Australia Instant Noodles Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Australia Instant Noodles Market Overview:

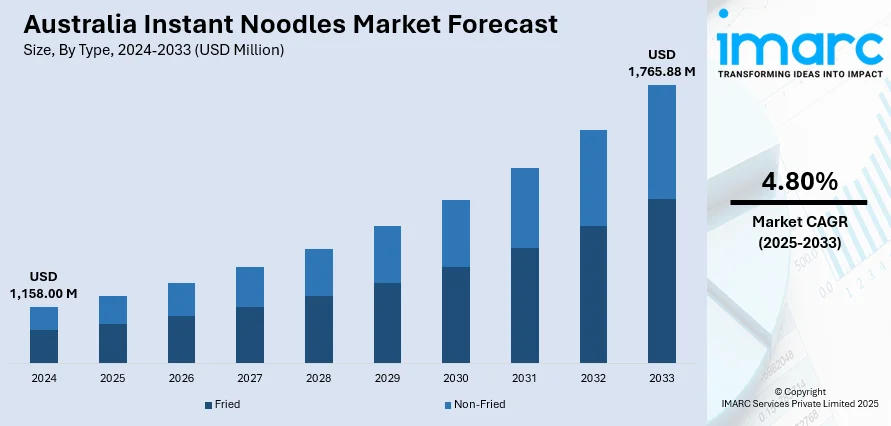

The Australia instant noodles market size reached USD 1,158.00 Million in 2024. Looking forward, the market is projected to reach USD 1,765.88 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. Rising multicultural influences, elevating demand for convenient low-cost meals, increased availability of diverse Asian flavors, sustainability-driven packaging innovations, and expanding retail distribution across supermarkets and online platforms are collectively driving the Australia instant noodles market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,158.00 Million |

| Market Forecast in 2033 | USD 1,765.88 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Key Trends in Australia Instant Noodles Market:

Growing Multicultural Population and Asian Culinary Influence

Australia's growing multiculturalism, specifically the expanding Asian population, has been a key driver of the country’s instant noodles market. More than 17% of Australians have Asian heritage (besides Middle East), especially from China, India, Vietnam, South Korea, and the Philippines. These communities, especially those from East Asia and Southeast Asia, have unique dietary habits and a cultural predisposition toward noodle-based foods, particularly instant noodles. This demographic change has generated a consistent demand for a broad range of instant noodle flavors, forms, and brands that appeal to regional Asian palates including miso, tom yum, laksa, buldak (Korean fire noodles), and spicy Sichuan. As a result, supermarkets, such as Woolworths and Coles, have expanded their Asian food sections, and specialty stores, such as Asian grocers, are experiencing higher traffic. In addition to this, Australian consumers outside ethnic communities are increasingly experimenting with Asian food as a result of culinary curiosity and exposure via social media, travel, and dining out trends. Instant noodles are a cheap and accessible gateway to Asian food culture and are thus consumed by even non-Asian Australians.

To get more information on this market, Request Sample

Increasing Demand for Convenient, Affordable Meal Solutions Amid Rising Living Costs

Australia has been struggling with inflation, especially in urban areas, such as Sydney and Melbourne, where the costs of food, accommodation, and utilities are relatively high. Consequently, consumers are growing increasingly price-sensitive and are actively on the lookout for affordable food that is not at the expense of taste or fullness. Instant noodles meed this demand as they are relatively inexpensive, easy to cook, possess a long shelf-life, and do not require high culinary skills or equipment for preparation. The convenience factor is particularly important among Australian families, where both parents can have full-time jobs and live hectic lifestyles. These consumers place a premium on meals that take less than five minutes to prepare, so instant noodles have become an obvious choice. Furthermore, the rise of e-commerce websites and food delivery companies made the purchase of these instant noodle foods even more accessible to consumers, extending to an even wider variety of products, including imported high-end brands.

Growing Vegan Trends

The increasing popularity of veganism and plant-based diets is significantly influencing consumer choices within the instant noodle market. Brands are actively introducing meat-free and plant-based noodle options to meet the needs of health-conscious customers, vegetarians, and environmentally conscious shoppers. These alternatives typically feature proteins derived from sources like soy, mushrooms, or legumes, completely omitting animal-based ingredients. Furthermore, products that include natural seasonings and clean-label formulations attract those who value transparency and nutrition. The presence of vegan-friendly instant noodles in mainstream supermarkets and specialty health food outlets has expanded their accessibility. As a growing number of Australians choose sustainable and ethical eating practices, the demand for plant-based convenience food continues to rise, playing a direct role in the increasing Australia instant noodles market demand.

Growth Drivers of Australia Instant Noodles Market:

Expanding Retail Channels Enhancing Market Reach

The development of modern retail infrastructure significantly contributes to the increased availability and visibility of instant noodles throughout Australia. Supermarkets and hypermarkets consistently provide a diverse selection of instant noodle brands and flavors, making them accessible to everyday consumers. Additionally, convenience stores serve the needs of on-the-go buyers, particularly in urban areas and near educational institutions. The growth of e-commerce and food delivery services has further broadened market access, allowing consumers to discover and purchase a wide range of products from the comfort of their homes. This multichannel retail strategy boosts sales and enables brands to reach a wider audience, playing a crucial role in the expansion of the Australian instant noodles market.

Product Innovation Driving Consumer Interest

Innovation is a key factor driving growth in the instant noodles sector in Australia. Manufacturers are proactively addressing changing consumer preferences by launching healthier alternatives that feature reduced sodium, added nutrients, and clean-label components. Simultaneously, premium and gourmet products showcasing authentic regional flavors, specialty broths, and exotic spices are appealing to more adventurous consumers. There is also a rising demand for gluten-free, organic, and vegan options that cater to particular dietary requirements. These innovations enhance the attractiveness of products and help brands stand out in a competitive landscape. By continually refreshing their offerings, companies keep consumers engaged and support ongoing growth in the Australian instant noodles market.

Youth and Student Demographics Fueling Consumption

The young population, especially students and early-career professionals, is a significant and stable demand group for instant noodles in Australia. Their inclinations stem from the products’ affordability, simple preparation, and diverse flavors. For students living independently or working individuals with limited cooking time, instant noodles provide a convenient meal or snack choice. The portability and lengthy shelf life of these items make them perfect for dorm rooms, office kitchens, and travel. Moreover, brand promotions, new flavor introductions, and marketing on social media frequently target this demographic, enhancing brand loyalty and encouraging repeat purchases. According to Australia instant noodles market analysis, this expanding youth segment continues to be essential in sustaining demand within the market.

Opportunities of Australia Instant Noodles Market:

Regional and Fusion Flavors Creating New Consumer Appeal

The Australian instant noodles market presents a growing opportunity to introduce regional and fusion flavors that meld local tastes with global influences. Consumers are becoming more receptive to bold and diverse flavors, paving the way for innovative combinations like spicy kangaroo-flavored broth, Aussie BBQ chicken noodles, or varieties inspired by Thai green curry. These new offerings appeal to adventurous eaters and multicultural households looking for a mix of the familiar and the novel. By merging authentic Australian ingredients with popular Asian-style bases, brands can differentiate themselves in a saturated market and attract flavor-savvy customers. Such fusion innovations broaden consumer choices and transform instant noodles from a basic meal into a flavorful and memorable dining experience, fostering long-term brand loyalty and market distinction.

Eco-Friendly Packaging Solutions Gaining Traction

With rising environmental awareness among Australian consumers, there is significant potential for instant noodle brands to implement sustainable packaging practices. This approach includes the use of recyclable cups, compostable wrappers, and reduced-plastic alternatives that lessen environmental impact. Brands that adopt eco-friendly packaging can appeal to environmentally conscious consumers, particularly within younger and urban demographics who emphasize sustainable living. This shift aligns with broader retail and regulatory trends that promote green initiatives. Clear messaging and labeling about sustainability can also serve as an effective marketing strategy, helping products stand out on shelves. By investing in innovative packaging that balances convenience with eco-responsibility, companies can bolster their brand reputation while addressing emerging consumer values, creating promising prospects in the evolving Australian instant noodles market.

Private Label and Local Brand Growth Opportunities

The market for instant noodles in Australia offers significant growth prospects through private labels and burgeoning local brands. Retailers have the opportunity to introduce store-brand noodle products that feature competitive pricing, high-quality ingredients, and flavors tailored to regional tastes. Private labels can also emphasize health-conscious or dietary-specific options such as gluten-free or vegan varieties at accessible price points. At the same time, smaller local producers benefit from their flexibility, allowing them to launch innovative and niche products that appeal to specific consumer segments. Increased support for locally made goods and a growing interest in homegrown brands create a conducive environment for private label growth. With effective marketing, unique product differentiation, and strategic placement, both retailers and local brands can capture a larger market share, driving category expansion and consumer diversity.

Australia Instant Noodles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Fried

- Non-Fried

The report has provided a detailed breakup and analysis of the market based on the type. This includes fried and non-fried.

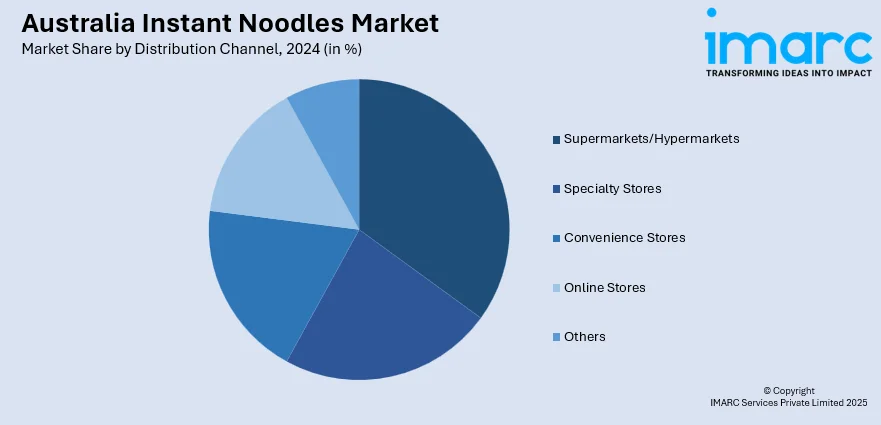

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, convenience stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Instant Noodles Market News:

- May 2025: Suimin introduced the K-Pow! range of Korean-style spicy instant noodles in Australia, catering to the growing demand for bold, spicy flavors. The range includes three varieties: Flaming Cheesy Chicken, Flaming Chicken, and Flaming Beef, each designed to appeal to younger consumers seeking adventurous tastes.

- November 2024: Nissin Foods and Nissin Asia formed a joint venture to distribute instant noodles and snacks in Australia and New Zealand. With popular brands like Demae Iccho and Cup Noodles, they aim to capture growing product demand by strengthening marketing, sales, and distribution networks across the region.

- January 2024: Nestlé Australia launched Maggi Mug Noodles, a sustainable alternative to traditional cup noodles. By eliminating the plastic cup, this innovation reduces plastic packaging by 83% per serve. Consumers can now prepare their noodles directly in a standard mug, promoting eco-friendly practices.

Australia Instant Noodles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fried, Non-Fried |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia instant noodles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia instant noodles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia instant noodles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The instant noodles market in Australia was valued at USD 1,158.00 Million in 2024.

The Australia instant noodles market is projected to exhibit a compound annual growth rate (CAGR) of 4.80% during 2025-2033.

The Australia instant noodles market is expected to reach a value of USD 1,765.88 Million by 2033.

The Australia instant noodles market is witnessing trends such as the introduction of vegan and gluten-free options, rising popularity of premium international flavors, and growing consumer preference for eco-friendly packaging. E-commerce channels and social media influence are also expanding product visibility and consumer engagement.

Market growth is driven by rising demand for quick meal solutions, increasing student and working-class consumption, and continuous product innovation catering to health and taste preferences. Expanding retail networks, combined with the affordability and long shelf life of instant noodles, further support widespread market penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)