel?

- What is the breakup of the Australia industrial welding machines market on the basis of end use industry?

- What is the breakup of the Australia industrial welding machines market on the basis of region?

- What are the various stages in the value chain of the Australia industrial welding machines market?

- What are the key driving factors and challenges in the Australia industrial welding machines market?

- What is the structure of the Australia industrial welding machines market and who are the key players?

- What is the degree of competition in the Australia industrial welding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial welding machines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial welding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial welding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)