Australia Industry 4.0 Market Size, Share, Trends and Forecast by Component, Technology Type, End Use Industry, and Region, 2025-2033

Australia Industry 4.0 Market Overview:

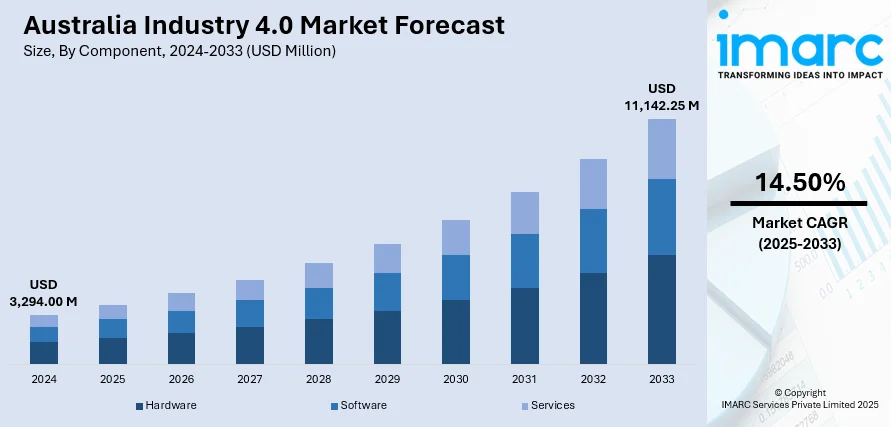

The Australia industry 4.0 market size reached USD 3,294.00 Million in 2024. Looking forward, the market is expected the market to reach USD 11,142.25 Million by 2033, exhibiting a growth rate (CAGR) of 14.50% during 2025-2033. The rapid deployment of 5G networks, which allow real-time communication between machines, sensors, and systems across industries, is driving the demand for industry 4.0 solutions. In addition, the increasing use of artificial intelligence (AI), which aids in improving operational efficiency, is contributing to the expansion of the Australia industry 4.0 market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,294.00 Million |

| Market Forecast in 2033 | USD 11,142.25 Million |

| Market Growth Rate 2025-2033 | 14.50% |

Key Trends of Australia Industry 4.0 Market:

Expansion of 5G networks

The market is being positively impacted by the expansion of 5G networks. Telstra, a well-known Australian telecom and technology company, had the most 5G sites as of January 2024, with 5,082, 1,044 more than Optus's 4,038 and 2,032 more than TPG's 3,050. Real-time communication between machines, sensors, and systems across industries is made possible by 5G's faster and more reliable connectivity. It offers fast data transfer, which is essential for remote monitoring and automation. 5G improves operational effectiveness in manufacturing by facilitating the seamless integration of robotics and networked devices. The minimal latency of 5G improves responsiveness in industrial operations, reducing delays and increasing productivity. Sectors like logistics, energy, and mining are gaining advantages from remote operations and predictive maintenance enabled by 5G-supported Internet of Things (IoT) technologies. They facilitate virtual reality (VR) and augmented reality (AR) applications for training and maintenance assistance. Improved connectivity allows companies to execute smart infrastructure and smart city initiatives more efficiently. The Australian government’s efforts for 5G deployment are enhancing its incorporation into industrial environments, consequently driving the market expansion.

To get more information on this market, Request Sample

Increasing adoption of AI

The rising adoption of AI is fueling the Australia Industry 4.0 market growth. AI improves efficiency, decision-making, and automation across manufacturing, logistics, energy, and other sectors. In smart factories, AI-oriented systems analyze real-time data from machines and sensors to optimize production, predict maintenance needs, and minimize downtime. AI also supports quality control by detecting defects during manufacturing, enhancing product consistency. In logistics, AI refines supply chain visibility, forecasting, and route optimization, ensuring timely deliveries and reduced operational costs. Energy companies are employing AI to monitor usage patterns, manage grids, and enhance energy efficiency. AI also enables adaptive systems that learn and evolve with changing demands, supporting customization and flexibility in production. Businesses are adopting AI-based robotics for complex, repetitive, and hazardous tasks, improving safety and output. In addition, AI is integrated with other Industry 4.0 technologies like cloud computing to enable smart operations and real-time insights. The escalating demand for digital transformation is motivating companies to implement AI for competitive advantage. Government initiatives and research are supporting AI usage in industries. Australian startups and tech firms are developing innovative AI solutions tailored to industrial requirements. Workforce training and AI literacy programs also boost its adoption across different levels. As AI continues to evolve, it is becoming central to intelligent systems, automation, and data-focused decisions. By 2025, Australia’s AI market is expected to attain a value of AUD 9.41 Billion. Between 2025 and 2030, the market is projected to expand at a yearly rate of 28.55%, resulting in a significant rise to AUD 20.34 Billion by 2030.

Growth Drivers of Australia Industry 4.0 Market:

Rising Automation and Robotics Integration

Automation and robotics are becoming central to Australia’s Industry 4.0 landscape, enabling industries to improve efficiency, accuracy, and productivity. Robotics processes in the manufacturing, mining, and logistics industries are performing more of the repetitive and labor-intensive processes within a company, lowering the cost of running the organization and increasing the safety of the workplace. The collaborative robots (cobots) are becoming more rampant in use by human employees to streamline processes and reduce downtimes. This is especially critical in resolving the workplace personnel shortages in Australia, with robots filling in the human resources gap without deterring the production levels. As robotics becomes precise and flexible, companies are more competitive in the global supply chains. The increased focus on automation is not only an accelerator of the digital transformation, but it also helps industries stay flexible when it comes to adapting to changes in the market and new consumer preferences.

Government-Led Digital Transformation Initiatives

Government support plays a critical role in driving Australia industry 4.0 market demand. Through strategic policies, funding programs, and national roadmaps, authorities are encouraging companies to adopt smart manufacturing, IoT, and advanced analytics. Initiatives such as the “Modern Manufacturing Strategy” highlight investment in digital infrastructure and innovation to boost global competitiveness. By creating technology hubs and innovation centers, the government fosters collaboration between businesses, research institutions, and startups, accelerating the pace of digital adoption. Supportive frameworks also provide small and medium enterprises (SMEs) access to resources and training, ensuring inclusivity in the transformation journey. These initiatives not only stimulate technological advancement but also strengthen Australia’s long-term industrial resilience, positioning the nation as a forward-looking hub for Industry 4.0.

Growing Adoption of IoT and Data Analytics

The integration of IoT and advanced data analytics is revolutionizing industries in Australia, acting as a major growth driver for Industry 4.0. According to the Australia industry 4.0 market analysis, connected devices and sensors enable real-time monitoring of equipment, supply chains, and production environments, improving transparency and efficiency. Information gathered in these systems will help in making predictive maintenance, which reduces downtimes and operational costs. Moreover, advanced analytics allows businesses to find problems and fix inefficiency issues, optimize resources, and improve decision-making processes. An OT-based solution can have the most significant improvement effects in the fields of agriculture, logistics, and manufacturing, where there is a lot of operational visibility needed. The use of IoT, coupled with intelligent analytics, can become the core to sustainable, scalable, and smarter industrial operations in Australia as industries turn more towards data-driven insights.

Australia Industry 4.0 Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology type, and end use industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Technology Type Insights:

- Industrial Robotics

- Industrial IoT

- AI and ML

- Blockchain

- Extended Reality

- Digital Twin

- 3D Printing

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes industrial robotics, industrial IoT, AI and ML, blockchain, extended reality, digital twin, 3D printing, and others.

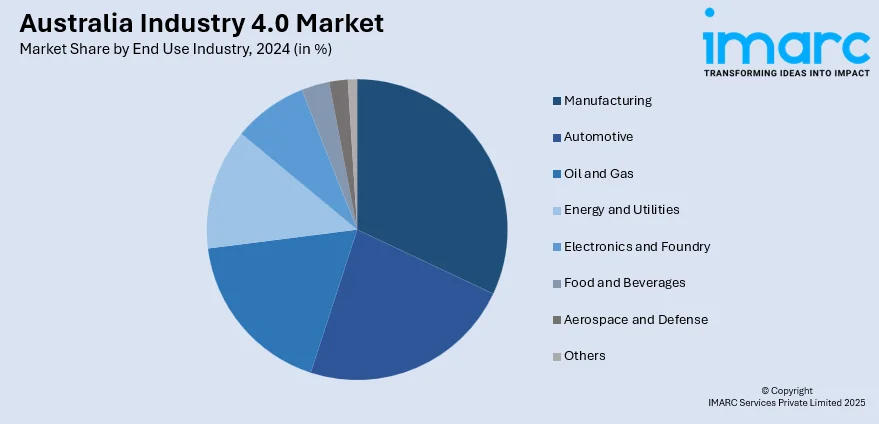

End Use Industry Insights:

- Manufacturing

- Automotive

- Oil and Gas

- Energy and Utilities

- Electronics and Foundry

- Food and Beverages

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes manufacturing, automotive, oil and gas, energy and utilities, electronics and foundry, food and beverages, aerospace and defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industry 4.0 Market News:

- In August 2024, Deloitte purchased a leading Industry 4.0 system integrator based in Australia. This action represented an important advancement in company’s continuous endeavors to enhance its abilities in digital transformation, especially within the manufacturing and industrial fields. Through this acquisition, Deloitte was set to offer the technical knowledge required to implement and integrate intricate Industry 4.0 systems.

- In March 2024, CSIRO and Swinburne aimed to enhance the manufacturing industry in Australia with the Industry 4.0 Testlab. It demonstrated its fully automated large-scale production plant utilizing a 3D-printing method for composite component manufacturing. It facilitated groundbreaking research and development (R&D) for Swinburne’s Aerostructures Innovation Research (AIR) Hub, ARC Research Hub for Future Digital Manufacturing, and Victorian Hydrogen Hub.

Australia Industry 4.0 Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technology Types Covered | Industrial Robotics, Industrial IoT, AI and ML, Blockchain, Extended Reality, Digital Twin, 3D Printing, Others |

| End Use Industries Covered | Manufacturing, Automotive, Oil and Gas, Energy and Utilities, Electronics and Foundry, Food and Beverages, Aerospace and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industry 4.0 market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industry 4.0 market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industry 4.0 industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industry 4.0 market in Australia was valued at USD 3,294.00 Million in 2024.

The Australia industry 4.0 market is projected to exhibit a CAGR of 14.50% during 2025-2033.

The Australia industry 4.0 market is projected to reach a value of USD 11,142.25 Million by 2033.

Key trends in the Australia Industry 4.0 market include rising adoption of automation and robotics, increasing integration of AI and IoT, growing focus on smart manufacturing, expansion of digital twins and predictive analytics, and strong emphasis on sustainability and advanced workforce skill development for future-ready industries.

The growth of Australia’s industry 4.0 market is driven by rising demand for automation, government initiatives supporting digital transformation, and increasing adoption of IoT and AI. These factors enhance operational efficiency, foster innovation, and strengthen the country’s competitiveness in advanced manufacturing and smart industrial practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)