Australia Infant Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2026-2034

Australia Infant Healthcare Products Market Summary:

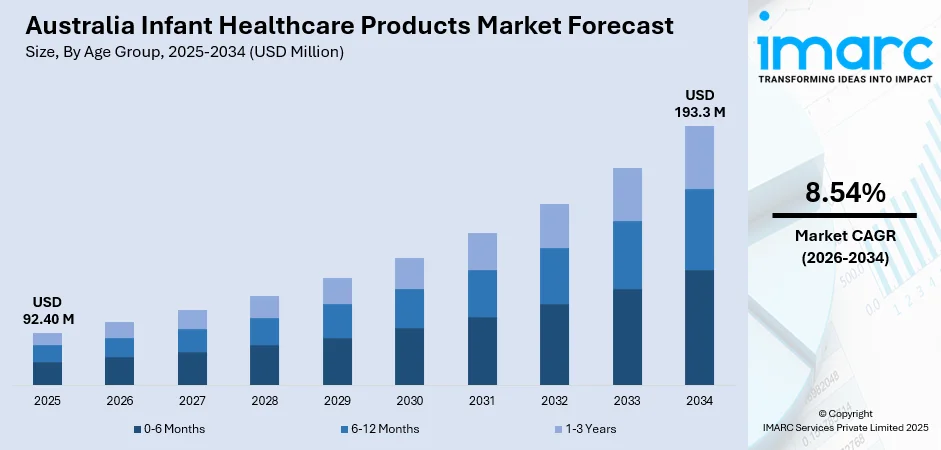

The Australia infant healthcare products market size was valued at USD 92.40 Million in 2025 and is projected to reach USD 193.3 Million by 2034, growing at a compound annual growth rate of 8.54% from 2026-2034.

The Australia infant healthcare products market is witnessing substantial growth, driven by increasing parental awareness regarding infant health and wellness. Australian parents are placing greater emphasis on ingredient safety and product quality, leading to a pronounced shift toward organic, natural, and dermatologically-tested baby care solutions. The expanding retail infrastructure and digital commerce platforms have enhanced product accessibility across metropolitan and regional areas, supporting market expansion throughout the country.

Key Takeaways and Insights:

-

By Product Type: Baby nutritional products dominate the market with a share of 36% in 2025, driven by rising demand for infant formula, vitamins, and supplements that support early childhood development and immune system strengthening.

-

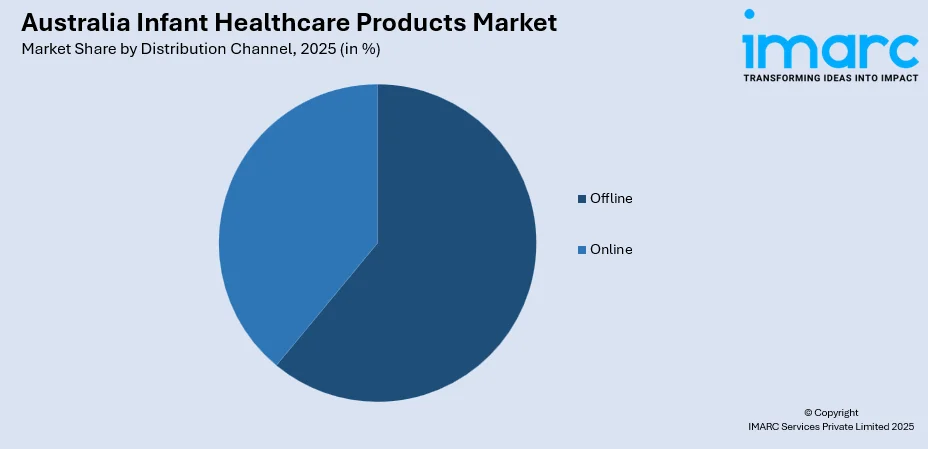

By Distribution Channel: Offline leads the market with a share of 61% in 2025, owing to parental preference for physical retail environments where product authenticity can be verified and expert guidance obtained from pharmacists and store personnel.

-

By Age Group: 6-12 months dominate the market with a share of 36% in 2025, attributed to the critical developmental stage requiring specialized nutritional products, follow-on formulas, and transitional healthcare items.

-

By Region: Australia Capital Territory & New South Wales lead the market with a share of 32% in 2025, driven by the concentration of Australia's population in Sydney and surrounding metropolitan areas with higher disposable incomes and premium product preferences.

-

Key Players: The Australia infant healthcare products market shows moderate competitive intensity, characterized by the presence of global multinational companies alongside well-established domestic brands, particularly those emphasizing organic, clean-label, and premium infant nutrition and care solutions.

To get more information on this market Request Sample

The Australia infant healthcare products market is characterized by a strong consumer preference for premium, organic, and sustainably-produced baby care solutions. Health-conscious millennial and Generation Z parents conduct extensive research before purchasing, favoring products free from parabens, sulfates, synthetic fragrances, and harsh chemicals. Reflecting broader safety priorities, the Australian Government in 2024 introduced new mandatory safety and information standards for infant sleep products to reduce risks of injury and reinforce trust in infant care goods. The market benefits from Australia's stringent regulatory standards ensuring product safety, which reinforces consumer confidence. Innovation in product formulations, including plant-based alternatives, allergen-free options, and functional ingredients with probiotics and prebiotics, is reshaping the competitive landscape and driving premiumization across all product categories.

Australia Infant Healthcare Products Market Trends:

Accelerating Demand for Organic and Clean-Label Products

Australian parents are increasingly favoring organic and clean-label infant healthcare products, prioritizing transparency and ingredient safety. The Australia organic food market size reached USD 1.1 Billion in 2024 and is projected to reach USD 2.2 Billion by 2033, reflecting a growth rate (CAGR) of 7.49% during 2025–2033. Demand spans baby skincare, toiletries, and nutrition, with strong preference for botanical extracts, natural oils, and GMO-free formulations. Brands highlighting non-toxic, cruelty-free, and eco-certified credentials are gaining traction, particularly among first-time parents focused on long-term child health.

Innovation in Plant-Based and Allergen-Free Infant Nutrition

Innovation in infant nutrition is gaining momentum with the introduction of plant-based and allergen-free formulas. In 2024, Else Nutrition expanded into Australia with almond- and buckwheat-based infant and toddler nutrition products, offering dairy- and soy-free alternatives for sensitive infants. Manufacturers are increasingly using sources such as coconut and buckwheat to address common allergens, aligning with rising vegan and flexitarian lifestyles while complying with strict nutritional and regulatory standards for infant growth and development.

Digital Transformation and E-Commerce Expansion

Australia’s infant healthcare products market is increasingly embracing digital channels alongside traditional retail. Online platforms provide convenience, subscriptions, product comparisons, and peer reviews. In 2023, Baby Bunting launched a new online marketplace, adding thousands of baby and kids’ products from partner brands and expanding its digital presence. Brands are also leveraging social media, parenting apps, and influencers to build trust and awareness, enabling wider reach into regional and rural areas beyond major cities.

Market Outlook 2026-2034:

The outlook for Australia’s infant healthcare products market remains strongly positive, driven by heightened parental awareness of infant health, safety, and nutrition. Increasing disposable incomes and the trend toward delayed parenthood are encouraging greater spending on premium, high-quality baby care products. Additionally, government funding for neonatal research and preventive healthcare programs is fostering product innovation, strengthening market growth prospects, and supporting the development of advanced infant healthcare solutions nationwide. The market generated a revenue of USD 92.40 Million in 2025 and is projected to reach a revenue of USD 193.3 Million by 2034, growing at a compound annual growth rate of 8.54% from 2026-2034.

Australia Infant Healthcare Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Baby Nutritional Products | 36% |

| Distribution Channel | Offline | 61% |

| Age Group | 6-12 Months | 36% |

| Region | Australia Capital Territory & New South Wales | 32% |

Product Type Insights:

- Baby Skincare Products

- Lotions

- Oils

- Creams

- Baby Hygiene Products

- Diapers

- Wipes

- Sanitizers

- Baby Nutritional Products

- Infant Formula

- Vitamins

- Supplements

- Baby Medical Products

- Thermometers

- Nasal Aspirators

The baby nutritional products dominate with a market share of 36% of the total Australia infant healthcare products market in 2025.

Baby nutritional products encompassing infant formula, vitamins, and supplements have emerged as the leading category within the Australian infant healthcare market. This dominance reflects heightened parental awareness regarding the critical importance of early childhood nutrition for cognitive development, immune system strengthening, and overall growth. Australian parents are increasingly willing to invest in premium nutritional products that offer organic certification, clean-label formulations, and functional ingredients supporting infant wellness.

The segment benefits from ongoing advances in formulation science, with products increasingly incorporating prebiotics, probiotics, DHA, and essential fatty acids to better mirror the nutritional composition of breast milk. Rising workforce participation among Australian women has accelerated demand for convenient, nutritionally balanced infant feeding solutions. Strong emphasis on organic ingredient sourcing, clean labels, and rigorous quality standards continues to influence purchasing decisions among health-conscious parents.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline leads with a share of 61% of the total Australia infant healthcare products market in 2025.

Offline retail channels including supermarkets, hypermarkets, pharmacies, and specialty baby stores maintain dominant market positioning in Australia's infant healthcare products sector. For instance, Australian brand Witsbb expanded offline availability by introducing its “nonallergenic” infant nutrition products in major pharmacy chains, including Cincotta Discount Chemist and Priceline Pharmacy, increasing convenience for parents. Parents show a strong preference for physical stores, allowing them to inspect packaging, confirm authenticity, and consult pharmacists or trained staff on suitable products for their infants’ needs.

Large retail outlets have strengthened their presence by expanding dedicated baby care sections that offer a wide range of skincare, hygiene, and nutrition products. Pharmacies remain trusted purchase channels, allowing parents to access professional guidance alongside essential products, which enhances confidence in safety and suitability. Hands-on product evaluation, personalized assistance, and immediate availability continue to support strong preference for offline retail, despite rising e-commerce adoption.

Age Group Insights:

- 0-6 Months

- 6-12 Months

- 1-3 Years

The 6-12 months dominates with a market share of 36% of the total Australia infant healthcare products market in 2025.

The 6-12 months age group holds the largest market share, highlighting a crucial transitional phase in infant development. During this period, infants begin complementary foods and shift from formula to follow-on products, increasing demand for specialized nutrition. Simultaneously, heightened vulnerability to common childhood illnesses drives the need for medical devices, hygiene solutions, and tailored healthcare products, making this segment a key focus for infant nutrition and healthcare providers.

Parents show increased purchasing activity during this stage, driven by infants’ needs for follow-on formulas with age-specific nutrients, transitional skincare for sensitive skin, and healthcare essentials like teething aids and fever management devices. The segment’s prominence reflects strong parental investment in products that support healthy developmental milestones, emphasizing the importance of tailored nutrition, hygiene, and medical solutions during this critical growth period.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibit a clear dominance with a 32% share of the total Australia infant healthcare products market in 2025.

The combined Australia Capital Territory and New South Wales region leads the infant healthcare products market, driven by Australia's largest population concentration in Sydney and surrounding metropolitan areas. New South Wales accounts for approximately one-third of Australia's total population, with a significant proportion of families with young children concentrated in urban centers characterized by higher disposable incomes and pronounced preference for premium baby care products.

The region leverages extensive retail infrastructure, robust pharmacy networks, and efficient e-commerce logistics to ensure smooth product distribution. Health-conscious consumers in Sydney and Canberra are early adopters of organic and premium infant healthcare products, setting trends later embraced across Australia. Additionally, the presence of major distribution hubs and headquarters of leading baby care brands strengthens the region’s leadership, making it a key driver of market growth and innovation.

Market Dynamics:

Growth Drivers:

Why is the Australia Infant Healthcare Products Market Growing?

Rising Parental Awareness and Health Consciousness

Australian parents, especially millennials and Gen Z, are increasingly proactive about infant health, safety, and development. Reflecting this trend, in October 2024, the Australian Government is moving to implement a mandatory industry code to regulate how baby formula products are marketed, aiming to protect parents and carers from misleading advertising and support informed decision‑making. This heightened awareness fuels demand for premium products featuring organic ingredients, hypoallergenic formulations, and dermatological validation. Parents actively research ingredients, consult pediatric advice, and review peer feedback before purchase. Such informed decision-making accelerates premiumization, pushing manufacturers toward transparent labeling, clinical backing, and science-led product innovation.

Government Investment in Infant Health Initiatives

Strong government support is driving growth in Australia’s infant healthcare market. In 2025, the National RSV Mother & Infant Protection Program (RSV‑MIPP) was launched, offering free maternal RSV vaccination (Abrysvo) and state-funded nirsevimab immunisation for eligible infants to reduce severe RSV infections. Complemented by investments in pediatric research, immunization programs, and preventive healthcare, these initiatives promote early-life wellness. Public–private collaborations, awareness campaigns, and policy support further encourage innovation, strengthen consumer trust, and attract manufacturer investment aligned with national health priorities.

Product Innovation and Premiumization Trends

Ongoing product innovation continues to drive Australia’s infant healthcare market, as brands respond to evolving parental expectations and nutritional science advancements. In December 2025, U.S.-based Owlet, Inc. gained TGA approval to launch its clinically validated Dream Sock, offering real-time infant health monitoring via online and retail channels. Market developments include enhanced formulas with functional ingredients, tech-enabled baby care devices, and eco-friendly packaging. Premiumization remains strong, with local brands using organic credentials and tailored formulations to compete with global players.

Market Restraints:

What Challenges the Australia Infant Healthcare Products Market is Facing?

Premium Pricing and Affordability Concerns

The growing premiumization of infant healthcare products in Australia raises affordability challenges, particularly amid cost-of-living pressures. Organic, specialized, and imported offerings are priced well above mass-market alternatives, limiting accessibility for budget-conscious households. This pricing gap may hinder penetration in regional markets and among younger families with constrained discretionary incomes.

Declining Birth Rates and Demographic Shifts

Australia’s declining birth rates and aging population pose structural constraints for the infant healthcare products market. Delayed parenthood and smaller family sizes are shrinking the core consumer base, moderating volume growth. Although spending per child is rising, demographic shifts may cap long-term demand expansion, requiring cautious market planning.

Stringent Regulatory Requirements and Compliance Costs

Australia’s strict regulatory framework for infant healthcare products ensures high safety standards but increases compliance complexity and costs. Extensive testing, certification, and approval processes raise entry barriers for smaller players and elevate supply-chain expenses. These regulatory demands can also slow innovation cycles, delaying the commercialization of new formulations and products.

Competitive Landscape:

The Australia infant healthcare products market features a dynamic and competitive landscape shaped by a mix of well-established global manufacturers and strong domestic organic brands. Large international participants benefit from advanced research capabilities, strong brand trust, and wide distribution reach, while local players strengthen their positions through a focus on organic certifications, locally sourced ingredients, and compliance with stringent national regulations. This competitive environment encourages continuous innovation, with market participants differentiating through transparent ingredient labeling, sustainability initiatives, and targeted formulations designed to address specific infant health and developmental needs.

Recent Developments:

-

In December 2025 Aiwibi, a Sydney-headquartered Australian baby-care brand, has launched a new infant formula in partnership with Australian dairy and nutrition manufacturer ViPlus. Designed for sensitive baby needs, the product marks Aiwibi’s expansion into premium infant nutrition beyond diapers and wipes, highlighting a growing domestic focus on quality and safety in infant nutrition.

Australia Infant Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0-6 Months, 6-12 Months, 1-3 Years |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia infant healthcare products market size was valued at USD 92.40 Million in 2025.

The Australia infant healthcare products market is expected to grow at a compound annual growth rate of 8.54% from 2026-2034 to reach USD 193.3 Million by 2034.

Baby nutritional products dominated the market with a 36% share, driven by rising demand for infant formula, vitamins, and supplements that support early childhood development, immune system strengthening, and overall infant wellness among health-conscious Australian parents.

Key factors driving the Australia infant healthcare products market include rising parental awareness regarding infant health and safety, increasing demand for organic and clean-label products, government investment in neonatal care initiatives, expanding e-commerce distribution channels, and continuous product innovation in nutritional formulations.

Major challenges include premium product pricing creating affordability barriers, declining birth rates affecting long-term demand projections, stringent regulatory compliance requirements increasing operational costs, and intense competition among established brands requiring continuous investment in innovation and marketing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)