Australia Infrastructure Maintenance and Repair Market Size, Share, Trends and Forecast by Type of Infrastructure, Service Type, Material Used, End User, and Region, 2025-2033

Australia Infrastructure Maintenance and Repair Market Overview:

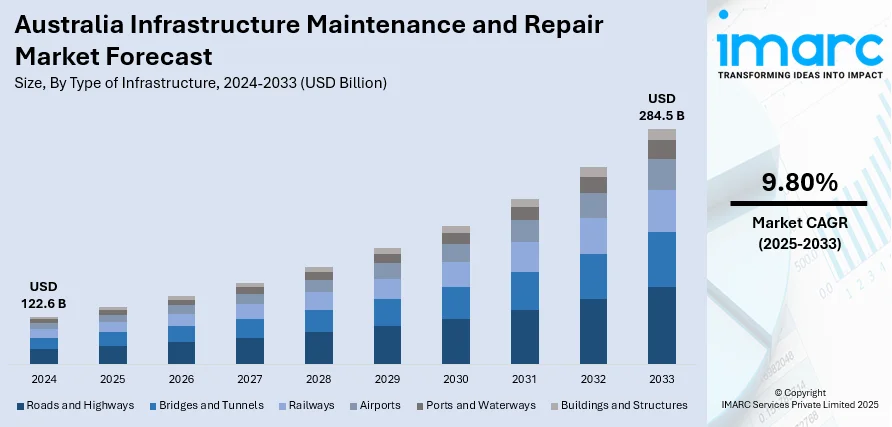

The Australia infrastructure maintenance and repair market size reached USD 122.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 284.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is driven by the rising need to extend the service life of aging public infrastructure assets, including roads, bridges, and water systems. Additionally, the implementation of government initiatives, such as the 10-year National Infrastructure Investment pipeline and targeted maintenance funding by Infrastructure Australia, are reinforcing demand for scheduled repair and upkeep activities. Apart from this, the increasing frequency of climate-related damages is prompting proactive maintenance strategies across key sectors, further augmenting the Australia infrastructure maintenance and repair market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 122.6 Billion |

|

Market Forecast in 2033

|

USD 284.5 Billion |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Infrastructure Maintenance and Repair Market Trends:

Aging Infrastructure and Lifecycle Extension Initiatives

Australia's infrastructure landscape is characterized by an extensive network of assets that were developed during the mid-to-late 20th century. Many of these, including highways, bridges, rail systems, and water pipelines, are reaching or have exceeded their original design lifespans. As a result, there is an urgent focus on asset lifecycle extension rather than replacement, primarily due to budgetary constraints and environmental considerations. Government agencies and local councils are increasingly investing in condition monitoring technologies, asset management platforms, and predictive maintenance tools to improve decision-making and prioritize critical repairs. The adoption of Building Information Modelling (BIM) and Geographic Information Systems (GIS) is also enhancing the planning and tracking of maintenance cycles. Additionally, there is growing use of corrosion-resistant materials and retrofit solutions to extend structural integrity without large-scale overhauls. These trends collectively position maintenance and repair as a strategic imperative rather than an operational afterthought in infrastructure policy.

To get more information on this market, Request Sample

Technological Integration in Maintenance Operations

The adoption of advanced technologies is contributing to the Australia infrastructure maintenance and repair market growth. Condition assessment tools such as ground-penetrating radar, remote sensors, and drones are now widely used for non-invasive inspection of roads, bridges, and utility networks. These tools enable real-time data collection and enhance the accuracy of fault detection, reducing the need for manual inspections and lowering safety risks for personnel. Artificial intelligence (AI) and Machine Learning (ML) are increasingly employed to analyze maintenance data, predict asset failure, and optimize scheduling. For instance, smart pavement systems embedded with sensors can alert authorities to surface degradation or subsurface stress in real time. Furthermore, cloud-based platforms are streamlining communication among project teams, contractors, and government stakeholders, ensuring faster issue resolution and accountability. These technological advancements not only improve maintenance efficiency but also contribute to cost savings and service continuity.

Climate Adaptation and Resilience-Oriented Maintenance

Climate variability, including increased frequency of floods, heatwaves, and bushfires, is placing added stress on the country's critical infrastructure systems. This has led to a pronounced shift in maintenance priorities toward climate adaptation and resilience-building. According to industry reports, in response to increasing climate-related events, the Australian government invested more than AUD 15 Billion particularly for climate resilience measures. These subsidies assist infrastructure initiatives that try to mitigate and adapt to the effects of bushfires, droughts, and floods, with a focus on resilience-oriented maintenance practices. Apart from this, in regions affected by sea-level rise, regular repair of seawalls and coastal transport routes has become essential. Moreover, the integration of nature-based solutions, such as green infrastructure for stormwater management, is gaining traction to reduce long-term maintenance costs while improving environmental outcomes. This trend is reinforcing the role of infrastructure maintenance as a frontline response to climate-induced vulnerabilities.

Australia Infrastructure Maintenance and Repair Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of infrastructure, service type, material used, and end user.

Type of Infrastructure Insights:

- Roads and Highways

- Bridges and Tunnels

- Railways

- Airports

- Ports and Waterways

- Buildings and Structures

The report has provided a detailed breakup and analysis of the market based on the type of infrastructure. This includes roads and highways, bridges and tunnels, railways, airports, ports and waterways, and buildings and structures.

Service Type Insights:

- Preventive Maintenance

- Corrective Maintenance

- Predictive Maintenance

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes preventive maintenance, corrective maintenance, and predictive maintenance.

Material Used Insights:

- Concrete Repair

- Asphalt Repair

- Steel Repair

- Composites and Polymers

The report has provided a detailed breakup and analysis of the market based on the material used. This includes concrete repair, asphalt repair, steel repair, and composites and polymers.

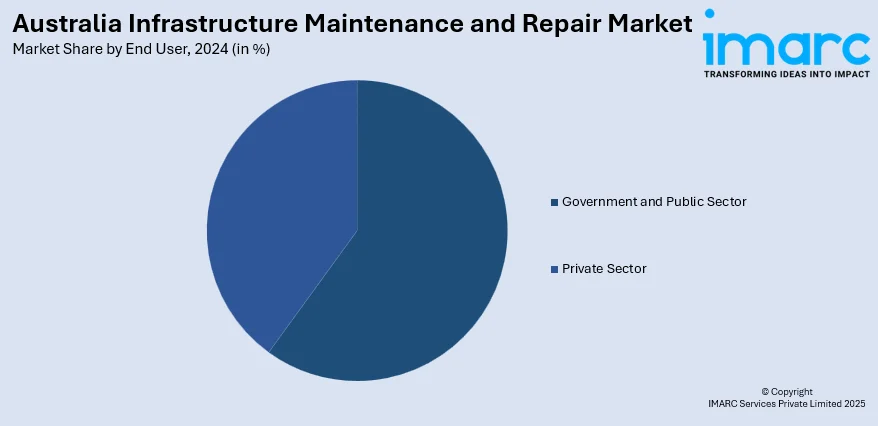

End User Insights:

- Government and Public Sector

- Private Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government and public sector and private sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Infrastructure Maintenance and Repair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Infrastructures Covered | Roads and Highways, Bridges and Tunnels, Railways, Airports, Ports and Waterways, Buildings and Structures |

| Service Types Covered | Preventive Maintenance, Corrective Maintenance, Predictive Maintenance |

| Materials Used Covered | Concrete Repair, Asphalt Repair, Steel Repair, Composites and Polymers |

| End Users Covered | Government and Public Sector, Private Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia infrastructure maintenance and repair market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia infrastructure maintenance and repair market on the basis of type of infrastructure?

- What is the breakup of the Australia infrastructure maintenance and repair market on the basis of service type?

- What is the breakup of the Australia infrastructure maintenance and repair market on the basis of material used?

- What is the breakup of the Australia infrastructure maintenance and repair market on the basis of end user?

- What is the breakup of the Australia infrastructure maintenance and repair market on the basis of region?

- What are the various stages in the value chain of the Australia infrastructure maintenance and repair market?

- What are the key driving factors and challenges in the Australia infrastructure maintenance and repair market?

- What is the structure of the Australia infrastructure maintenance and repair market and who are the key players?

- What is the degree of competition in the Australia infrastructure maintenance and repair market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia infrastructure maintenance and repair market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia infrastructure maintenance and repair market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia infrastructure maintenance and repair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)